- Technical analysis

Arany (XAU/USD) — kereskedési jelzések, 2024. február 29. — eladni, ha 2031$ alá esik az árfolyam (2/8-as Murray - 200-as EMA)

Ha viszont 2031$ alá esik és megállapodik a 2025$-nál lévő 200-as EMA alatt, azt trendfordulat kezdetének tekinthetjük. Medvés irányba gyorsulhat tehát az árfolyam, és elérheti a 2000 dolláros lélektani határtAuthor: Dimitrios Zappas

15:53 2024-02-29 UTC+2

70

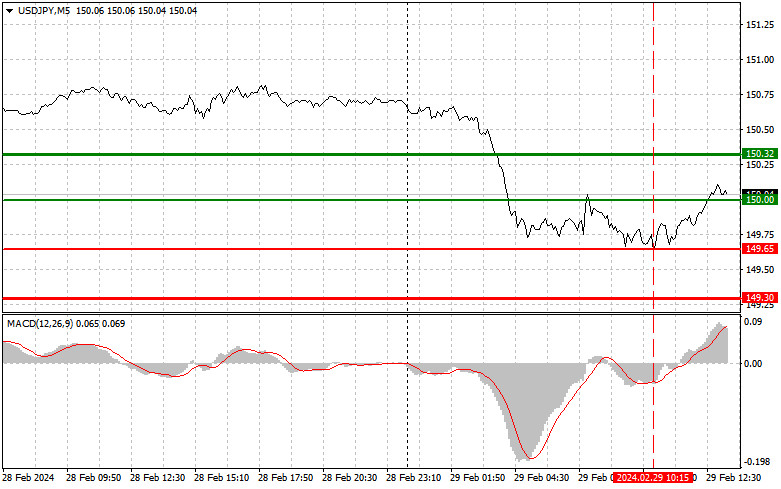

Kereskedési tippek és az USD/JPY devizapár tranzakcióinak elemzése A 149,65-ös szint tesztelésekor a nulláról hirtelen visszaeső MACD-vonal korlátozta a devizapár csökkenését. Ma amerikai jelentések érkeznek a személyes fogyasztói kiadásokrólAuthor: Jakub Novak

