- Plan de négociation

Recommandations de trading et analyse pour EUR/USD le 9 avril : Le marché se prépare à une nouvelle évasion

Le pair de devises EUR/USD s'est légèrement calmé mardi, mais le tableau technique ne promet rien de bon—ni le fondamental d'ailleurs. Commençons par l'aspect technique. Un "drapeau haussier" classiqueAuthor: Paolo Greco

02:55 2025-04-09 UTC+2

0

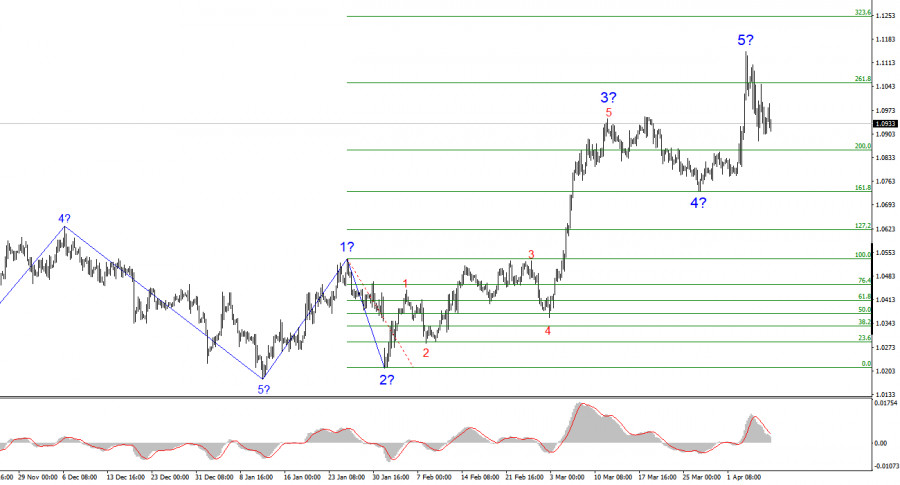

Le schéma ondulatoire sur le graphique en 4 heures pour l'EUR/USD s'est transformé en un schéma haussier. Je pense qu'il ne fait guère de doute que cette transformation est entièrementAuthor: Chin Zhao

19:51 2025-04-08 UTC+2

4

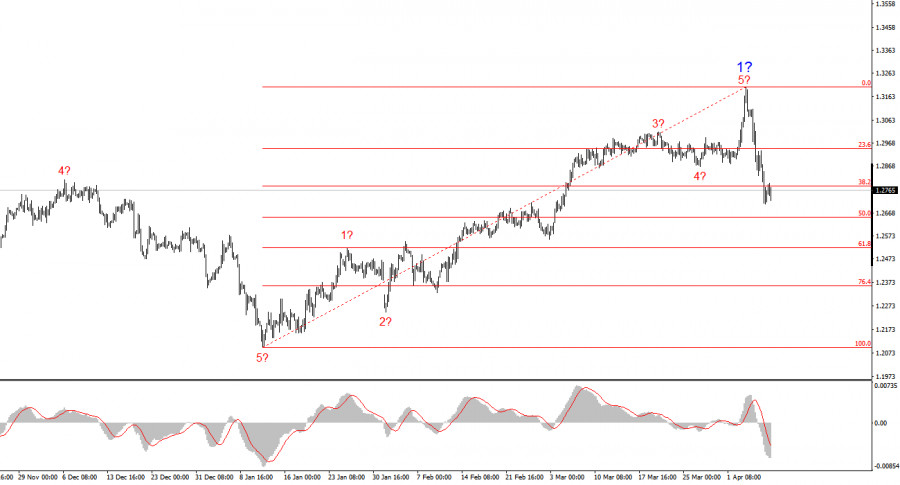

Le schéma en vagues pour le GBP/USD s'est également transformé en une structure haussière et impulsive — "merci" à Donald Trump. La formation de vagues est presque identique à celleAuthor: Chin Zhao

19:48 2025-04-08 UTC+2

4

- La paire NZD/USD tente de retrouver une dynamique positive, soutenue par une nouvelle vente du dollar américain. Cependant, étant donné les fondamentaux sous-jacents, les traders optimistes sont priés d'être prudents

