Dear colleagues!

Recently, the main events have been the resignation of Liz Truss, the assumption of British Prime Minister Rishi Sunak and the statements of the head of the San Francisco Fed Mary Daly about the possibility of slowing down the pace of the US Federal Reserve's target rate hike.

Speaking about Truss and Sunak, who replaced her as prime minister, one very interesting point should be noted, which speaks of the deplorable situation in the world of finance. The formal reason for the resignation of Truss was the unreasonable economic policy, which led to the collapse of the pound and the increase in the yield of UK Treasury bonds. In general terms, this was the program of Ronald Reagan, carried out by him in the USA in the mid-80s of the last century. The Truss cabinet proposed tax cuts for the wealthy to stimulate the economy and borrow money from the debt market to subsidize the population amid the energy crisis.

However, the program, instead of being approved, provoked sharp criticism not only from the opposition, but from the prime minister's fellow party members. The Bank of England even had to intervene in the situation, temporarily resuming purchases of bonds. This gave hope to speculators around the world that central banks would soon stop tightening the screws. At the same time, the situation in the UK economy looks daunting only at first glance. Macroeconomic indicators in the US economy are much worse. But what is allowed to some may not be allowed to the bull!

As with the rest of the world's "golden billion", the main blow to UK consumers has been a large-scale energy crisis caused by high prices and a reduction in energy supplies from Russia. In this sense, the situation in the US is, of course, better than in the UK, but in terms of financial discipline everything is exactly the opposite, judge for yourself...

Great Britain. Inflation at 10%. Food inflation 14.5%. Public debt 96%, or 2.5 trillion pounds. Budget deficit 6%. The yield on 10-year bonds is 4.05%.

USA. Public debt 137% of GDP, or $31.2 trillion. The state budget deficit is 8%. The yield on 10-year bonds is 4.2%.

As you can see, the problems in the US are much deeper than in the UK, but the Biden administration took credit for the adoption of the new FY2022 budget, unlike Liz Truss, who resigned.

Both economies are sick with debt problems. The rise in interest rates on bonds threatens the US, the UK, and other countries of the "golden billion". Both central banks are pursuing the same policy of tightening monetary policy, but the dollar is rising and the pound is declining.

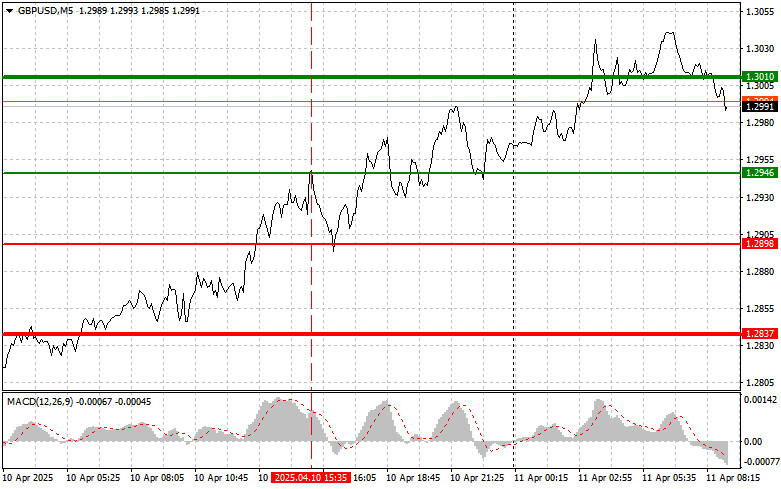

Will new prime minister Rishi Sunak solve the UK's problems? Time will tell, but what we should not do is get ahead of the curve and fantasize about buying the British pound, at least until the GBPUSD chart tells us to. Therefore, before doing anything, let's look at the technical picture of the British pound and the US dollar.

