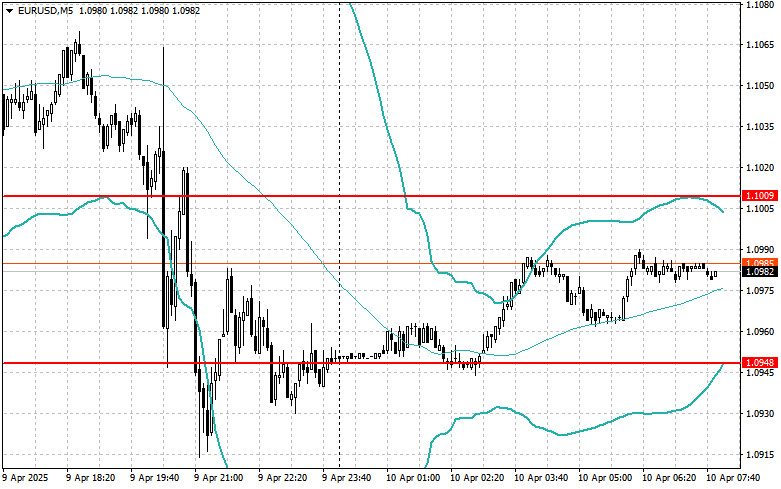

- L'euro et la livre sterling ont réussi à résister à une pression renouvelée des vendeurs et même à récupérer légèrement leurs positions lors de la session de trading asiatique d'aujourd'hui

Author: Miroslaw Bawulski

07:44 2025-04-10 UTC+2

0

Analyse fondamentaleÀ quoi faire attention le 10 avril ? Analyse des événements fondamentaux pour les débutants

Il y a très peu d'événements macroéconomiques prévus pour jeudi, mais le rapport sur l'inflation aux États-Unis conserve tout de même une certaine importance pour les traders. Actuellement, l'inflationAuthor: Paolo Greco

06:49 2025-04-10 UTC+2

1

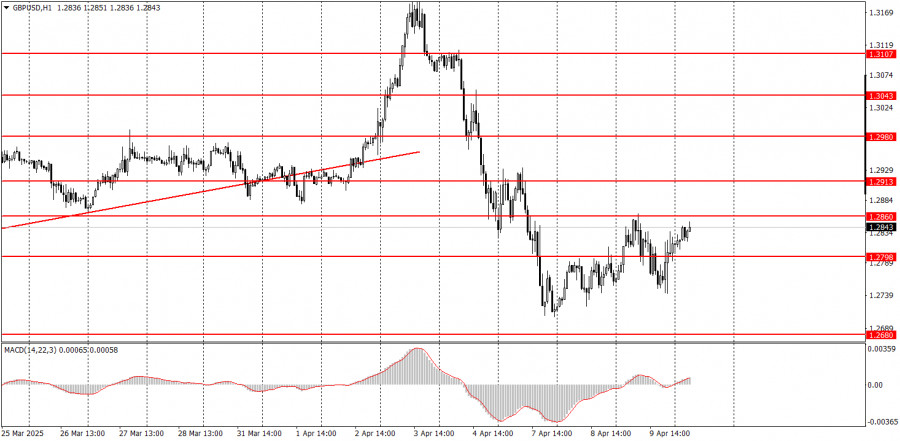

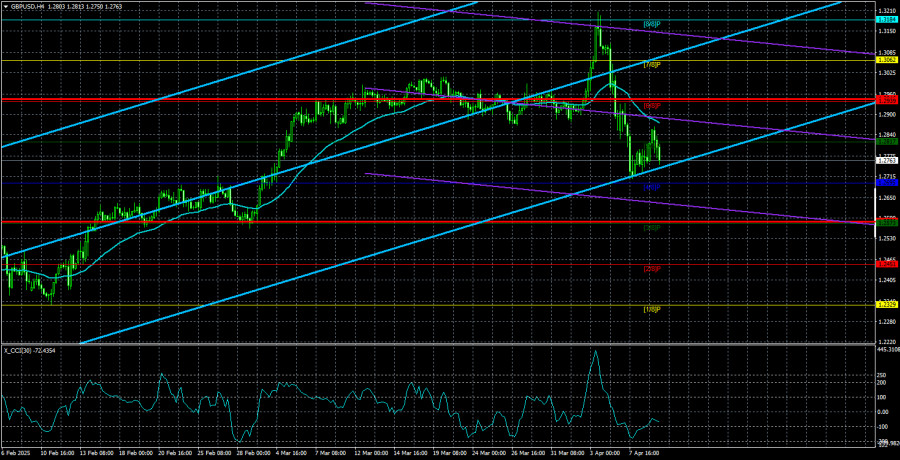

Plan de négociationComment échanger la paire GBP/USD le 10 avril ? Conseils simples et analyse de trade pour les débutants

