The US dollar began this week in positive territory following Friday's economic data.

On Friday, the University of Michigan reported that inflation expectations of Americans for the next year increased in early February to 4.2% from 3.9% in January.

This data release, which came out ahead of January's CPI report, helped the US dollar overtake other major currencies on Friday.

As a result, USD finished the week in positive territory for the second time in a row.

Early on Monday, traders were anxious that the Fed would resume aggressive monetary tightening following new inflation data.

Last year, the US central bank quickly raised the key interest rate to bring soaring inflation under control.

Once consumer prices began to decelerate, the regulator reduced the size of rate hikes as well. In February, the Fed raised the rate by 25 basis points to 4.5-4.75%.

According to CME Group, 86.3% of traders expect a 25 bps hike to 4.75-5% in March.

At the beginning of the European session, the US dollar attracted safe haven demand of investors and gained 0.25%.

However, US stock index futures shed between 0.25% and 0.35% as market participants remained cautious.

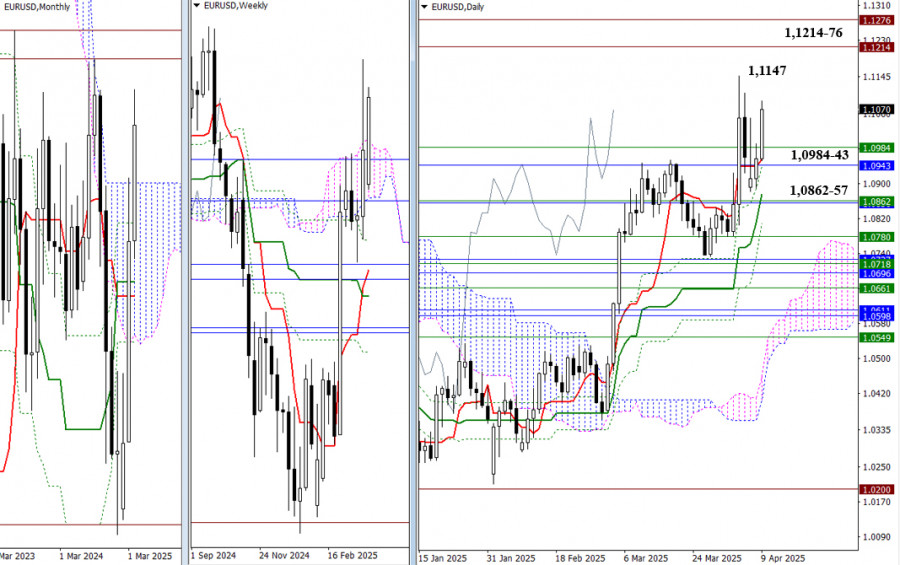

As a result, EUR/USD declined to a 5-week low below 1.0660.

However, the euro was able to recover after the European Commission announced an updated forecast for 2023 for the eurozone economy. The EU economy is expected to increase by up to 0.9%, compared to the 0.3% expected in autumn 2022.

At the same time, a moderate drop in US Treasury yields and a positive turnaround in risk sentiment put some downward pressure on the safe-haven dollar.

On Monday, key Wall Street indexes advanced by 1%, rallying after a drop on Friday.

Last week, the S&P 500 decreased by 1.1% in its biggest drop since mid-December.

Analysts have noted that stock market indexes are currently trading in a very narrow channel, with the S&P 500 moving between 4,000 and 4,200.

"It feels like the market is transitioning into a tighter range before getting new information on which to decide whether to continue to uptrend or reverse lower," Peter Garnry, head of equity strategy at Saxo Bank said.

Analysts at Morgan Stanley believe that a US stock sell-off is overdue after expectations of the Fed pausing its rate hikes turned out to be premature.

"While the recent move higher in front-end rates is supportive of the notion that the Fed may remain restrictive for longer than appreciated, the equity market is refusing to accept this reality," they noted.

According to Morgan Stanley, declining fundamentals coupled with the Fed's rate hike and falling corporate earnings would result in stocks tumbling to an ultimate low this spring.

"Price is about as disconnected from reality as it's been during this bear market," the analysts added.

Last week, yields on US two-year notes exceeded 10-year yields by the highest level since the early 1980s. It indicates that confidence in the US economy's ability to withstand an additional round of monetary tightening has declined.

Earlier this year, US equities had one of its strongest starts to a year on record. However, this rally has begun to lose steam.

Morgan Stanley's analysts added that the latest US inflation data could bring investors back to reality and would get stocks in line with bonds again, if prices rose more than expected.

They predicted that the S&P 500 would finish 2023 at 3,900, which is below Monday's closing price by 5.6%.

The bank expects equities to fall as earnings estimates decline, before rebounding in the second half of the year.

