- Nouvelles analytiques

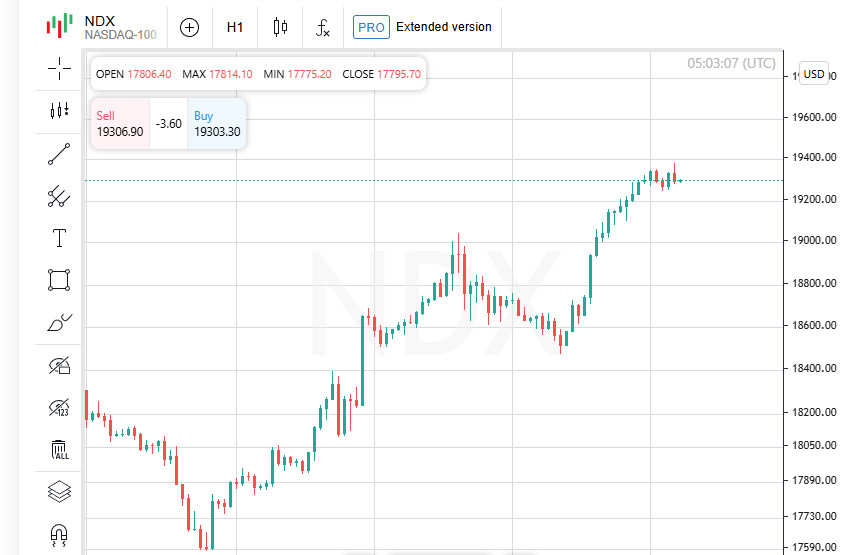

Wall Street en hausse : le Nasdaq s'envole de 2,74 %, le secteur technologique propulse le marché vers le haut

Procter & Gamble, PepsiCo chutent après des révisions à la baisse des prévisions Hasbro, ServiceNow bondissent après leurs résultats Les commandes de biens durables de mars augmentent plus que prévuAuthor: Thomas Frank

07:15 2025-04-25 UTC+2

0

Analyse fondamentaleÀ quoi faut-il prêter attention le 25 avril ? Une analyse des événements fondamentaux pour les débutants

Quelques événements macroéconomiques sont prévus pour vendredi, mais cela importe peu, car le marché continue d'ignorer 90 % de toutes les publications. Parmi les rapports plus ou moins significatifs d'aujourd'huiAuthor: Paolo Greco

07:06 2025-04-25 UTC+2

0

DevisAnalyse technique du mouvement des prix intrajournaliers de la cryptomonnaie Polkadot, vendredi 25 avril 2025.

Avec la condition de l'indicateur Stochastic Oscillator qui est déjà au-dessus du niveau de Surachat (80), bien qu'il soit actuellement toujours au-dessus de la WMA (30 Shift 2)Author: Arief Makmur

07:02 2025-04-25 UTC+2

0

- Devis

Analyse technique des mouvements de prix intraday de la cryptomonnaie Solana, vendredi 25 avril 2025.

Bien que la cryptomonnaie Solana soit actuellement en condition de renforcement, comme l'indique le mouvement de son prix qui évolue au-dessus de la WMA (30 Shift 2), l'apparition d'une divergenceAuthor: Arief Makmur

07:02 2025-04-25 UTC+2

0

Plan de négociationRecommandations de trading et analyse pour GBP/USD le 25 avril : La livre ne recule pas

Jeudi, la paire de devises GBP/USD a continué à évoluer dans un "style euro." Les mouvements intrajournaliers ont été relativement faibles, et le tableau technique suggère que la tendance pourraitAuthor: Paolo Greco

03:48 2025-04-25 UTC+2

2

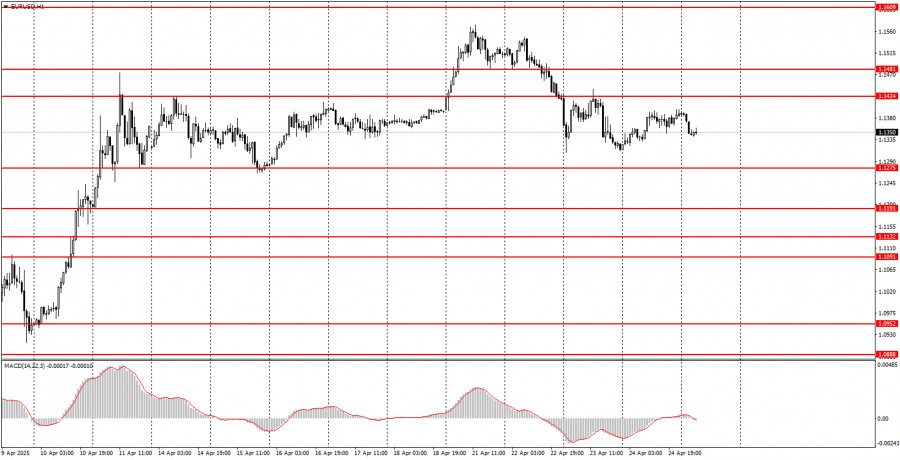

Plan de négociationRecommandations de Trading et Analyse pour EUR/USD le 25 avril : Le Marché Attent de Nouvelles Déclarations de Trump

La paire de devises EUR/USD a évolué de manière beaucoup plus calme jeudi que pendant la première moitié de la semaine, et le marché était également relativement plus technique. DepuisAuthor: Paolo Greco

