#PAF (Palladium, Current Month). Exchange rate and online charts.

Currency converter

26 Mar 2025 21:04

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Pan African Resources PLC (Pan African) is engaged in gold mining and exploration activities. As of June 30, 2010, it primarily focused on Africa, and produced approximately 100,000 ounces of gold per year and also focused on acquiring near production projects. It operates in three segments: Barberton Mines, Phoenix Platinum and Corporate Growth Projects. Barberton Mines is located in Barberton South Africa. As of June 30, 2010, its main projects included Sheba-35 ZK decline; Sheba-Edwin Bray; Thomas and Joe’s Luck area; Fairview-60/62 level development; Fairview-3 shaft deepening; Consort-40 level exploration; Consort-50 level decline west, and Consort-37 Inter-level exploration drive.

Its subsidiaries include Barberton Mines (Pty) Limited (Barberton) and Phoenix Platinum Mining (Pty) Limited. During the fiscal year ended June 30, 2010, Barberton Mines sold 98,091 ounce of gold. On July 1, 2009, it announced that Barberton Mines had cancelled the Metorex management agreement.

Δείτε επίσης

- Gold maintains a positive tone today, but lacks strong bullish momentum

Δημιουργός: Irina Yanina

11:54 2025-03-26 UTC+2

1408

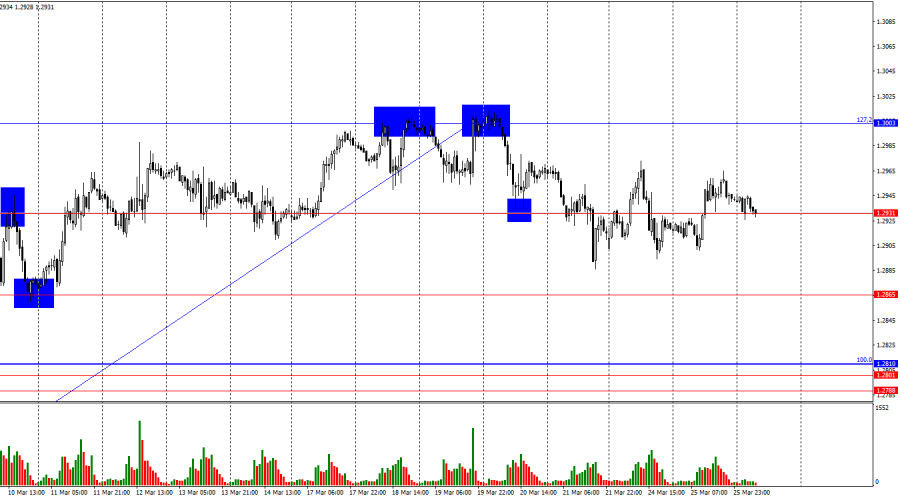

Bulls pushed for two weeks, but now it's time for a pauseΔημιουργός: Samir Klishi

11:32 2025-03-26 UTC+2

1378

USD/JPY. Analysis and ForecastΔημιουργός: Irina Yanina

11:42 2025-03-26 UTC+2

1333

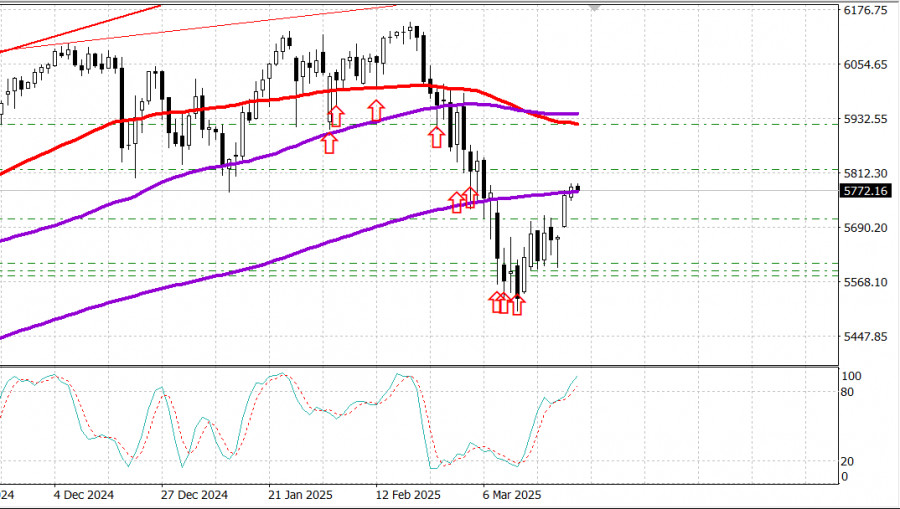

- KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%

Δημιουργός: Thomas Frank

10:02 2025-03-26 UTC+2

1063

Technical analysisTrading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Δημιουργός: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1063

Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks convictionΔημιουργός: Irina Maksimova

11:47 2025-03-26 UTC+2

1063

- Bulls and bears remain in balance

Δημιουργός: Samir Klishi

11:29 2025-03-26 UTC+2

1033

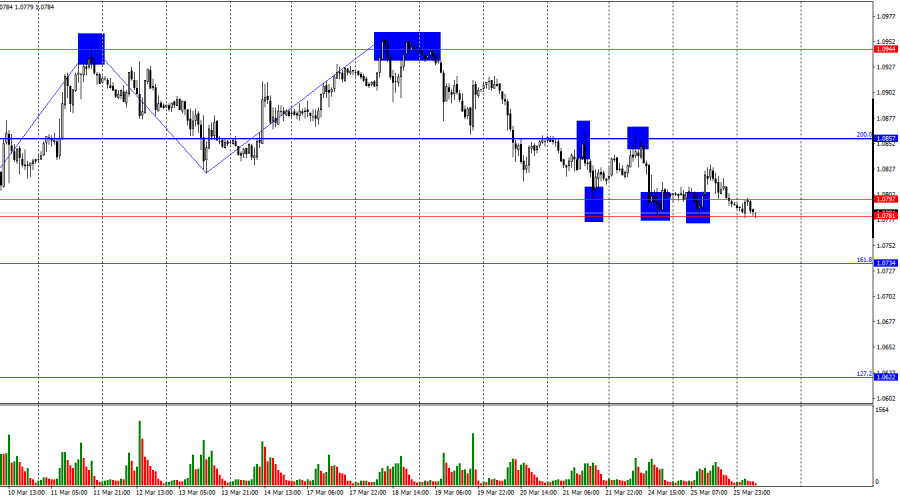

Technical analysisTrading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Δημιουργός: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1003

US stock market displaying modest growthΔημιουργός: Jozef Kovach

10:21 2025-03-26 UTC+2

973

- Gold maintains a positive tone today, but lacks strong bullish momentum

Δημιουργός: Irina Yanina

11:54 2025-03-26 UTC+2

1408

- Bulls pushed for two weeks, but now it's time for a pause

Δημιουργός: Samir Klishi

11:32 2025-03-26 UTC+2

1378

- USD/JPY. Analysis and Forecast

Δημιουργός: Irina Yanina

11:42 2025-03-26 UTC+2

1333

- KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%

Δημιουργός: Thomas Frank

10:02 2025-03-26 UTC+2

1063

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Δημιουργός: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1063

- Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks conviction

Δημιουργός: Irina Maksimova

11:47 2025-03-26 UTC+2

1063

- Bulls and bears remain in balance

Δημιουργός: Samir Klishi

11:29 2025-03-26 UTC+2

1033

- Technical analysis

Trading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Δημιουργός: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1003

- US stock market displaying modest growth

Δημιουργός: Jozef Kovach

10:21 2025-03-26 UTC+2

973