La paire GBP/USD a passé les dernières 24 heures à monter, puis à descendre de nouveau, avant de remonter. Comme auparavant, il est impossible d'identifier une tendance claireAuthor: Paolo Greco

06:49 2025-04-10 UTC+2

1

- Plan de négociation

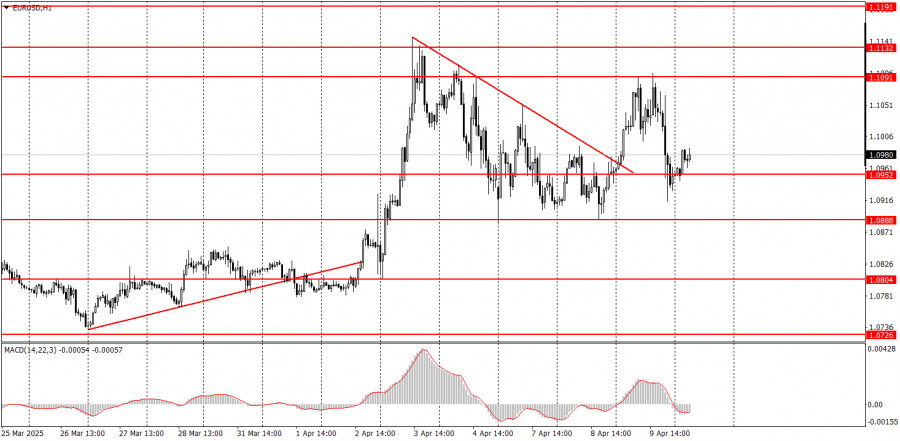

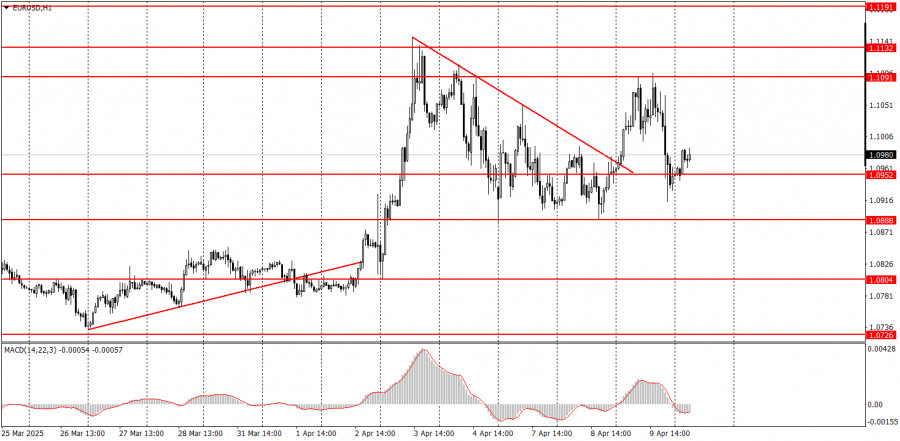

Comment échanger la paire EUR/USD le 10 avril ? Conseils simples et analyse de marché pour débutants

La paire de devises EUR/USD a montré une forte croissance puis un déclin mercredi. Récemment, ces mouvements ont tous deux été déclenchés par Donald Trump. Tout d'abord, la nouvelle s'estAuthor: Paolo Greco

06:49 2025-04-10 UTC+2

1

Hier, le président des États-Unis, Donald Trump, a réduit les tarifs à 10 % pendant 90 jours pour les pays qui n’ont pas riposté aux tarifs américains initiaux (plusAuthor: Laurie Bailey

05:08 2025-04-10 UTC+2

2

Mercredi, la livre sterling a entièrement parcouru la plage cible de 1,2816/47, mais comme prévu, elle n'a pas réussi à se consolider au-dessus de cette plage, entrant plutôt dansAuthor: Laurie Bailey

05:08 2025-04-10 UTC+2

1

- La volatilité accrue d'hier sur l'USD/JPY n'a pas réussi à inverser le sentiment baissier—le corps de la bougie n'a jamais clôturé au-dessus de la ligne d'équilibre. La baisse

Author: Laurie Bailey

05:08 2025-04-10 UTC+2

3

L'indice boursier américain, le S&P 500, a enregistré l'une des plus grandes hausses en une seule journée de son histoire hier. Il est tombé à quelques points près du niveauAuthor: Laurie Bailey

05:08 2025-04-10 UTC+2

3

La paire de devises GBP/USD a montré des fluctuations tout au long de la journée de mercredi. La baisse de l'après-midi a une fois de plus soulevé des questions, mêmeAuthor: Paolo Greco

03:21 2025-04-10 UTC+2

3