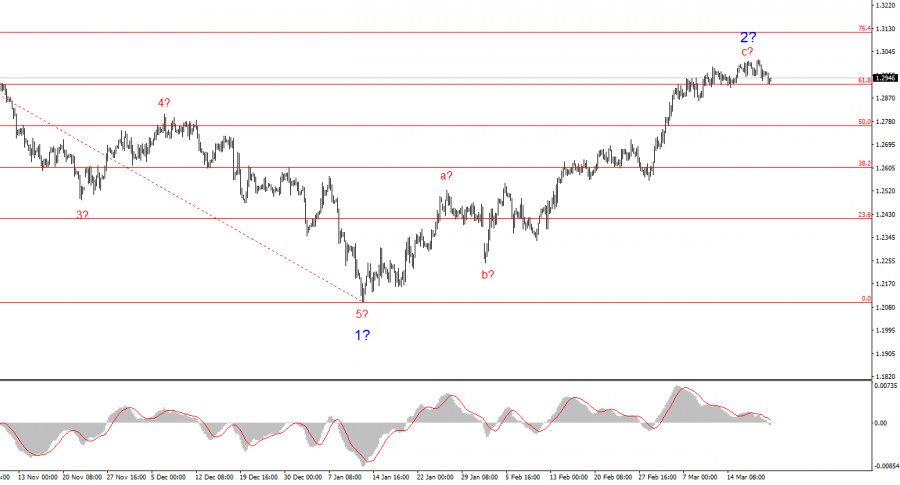

- La structure de vagues pour le GBP/USD reste quelque peu ambiguë, mais globalement gérable. À l'heure actuelle, la probabilité qu'une tendance baissière à long terme se développe reste élevée

Author: Chin Zhao

19:42 2025-03-21 UTC+2

16

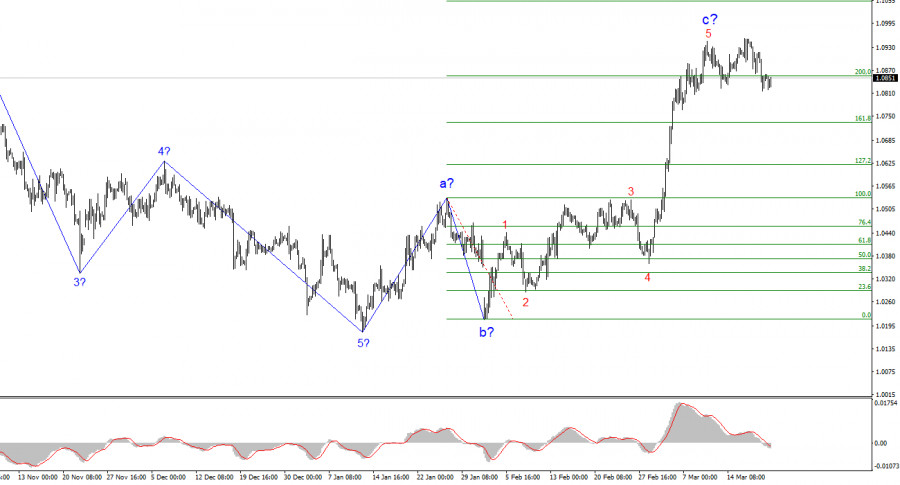

Le couple EUR/USD n'a connu aucun changement vendredi. Il n'y avait pas de nouvelles dans le sens direct du terme aujourd'hui, donc le marché n'avait rien à quoi réagirAuthor: Chin Zhao

19:39 2025-03-21 UTC+2

15

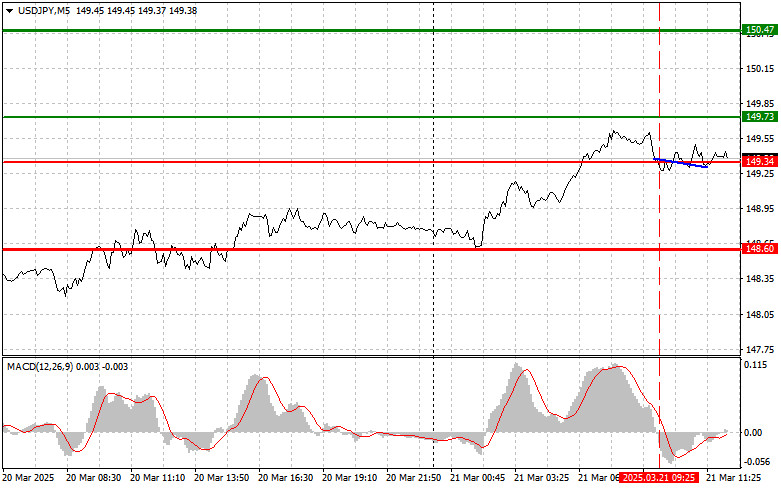

PrévisionsUSDJPY : Conseils de trading simples pour les traders débutants le 21 mars (session américaine)

