- S&P, Nasdaq enregistrent leur pire mois depuis décembre 2022 La plus forte baisse trimestrielle des taux d'intérêt : S&P depuis T3 2022, Nasdaq T2 2022 L'incertitude sur les tarifs Trump

Author: Thomas Frank

12:03 2025-04-01 UTC+2

8

Liens utiles : Mes autres articles sont disponibles dans cette section Cours pour débutants chez InstaForex Analytique Populaire Ouvrir un compte de trading Important : Les débutants dans le tradingAuthor: Sebastian Seliga

11:43 2025-04-01 UTC+2

11

Les indices boursiers américains ont terminé la séance de trading avec des résultats mitigés : le S&P 500 a augmenté de 0,55 %, tandis que le Nasdaq 100 a perduAuthor: Ekaterina Kiseleva

11:37 2025-04-01 UTC+2

5

- Aujourd'hui, la paire USD/JPY peine à tirer profit d'un léger mouvement haussier intrajournalier, notamment dans un contexte d'attentes selon lesquelles la Banque du Japon pourrait augmenter ses taux d'intérêt

Author: Irina Yanina

11:37 2025-04-01 UTC+2

5

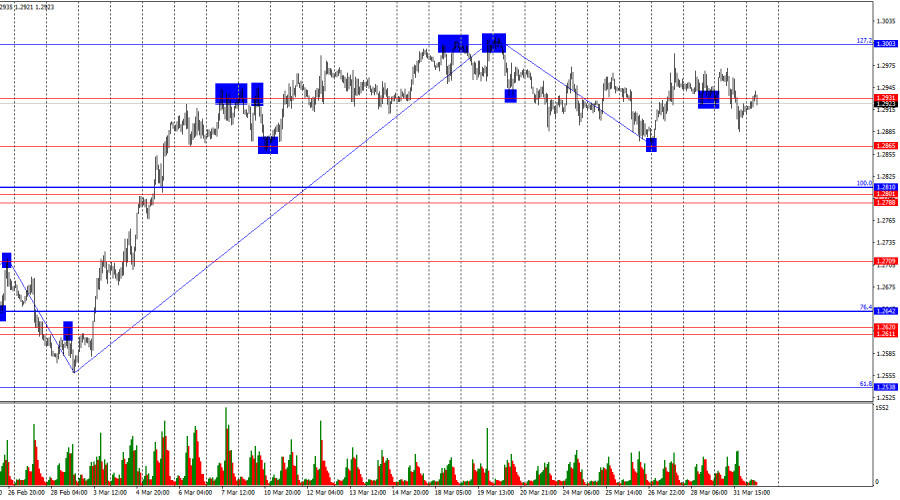

Lundi, la paire EUR/USD a continué son mouvement à la hausse et a même rebondi depuis la zone de support à 1.0781–1.0797. Cependant, croire en une nouvelle hausse de l'euroAuthor: Samir Klishi

