- Analisis Teknikal

Meski ada potensi koreksi terbatas namun secara overall USD/CHF masih Bullish, Rabu 30 Juli 2025.

USD/CHF – Rabu, 30 Juli 2025. Dengan munculnya Divergence antara pergerakan harga USD/CHF dengan indikator RSI(14) memberi petunjuk akan adanya potensi koreksi terbatas meski kondisi RSI(14) berada dalam posisi Netral-BearishPenulis: Arief Makmur

06:09 2025-07-30 UTC+2

0

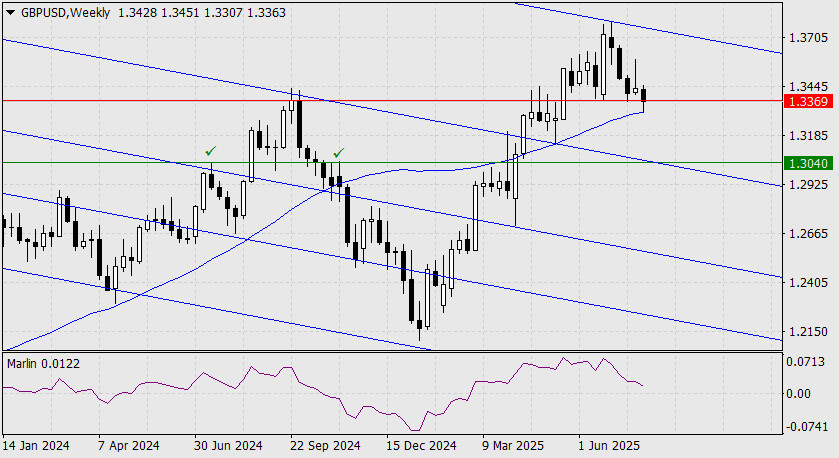

Menjelang akhir kemarin, pound Inggris menetap di bawah level 1.3369. Namun, mari kita lihat grafik mingguan, di sini, harga telah menguji dukungan pada garis MACD: Penurunan di bawah garisPenulis: Laurie Bailey

05:13 2025-07-30 UTC+2

0

Minyak (CL) Pada pagi ini, harga telah mencapai level target 69,43 dan garis MACD pada skala mingguan. Dua minggu yang lalu, terjadi penurunan selama dua minggu dari level resistancePenulis: Laurie Bailey

05:13 2025-07-30 UTC+2

3

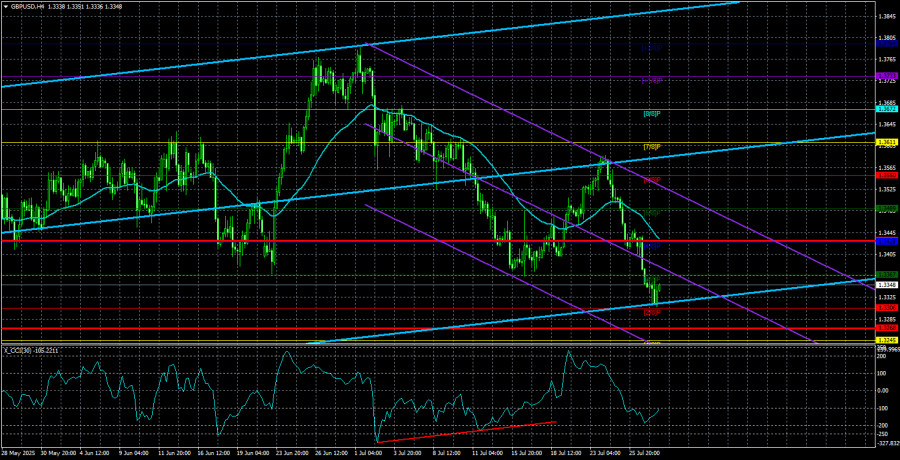

- Pada hari Senin, pasangan mata uang GBP/USD melanjutkan penurunannya dan memperpanjang pergerakan tersebut hingga Selasa. Perlu diingat bahwa pound sterling mulai jatuh lebih awal daripada euro, yaitu sejak minggu lalu

Penulis: Paolo Greco

03:48 2025-07-30 UTC+2

11

Pada hari Selasa, pasangan mata uang EUR/USD melanjutkan pergerakan turunnya, didorong oleh faktor yang sama seperti pada hari Senin—seperti yang telah kami peringatkan sebelumnya. Pada hari Senin, terungkap bahwaPenulis: Paolo Greco

03:48 2025-07-30 UTC+2

10

Rencana TradingRekomendasi Trading dan Analisis Trading untuk EUR/USD pada 30 Juli: Krisis Euro Berlanjut

Pada hari Selasa, pasangan mata uang EUR/USD melanjutkan pergerakan turunnya, meskipun selama hari itu, ada upaya pertama untuk menghentikan penurunan dan pulih. Secara keseluruhan, kami sepenuhnya mendukung penurunan euro padaPenulis: Paolo Greco

03:47 2025-07-30 UTC+2

6

- Kemungkinan akan ada ada beberapa petunjuk dovish, tetapi kemungkinan besar tidak akan berbeda dari pernyataan dan retorika sebelumnya oleh pejabat Federal Reserve. Ini adalah ekspektasi umum satu hari sebelum penutupan

Penulis: Chin Zhao

01:14 2025-07-30 UTC+2

11

Pada tanggal 30 Juli, data penting mengenai pertumbuhan inflasi di Australia untuk kuartal kedua akan dipublikasikan. Rilis ini sangat signifikan bagi pasangan AUD/USD, terutama menjelang pertemuan Reserve Bank of AustraliaPenulis: Irina Manzenko

01:14 2025-07-30 UTC+2

9

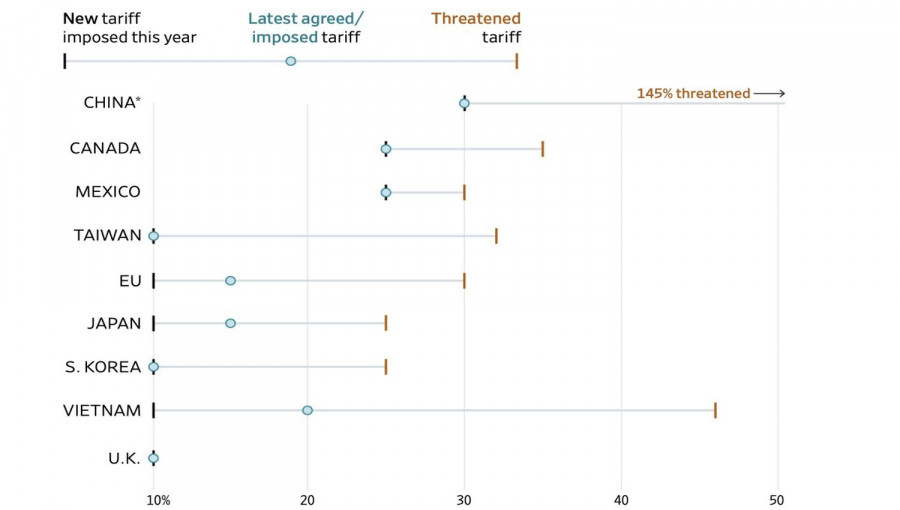

Lonjakan tajam EUR/USD ke level tertinggi hampir empat tahun pada awal Juli mungkin tampak seperti keyakinan zona euro terhadap masa depan yang cerah. Ekonomi yang kuat berarti mata uang yangPenulis: Marek Petkovich

01:14 2025-07-30 UTC+2

19