- Analyse fondamentale

Vue d'ensemble GBP/USD – 18 avril. Discours de Powell : Rien de positif pour le dollar

La paire de devises GBP/USD a continué à se négocier de manière relativement calme jeudi, affichant seulement une légère tendance baissière. Nous ne pouvons toujours pas classer le mouvement actuelAuthor: Paolo Greco

03:48 2025-04-18 UTC+2

6

Analyse fondamentaleVue d'ensemble EUR/USD – 18 avril : La BCE a prévisiblement réduit ses taux, et le marché l'a prévisiblement ignoré

La paire de devises EUR/USD a passé la majeure partie de la journée à évoluer latéralement. Lorsque les résultats de la réunion de la Banque Centrale Européenne ont été publiésAuthor: Paolo Greco

03:48 2025-04-18 UTC+2

5

Plan de négociationRecommandations de Trading et Analyse pour GBP/USD le 18 avril : La Livre Sterling Perd de son Élan

La paire de devises GBP/USD a poursuivi son mouvement à la hausse jeudi, s'échangeant près de sommets pluriannuels. Malgré l'absence d'événements significatifs aux États-Unis ou au Royaume-Uni (contrairement à mercredi)Author: Paolo Greco

03:48 2025-04-18 UTC+2

4

- Plan de négociation

Recommandations de Trading et Analyse pour l'EUR/USD le 18 Avril : La BCE n’a pas Réussi à Influencer le Marché

La paire de devises EUR/USD a continué à évoluer de manière latérale jeudi. Alors que précédemment elle fluctuait dans une fourchette entre 1,1274 et 1,1391, jeudi, elle s'est retrouvée bloquéeAuthor: Paolo Greco

03:48 2025-04-18 UTC+2

5

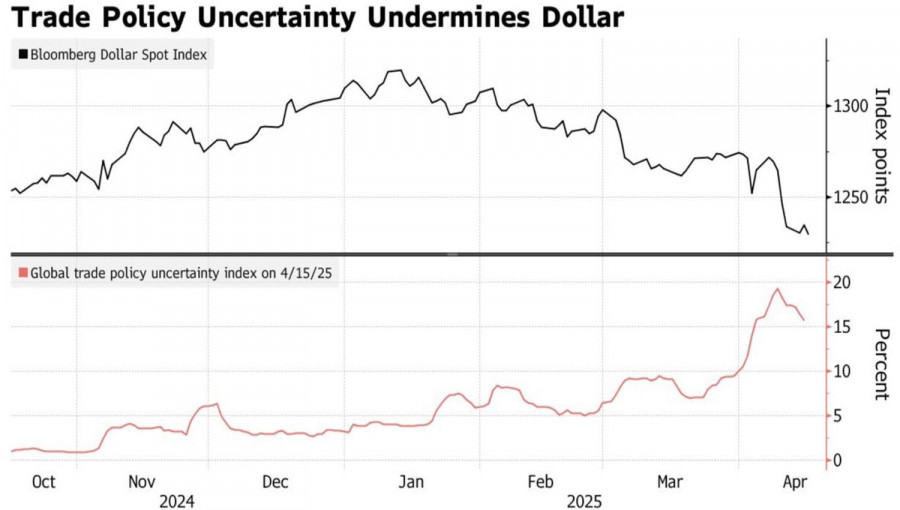

Il avait de bonnes intentions, mais cela s'est terminé comme d'habitude. Donald Trump croit fermement que les tarifs peuvent remplacer l'impôt sur le revenu, générer des revenus massifs pourAuthor: Marek Petkovich

