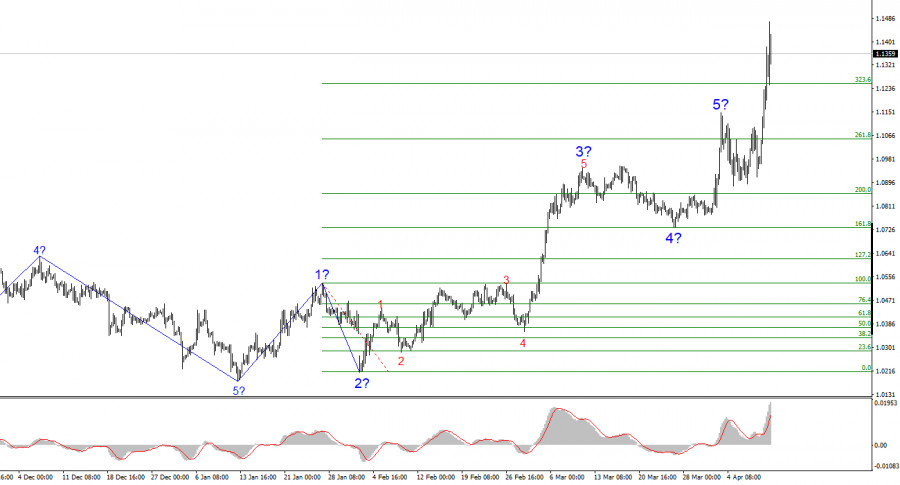

- La structure des vagues sur le graphique de l'EUR/USD en 4 heures s'est transformée en une tendance haussière. Je crois qu'il n'y a aucun doute que cette transformation s'est produite

Author: Chin Zhao

18:33 2025-04-11 UTC+2

10

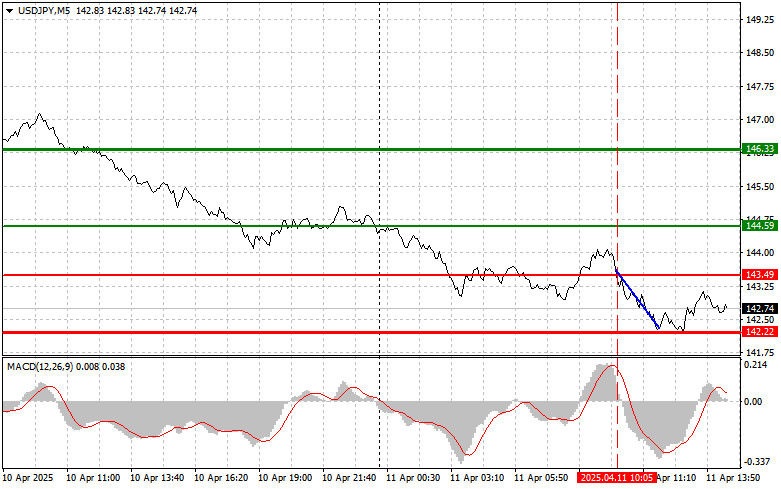

PrévisionsUSD/JPY : Astuces de trading simples pour les traders débutants le 11 avril (Session américaine)

Analyse du Trade et Conseils pour la Négociation du Yen Japonais Le test du niveau de prix de 143,49 a coïncidé avec le moment où l'indicateur MACD venait justeAuthor: Jakub Novak

18:26 2025-04-11 UTC+2

7

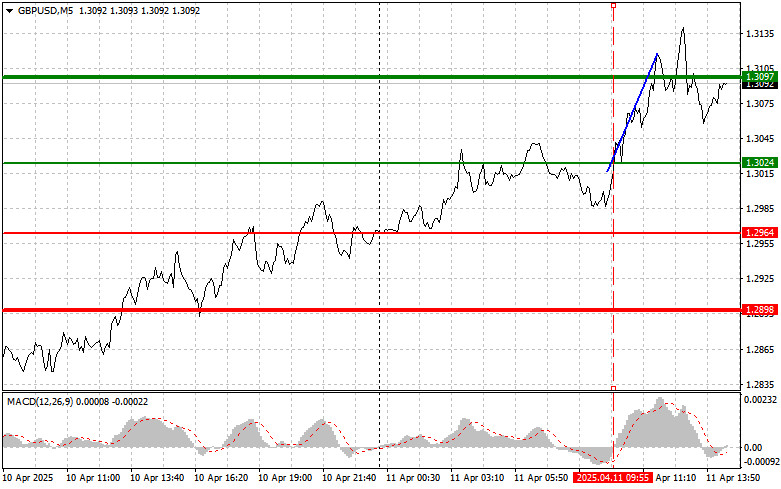

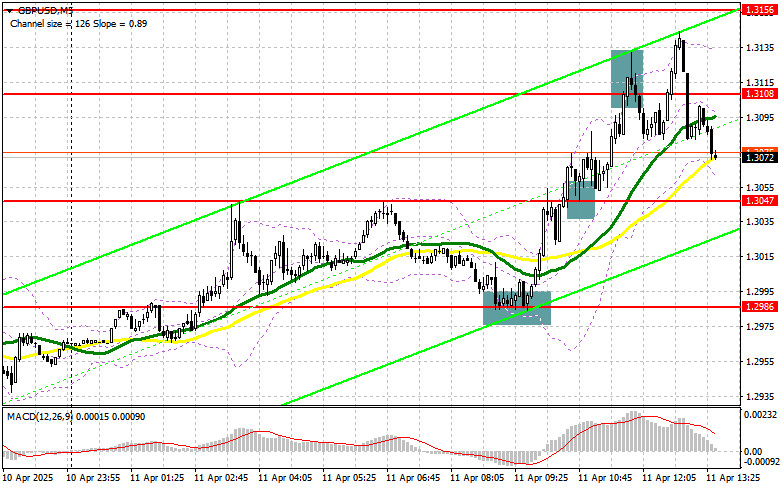

PrévisionsGBP/USD : Conseils de Trading Simples pour les Traders Débutants le 11 Avril (Session Américaine)