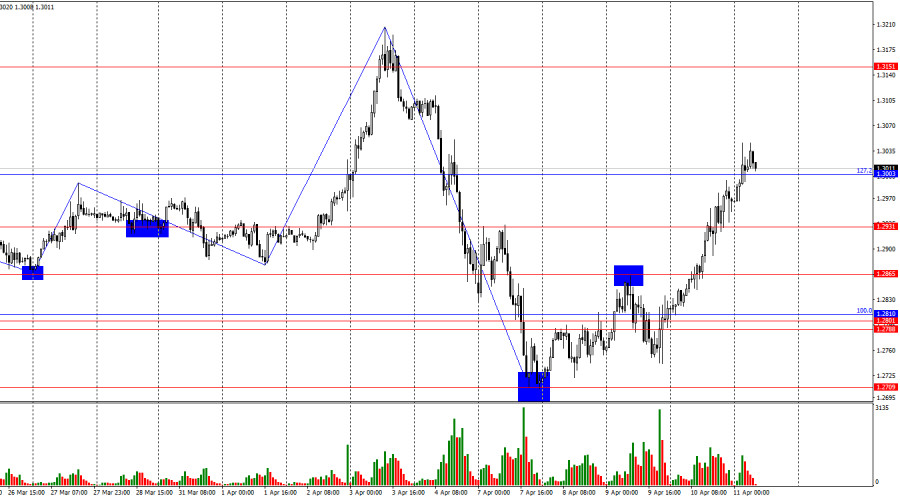

fig.1: Dynamics of the British pound GBPUSD, daily time

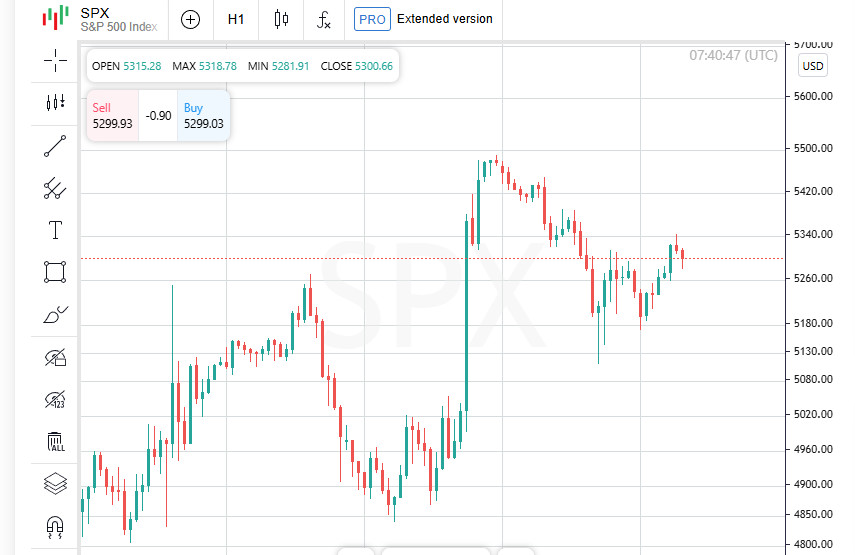

fig.2: Dynamics of the US dollar index, daily time

On the chart of the British pound GBPUSD (Fig. 1), we can observe a downward trend, which, after reaching a low at 1.0385, experienced a corrective recovery and reached the level of 1.1470. At the time of this writing, the situation has already changed and the pound is quoted at 1.1580, which forms the "double bottom" pattern. In general, this may mean the pound's growth with targets at 1.20 and even its movement into the 1.27 value zone.

Approximately, the US dollar index behaves the same way, adjusted for growth, (Fig. 2), showing the value of the dollar against a basket of six foreign currencies. The dollar is in an upward trend on the daily time and after reaching the level of 1.1475, it went into a correction stage and formed a double top reversal pattern, which has a base level of 110. At the moment I write these lines, the dollar index quote is at a value of 110.22, and if in the near future, the US dollar will be able to close the day below the base level of 110, which will mean at least a corrective reversal in the currency market, which will also be true for the GBPUSD pair.

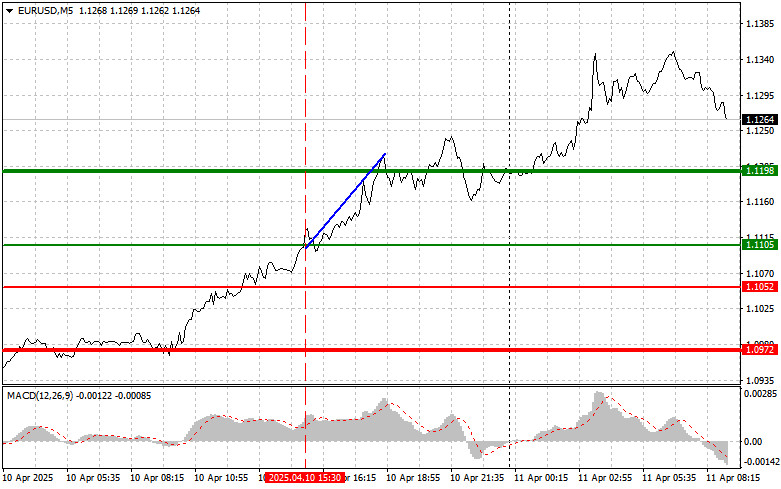

Since 58% of the US dollar index is the exchange rate of the euro, it is quite reasonable to assume that the USDX decline by 5%, and we can calculate such a decline as the first target, based on the practice of working out the "double top" and "double bottom" models , will lead to the euro's growth, reflected by the EURUSD pair.

