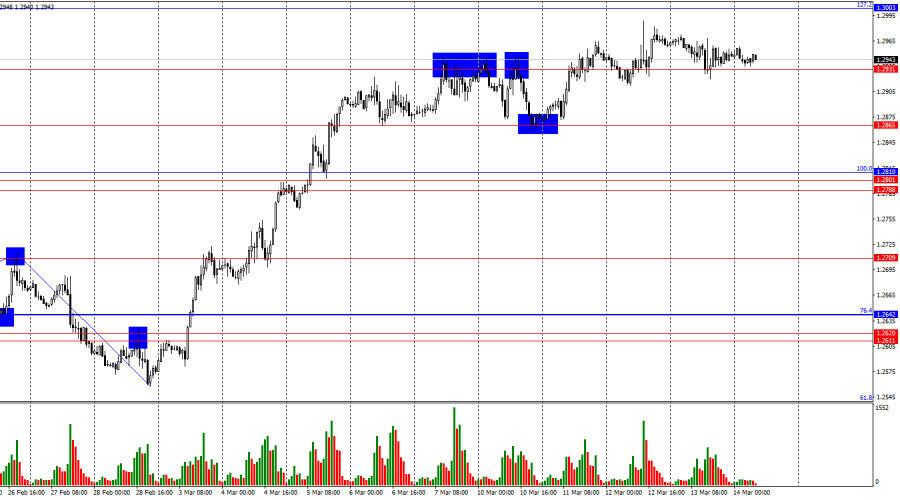

- Pada grafik per jam, GBP/USD mundur ke 1,2931 pada hari Kamis, di mana momentum bearish memudar. Ujian lain pada level tersebut terjadi hari ini, tetapi secara keseluruhan, pound bergerak sideways

Penulis: Samir Klishi

12:06 2025-03-14 UTC+2

49

Kemarin, indeks S&P 500 mencapai level target 5,516 – level yang sama dengan 20 Juni 2024, yang merupakan retracement Fibonacci 23,6% dari seluruh rally sejak Oktober 2022. Marlin Oscillator segeraPenulis: Natalia Andreeva

11:34 2025-03-14 UTC+2

38

Emas sedang mengalami konsolidasi setelah mencapai rekor tertinggi baru. Kekhawatiran terhadap kebijakan trading agresif Presiden AS Donald Trump dan dampaknya terhadap ekonomi global terus mendorong permintaan untuk aset safe havenPenulis: Irina Yanina

11:08 2025-03-14 UTC+2

38

- Berita Analitik

Emas mencapai rekor tertinggi hampir $3,000 per ons. Mengapa investor ramai-ramai melepas saham?

Indeks Wall Street turun 1%, S&P 500 mengonfirmasi koreksi Perubahan tarif Trump mempengaruhi sentimen Emas mencapai rekor tertinggi di $2,993.80 per ons Dolar AS melemah terhadap yen, tetapi menguat terhadapPenulis: Thomas Frank

10:40 2025-03-14 UTC+2

28

Bitcoin dan Ethereum saat ini sedang berkonsolidasi dalam channel, menciptakan kondisi yang mungkin mengarah pada berlanjutnya penurunan. Meskipun banyak ahli setuju bahwa titik terendah telah tercapai dan rally yangPenulis: Miroslaw Bawulski

