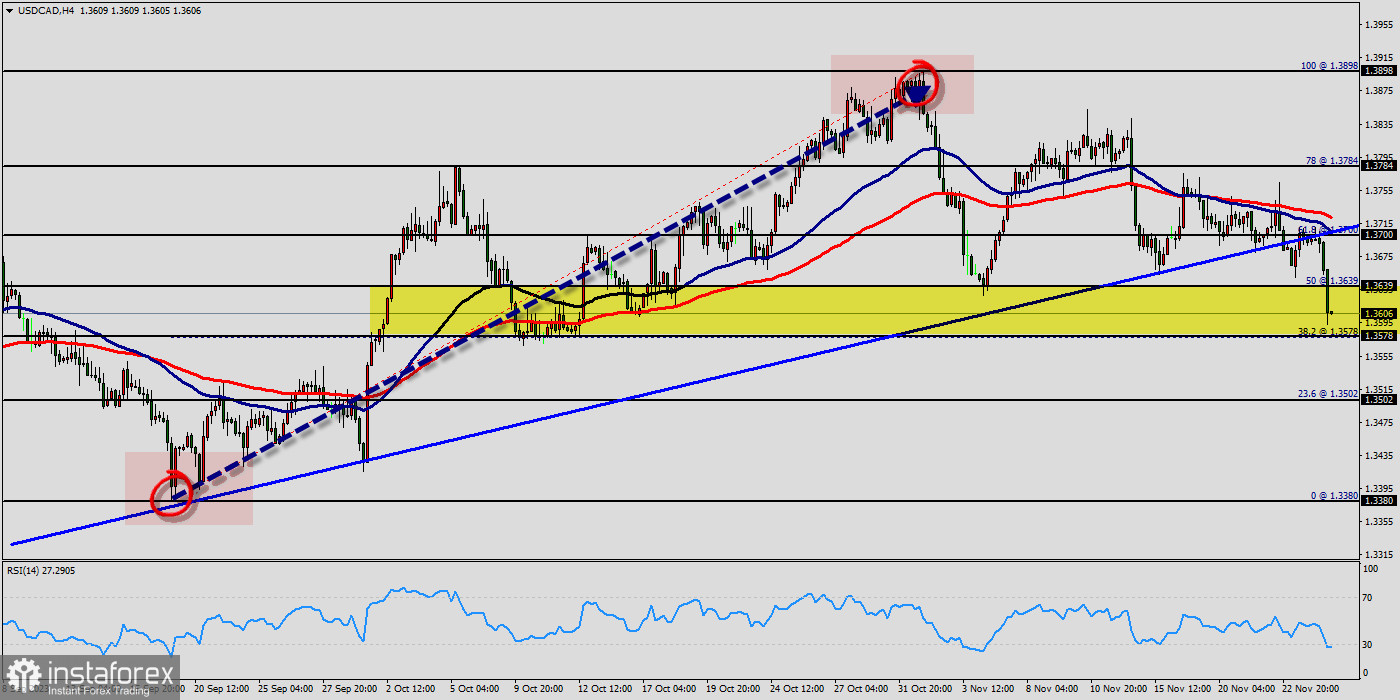

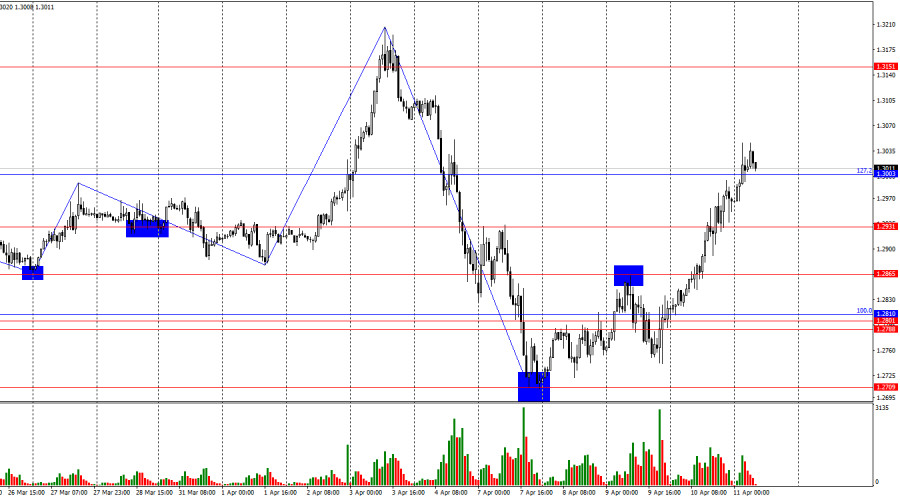

- Pada grafik per jam, pasangan GBP/USD melanjutkan pergerakan naiknya pada hari Kamis dan berhasil menempatkan diri di atas level korektif 127,2% di 1,3003 – pada Jumat pagi. Ini menunjukkan bahwa