Critique du marché et conseils pour échanger le Yen japonais Le test du niveau de 149,34 s'est produit lorsque l'indicateur MACD venait de commencer à descendre depuis la ligne zéroAuthor: Jakub Novak

19:30 2025-03-21 UTC+2

15

- Prévisions

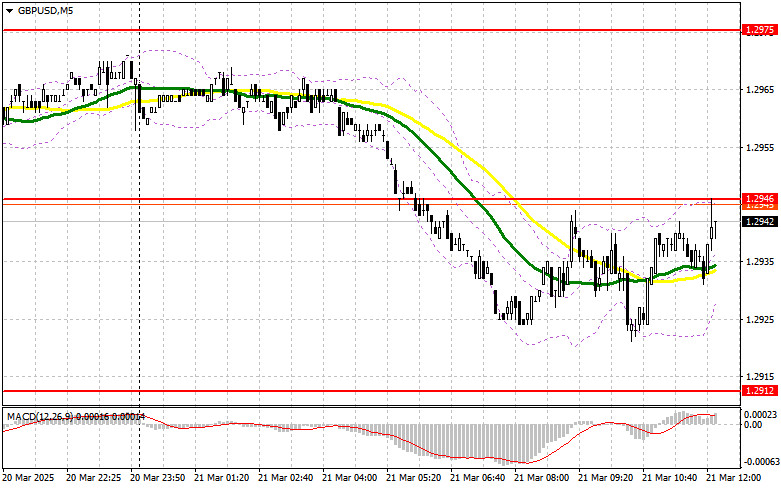

GBPUSD : Conseils de Trading Simples pour les Traders Débutants le 21 Mars (Session Américaine)

Analyse du Marché et Conseils pour le Trading de la Livre Sterling Aucun test des niveaux clés que j'avais indiqués ne s'est produit dans la première moitié de la journéeAuthor: Jakub Novak

19:17 2025-03-21 UTC+2

16

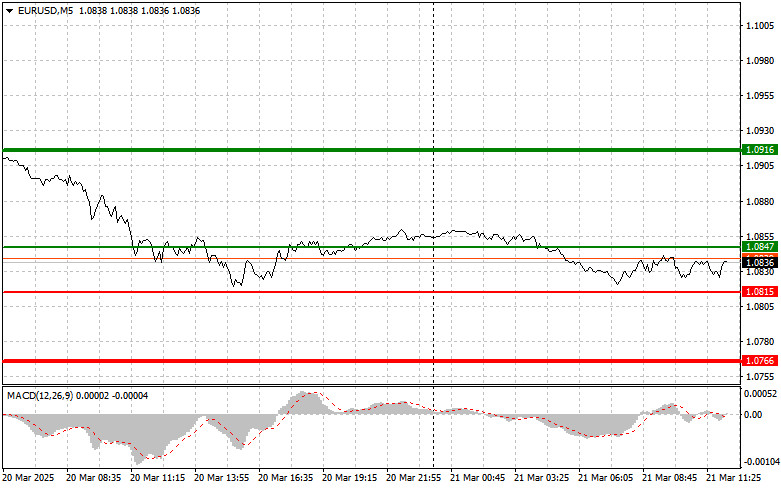

Revue des échanges et conseils pour le trading de l'euro Aucun test des niveaux clés que j'ai identifiés plus tôt aujourd'hui n’a eu lieu. La raison en est la faibleAuthor: Jakub Novak

19:09 2025-03-21 UTC+2

15

Plan de négociationGBP/USD : Plan de Trading pour la Session Américaine du 21 Mars (Revue des Transactions de la Matinée)

Dans mes prévisions matinales, je me suis concentré sur le niveau de 1.2946 et j'ai prévu de prendre des décisions commerciales à partir de ce point. Jetons un coup d'œilAuthor: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

12

- Plan de négociation

EUR/USD : Plan de trading pour la session américaine du 21 mars (Revue des transactions matinales)

Dans ma prévision du matin, j'ai souligné le niveau de 1.0856 et prévu de prendre des décisions de trading autour de celui-ci. Regardons le graphique de 5 minutes pour voirAuthor: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

12

Jeudi, les indices boursiers de référence américains ont clôturé dans le rouge : le Dow Jones a baissé de 0,1 %, le NASDAQ a chuté de 0,3 %Author: Natalia Andreeva

15:48 2025-03-21 UTC+2

19

Analyse techniqueSignaux de trading pour EUR/USD du 21 au 24 mars 2025 : acheter au-dessus de 1.0810 (+1/8 Murray - rebond)

Notre prévision à moyen terme reste baissière. Ainsi, tout rebond technique sera perçu comme un signal de vente avec un objectif à moyen terme autour de 1.0361, le niveauAuthor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

17