11:32 2025-04-01 UTC+2

5

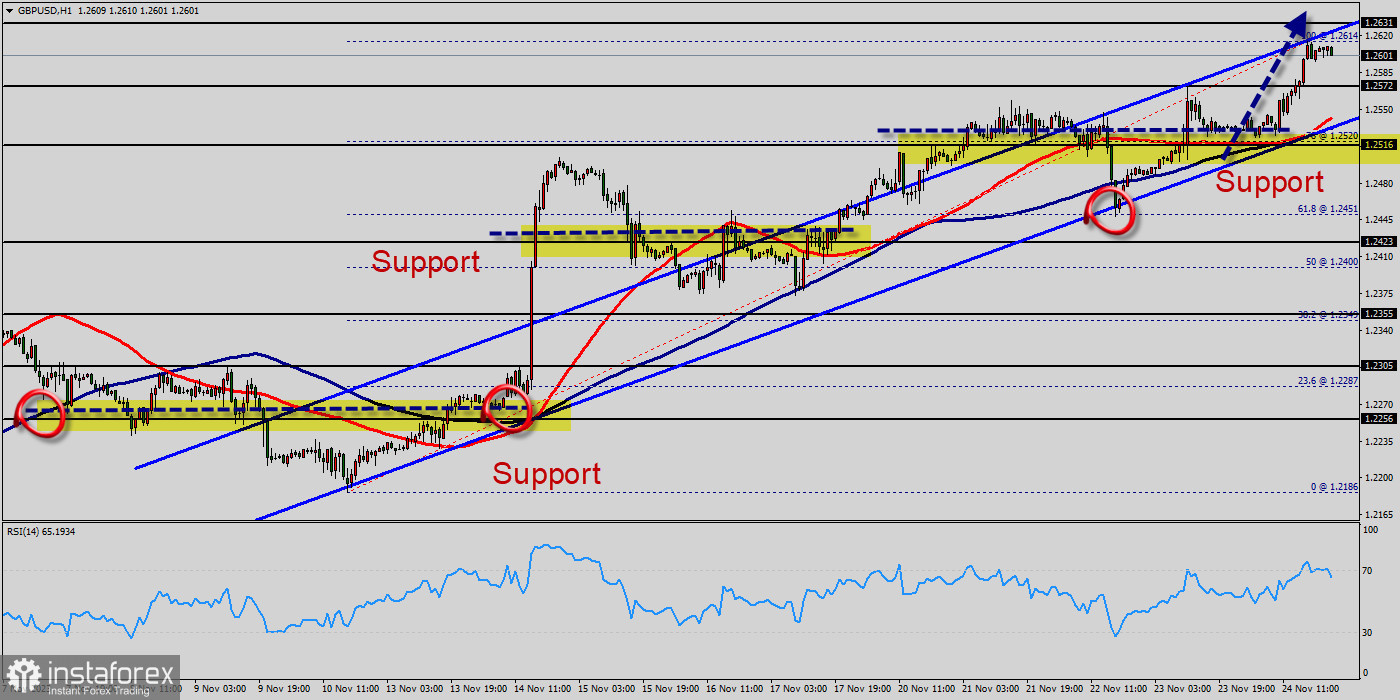

Sur le graphique horaire, la paire GBP/USD a continué de se déplacer latéralement lundi. Actuellement, il n'y a pas de domination des haussiers ou des baissiers sur le marché. CelaAuthor: Samir Klishi

11:29 2025-04-01 UTC+2

5

- Marchés boursiers

Pourquoi les tarifs pourraient-ils déclencher une hausse plutôt qu'un effondrement ?

La panique actuelle sur les marchés pourrait être exagérée. Si les tarifs de demain s'avèrent être moins dommageables que prévu, nous pourrions assister à un rebond bref mais marquéAuthor: Anna Zotova

11:03 2025-04-01 UTC+2

6

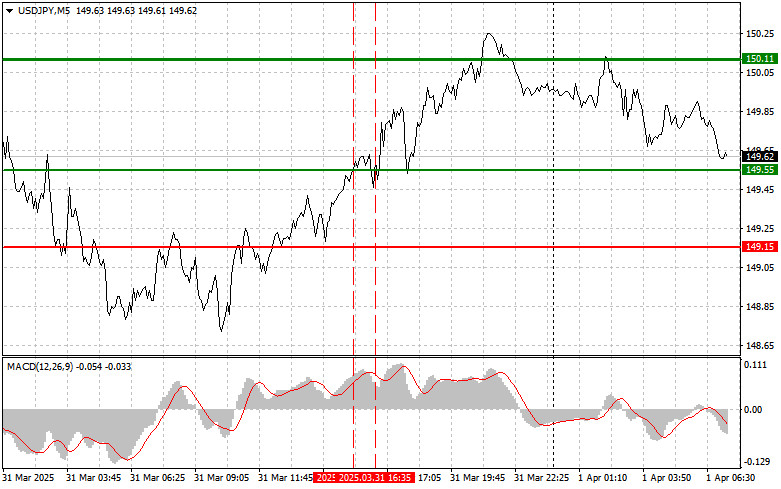

PrévisionsUSDJPY : Conseils de trading simples pour les traders débutants le 1er avril – Revue des transactions Forex d'hier

Analyse des Échanges et Conseils de Trading pour le Yen Japonais Le test du niveau de 149.55 s'est produit à un moment où l'indicateur MACD était déjà monté significativement au-dessusAuthor: Jakub Novak

10:58 2025-04-01 UTC+2

6

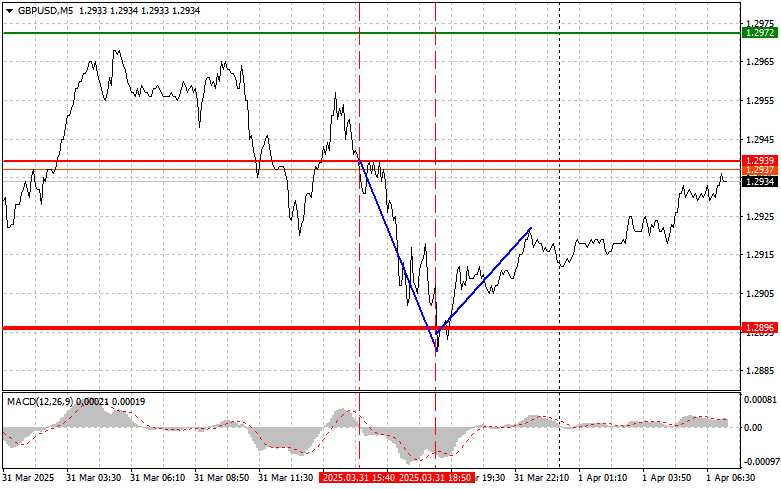

PrévisionsGBP/USD : Conseils de Trading Simples pour les Débutants le 1er Avril – Revue du Commerce Forex

Revue des Transactions et Conseils pour le Trading de la Livre Sterling Le test du niveau 1.2939 s'est produit juste au moment où l'indicateur MACD commençait à se déplacer versAuthor: Jakub Novak

10:55 2025-04-01 UTC+2

6