03:39 2025-04-18 UTC+2

3

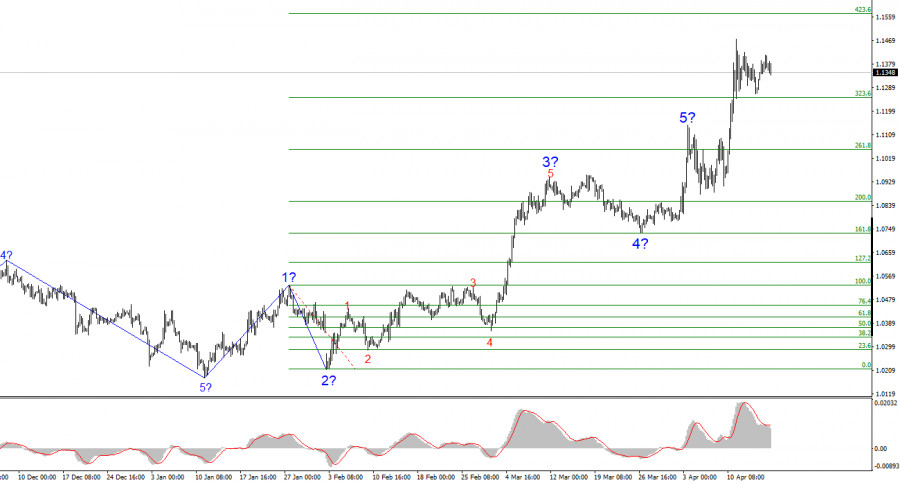

La structure des vagues sur le graphique 4 heures de l'EUR/USD s'est transformée en une formation impulsive haussière. Je pense qu'il n'y a aucun doute que cette transformation est uniquementAuthor: Chin Zhao

19:12 2025-04-17 UTC+2

9

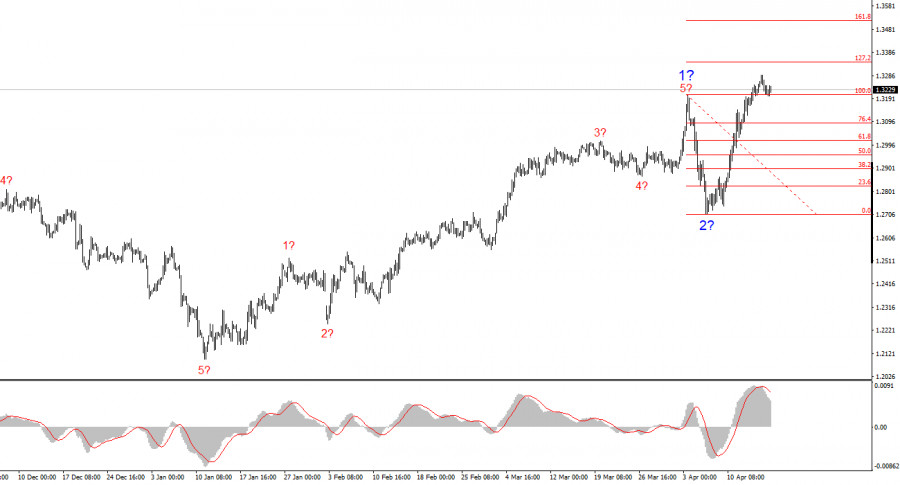

- La paire GBP/USD est restée inchangée jeudi. Bien qu’un tel comportement de marché pouvait être attendu pour jeudi, il était surprenant de ne pas voir de baisse mercredi, compte tenu

Author: Chin Zhao

19:09 2025-04-17 UTC+2

6

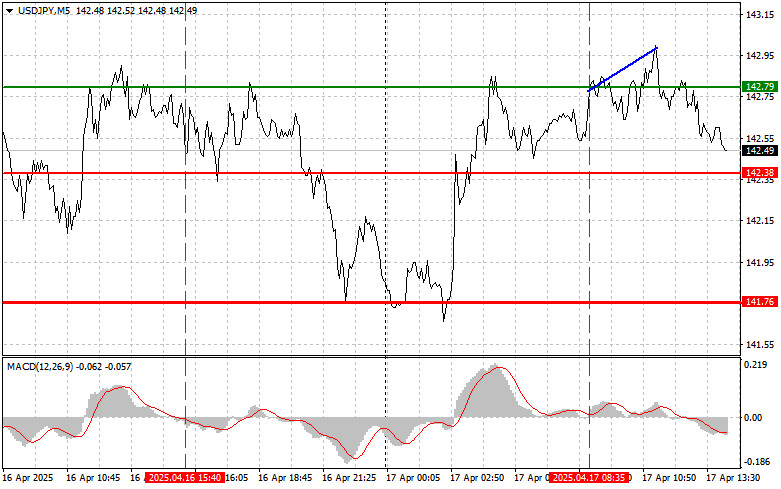

PrévisionsUSD/JPY : Conseils de trading simples pour les traders débutants – 17 avril (session américaine)

Le test du niveau de 142,79 s'est produit lorsque l'indicateur MACD venait de commencer à monter à partir de la valeur zéro, ce qui a confirmé un point d'entrée valideAuthor: Jakub Novak

19:05 2025-04-17 UTC+2

8

Le test du niveau de 1.3230 s'est produit alors que l'indicateur MACD avait déjà bien dépassé la ligne zéro, ce qui a limité le potentiel de hausse de la livreAuthor: Jakub Novak

19:02 2025-04-17 UTC+2

7