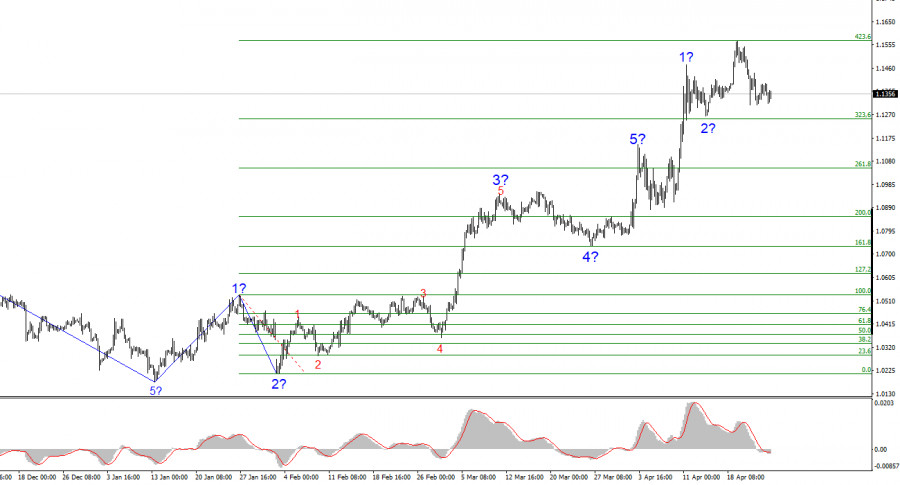

- Le modèle des vagues sur le graphique de 4 heures de l'EUR/USD a évolué vers une formation haussière. Il est raisonnable de dire que cette transformation s'est produite uniquement

Author: Chin Zhao

20:26 2025-04-25 UTC+2

32

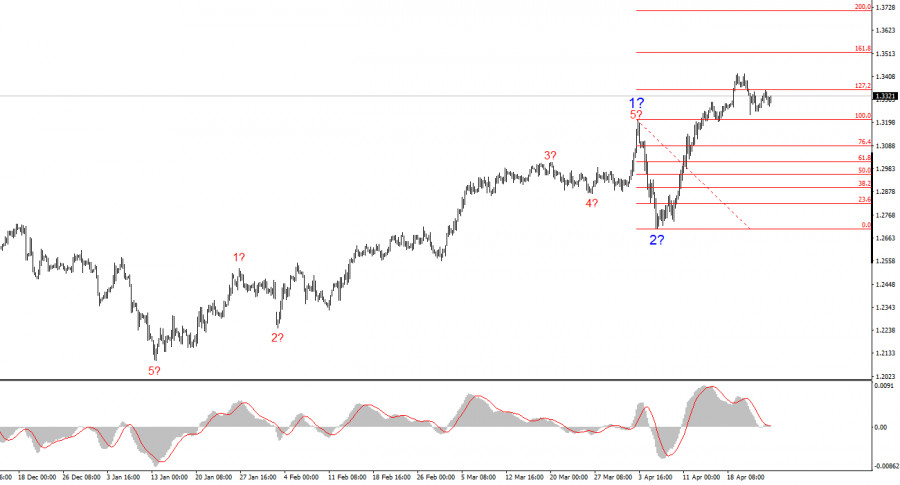

Le modèle de vagues sur le graphique GBP/USD s'est également transformé en une structure haussière et impulsive — "grâce" à Donald Trump. La configuration de vagues ressemble de prèsAuthor: Chin Zhao

20:21 2025-04-25 UTC+2

35

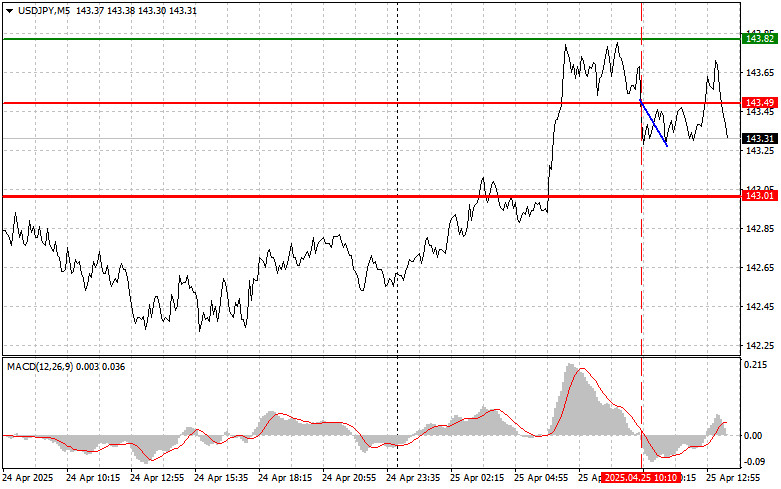

Analyse et Conseils de Trading pour le Yen Japonais Le test du prix à 143.49 s'est produit juste au moment où l'indicateur MACD a commencé à descendre de la ligneAuthor: Jakub Novak

