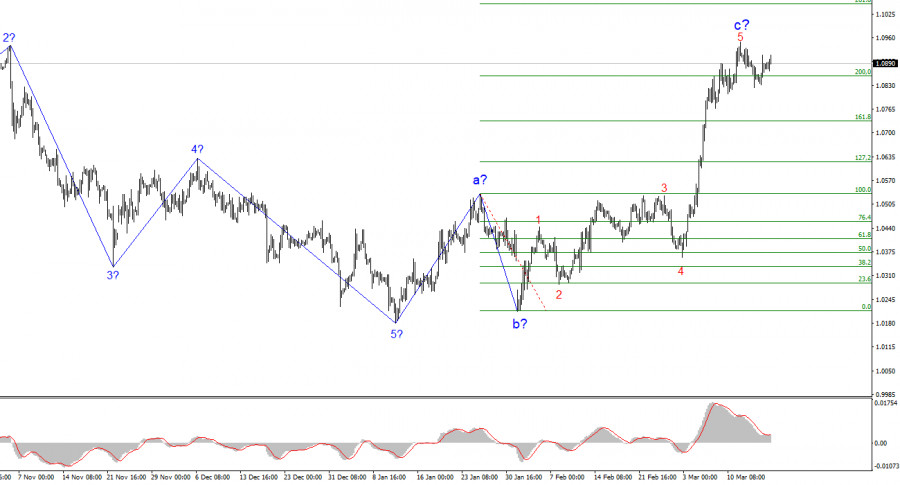

- L'analyse des vagues sur 4 heures pour l'EUR/USD risque de se transformer en une structure plus complexe. Une nouvelle tendance baissière a débuté le 25 septembre, prenant la forme d'une

Author: Chin Zhao

18:34 2025-03-17 UTC+2

7

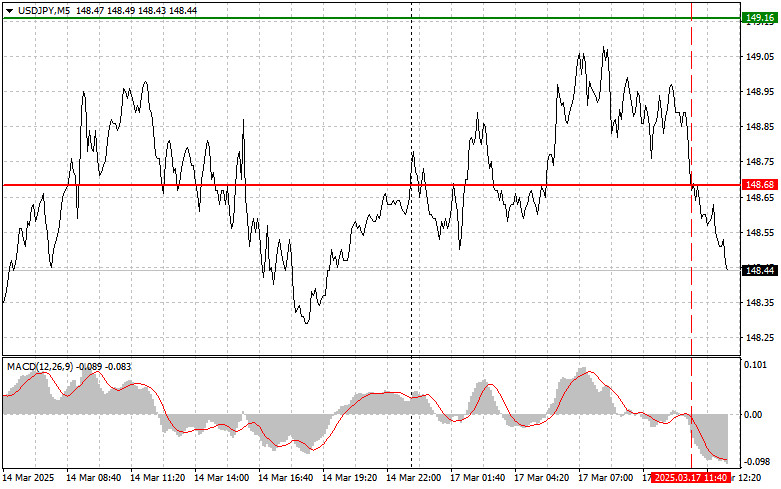

PrévisionsUSD/JPY : Conseils Simples de Trading pour les Traders Débutants – 17 mars (Session Américaine)

Le test du niveau de 148.68 a eu lieu lorsque l'indicateur MACD était déjà significativement tombé en dessous de la marque zéro, limitant le potentiel à la baisseAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

6

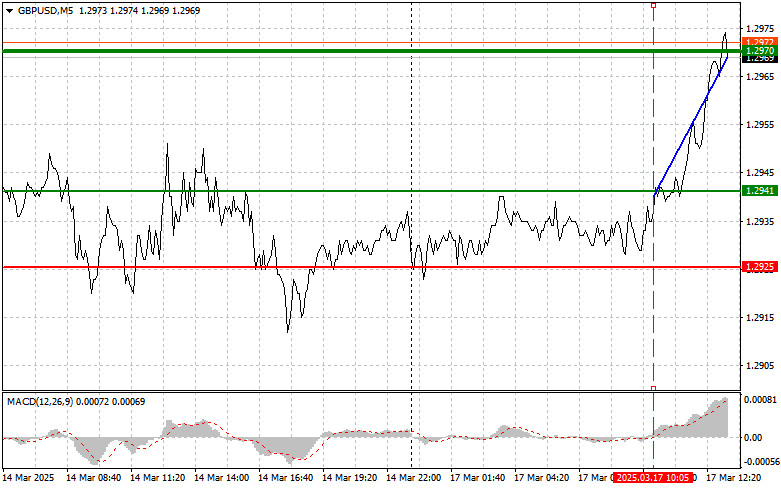

PrévisionsGBP/USD : Conseils de Trading Simples pour les Traders Débutants – 17 Mars (Session Américaine)

Le test du niveau de 1.2941 a eu lieu lorsque l'indicateur MACD venait de commencer à se déplacer vers le haut depuis la marque zéro, confirmant un point d'entrée valableAuthor: Jakub Novak

18:27 2025-03-17 UTC+2

6

- Le test du niveau de 1,0873 s'est produit lorsque l'indicateur MACD venait de commencer à descendre depuis le point zéro, confirmant un point d'entrée valide pour la vente. Cependant

