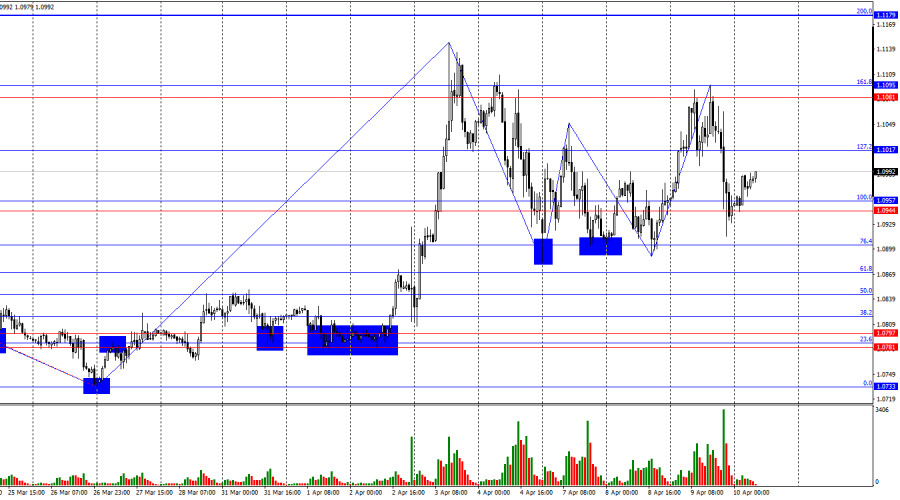

- Mercredi, la paire EUR/USD a effectué deux rebonds à partir de la zone de résistance de 1,1081–1,1095, s'est orientée en faveur du dollar américain et a décliné vers la zone

Author: Samir Klishi

12:19 2025-04-10 UTC+2

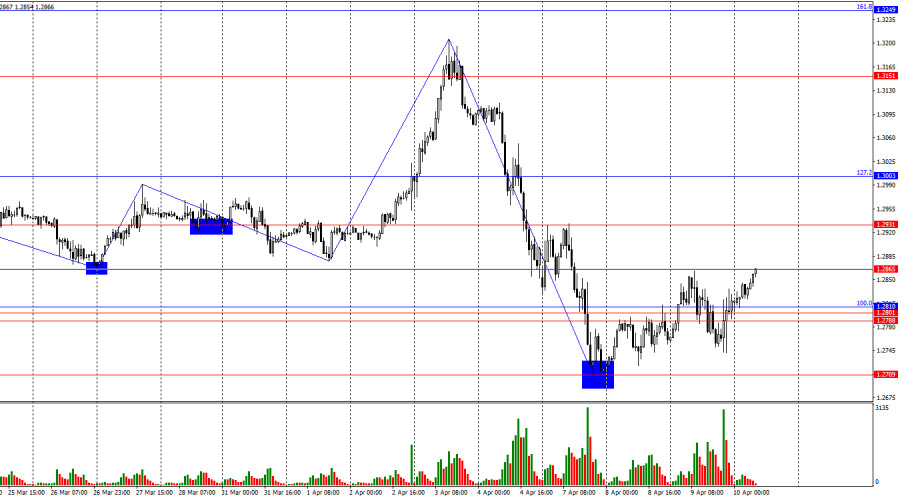

1

Sur le graphique horaire, la paire GBP/USD a rebondi depuis le niveau de 1.2865 mercredi, a connu un léger déclin, et est revenue aujourd'hui à ce même niveau. Un autreAuthor: Samir Klishi

12:12 2025-04-10 UTC+2

1

Un rapport sur l'inflation très attendu en provenance des États-Unis pour le mois de mars est prévu aujourd'hui, les analystes prédisant un ralentissement, en partie dû à la baisseAuthor: Jakub Novak

12:09 2025-04-10 UTC+2

1

- Analyse fondamentale

La Chine prévoit une réunion d'urgence et une réaction forte face aux États-Unis

Selon les rapports des médias, les plus hautes instances dirigeantes de la Chine doivent tenir une réunion d'urgence aujourd'hui pour discuter de mesures de relance économique supplémentaires suite à l'annonceAuthor: Jakub Novak

12:07 2025-04-10 UTC+2

1

Analyse fondamentaleTrump suspend les tarifs pendant 90 jours mais augmente encore davantage les taux sur la Chine

Le Président Donald Trump a annoncé hier une suspension de 90 jours des augmentations de tarifs qui avaient affecté des dizaines de partenaires commerciaux, tout en augmentant simultanément les tarifsAuthor: Jakub Novak

11:57 2025-04-10 UTC+2

2

Analyse techniquePrévision Forex du 04/10/2025 : EUR/USD, SP500, NASDAQ, Dow Jones, USDX et Bitcoin

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytique Populaire Ouvrir un compte de trading Important : Les débutants dans le trading forexAuthor: Sebastian Seliga

11:35 2025-04-10 UTC+2

7

- Marchés boursiers

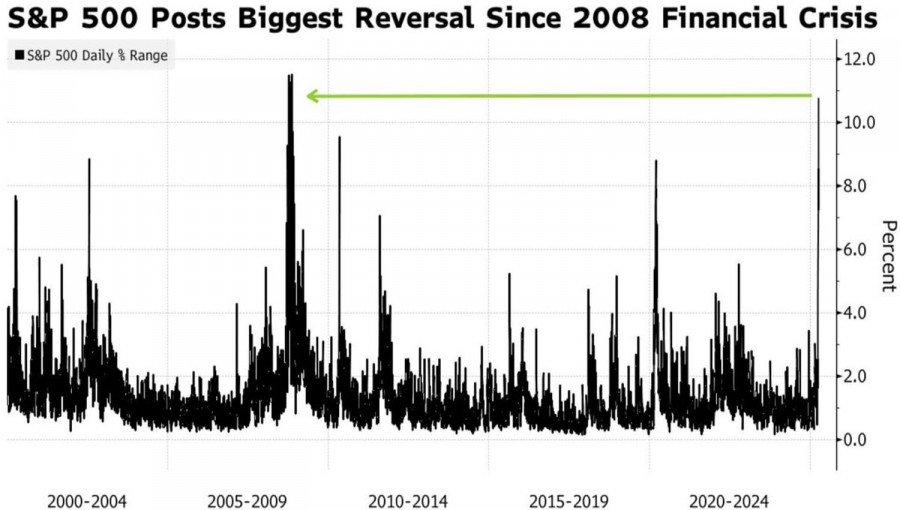

Mise à jour du marché boursier américain au 10 avril. Le SP500 et le NASDAQ croissent à toute vitesse

À la clôture de la séance de bourse d'hier, les indices boursiers américains ont terminé avec de solides gains. Le S&P 500 a bondi de 9,52 %, tandisAuthor: Jakub Novak

11:31 2025-04-10 UTC+2

1

Il n'y a pas de fumée sans feu. Au début de la deuxième semaine d'avril, une rumeur s'est propagée sur les réseaux sociaux concernant un report de 90 joursAuthor: Marek Petkovich

10:58 2025-04-10 UTC+2

2

Nouvelles analytiquesPourquoi les actions augmentent-elles alors que le yuan s'affaiblit et que les contrats à terme américains baissent ?

Les actions montent en flèche, mais les contrats à terme américains chutentLes actions chinoises augmentent même si le yuan atteint son plus bas niveau depuis plusieurs annéesLes actions européennes bondissentAuthor: Thomas Frank

10:17 2025-04-10 UTC+2

1