- Bitcoin et Ethereum rencontrent des difficultés à maintenir leur dynamique ascendante. Cependant, cela semble davantage être une réaction aux dernières déclarations politiques de Donald Trump—qui ont conduit à une diminution

Author: Miroslaw Bawulski

09:06 2025-03-27 UTC+2

0

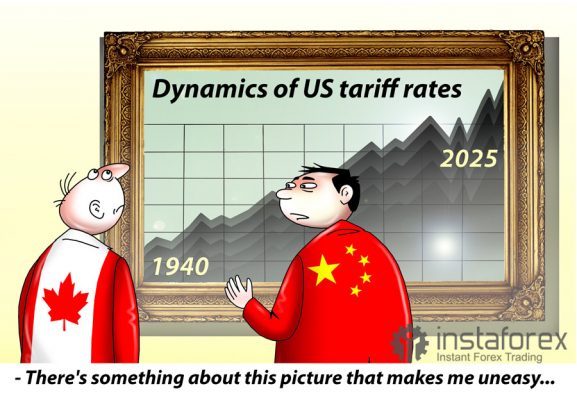

Nouvelles analytiquesLes enjeux augmentent : GameStop mise sur la crypto, Trump sur les tarifs douaniers

Trump Prêt à Annoncer Bientôt des Tarifs Douaniers sur l'Automobile, Selon un Rapport Dollar Tree Monte suite à la Vente de l'Activité Family Dollar GameStop Monte sur son PariAuthor: Thomas Frank

09:04 2025-03-27 UTC+2

2

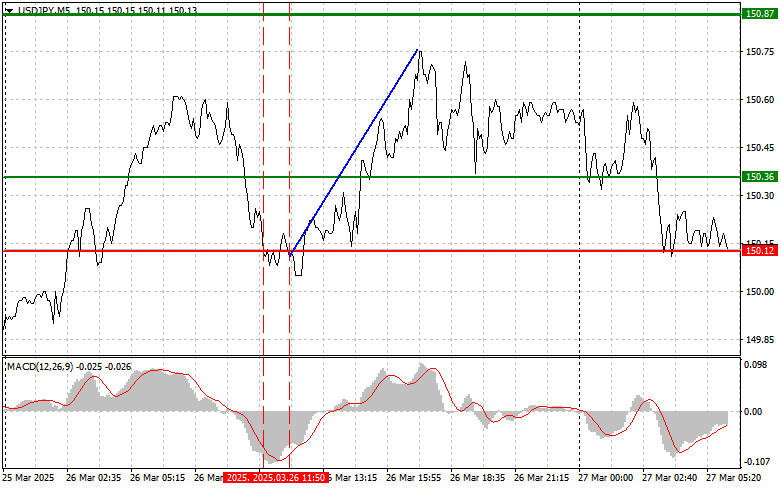

PrévisionsUSD/JPY : Conseils de Trading Simples pour Les Traders Débutants le 27 Mars. Revue des Transactions Forex d'Hier

Le premier test de prix à 150.12 s'est produit lorsque l'indicateur MACD s'est déplacé nettement en dessous de la ligne zéro, limitant le potentiel de baisse de la paire. PourAuthor: Jakub Novak

09:03 2025-03-27 UTC+2

5

- Prévisions

GBP/USD : Conseils de trading simples pour les traders débutants le 27 mars. Revue des échanges Forex d'hier

Le test du prix à 1,2875 s'est produit lorsque l'indicateur MACD est descendu bien en dessous de la ligne zéro, limitant ainsi le potentiel de baisse de la paire. PourAuthor: Jakub Novak