Penulis: Samir Klishi

12:32 2025-04-11 UTC+2

34

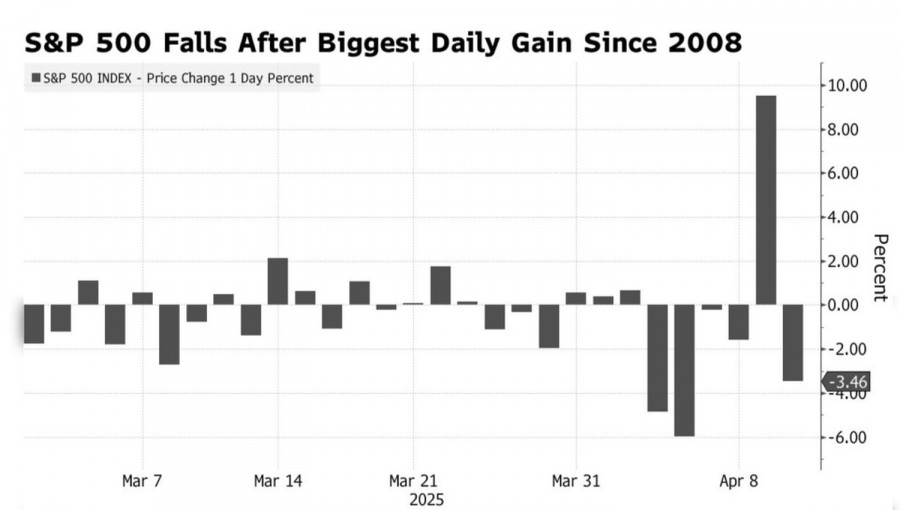

Bursa SahamPembaruan pasar saham AS pada 11 April. Penurunan besar setelah lonjakan kuat. Pasar kembali sadar.

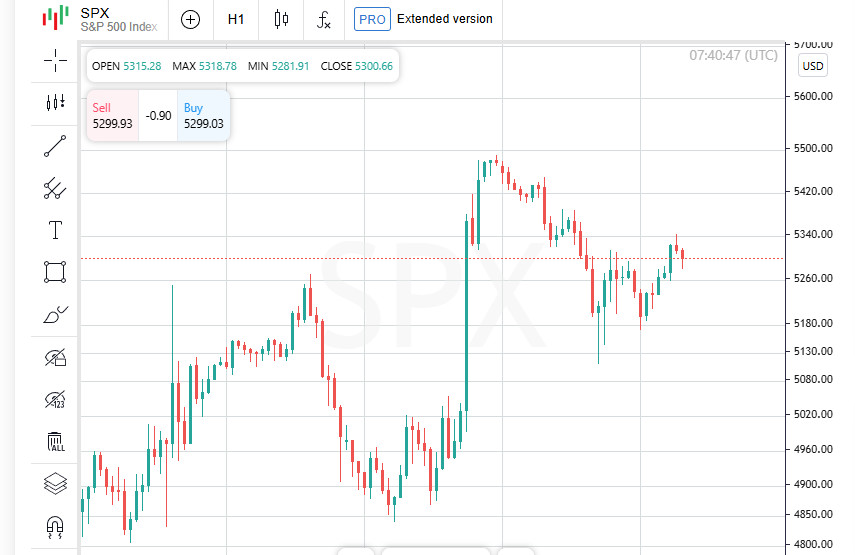

S&P500 Gambaran singkat indeks saham acuan AS pada hari Kamis: * Dow -2,5%, * NASDAQ -4,3%, * S&P 500 -3,5% S&P 500 ditutup pada 5.268, dalam rentang 4.800 hingga 5.800Penulis: Jozef Kovach

12:00 2025-04-11 UTC+2

21

Saham AS turun setelah peristiwa hari Rabu, S&P 500 turun 3% Saham Eropa dan Asia ditutup lebih tinggi setelah Trump menangguhkan sebagian besar tarif Lonjakan pasar obligasi stabil, harga emasPenulis: Thomas Frank

09:44 2025-04-11 UTC+2

17

- Nilai Bitcoin dan Ethereum turun menjelang akhir sesi perdagangan di AS pada hari Kamis, tetapi pulih selama jam perdagangan di Asia hari ini. Sudah menjadi praktik umum bahwa pasar crypto

Penulis: Miroslaw Bawulski

09:28 2025-04-11 UTC+2

14

Analisis FundamentalPasar Menghadapi Periode Ketidakstabilan yang Berkepanjangan (USD/JPY dan USD/CHF Kemungkinan Terus Jatuh)

Pada hari Kamis, para investor menyadari bahwa saat ini tidak ada yang namanya stabilitas. Volatilitas pasar yang tinggi tetap ada dan akan terus mendominasi untuk beberapa waktu. Penyebab yang sedangPenulis: Pati Gani

09:11 2025-04-11 UTC+2

25

Apa itu hidup jika bukan sebuah permainan? Dalam beberapa tahun terakhir, para investor berfokus pada ketegangan antara Federal Reserve dan pasar keuangan. Namun pada tahun 2025, aturan permainan telah berubahPenulis: Marek Petkovich

