Forecast for October 17:

Analytical review of currency pairs on the scale of H1:

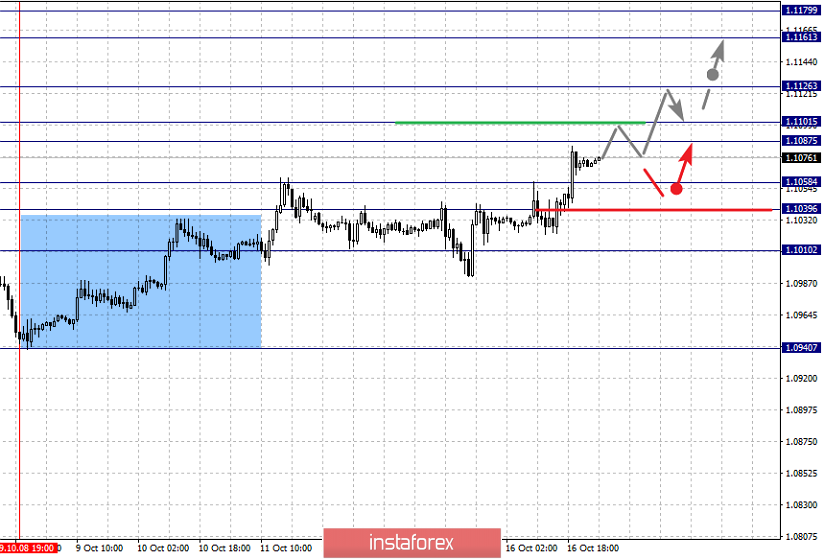

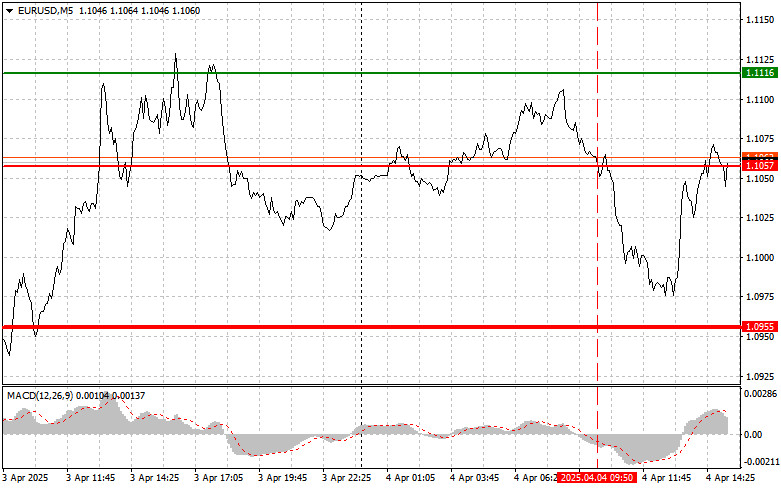

For the euro / dollar pair, the key levels on the H1 scale are: 1.1179, 1.1161, 1.1126, 1.1101, 1.1087, 1.1058, 1.1039 and 1.1010. Here, the continuation of the development of the upward cycle of October 8 is expected after the price passes the noise range 1.1087 - 1.1101. In this case, the target is 1.1126. Price consolidation is near this level. The breakdown of the level of 1.1128 will lead to movement to the potential target 1.1161. Price consolidation is in the range of 1.1161 - 1.1179, and from here, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.1058 - 1.1039. The breakdown of the last value will lead to a long correction. Here, the target is 1.1010. This level is a key support for the top.

The main trend is the local ascending structure of October 8.