20:09 2025-04-25 UTC+2

38

- Analyse et conseils commerciaux pour la livre sterling Le test de prix à 1,3292 a eu lieu lorsque l'indicateur MACD venait tout juste de commencer à remonter à partir

Author: Jakub Novak

19:22 2025-04-25 UTC+2

28

PrévisionsEUR/USD : Conseils de trading simples pour les traders débutants – 25 avril (session américaine)

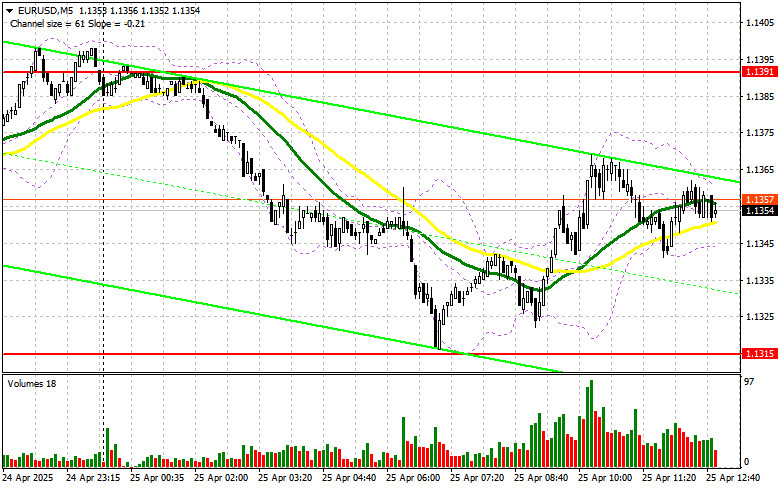

Analyse et Conseils de Négociation pour l'Euro Le test du prix à 1.1355 a eu lieu alors que l'indicateur MACD avait déjà nettement dépassé la ligne zéroAuthor: Jakub Novak

19:17 2025-04-25 UTC+2

30

Plan de négociationGBP/USD : Plan de trading pour la session américaine du 25 avril (Revue des échanges matinaux)

Dans ma prévision matinale, je me suis concentré sur le niveau de 1,3310 et j'ai prévu de prendre des décisions de trading à partir de là. Regardons le graphiqueAuthor: Miroslaw Bawulski

19:05 2025-04-25 UTC+2

27

- Plan de négociation

EUR/USD : Plan de trading pour la session américaine du 25 avril (Revue des transactions matinales)

Dans ma prévision matinale, je me suis concentré sur le niveau de 1.1391 et j'ai prévu de prendre des décisions d'entrée autour de celui-ci. Jetons un œil au graphiqueAuthor: Miroslaw Bawulski

19:00 2025-04-25 UTC+2

26

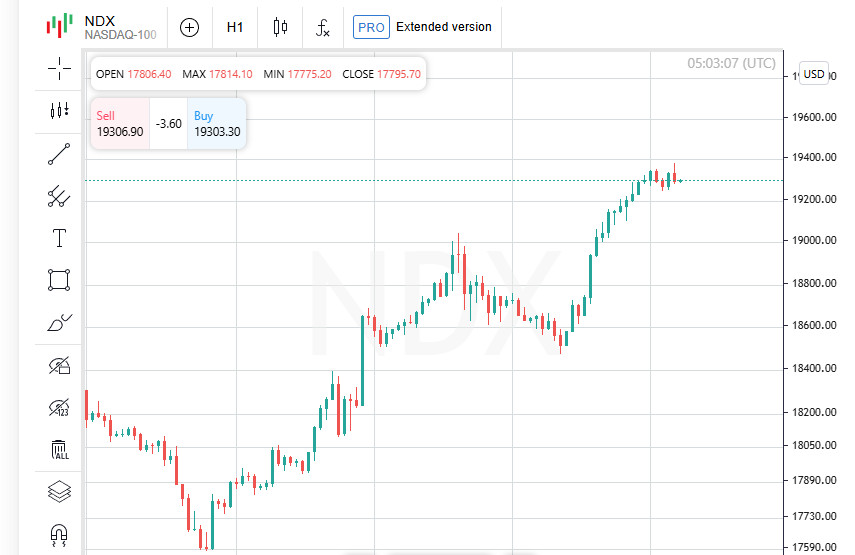

Nouvelles analytiquesWall Street en forte hausse : le Nasdaq bondit de 2,74 % alors que les actions technologiques propulsent le marché à la hausse

Procter & Gamble et PepsiCo ont chuté après avoir révisé leurs prévisions à la baisse, tandis que Hasbro et ServiceNow ont grimpé après la publication de leurs résultats financiersAuthor:

12:52 2025-04-25 UTC+2

28

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analytics Populaires Ouvrir un compte de trading Important : Les débutants en trading forex doiventAuthor: Sebastian Seliga

12:25 2025-04-25 UTC+2

35