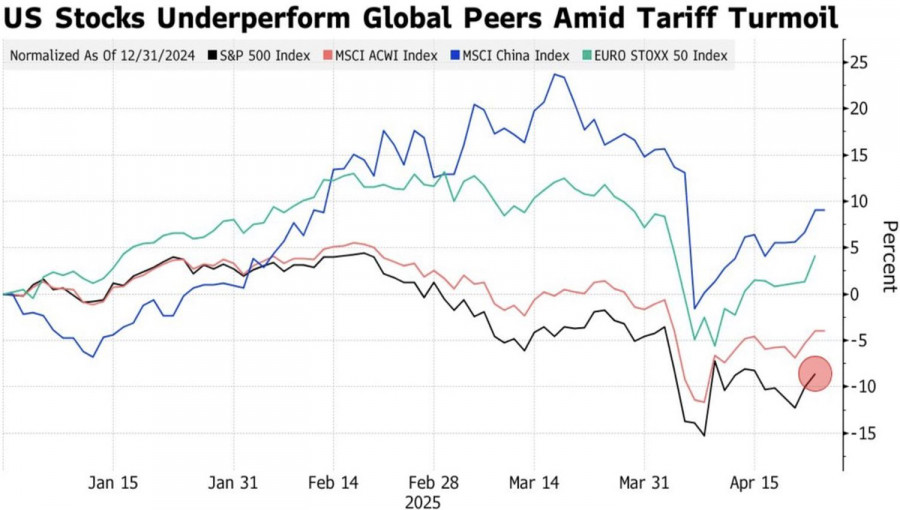

- Pasar semakin peka terhadap berita baik, tetapi hari-hari terbaiknya sudah berlalu. Nilai ekuitas AS sebagai persentase dari MSCI All Country World Index mencapai puncaknya pada bulan Desember. Menurut Jefferies Financial

Penulis: Marek Petkovich

11:42 2025-04-24 UTC+2

14

Yen Jepang tetap menunjukkan nada bullish meskipun ada beberapa tantangan dan tetap menjadi fokus karena pembaruan aversi risiko global mendorong permintaan terhadap aset safe-haven. Semakin berkurangnya harapan untuk resolusi cepatPenulis: Irina Yanina

11:35 2025-04-24 UTC+2

18

Emas menunjukkan momentum positif saat mencoba bertahan di atas level $3300, mengindikasikan minat investor yang semakin meningkat terhadap aset safe haven tradisional ini. Ketidakpastian seputar hubungan dagang AS-Tiongkok—yang disoroti olehPenulis: Irina Yanina

11:33 2025-04-24 UTC+2

14

- Menurut seorang pejabat senior di Bank Sentral Eropa, Presiden Donald Trump telah menarik seluruh dunia ke dalam permainan di mana semua orang akhirnya kalah — merujuk pada kebijakan perdagangannya, yang

Penulis: Jakub Novak

11:21 2025-04-24 UTC+2

16

Dolar AS melonjak tajam terhadap sebagian besar mata uang utama setelah Presiden Donald Trump menyatakan bahwa ia berencana untuk bersikap sangat "sopan" dengan Tiongkok dalam setiap pembicaraan dagang dan tarifPenulis: Jakub Novak