The uptrend in the market during Monday's trading session in the US was fuelled by hopes that the Fed would soften its stance as inflation decreases.

As a result, EUR/USD bounced back from its 5-week low and rose by about 60 pips or 0.4% to 1.0720.

US stock index futures increased on Tuesday, while the US dollar remained under pressure and EUR/USD tried to extend its upward momentum.

The key data release of Tuesday's US session is the US CPI data for January.

According to preliminary estimates, core CPI increased by 0.4%.

Higher used car prices are expected to push core inflation higher in January. If the final data is close to market estimates, it could trigger a "buy on rumor, sell on fact" reaction from the market.

In such a scenario, it would be hard for the greenback to take advantage of this data, which would allow EUR/USD to move higher.

An unexpected decline of the core CPI to 0.3% or 0.2% would also give an opportunity for the pair to rise

On the other hand, if the core CPI is at 0.5% or higher, it may convince market participants that the Fed is not going to take a pause in March. In that case, EUR/USD is at risk of coming under downward pressure.

According to a poll recently conducted by Reuters, most economists expect the Fed to raise interest rates at least twice in the coming months. There is a risk that rates will be even higher, and most economists do not expect a rate cut by the end of the year.

With US inflation still more than double the Fed's 2% target, 46 of 86 economists polled believe the central bank will carry out two more 25-basis-point hikes in March and May.

"We currently expect two more hikes. But the risk is towards higher rates. The labor market remains strong, and it's going to take a bit more time for it to start showing signs of deterioration," Oscar Munoz, US macro strategist at TD Securities said.

"That puts the risk of keeping services inflation and wage growth elevated for quite a bit and that's going to filter back into inflation. That means the Fed is going to keep the policy rate at high levels for quite a bit longer," he added.

The survey indicated that economists expect a 60% probability of a recession in 2023 and that it would be unlikely to lead to a rate cut this year.

"Cutting shortly after an unsettling inflation surge with a still-tight labor market would risk reputational damage if inflation flared back up," David Mericle, chief US economist at Goldman Sachs commented.

"The Fed needs to keep the economy on a below-potential growth path for a while longer in order to further rebalance the labor market and create the conditions for inflation to settle sustainably at 2%."

Analysts at Commerzbank believe that the Federal Reserve has few reasons for easing its monetary policy as the US labor market remains tight and inflation still greatly exceeds the target level. "This is unlikely to be changed by today's inflation data," they added.

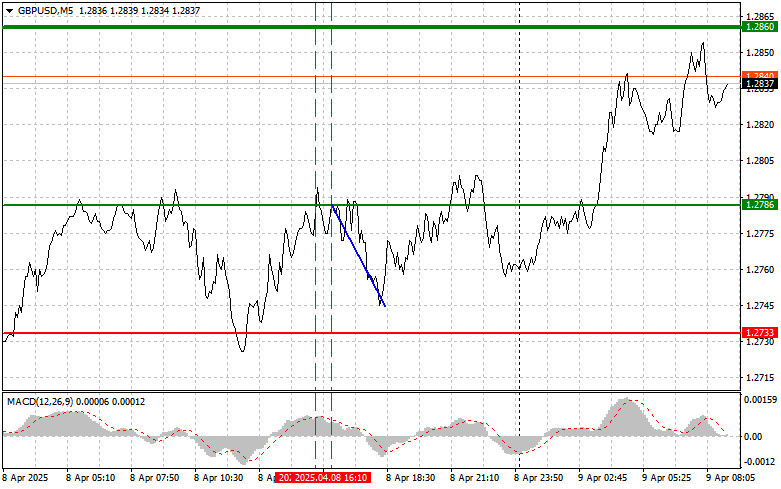

On Tuesday, USD is testing its support at 103.00, as Monday's retreat continues.

A drop below last week's low of 102.65 (from February 9) would pave the way for a deeper short-term decline, with an initial target near the three-month support line near 102.35.

As for EUR/USD, the area of 1.0760-1.0770, where the 50-day moving average and the 200-day moving average converge, provides a strong resistance. If bulls manage to break through that obstacle they might aim at the 100-day moving average at 1.0820 and the Fibo level of 23.6% at 1.0900 above it.

Meanwhile, the Fibo level of 61.8% at 1.0700 will provide initial support for the pair. If it breaks below 1.0650, it will extend the decline towards 1.0600.

Manfaat dari rekomendasi para analis saat ini

Akun trading teratas

Buka akun trading

Tinjauan analitis InstaSpot akan membuat Anda menyadari sepenuhnya tren pasar! Sebagai klien InstaSpot, Anda dilengkapi dengan sejumlah besar layanan gratis untuk trading yang efisien.