15:48 2024-02-29 UTC+2

84

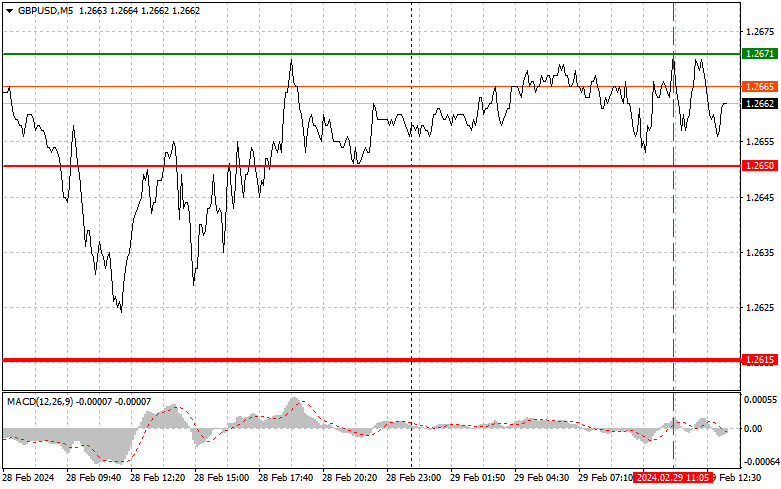

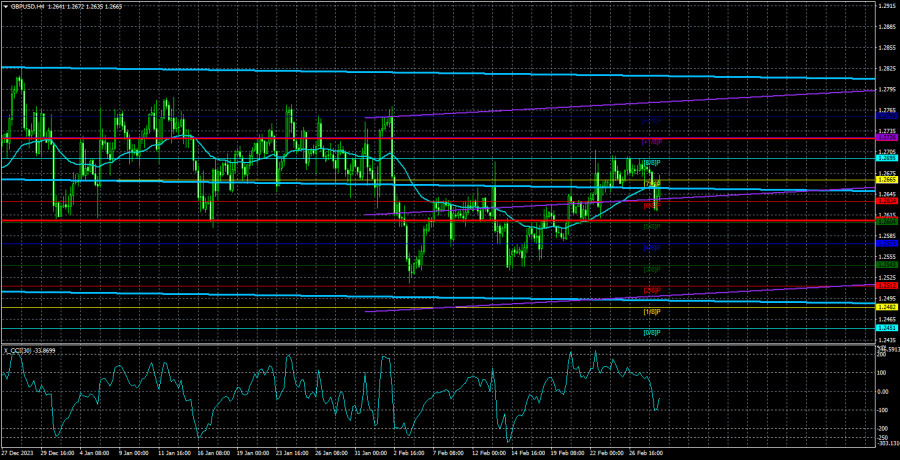

Kereskedési tippek és a GBP/USD devizapár tranzakcióinak elemzése Az 1,2671-es szint tesztelésekor a nulláról meglehetősen nagy erővel felemelkedő MACD-vonal korlátozta a devizapár növekedését. Ma amerikai jelentések érkeznek a személyes fogyasztóiAuthor: Jakub Novak

15:44 2024-02-29 UTC+2

74

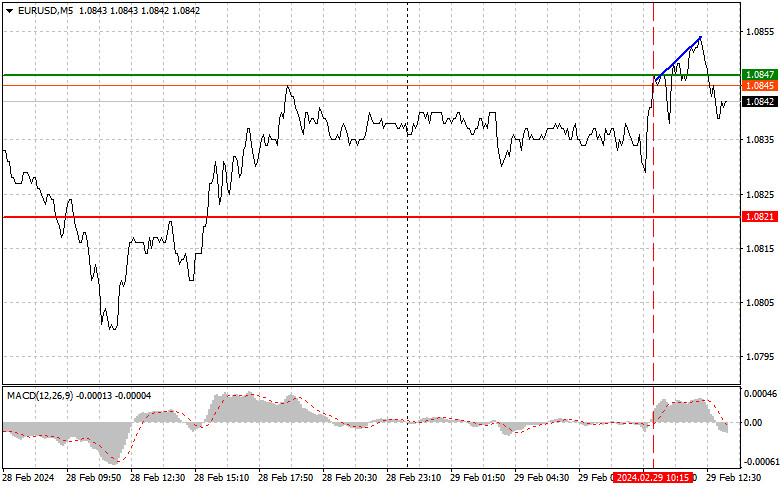

- Kereskedési tippek és az EUR/USD devizapár tranzakcióinak elemzése Az 1,0847-es szint tesztelésekor a nulláról felemelkedő MACD-vonal vételi jelzést adott, de nem történt erős árnövekedés annak ellenére sem, hogy az euróövezetből