03:48 2025-04-25 UTC+2

1

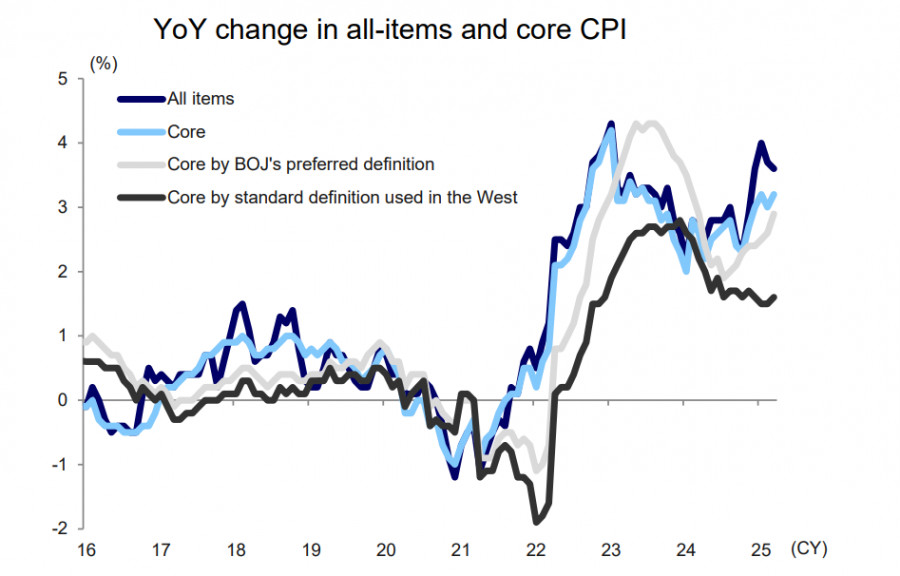

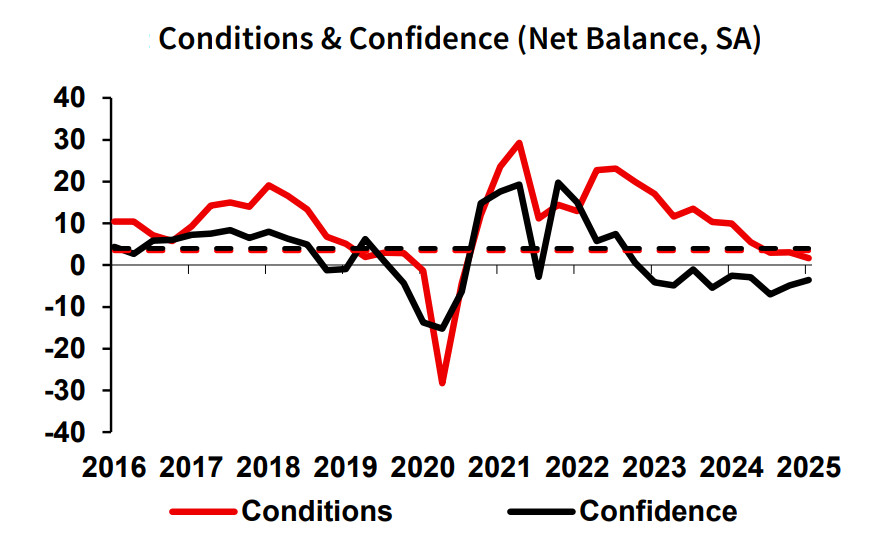

- L'indice national des prix à la consommation publié la semaine dernière a révélé une accélération de l'inflation sous-jacente en mars—passant de 2,6 % à 2,9 %. Les pressions inflationnistes augmentent

Author: Kuvat Raharjo

01:23 2025-04-25 UTC+2

10

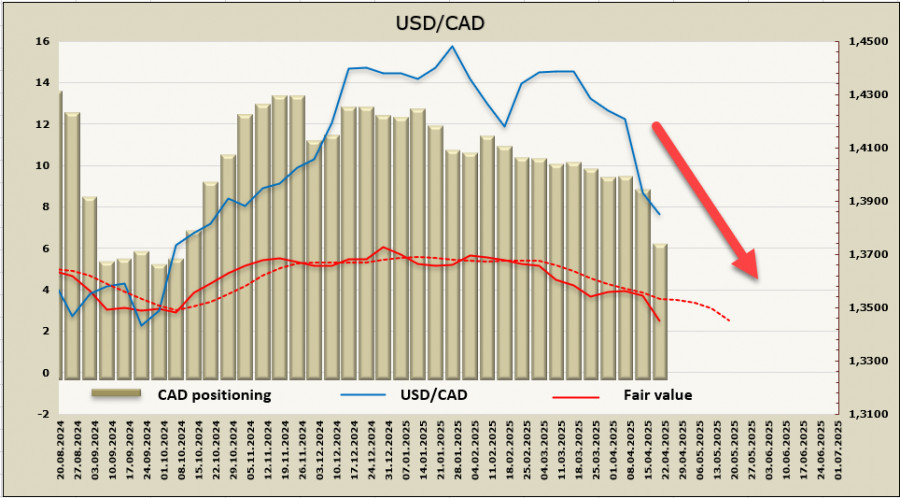

La semaine dernière, la Banque du Canada a maintenu son taux d'intérêt inchangé à 2,75 %, comme prévu. La déclaration qui l'accompagnait avait un ton neutre, soulignant l'incertitude persistanteAuthor: Kuvat Raharjo

00:59 2025-04-25 UTC+2

6

Analyse fondamentaleLe dollar australien pourrait souffrir si la guerre commerciale entre les États-Unis et la Chine s'intensifie

Le président américain Donald Trump a de nouveau commenté le président de la Réserve fédérale, Jerome Powell, exprimant ouvertement sa mécontentement vis-à-vis du rythme des baisses de taux. Une autreAuthor: Kuvat Raharjo

00:59 2025-04-25 UTC+2

2