- La paire de devises GBP/USD a continué son mouvement à la hausse lundi. Comme avec l'euro, il n'y avait pas de raison spécifique pour que la paire baisse. Bien

Author: Paolo Greco

03:57 2025-04-15 UTC+2

2

La paire de devises EUR/USD a poursuivi son mouvement haussier lundi. Malgré une croissance plus lente cette fois-ci, la paire continue de grimper. Hier, elle a augmenté de 50 pipsAuthor: Paolo Greco

03:57 2025-04-15 UTC+2

3

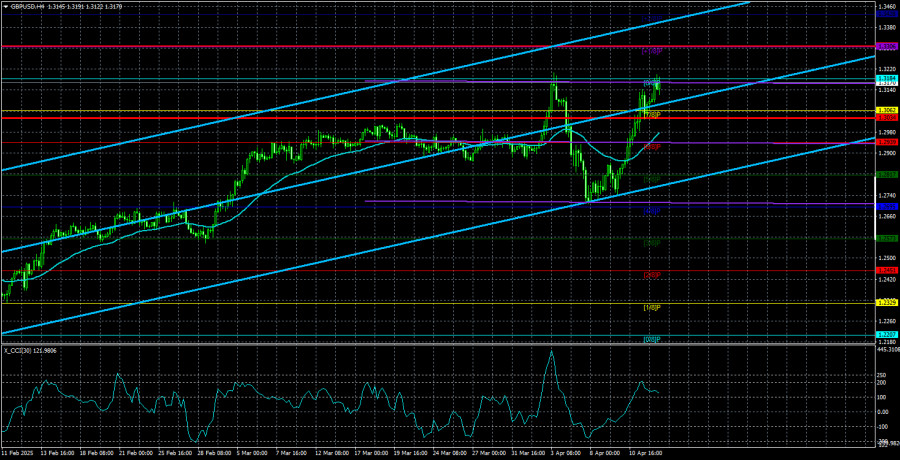

Plan de négociationRecommandations de Trading et Analyse pour GBP/USD au 15 avril : La Livre Sterling Ne Trouve Aucune Raison de Rester Immobile

Le couple de devises GBP/USD a enregistré une hausse lundi, sans aucune hésitation. Alors que l'euro a affiché quelques gains en fin de journée, ceux-ci n'étaient pas significatifs —Author: Paolo Greco

03:57 2025-04-15 UTC+2

5

- Plan de négociation

Recommandations et Analyse de Trading pour EUR/USD le 15 avril : Un Lundi sans Ennui

La paire de devises EUR/USD a tenté de poursuivre sa croissance lors de la séance de lundi, mais a finalement reculé dans la seconde moitié de la journée. En réalitéAuthor: Paolo Greco

03:57 2025-04-15 UTC+2

6

Cette semaine, la réunion d’avril de la BCE se tient, et l'euro est en bonne forme. L'euro a connu des performances exceptionnelles depuis au moins deux mois—apparemment sans grand effortAuthor: Chin Zhao

00:35 2025-04-15 UTC+2

6

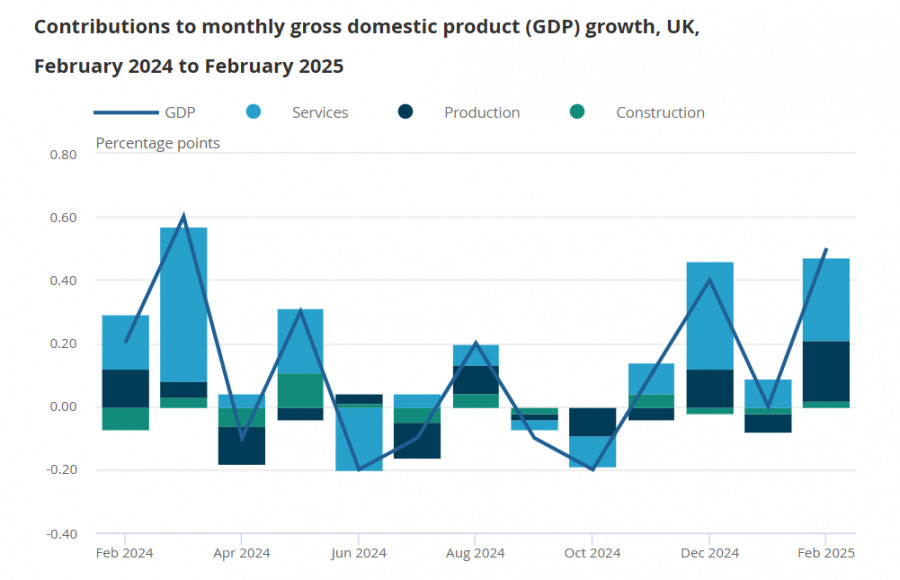

En février, l'économie britannique a enregistré une croissance de 0,5 %, rebondissant après une stagnation en janvier et dépassant largement la prévision de +0,1 %. Il s'agit de la croissanceAuthor: Kuvat Raharjo

00:35 2025-04-15 UTC+2

7

- La tendance haussière de la paire EUR/USD reste intacte dans un contexte de faiblesse générale du dollar américain. Les replis significatifs vers le bas permettent aux acheteurs d'ouvrir des positions

Author: Irina Manzenko

00:35 2025-04-15 UTC+2

7

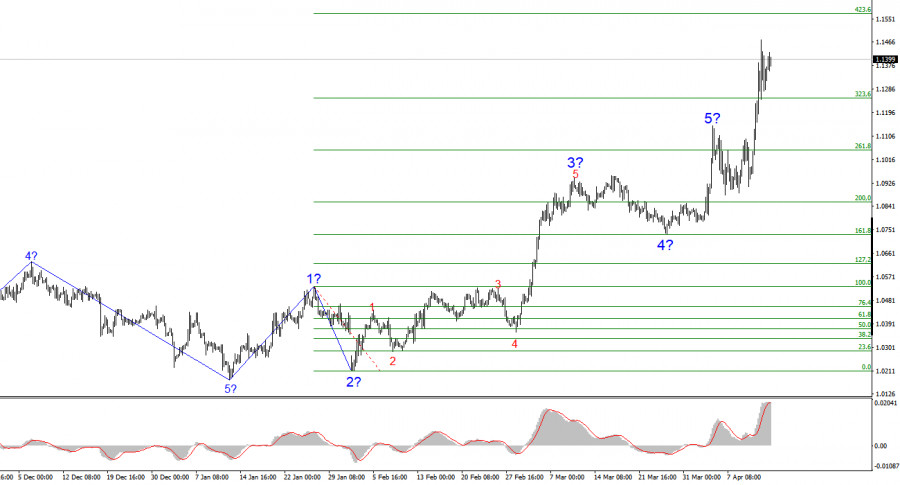

La structure en vagues de la paire GBP/USD est également passée à une formation haussière et impulsive — grâce à Donald Trump. Le modèle de vague semble presque identiqueAuthor: Chin Zhao

19:09 2025-04-14 UTC+2

11

La structure de vagues sur le graphique de 4 heures pour la paire EUR/USD est passée à une formation haussière. Je pense que ce changement s'est produit principalement en raisonAuthor: Chin Zhao

19:05 2025-04-14 UTC+2

13