09:20 2025-03-14 UTC+2

25

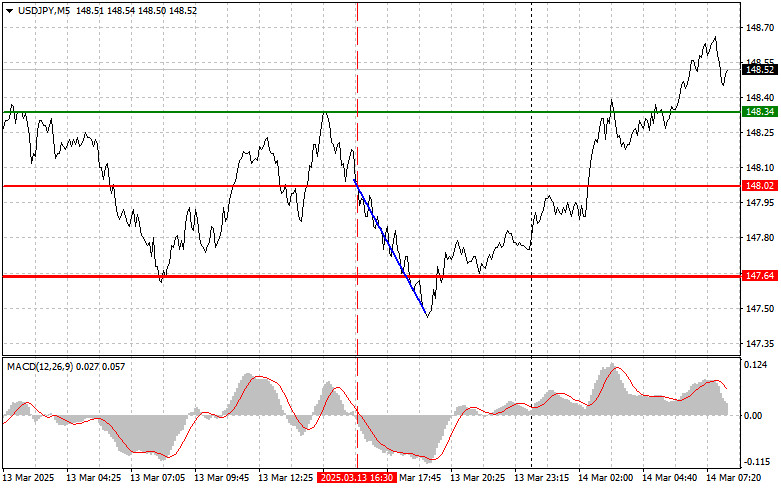

PerkiraanUSD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 14 Maret. Tinjauan Trading Forex Kemarin

Uji level harga di 148,02 terjadi ketika indikator MACD baru saja mulai bergerak turun dari level nol, mengonfirmasi titik entri yang valid untuk menjual dolar. Akibatnya, pasangan ini turunPenulis: Jakub Novak

09:20 2025-03-14 UTC+2

39

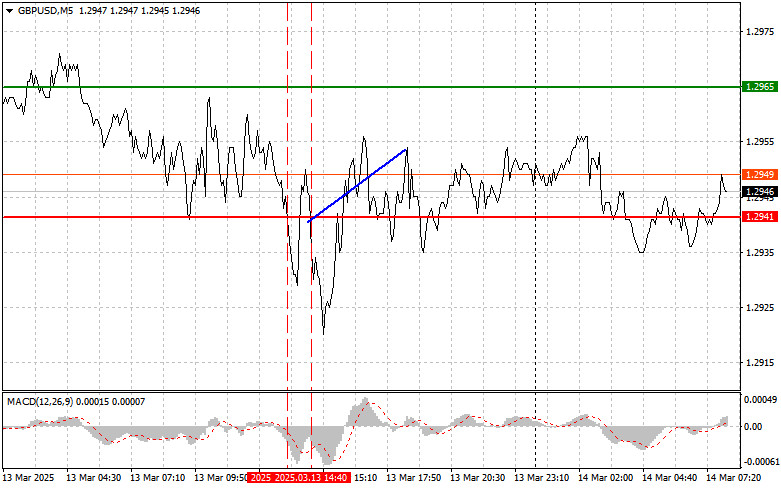

- Perkiraan

GBP/USD: Tips Trading Sederhana untuk Trader Pemula pada 14 Maret. Tinjauan Trading Forex Kemarin

Uji pertama pada level harga 1.2941 terjadi ketika indikator MACD sudah bergerak turun secara signifikan dari titik nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya memilih untuk tidakPenulis: Jakub Novak