09:03 2025-03-27 UTC+2

2

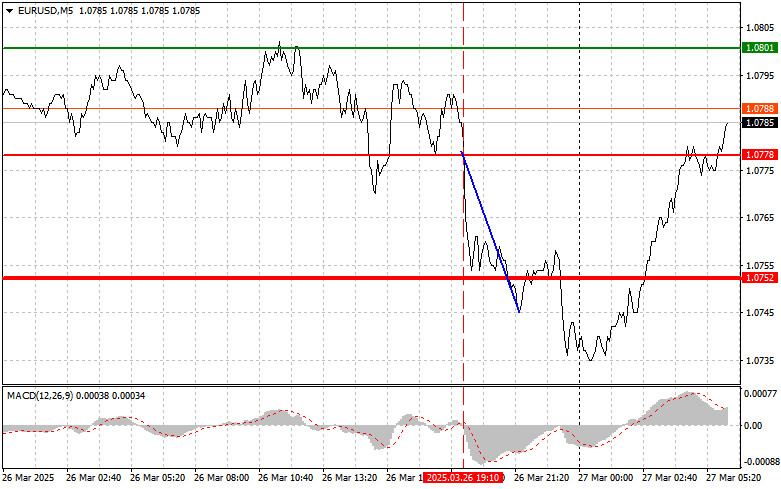

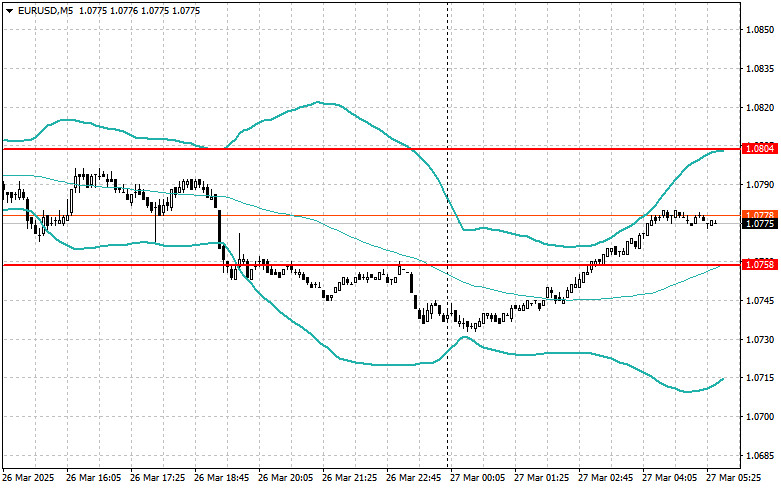

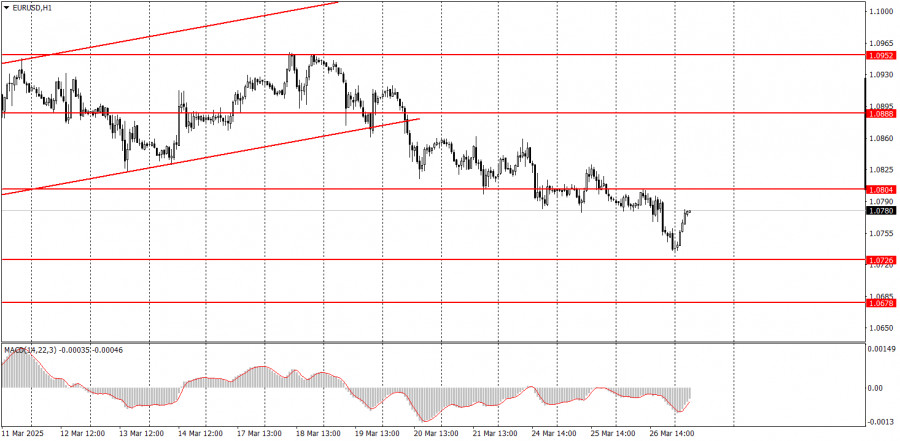

PrévisionsEUR/USD : Conseils de Trading Simples pour les Traders Débutants le 27 Mars. Revue des Transactions Forex d'Hier

Le test du prix à 1.0778 a eu lieu alors que l'indicateur MACD commençait à descendre de la ligne zéro, confirmant un point d'entrée valide pour vendre l'euro. En conséquenceAuthor: Jakub Novak

