- Prévisions

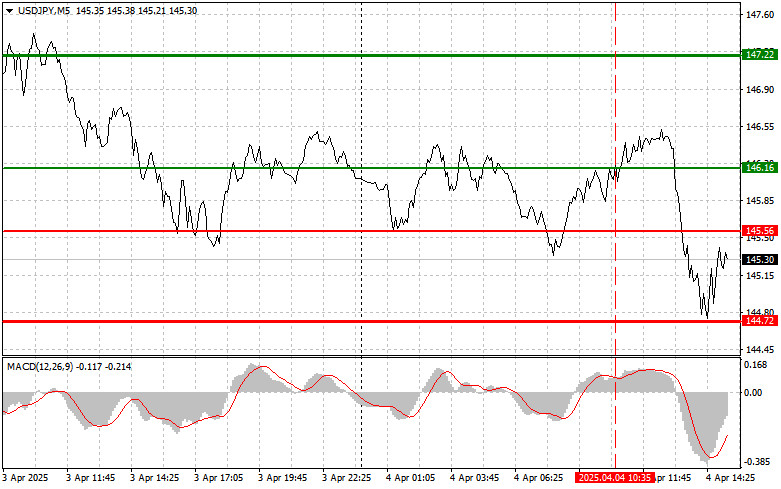

USD/JPY : Conseils de trading simples pour les traders débutants - 4 avril (Session U.S.)

Le test du prix à 146.16 s'est produit à un moment où l'indicateur MACD avait déjà significativement dépassé la ligne zéro, ce qui a limité le potentiel haussierAuthor: Jakub Novak

20:08 2025-04-04 UTC+2

45

Le test du prix à 1.3077 s'est produit lorsque l'indicateur MACD avait déjà considérablement passé la ligne zéro, ce qui a limité le potentiel de baisse supplémentaire de la paireAuthor: Jakub Novak

20:03 2025-04-04 UTC+2

37

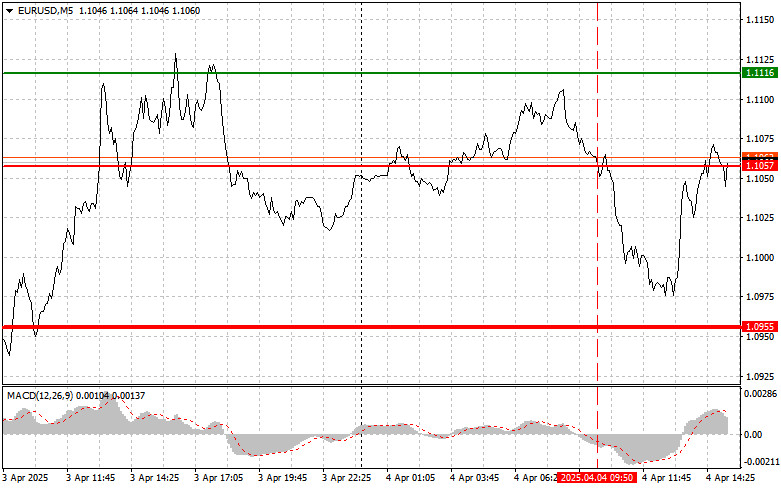

PrévisionsEUR/USD : Conseils de trading simples pour les traders débutants – 4 avril (Session américaine)

Le test du prix à 1,1050 s'est produit à un moment où l'indicateur MACD avait déjà chuté de manière significative en dessous de la ligne zéro, limitant le potentiel baissierAuthor: Jakub Novak

