- Le Dow, le NASDAQ et le S&P 500 glissent alors que la Maison Blanche intensifie la pression sur la Chine. Les tarifs douaniers pèsent sur les indices : les marchés

Author: Irina Maksimova

12:33 2025-04-09 UTC+2

4

DevisBitcoin sous pression de vente. Pourquoi même un pic pourrait difficilement sauver les investisseurs haussiers

Bitcoin est en chute libre, les fonds signalent des pertes, et les analystes ne voient aucune raison de croissance. Que se passe-t-il avec le leader du marché des crypto-monnaiesAuthor: Ekaterina Kiseleva

12:07 2025-04-09 UTC+2

5

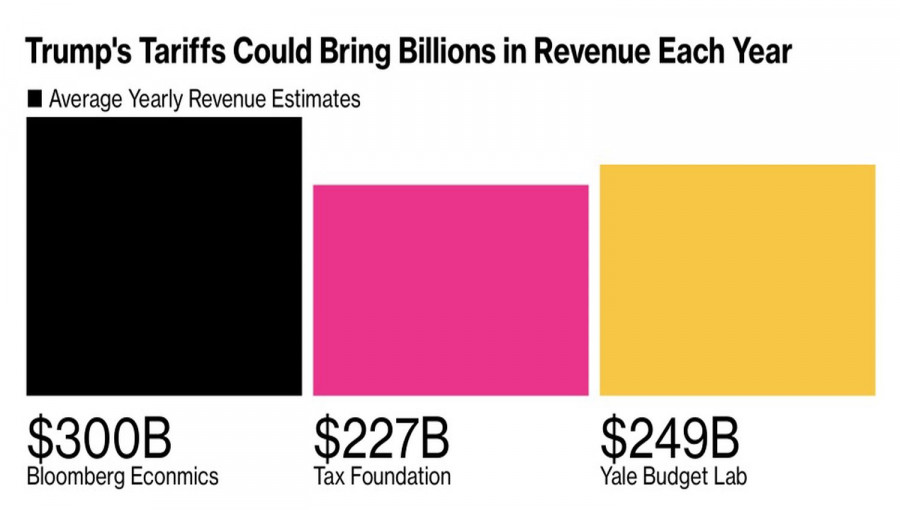

Nouvelles analytiquesEffet domino : les tarifs américains secouent les marchés, les investisseurs se débarrassent du dollar et des obligations

Les tarifs douaniers de Trump sur la Chine suscitent des craintes de récession Les bons du Trésor américains et le dollar frappés par la vente massive, les rendements grimpentAuthor: Thomas Frank

11:20 2025-04-09 UTC+2

4

- Les prévisions concernant l'or deviennent de plus en plus spectaculaires à tous points de vue, alors que les analystes semblent rivaliser pour savoir jusqu'où le métal précieux pourrait monter. L'instabilité

Author: Larisa Kolesnikova

11:07 2025-04-09 UTC+2

5

S&P 500 Le marché essaie de maintenir le support Principaux indices américains mardi : Dow -0,8%, NASDAQ -2,2%, S&P 500 -1,6%, S&P 500 à 4983, gamme 4800–5700. C'était encoreAuthor: Jozef Kovach

10:44 2025-04-09 UTC+2

6

104 % ! Qui est le prochain ? Les enjeux dans la guerre commerciale entre les États-Unis et la Chine montent en flèche, entraînant le S&P 500 de plusAuthor: Marek Petkovich

10:36 2025-04-09 UTC+2

5

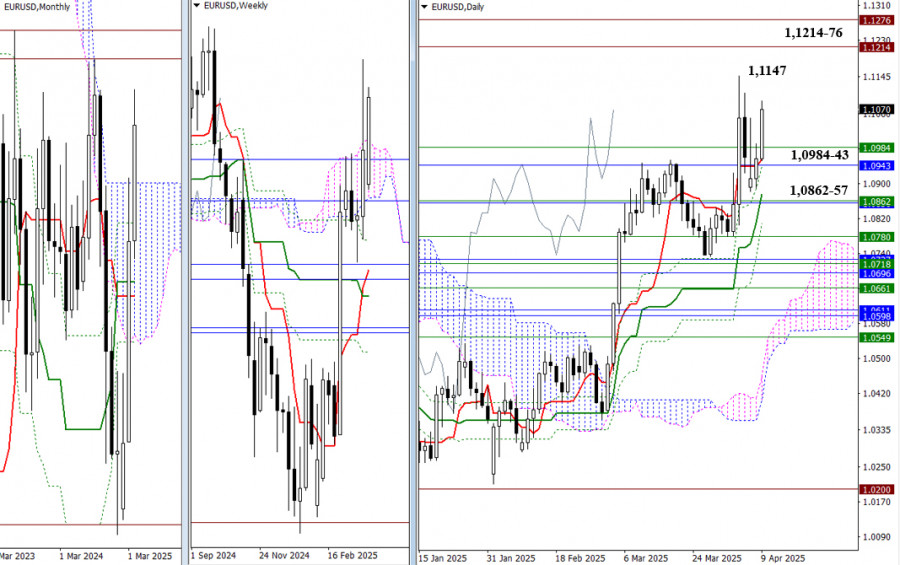

- Les acheteurs tentent de reprendre le contrôle, et nous observons actuellement une activité accrue et une poussée vers le sommet de la correction en cours à 1,1147. Une rupture au-dessus

Author: Evangelos Poulakis

10:07 2025-04-09 UTC+2

4

Marchés boursiersAperçu du Marché Boursier pour le 9 Avril : Le S&P 500 et le NASDAQ Reviennent à Leurs Niveaux Annuel Bas

Après la session de trading régulière de mardi, les indices boursiers américains ont clôturé avec une nouvelle baisse, finissant à peine à une distance de leurs plus bas annuelsAuthor: Jakub Novak

09:22 2025-04-09 UTC+2

4

Bitcoin et Ethereum se sont effondrés à la fin de mardi, poursuivant la forte vente lors de la session asiatique d'aujourd'hui. Une autre baisse brutale du marché boursier américainAuthor: Miroslaw Bawulski

09:22 2025-04-09 UTC+2

4