08:42 2025-04-11 UTC+2

12

- Perkiraan

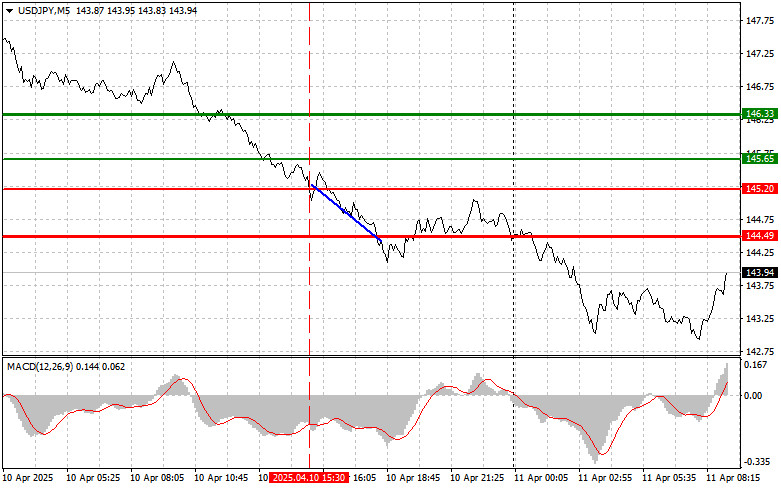

USD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 11 April. Tinjauan Trading Forex Kemarin

Pengujian harga pada 145.,20 terjadi ketika indikator MACD bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Namun, hal ini tidak mencegah penjualan dolar AS, karena pengujianPenulis: Jakub Novak

08:42 2025-04-11 UTC+2

14

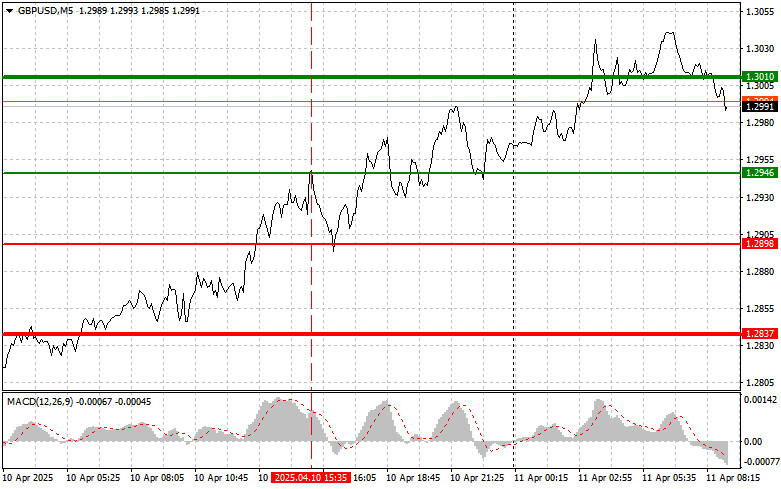

PerkiraanGBP/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 11 April. Tinjauan Trading Forex Kemarin

Uji harga di 1,2946 terjadi ketika indikator MACD bergerak jauh di atas garis nol. Namun, uji ini bertepatan dengan rilis data AS yang membenarkan pembelian GBP berdasarkan ekspektasi pelemahan dolarPenulis: Jakub Novak

08:42 2025-04-11 UTC+2

10

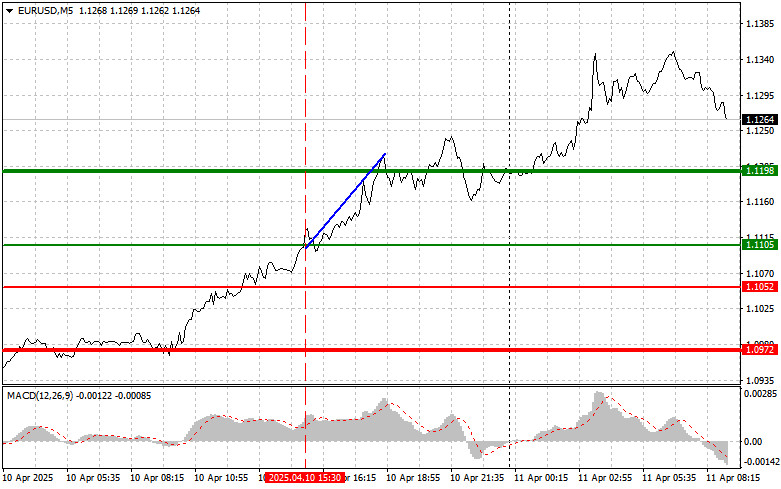

PerkiraanEUR/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 11 April. Tinjauan Trading Forex Kemarin

Pengujian harga di 1,1105 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol. Namun, setelah rilis data utama AS, ini tidak menghalangi masuknya pembelian euro dengan harapan terbentuknyaPenulis: Jakub Novak

08:42 2025-04-11 UTC+2

13