Trading recommendations:

Buy: 1.1101 Take profit: 1.1124

Buy 1.1128 Take profit: 1.1160

Sell: 1.1058 Take profit: 1.1040

Sell: 1.1036 Take profit: 1.1010

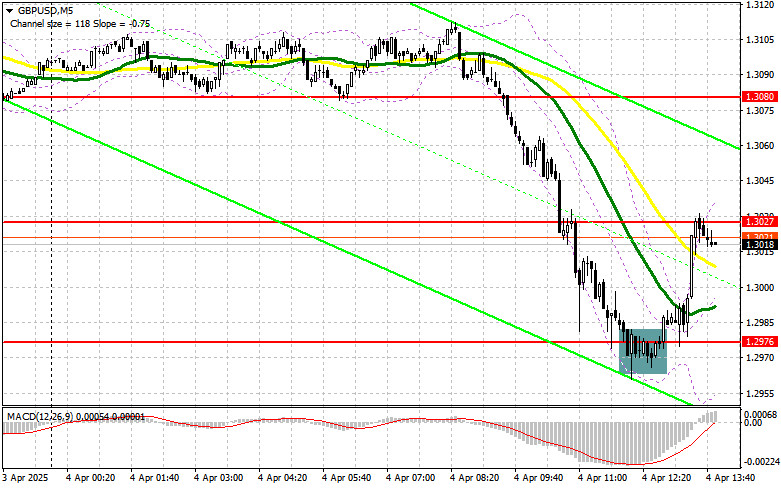

For the pound / dollar pair, the key levels on the H1 scale are: 1.3033, 1.2906, 1.2810, 1.2678, 1.2625 and 1.2532. Here, we are following the development of the upward cycle of October 9. Short-term upward movement, as well as consolidation, are expected in the range 1.2810 - 1.2906. The breakdown of the level of 1.2906 should be accompanied by a pronounced upward movement. Here, the potential target is 1.3033.

Short-term downward movement is expected in the range of 1.2678 - 1.2625. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2532. This level is a key support for the top.

The main trend is the upward structure of October 9.

Trading recommendations:

Buy: 1.2810 Take profit: 1.2904

Buy: 1.2908 Take profit: 1.3030

Sell: 1.2678 Take profit: 1.2625

Sell: 1.2623 Take profit: 1.2534

For the dollar / franc pair, the key levels on the H1 scale are: 1.0054, 1.0033, 1.0018, 0.9999, 0.9950, 0.9934, 0.9892 and 0.9872. Here, we are following the ascending structure of October 10. The development of this structure is expected after the breakdown of the level of 0.9999. In this case, the target is -1.0018. Price consolidation is in the range of 1.0018 - 1.0033. For the potential value for the top, we consider the level of 1.0054. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement, as well as consolidation, are possible in the range 0.9950 - 0.9934. The breakdown of the latter value will favor the development of a downward structure from October 3. In this case, the first goal is 0.9892.

The main trend is the descending structure of October 3, the formation of the potential for the top of October 10.

Trading recommendations:

Buy : 0.9999 Take profit: 1.0018

Buy : 1.0035 Take profit: 1.0054

Sell: 0.9950 Take profit: 0.9936

Sell: 0.9931 Take profit: 0.9894

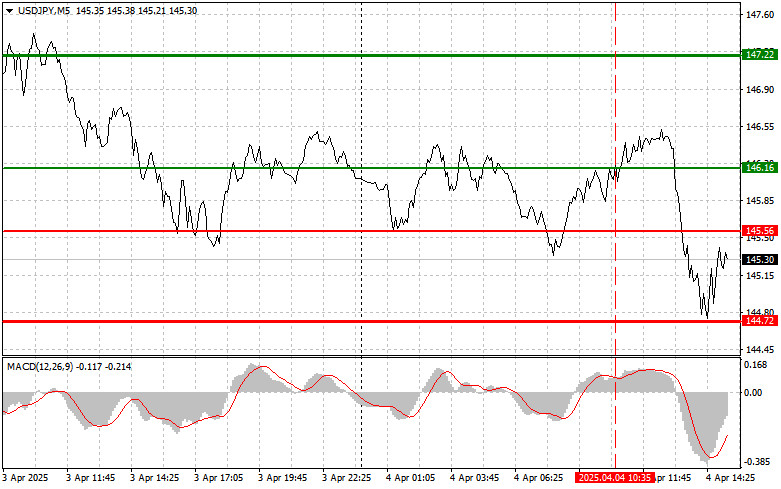

For the dollar / yen pair, the key levels on the scale are : 109.66, 109.33, 108.90, 108.72, 108.24, 108.02 and 107.67. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 108.72 - 108.90. The breakdown of the latter value will lead to a movement to the level of 109.33. Price consolidation is near this level. For the potential value for the top, we consider the level of 109.66. Upon reaching this level, we expect a consolidated movement, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 108.24 - 108.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.67. This level is a key support for the top.