Author: Jakub Novak

18:23 2025-03-17 UTC+2

6

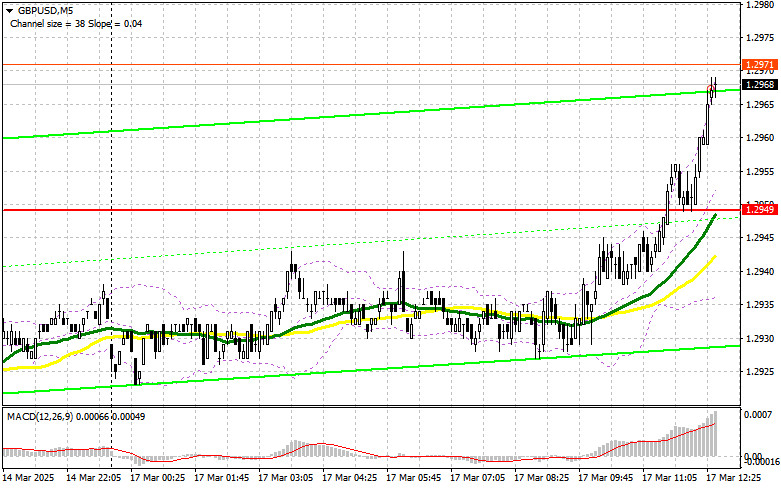

Plan de négociationGBP/USD : Plan de trading pour la session américaine du 17 mars (Revue des transactions du matin)

Dans ma prévision du matin, j'ai souligné le niveau de 1.2949 comme un point clé pour prendre des décisions d'entrée sur le marché. Analysons le graphique en 5 minutes pourAuthor: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

9

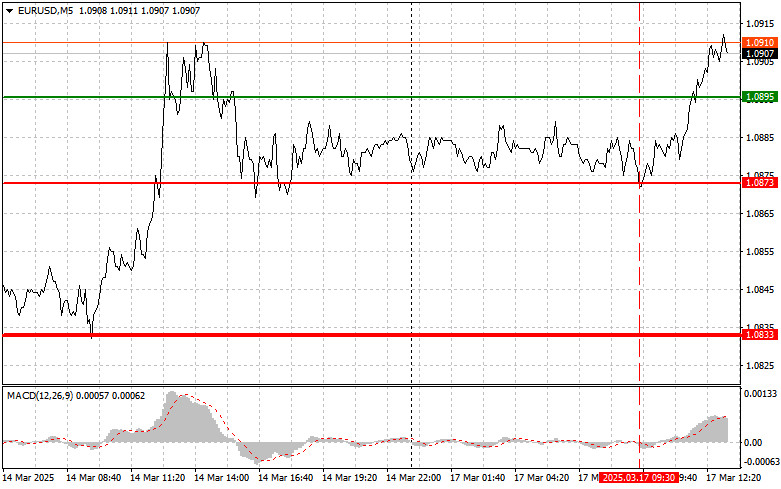

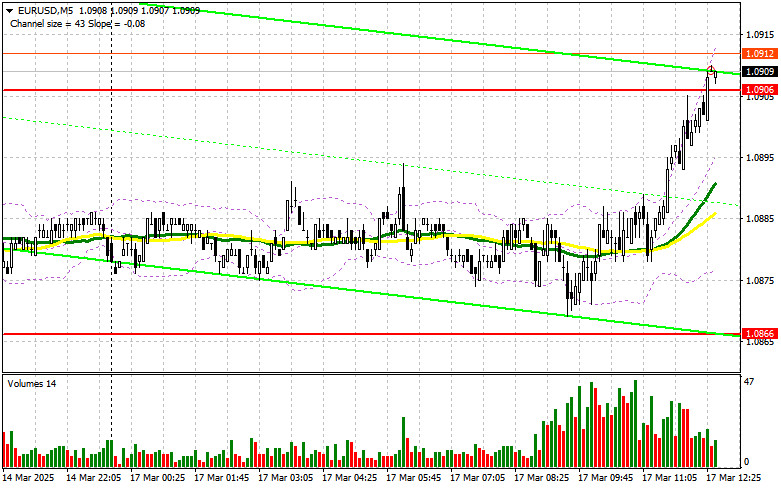

Plan de négociationEUR/USD : Plan de trading pour la session américaine du 17 mars (Revue des transactions du matin)

Dans mes prévisions de ce matin, j'ai souligné le niveau de 1,0866 comme un point clé pour prendre des décisions d'entrée. Examinons le graphique de 5 minutes pour analyserAuthor: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

9

- Analyse technique

Signaux de Trading pour BITCOIN du 17 au 19 mars 2025 : vendre en-dessous de 85,000 $ (21 SMA - 200 EMA)

Le point clé pour vendre du Bitcoin est d'attendre qu'il atteigne entre 87 500 $ et 88 500 $, qui pourraient tous deux être de bons points de vente avecAuthor: Dimitrios Zappas

16:16 2025-03-17 UTC+2

1

Analyse techniqueSignaux de Trading pour EUR/USD du 17 au 19 mars 2025 : acheter au-dessus de 1.0875 (+1/8 Murray - 21 SMA)

Tôt dans la session américaine, la paire EUR/USD se négociait autour de 1,0895, au-dessus de la moyenne mobile simple (SMA) de 21 jours, et au-dessus du niveau 8/8 de MurrayAuthor: Dimitrios Zappas

15:56 2025-03-17 UTC+2

0

Analyse techniqueSignaux de Trading pour GOLD (XAU/USD) du 17 au 19 mars 2025 : acheter au-dessus de $2,964 - $2,980 (21 SMA - 8/8 Murray)

Une chute en dessous de la 21 SMA pourrait changer le cours, et l'or pourrait entrer dans une phase baissière. Ainsi, nous pourrions nous attendre à ce que le prixAuthor: Dimitrios Zappas

15:53 2025-03-17 UTC+2

0