09:20 2025-03-14 UTC+2

24

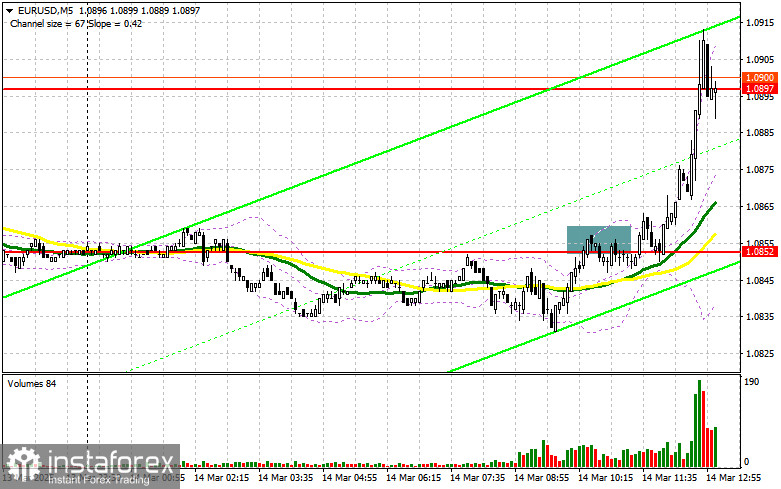

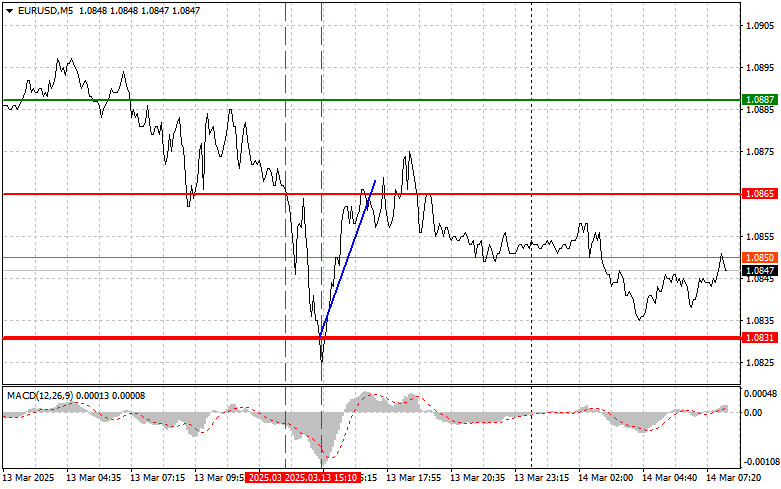

PerkiraanEUR/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 14 Maret. Tinjauan Trading Forex Kemarin

Level harga 1,0865 diuji ketika indikator MACD sudah bergerak turun secara signifikan dari titik nol, yang menurut saya membatasi potensi penurunan pasangan ini. Oleh karena itu, saya memilih untuk tidakPenulis: Jakub Novak

09:19 2025-03-14 UTC+2

43

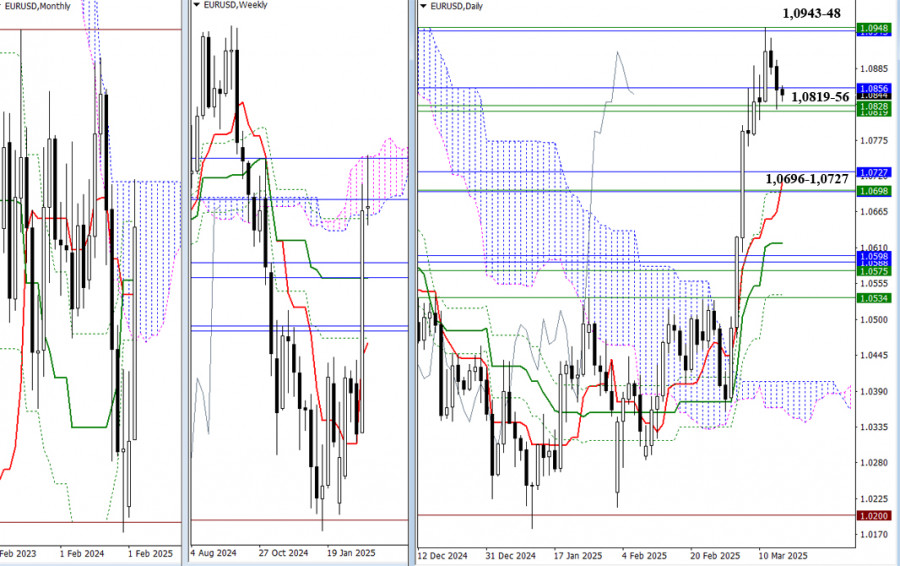

Menjelang akhir pekan, para pemain bullish telah menguji batas atas cloud Ichimoku, dengan level bulanan di 1,0943 dan level mingguan di 1,0948. Saat ini, pasar telah kembali ke kluster resistancePenulis: Evangelos Poulakis

08:22 2025-03-14 UTC+2

25