Author: Jakub Novak

14:57 2024-02-29 UTC+2

60

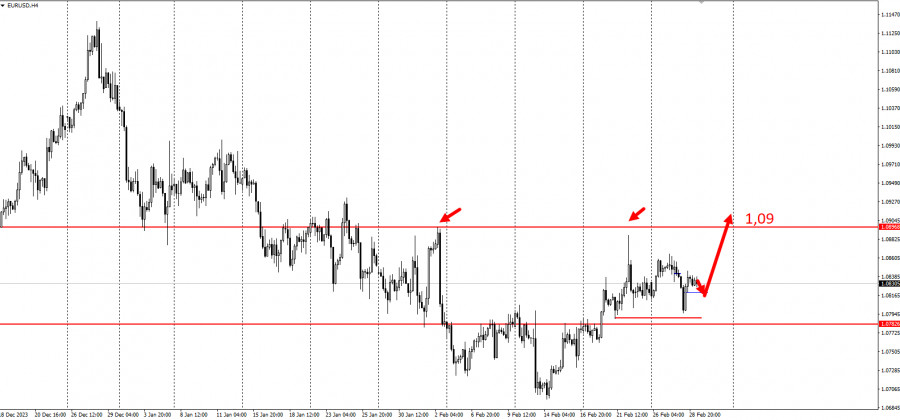

Az EUR/USD célpontja továbbra is az eladók 1,09-es területe lesz, főképp a gyenge amerikai GDP-adatokat követően. Az alacsonyabb időkereten nyitott long pozíciók teszik lehetővé a mozgás kialakulását. Vásároljanak eurótAuthor: Andrey Shevchenko

14:55 2024-02-29 UTC+2

56

Fundamental analysisA GBP/USD devizapár áttekintése, február 29. — a Bank of England akár már augusztusban megkezdheti az enyhítést

Az GBP/USD devizapár tegnap is csökkent, de sajnos nem sokáig. Többször is figyelmeztettük már Önöket, hogy az angol font árfolyamának újabb csökkenése várható. Még ha most laposan is mozog, ezenAuthor: Paolo Greco

13:26 2024-02-29 UTC+2

63

- Fundamental analysis

Az EUR/USD devizapár áttekintése, 2024. február 29. — az Európai Parlament tart a magas inflációtól

Az EUR/USD devizapár kereskedése szerdán változatosabb és érdekesebb volt a korábbinál. Az európai valuta csökkenése éjszaka kezdődött, amikor nem voltak makrogazdasági események, és a fundamentális háttér hiányzott. Ennek ellenéreAuthor: Paolo Greco

12:49 2024-02-29 UTC+2

62

A japán jen erős pozitív lendületet kap Hajime Takata, a Bank of japan igazgatótanácsának tagjának hawkish nyilatkozatai nyomán. Emellett a részvénytőzsdék alapvetően gyengébb hangulata további lökést ad a jennek, mintAuthor: Irina Yanina

12:15 2024-02-29 UTC+2

73

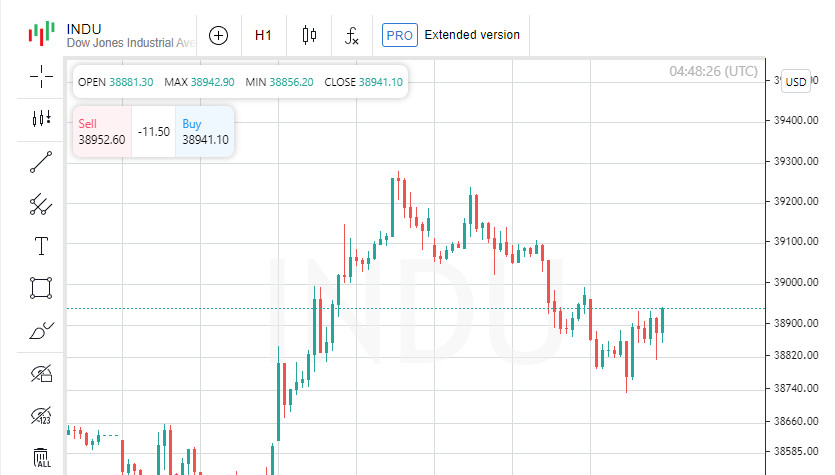

Analytical NewsVihar előtti csend: a dollár erősödik, a részvények az amerikai infláció miatt esnek

Az amerikai gazdasági növekedés enyhén csökkent a negyedik negyedévben Az Applied Materials bezuhant, miután idézést kapott az Egyesült Államok Értékpapír- és Tőzsdefelügyeletétől A UnitedHealth a trösztellenes nyomozás jelentése miatt zuhantAuthor: Thomas Frank

11:09 2024-02-29 UTC+2

69