20:00 2025-04-04 UTC+2

39

- Plan de négociation

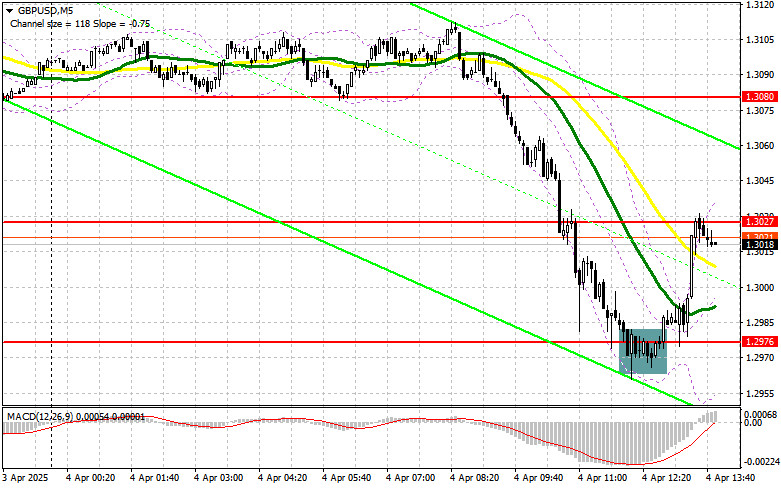

GBP/USD : Plan de trading pour la session américaine du 4 avril (Revue des transactions du matin)

Dans mes prévisions du matin, j'avais mis en avant le niveau de 1.2976 et prévu de baser mes décisions d'entrée sur le marché autour de ce point. Examinons le graphiqueAuthor: Miroslaw Bawulski

19:55 2025-04-04 UTC+2

38

Plan de négociationEUR/USD : Plan de trading pour la session américaine du 4 avril (Revue des échanges du matin)

Dans ma prévision de ce matin, j'ai mis en avant le niveau de 1,0994 et prévoyais de baser mes décisions d'entrée sur le marché sur celui-ci. Regardons le graphiqueAuthor: Miroslaw Bawulski

19:52 2025-04-04 UTC+2

35

Analyse techniqueSignaux de trading pour l'OR (XAU/USD) du 4 au 7 avril 2025 : vendre en dessous de 3 120 USD ou acheter au-dessus de 3 025 USD (rebond sur la MMA 21)

Si le prix de l'or casse à nouveau le canal haussier et se consolide sous les 3 090 dans les heures à venir, nous pourrions nous attendre à ce qu'ilAuthor: Dimitrios Zappas

17:37 2025-04-04 UTC+2

38

- Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytique Populaire Ouvrir un compte de trading Important : Les débutants en trading forex doivent

Author: Sebastian Seliga

14:17 2025-04-04 UTC+2

33

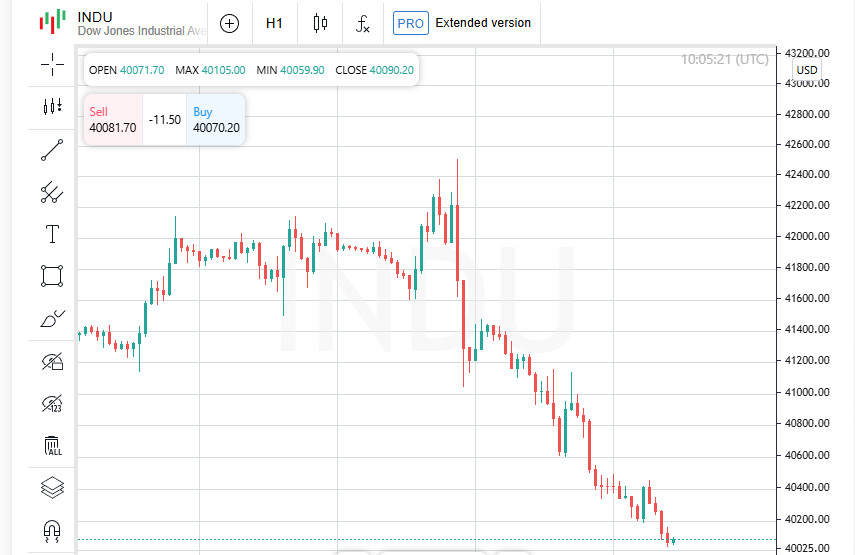

Nouvelles analytiquesÉtats-Unis vs. le reste du monde : les tarifs de Trump font chuter les marchés de Wall Street à l'Europe

Tous les trois indices chutent après l'annonce des tarifs par Trump Apple mène les perdants des grandes technologies Les actions de détail chutent en raison des inquiétudes sur les tarifsAuthor: Thomas Frank

12:09 2025-04-04 UTC+2

44

L'or attire certains vendeurs pour le deuxième jour consécutif, malgré l'absence de catalyseur fondamental clair pour une baisse. Cela est probablement dû à un repositionnement des transactions avant le rapportAuthor: Irina Yanina

11:50 2025-04-04 UTC+2

48