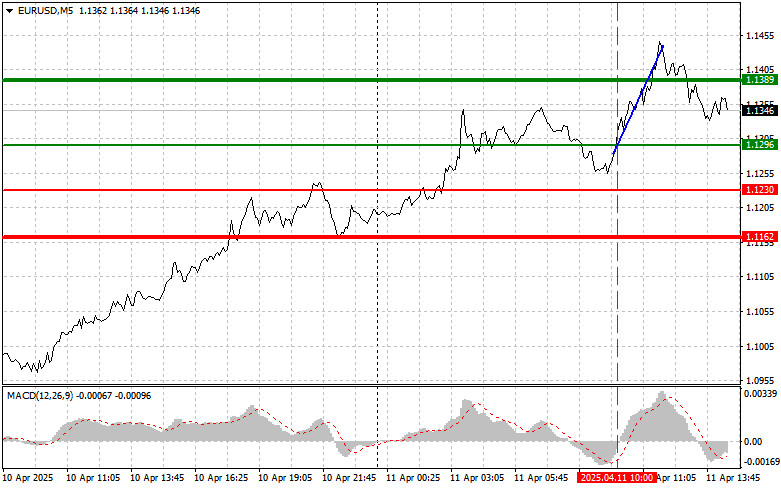

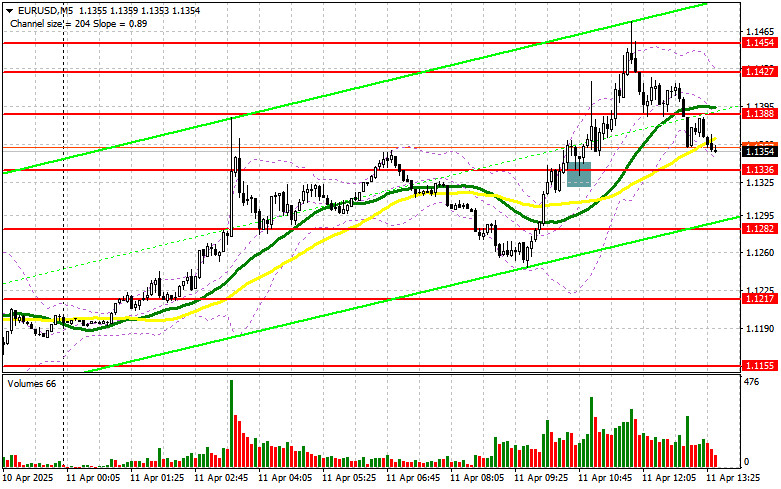

The balance of trading forces between the US dollar and the euro is shifting to the greenback's favor. The US currency is showing some signs of exhaustion, but the outlook remains firmly bullish. In this context, EUR/USD has been carrying on with its slide.

On Tuesday, September 26, the EUR/USD pair closed with a significant decline, reaching the level of 1.0580. According to analysts, the single European currency continues its downward movement. EUR gain bearish momentum at the beginning of the last week. EUR/USD plunged to a low not seen since March 2023.

At the same time, pressure on the euro is intensifying due to the prolonged advance of the US dollar amidst strong macroeconomic data from the US. The greenback is receiving considerable support from the expectations of another rate hike by 25 basis points by the Federal Reserve by the end of 2023.

Under such fundamentals, the euro remains under selling pressure. At the beginning of this week, EUR/USD was trading within a narrow range of 1.0575–1.0600. On Tuesday, September 26, EUR/USD rose to 1.0608, but then declined again. At one point, the pair reached 1.0575, hovering close to its low. On the morning of Wednesday, September 27, EUR/USD was near 1.0570, trying to break out of its downward spiral, but without success.

In the near future, analysts expect a test of the 1.0500 level, followed by a brief rise in the EUR/USD pair. Moreover, many experts believe that before starting its decline, the instrument will return to the 1.1000–1.1100 area. Presumably, EUR/USD is likely to grow for 3–4 weeks. A potential catalyst could be the US government shutdown, which is expected on October 1.

Against this backdrop, the greenback is aiming for its November 2022 highs after a steady ten-week rise. Despite the USD's leadership over the EUR, many analysts are revisiting the topic of parity in the EUR/USD pair. According to experts, the likelihood of such a scenario is increasing in the near term. However, its implementation is an open question. Achieving parity in the EUR/USD remains elusive: just when it seems it's almost within reach, the instrument makes a 360-degree turn, and the picture changes.

Amid the dollar's ten-week rally, OCB Bank economists are analyzing its prospects, believing that the USD has excellent bullish opportunities. "One should take note of the moderate and somewhat weak profile of the greenback, as the Fed has concluded rate hikes in the current cycle. Yet, the rates will remain high for a prolonged period, and any dollar depreciation will be minimal, especially in the absence of a 'dovish' revision," the bank emphasizes.

Currency strategists at OCB Bank are confident that the "turning point in the dollar" will come when the market anticipates a significant rate cut by the Fed in 2024." The strengthening disinflationary trend and the gradual easing of labor market tensions in the US contribute to the USD's depreciation. Thus, dollar 'bears' need to be patient – their time will come," the bank believes.

The question of ever-increasing inflation also concerns ECB policymakers. At the beginning of the week, Christine Lagarde, the head of the regulator, addressed the European Parliament, noting that the labor market is gradually getting back on track, but inflation remains too high. However, the current level of the ECB's key rate, in Lagarde's view, should remain unchanged. It is sufficient to bring inflation in the eurozone firmly to the 2% target, added the ECB chief. Market participants interpreted this signal as evidence that the regulator will refrain from further rate hikes.

![Exchange Rates 27.09.2023 analysis]()

The current situation is quite unfavorable for the European currency, with the pressure on it constantly intensifying. The negative economic data from the eurozone added fuel to the fire. On Monday, September 25, reports from the IFO research center showed another decline in business optimism in Germany (to 85.7 from the previous 85.8). This further confirmed the slide of the European economy into recession, experts believe.

In this context, the American currency remains somewhat euphoric, not losing optimism even during short-term downturns. On Thursday, September 28, the revised data on the US GDP for the second quarter of 2023 is due to be released. Moreover, markets continue to monitor the situation surrounding the adoption of the US federal budget. Currently, US lawmakers can't agree on a number of key issues, particularly spending cuts.

If they don't reach consensus, a shutdown of the US government is possible on Sunday, October 1. This could involve measures such as laying off government employees and canceling benefit payments. In turn, this situation could entail a slowdown in economic growth, analysts warn. However, in this scenario, the dollar will retain its advantage as investors will seek shelter in the safe haven greenback.

The current events are unfolding as the Fed winds down its tightening cycle. Yet, the regulator sticks to its hawkish rhetoric, causing concern among investors who had hoped for rate cuts in spring 2024. Preliminary estimates suggest that the likelihood of another 25 basis points rate hike is 50%. Before the FOMC meeting last week, this figure didn't exceed 40%.

At present, there's still room for further rate adjustments if inflation remains stubbornly high. Therefore, the dollar will continue to rise, maintaining bullish momentum. According to experts, the economic prospects for the US are now much brighter than those of other developed economies. Meanwhile, the economic and geopolitical tensions prevailing in the world make investors flock to the dollar as a safe-haven asset. As a result, the greenback manages to assert its strength and stand up to global competitors.