- Plan de négociation

Recommandations de Trading et Analyse pour GBP/USD le 18 avril : La Livre Sterling Perd de son Élan

La paire de devises GBP/USD a poursuivi son mouvement à la hausse jeudi, s'échangeant près de sommets pluriannuels. Malgré l'absence d'événements significatifs aux États-Unis ou au Royaume-Uni (contrairement à mercredi)Author: Paolo Greco

03:48 2025-04-18 UTC+2

0

Plan de négociationRecommandations de Trading et Analyse pour l'EUR/USD le 18 Avril : La BCE n’a pas Réussi à Influencer le Marché

La paire de devises EUR/USD a continué à évoluer de manière latérale jeudi. Alors que précédemment elle fluctuait dans une fourchette entre 1,1274 et 1,1391, jeudi, elle s'est retrouvée bloquéeAuthor: Paolo Greco

03:48 2025-04-18 UTC+2

0

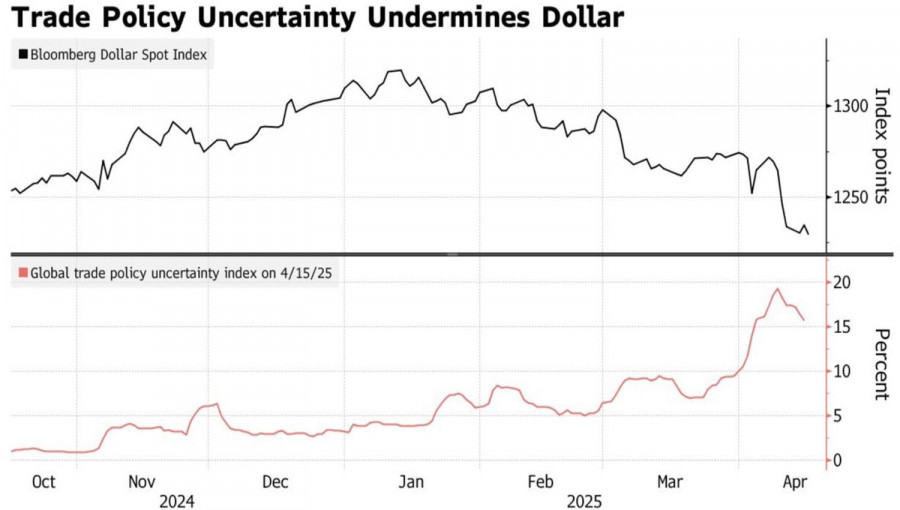

Il avait de bonnes intentions, mais cela s'est terminé comme d'habitude. Donald Trump croit fermement que les tarifs peuvent remplacer l'impôt sur le revenu, générer des revenus massifs pourAuthor: Marek Petkovich

03:39 2025-04-18 UTC+2

0

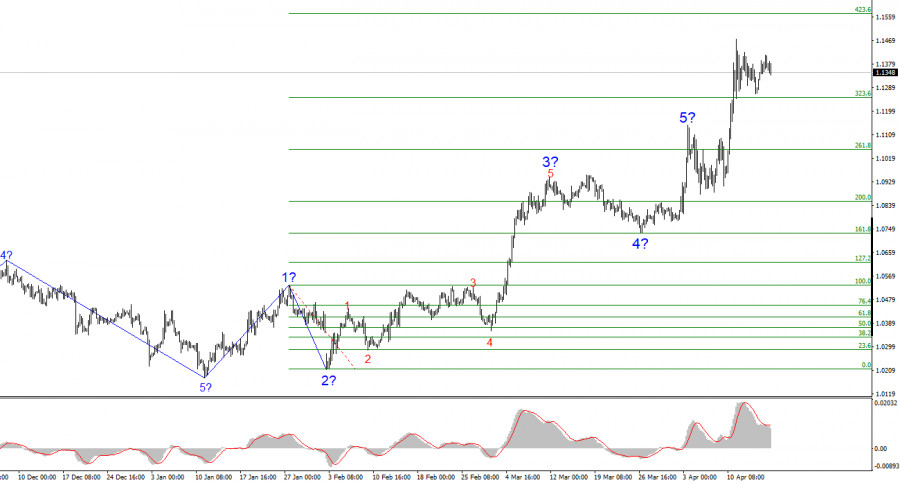

- La structure des vagues sur le graphique 4 heures de l'EUR/USD s'est transformée en une formation impulsive haussière. Je pense qu'il n'y a aucun doute que cette transformation est uniquement

Author: Chin Zhao

19:12 2025-04-17 UTC+2

8

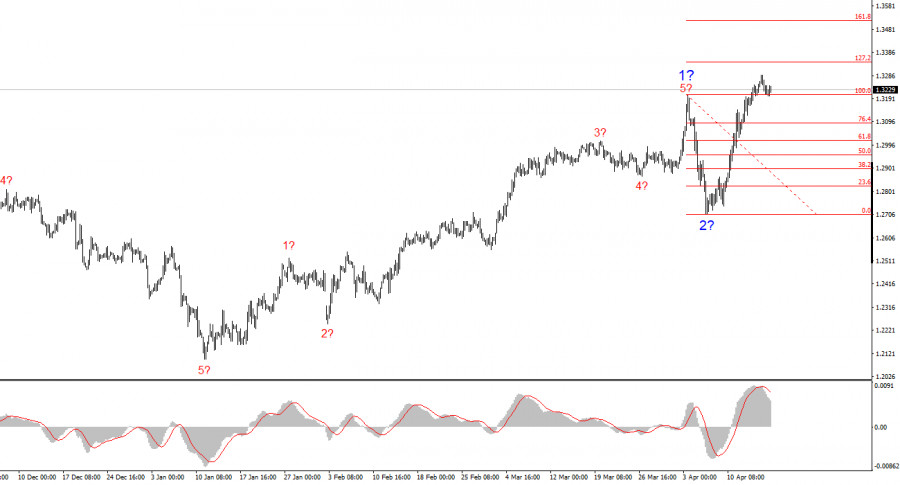

La paire GBP/USD est restée inchangée jeudi. Bien qu’un tel comportement de marché pouvait être attendu pour jeudi, il était surprenant de ne pas voir de baisse mercredi, compte tenuAuthor: Chin Zhao