Analyse du Commerce et Conseils pour Échanger la Livre Sterling Le test du niveau de prix de 1,3024 s'est produit juste au moment où l'indicateur MACD commençait à évoluer versAuthor: Jakub Novak

18:22 2025-04-11 UTC+2

8

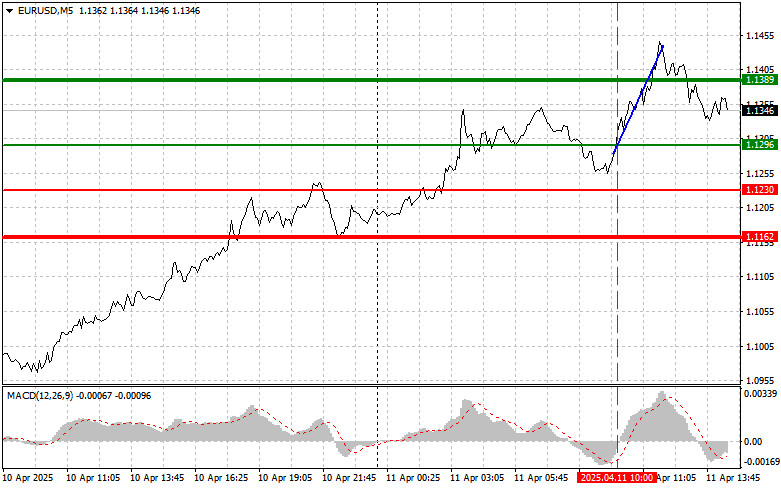

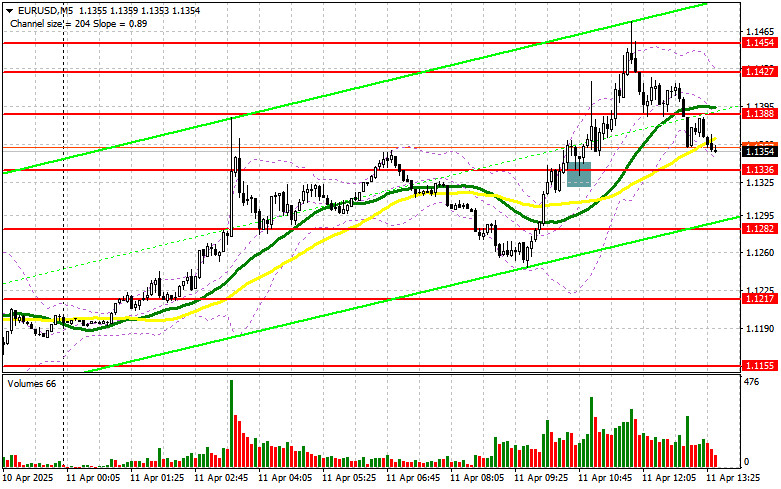

- Prévisions

EUR/USD : Conseils de trading simples pour les traders débutants le 11 avril (Session américaine)

Analyse et Conseils de Trading pour l'Euro Le test du niveau de prix de 1.1296 s'est produit lorsque l'indicateur MACD commençait à monter à partir de la marque zéroAuthor: Jakub Novak

18:20 2025-04-11 UTC+2

8

Plan de négociationGBP/USD : Plan de trading pour la session américaine du 11 avril (Révision des transactions du matin)

Dans ma prévision matinale, j'ai souligné le niveau de 1,2986 et prévu de prendre des décisions d'entrée sur le marché à partir de ce point. Regardons le graphiqueAuthor: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

9

Plan de négociationEUR/USD : Plan de trading pour la session américaine du 11 avril (Revue des transactions matinales)

Dans ma prévision matinale, je me suis concentré sur le niveau de 1.1336 et j'avais prévu de prendre des décisions d'entrée sur le marché en fonction de celui-ci. ExaminonsAuthor: Miroslaw Bawulski

18:15 2025-04-11 UTC+2

9

- Analyse technique

Signaux de trading pour EUR/USD du 11 au 15 avril 2025 : vendre en dessous de 1.1470 (+2/8 Murray - surachat)

Durant la séance européenne, l'euro a atteint un nouveau sommet autour de +2/8 Murray, situé à 1,1473. Ce mouvement sur l'EUR/USD est survenu après l'annonce par le Ministère des FinancesAuthor: Dimitrios Zappas

16:44 2025-04-11 UTC+2

5

Bitcoin et Ethereum ont chuté tard hier mais ont ensuite réussi à récupérer leur position. Pour l'instant, les ours ont encore plus de force que les acheteurs, mais cela pourraitAuthor: Jakub Novak

16:38 2025-04-11 UTC+2

8

Analyse techniqueSignaux de trading pour l'OR (XAU/USD) du 11 au 13 avril 2025 : vendre en dessous de 3 235 $ (+1/8 Murray - surachat)

Nous pourrions nous attendre à une forte correction technique vers le niveau 8/8 Murray à 3 125 dans les prochains jours. Le métal pourrait même atteindre la moyenne mobile simpleAuthor: Dimitrios Zappas

16:04 2025-04-11 UTC+2

8