The main trend: the upward cycle of October 4.

Trading recommendations:

Buy: 108.90 Take profit: 109.30

Buy : 109.34 Take profit: 109.65

Sell: 108.24 Take profit: 108.03

Sell: 108.00 Take profit: 107.70

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3279, 1.3251, 1.3223, 1.3177, 1.3158, 1.3142 and 1.3107. Here, we are following the development of the downward cycle of October 10. At the moment, the price is in correction. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3177. In this case, the target is 1.3158. Price consolidation is in the range of 1.3158 - 1.3142. For the potential value for the bottom, we consider the level of 1.3107. The movement to which is expected after the breakdown of the level of 1.3140.

Short-term upward movement is possibly in the range of 1.3223 - 1.3251. The breakdown of the latter value will lead to the formation of initial conditions for the upward cycle. In this case, the first potential target is 1.3279.

The main trend is the downward cycle of October 10.

Trading recommendations:

Buy: 1.3226 Take profit: 1.3250

Buy : 1.3253 Take profit: 1.3276

Sell: 1.3177 Take profit: 1.3158

Sell: 1.3140 Take profit: 1.3110

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6810, 0.6788, 0.6770, 0.6759, 0.6731, 0.6710, 0.6694, 0.6674 and 0.6661. Here, we are following the formation of the descending structure of October 11. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6730. In this case, the target is 0.6710. Short-term downward movement, as well as consolidation is in the range of 0.6710 - 0.6694. The breakdown of the level of 0.6694 should be accompanied by a pronounced downward movement to the potential target - 0.6674. Price consolidation is in the range of 0.6674 - 0.6661, and from here, we expect a pullback in correction.

Short-term upward movement is possibly in the range of 0.6759 - 0.6770. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6788. This level is a key support for the downward structure. Its passage in price will lead to the development of the upward structure. Here, the first potential target is 0.6810.

The main trend is the formation of the downward movement of October 11.

Trading recommendations:

Buy: 0.6770 Take profit: 0.6786

Buy: 0.6790 Take profit: 0.6810

Sell : 0.6730 Take profit : 0.6710

Sell: 0.6709 Take profit: 0.6696

For the euro / yen pair, the key levels on the H1 scale are: 121.79, 121.34, 121.03, 120.61, 120.28, 119.92, 119.64, 119.08 and 118.75. Here, we are following the development of the local ascendant structure of October 15. Short-term upward movement, as well as consolidation, are expected in the range of 120.28 - 120.60. The breakdown of the level of 120.61 should be accompanied by a pronounced upward movement. Here, the target is 121.03. Short-term upward movement, as well as consolidation is in the range of 121.03 - 121.34. For the potential value for the top, we consider the level of 121.79. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 119.92 - 119.64. The breakdown of the last value will have the downward structure formation. Here, the first potential target is 119.08.

The main trend is the local ascending structure of October 15.

Trading recommendations:

Buy: 120.63 Take profit: 121.00

Buy: 121.05 Take profit: 121.34

Sell: 119.90 Take profit: 119.66

Sell: 119.60 Take profit: 119.20

For the pound / yen pair, the key levels on the H1 scale are : 142.82, 140.89, 139.53, 137.79, 137.08, 136.05 and 135.47. Here, we are following the development of the upward cycle of October 8. The continuation of the movement to the top is expected after the breakdown of the level of 139.55. In this case, the target is 140.89. Price consolidation is near this level. The breakdown of the level of 140.92 will lead to the development of a pronounced movement. In this case, the potential goal is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 137.79 - 137.08. The breakdown of the last value will lead to a long correction. Here, the target is 136.05. The range of 136.05 - 135.47 is a key support for the top.

The main trend is the medium-term upward structure of October 8.

Trading recommendations:

Buy: 139.55 Take profit: 140.85

Buy: 141.00 Take profit: 142.80

Sell: 137.77 Take profit: 137.08

Sell: 137.05 Take profit: 136.05