19:09 2025-04-17 UTC+2

6

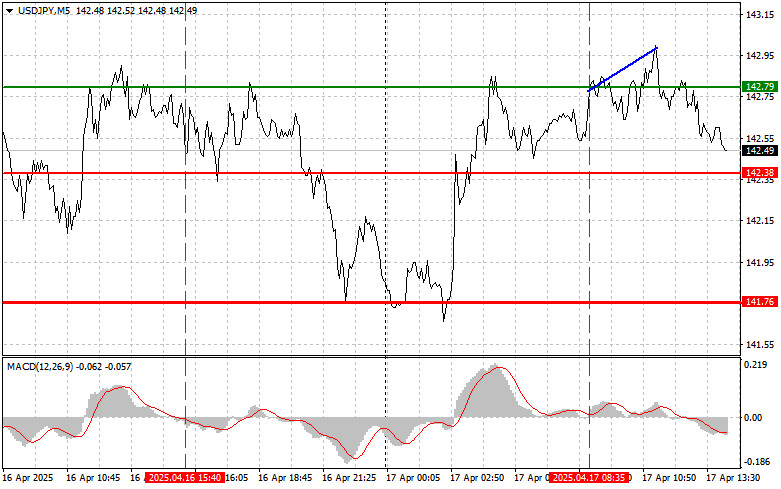

PrévisionsUSD/JPY : Conseils de trading simples pour les traders débutants – 17 avril (session américaine)

Le test du niveau de 142,79 s'est produit lorsque l'indicateur MACD venait de commencer à monter à partir de la valeur zéro, ce qui a confirmé un point d'entrée valideAuthor: Jakub Novak

19:05 2025-04-17 UTC+2

7

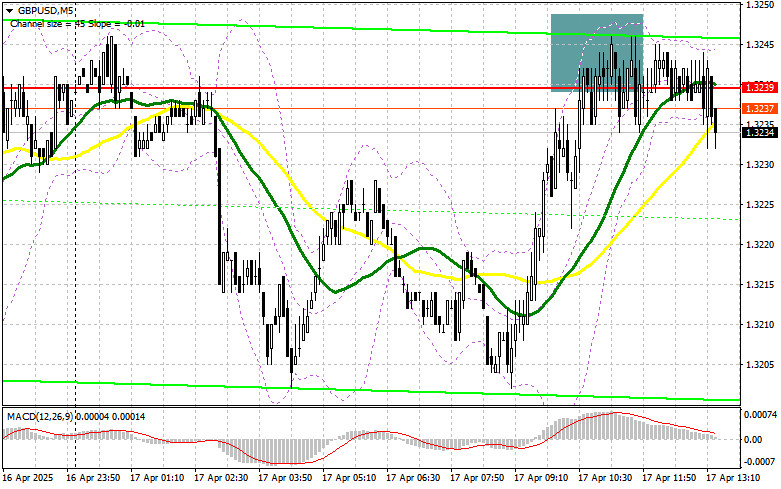

- Le test du niveau de 1.3230 s'est produit alors que l'indicateur MACD avait déjà bien dépassé la ligne zéro, ce qui a limité le potentiel de hausse de la livre

Author: Jakub Novak

19:02 2025-04-17 UTC+2

7

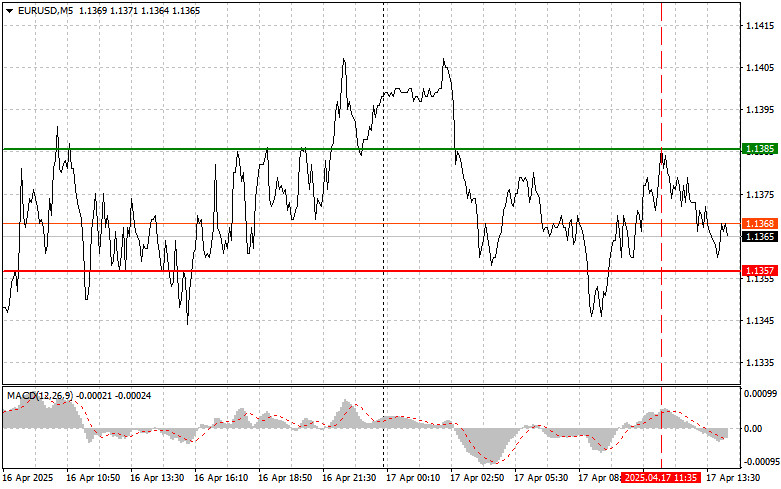

Le test du niveau de 1.1385 a eu lieu lorsque l'indicateur MACD avait déjà considérablement dépassé la barre du zéro, ce qui a limité le potentiel haussier de la paireAuthor: Jakub Novak

18:57 2025-04-17 UTC+2

7

Plan de négociationGBP/USD : Plan de trading pour la session américaine du 17 avril (Revue des transactions matinales)

Dans ma prévision du matin, je me suis concentré sur le niveau de 1.3239 et j'ai prévu de baser mes décisions d'entrée autour de celui-ci. Regardons le graphiqueAuthor: Miroslaw Bawulski

18:53 2025-04-17 UTC+2

5