- Emas mempertahankan sikap bearish hari ini, meskipun sedikit pulih dari posisi terendah harian, naik kembali di atas level $3300. Para investor terus berharap akan adanya potensi de-eskalasi dalam perang dagang

Penulis: Irina Yanina

12:23 2025-04-25 UTC+2

66

Sementara Donald Trump dan Beijing masih mencoba mencari tahu apakah negosiasi perdagangan antara AS dan Tiongkok benar-benar terjadi, S&P 500 terus naik untuk hari ketiga berturut-turut — kali ini berkatPenulis: Marek Petkovich

11:57 2025-04-25 UTC+2

32

Indeks saham AS ditutup lebih tinggi untuk sesi ketiga berturut-turut, didorong oleh lonjakan tajam di sektor teknologi. Nasdaq melonjak 2,74%, dipicu oleh laporan pendapatan yang kuat dari perusahaan seperti AlphabetPenulis: Ekaterina Kiseleva

11:42 2025-04-25 UTC+2

49

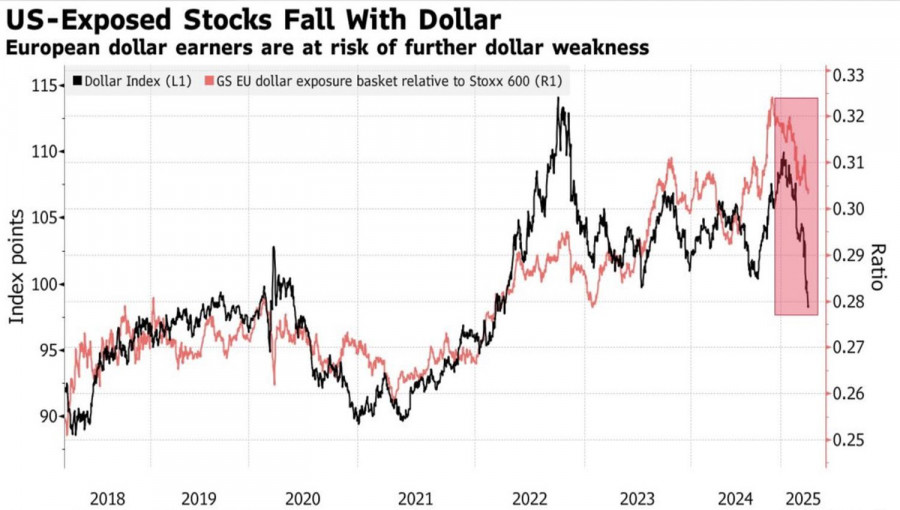

- Dolar AS menguat terhadap sejumlah mata uang global, begitu pula pasar saham AS, setelah laporan bahwa pemerintah Tiongkok sedang mempertimbangkan untuk menangguhkan tarif 125% pada beberapa jenis impor dari

Penulis: Jakub Novak

11:31 2025-04-25 UTC+2

25

Pada penutupan sesi reguler terakhir, indeks saham AS berakhir lebih tinggi. S&P 500 naik sebesar 2,03%, sementara Nasdaq 100 meningkat 2,74%. Dow Jones Industrial Average naik sebesar 1,23%. Saham telahPenulis: Jakub Novak

11:27 2025-04-25 UTC+2

35

Analisis FundamentalMengapa Harga Emas Bisa Turun Secara Signifikan? (Ada kemungkinan emas akan terus turun sementara kontrak berjangka CFD NASDAQ 100 mungkin naik)

Dimulainya negosiasi yang sebenarnya dapat menyebabkan penurunan signifikan pada harga emas dalam waktu dekat. Dalam artikel sebelumnya, saya menyatakan bahwa harga emas yang sebelumnya melonjak dapat mengalami koreksi besar akibatPenulis: Pati Gani

10:14 2025-04-25 UTC+2

73

- Upaya yang tidak berhasil kemarin untuk tetap di atas $94.000 menunjukkan bahwa masih ada minat beli yang signifikan. Ethereum juga bertahan dengan cukup baik, meskipun koreksi kemarin selama sesi Eropa

Penulis: Miroslaw Bawulski

08:56 2025-04-25 UTC+2

32

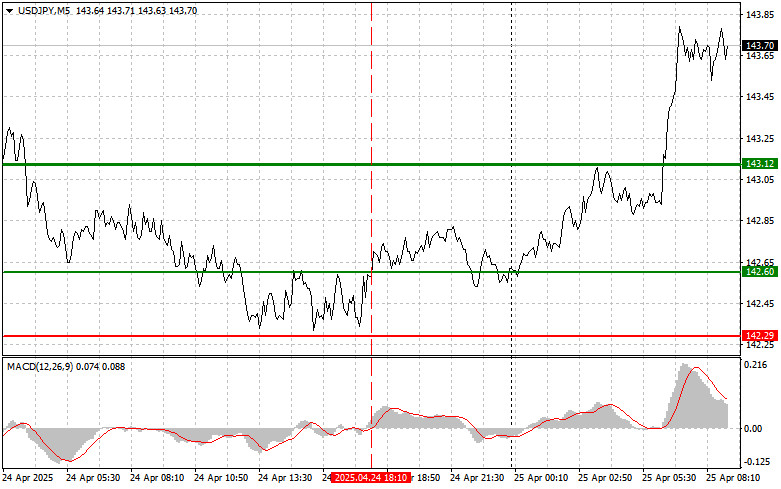

PerkiraanUSD/JPY: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 25 April. Tinjauan Trading Forex Kemarin

Pengujian harga di 142,60 terjadi ketika indikator MACD telah bergerak jauh di atas angka nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolarPenulis: Jakub Novak

08:31 2025-04-25 UTC+2

33

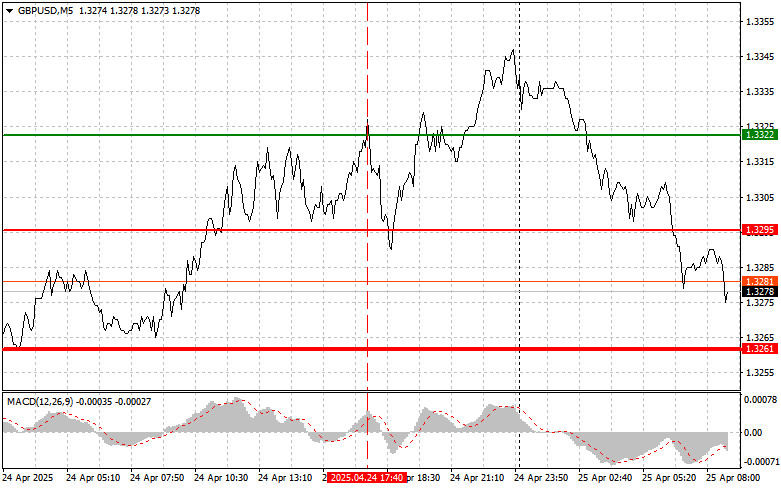

Uji harga di 1.3322 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Itulah sebabnya saya tidak membeli pound. Situasi serupa, tetapi kaliPenulis: Jakub Novak

08:31 2025-04-25 UTC+2

31