09:03 2025-03-27 UTC+2

1

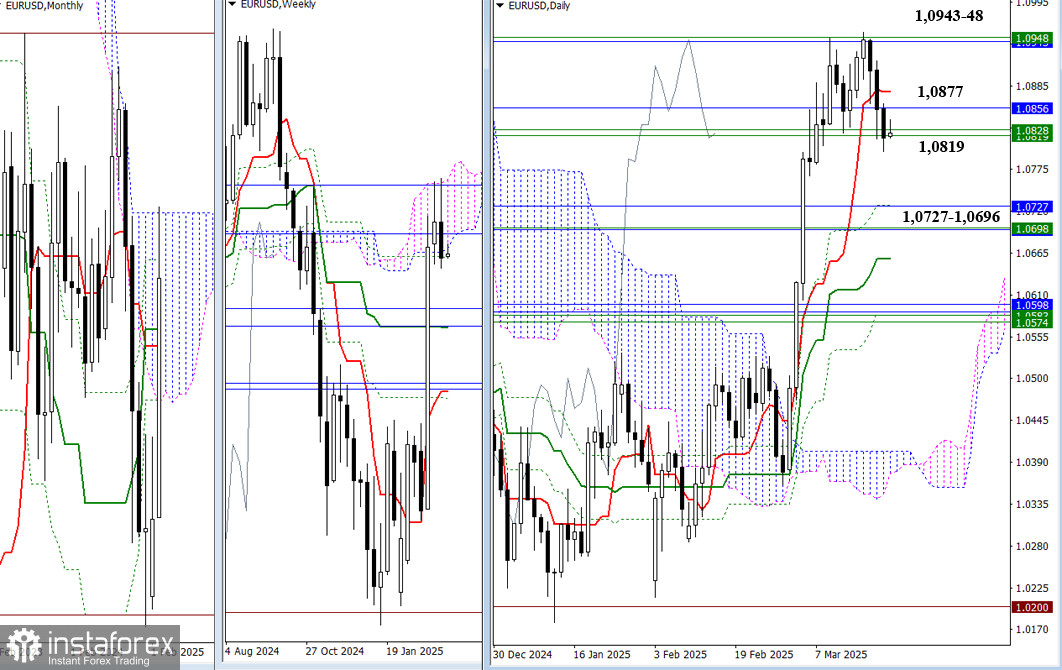

L'euro s'est à nouveau effondré fortement, entraînant avec lui d'autres actifs risqués, dont la livre sterling. Outre les solides données américaines d'hier, qui ont soutenu le dollar, la pressionAuthor: Miroslaw Bawulski

08:21 2025-03-27 UTC+2

7

- Devis

Analyse technique du mouvement des prix intraday de la cryptomonnaie Ethereum, jeudi 27 mars 2025.

Si dans les prochains jours, il n'y a pas de renforcement significatif, notamment si l'on perce et clôture au-dessus du niveau de 2549,05 sur le graphique quotidien de la cryptomonnaieAuthor: Arief Makmur

07:36 2025-03-27 UTC+2

5

DevisAnalyse technique du mouvement intrajournalier des prix de la cryptomonnaie Filecoin, jeudi 27 mars 2025.

En réussissant à casser en dessous de la ligne inférieure du canal Rising Wedge de la cryptomonnaie Filecoin sur son graphique de 4 heures et avec son mouvement de prixAuthor: Arief Makmur

07:36 2025-03-27 UTC+2

5

Analyse fondamentaleÀ quoi faut-il prêter attention le 27 mars ? Une analyse des événements fondamentaux pour les débutants

Il y a très peu d'événements macroéconomiques prévus pour jeudi, et encore moins sont jugés importants. Le seul rapport qui mérite de l'attention est la troisième estimationAuthor: Paolo Greco

06:42 2025-03-27 UTC+2

13