Author: Irina Yanina

19:45 2025-04-08 UTC+2

4

La paire EUR/USD tente de retrouver un élan positif pour la deuxième journée consécutive, interrompant ainsi le récent repli depuis les plus hauts niveaux mensuels observés en septembre. D'un pointAuthor: Irina Yanina

19:44 2025-04-08 UTC+2

4

PrévisionsUSD/JPY : Conseils de trading simples pour les traders débutants le 8 avril (session américaine)

Analyse des échanges et conseils de trading pour le yen japonais Le test du niveau 147.47 s'est produit lorsque l'indicateur MACD venait de commencer à se déplacer versAuthor: Jakub Novak

19:42 2025-04-08 UTC+2

4

- Prévisions

GBP/USD : Conseils de trading simples pour les traders débutants le 8 avril (session américaine)

Analyse des transactions et conseils de trading pour la livre sterling Le test du niveau de 1.2792 s'est produit à un moment où l'indicateur MACD s'était déjà déplacé bien au-dessusAuthor: Jakub Novak

19:39 2025-04-08 UTC+2

4

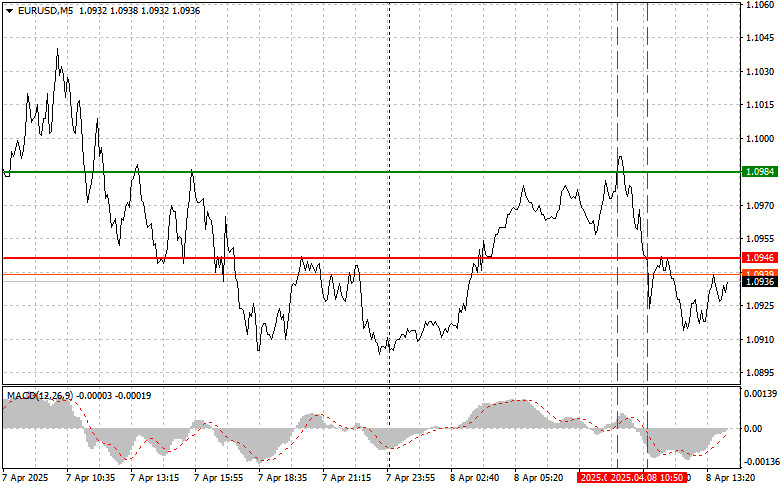

PrévisionsEUR/USD : Conseils de trading simples pour les traders débutants le 8 avril (session américaine)

Analyse des transactions et conseils pour le trading de l'euro Le test du niveau 1.0984 a coïncidé avec le moment où l'indicateur MACD avait déjà considérablement dépassé la ligne zéroAuthor: Jakub Novak

19:37 2025-04-08 UTC+2

4

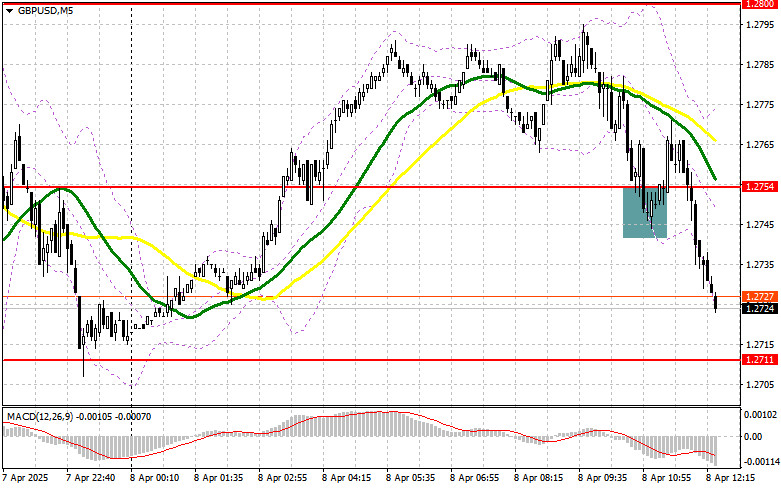

Plan de négociationGBP/USD : Plan de trading pour la séance américaine du 8 avril (analyse des opérations du matin)

Dans ma prévision du matin, je me suis concentré sur le niveau de 1,2754 et j'avais prévu de prendre des décisions de trading à partir de celui-ci. Regardons le graphiqueAuthor: Miroslaw Bawulski

19:33 2025-04-08 UTC+2

4