11:16 2025-04-24 UTC+2

20

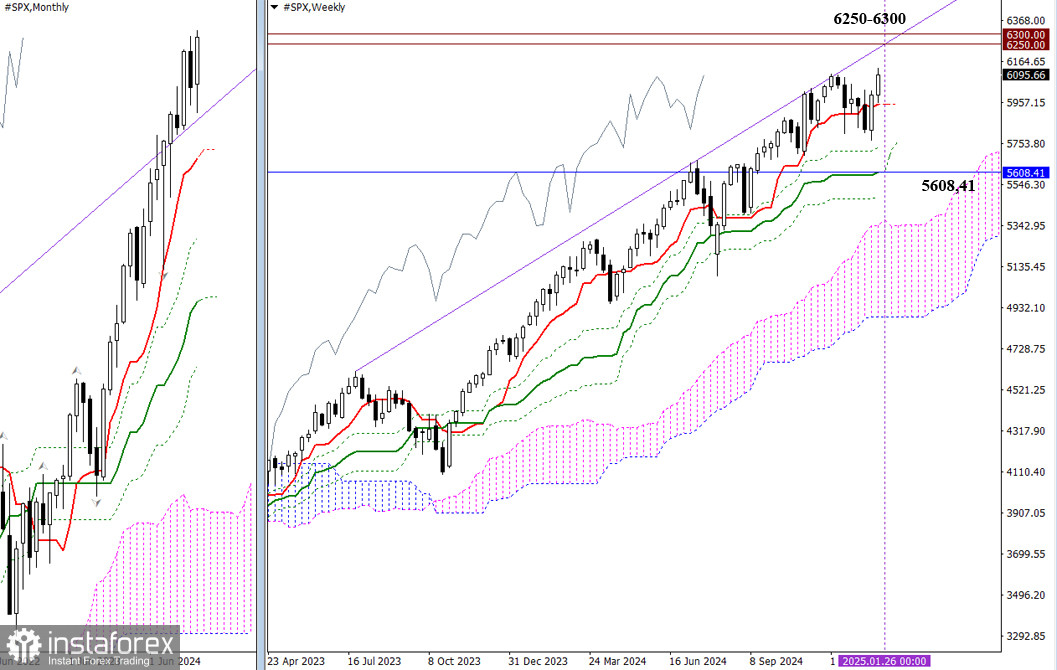

Indeks saham AS, termasuk S&P 500 dan Nasdaq 100, mencatat kenaikan yang solid karena optimisme terhadap kemajuan dalam negosiasi perdagangan. Meskipun tidak ada posisi yang jelas dari Gedung Putih, sentimenPenulis: Ekaterina Kiseleva

11:05 2025-04-24 UTC+2

10

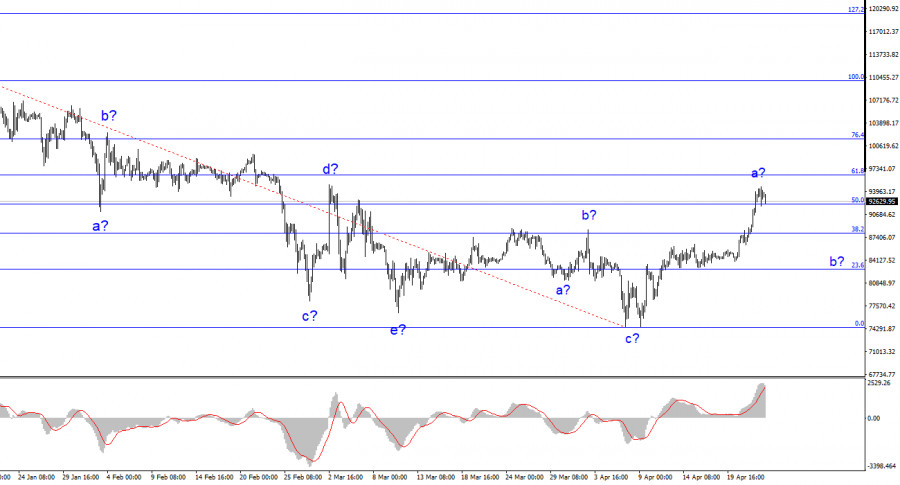

- Pola gelombang pada grafik 4 jam untuk BTC/USD menjadi agak lebih kompleks. Kami mengamati struktur korektif ke bawah yang menyelesaikan formasinya di sekitar angka $75,000. Setelah itu, pergerakan naik yang

Penulis: Chin Zhao

10:15 2025-04-24 UTC+2

15

Sementara Donald Trump berusaha untuk mencapai kesepakatan dengan Tiongkok, Gubernur Federal Reserve Adriana Kugler menyatakan bahwa kebijakan tarif saat ini kemungkinan akan memberikan tekanan ke atas pada harga dan mungkinPenulis: Jakub Novak

10:05 2025-04-24 UTC+2

25

Pasar merespons dengan kenaikan, dan dolar AS menguat terhadap euro dan aset berisiko lainnya setelah Presiden AS Donald Trump mengatakan bahwa dia tidak berniat memecat Ketua Federal Reserve Jerome PowellPenulis: Jakub Novak

09:59 2025-04-24 UTC+2

14