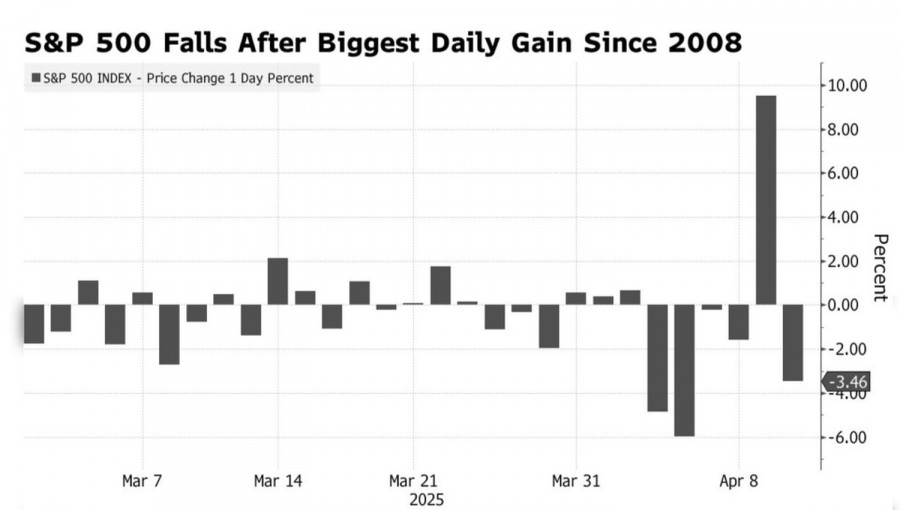

Based on the current picture of the technical analysis of the euro, we can state that the EURUSD rate, which is in a downward trend, has now moved to recovery in corrective dynamics, and also in case of forming the "double bottom" pattern, it has every chance of rising to the zone of 1.04 values. At the same time, the exchange rate is already rising above the level of the base of the "double bottom", located at the parity level of the euro and the dollar - 1.0.

Fig. 3: Dynamics of the EURUSD rate, daily time

And here, when everything, it would seem, has already been decided, the main danger lurks. The fact is that in the coming days we are facing major events that can change the current picture beyond recognition. The European Central Bank held its meeting on Thursday, October 27, and there was reason to believe that the refinancing rate in the eurozone will be raised by 75 basis points, to the level of 2.00%.

Next week, on November 2, the US Federal Reserve's decision will be announced, where traders are waiting for an increase in the federal funds rate by 75 basis points to the range of 3.75-4.00%. However, in connection with the statements of the head of the Fed of San Francisco, market participants are waiting for the Fed's tightening policy to slow down, and some analysts suggest a 50 bps rate hike already at the current meeting, instead of 75 bps.

Finally, immediately after the meeting of the Open Market Committee on November 3, the Bank of England will hold a meeting, where decisions on rates will also be announced and, in general, some softening of the rhetoric of the central bank due to the growing crisis in the economy can be expected.

All three meetings of the central banks can radically change the technical picture and weaken the dollar or, conversely, strengthen its position. And if we take into account that the Bank of Japan will make a decision on Thursday and Friday, the picture becomes extremely uncertain from a fundamental point of view. Now everything looks like the dollar will really weaken, it has grown too much lately, which is starting to hurt even the United States. At the same time, you should not draw conclusions instead of the market and make decisions that can later be very costly.

They say that all news works in the direction of technical analysis, so let's look at the implementation of this principle in practice. Be careful and cautious, follow the rules of money management!

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Manfaat dari rekomendasi para analis saat ini

Akun trading teratas

Buka akun trading

Tinjauan analitis InstaSpot akan membuat Anda menyadari sepenuhnya tren pasar! Sebagai klien InstaSpot, Anda dilengkapi dengan sejumlah besar layanan gratis untuk trading yang efisien.