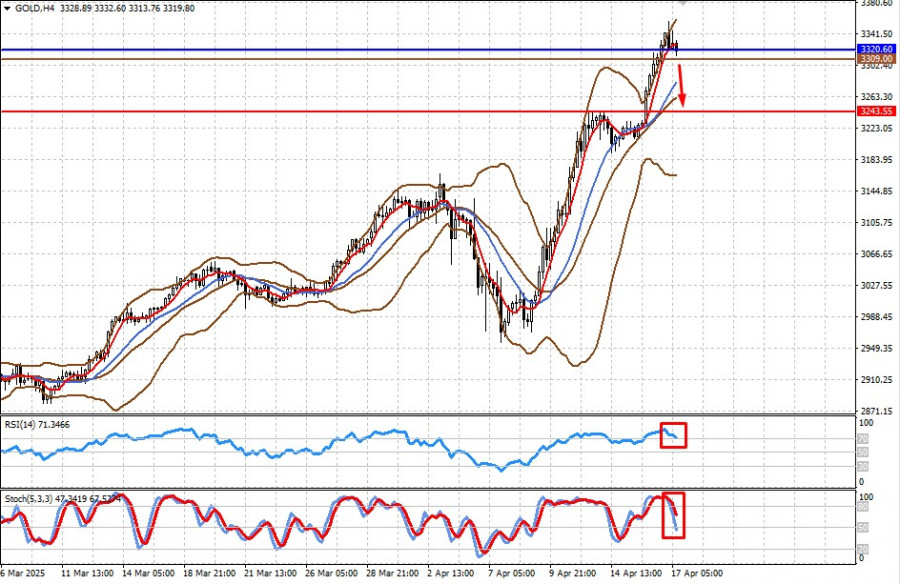

- Harga emas mengalami penurunan korektif hari ini karena para trader mengambil keuntungan setelah lonjakan baru-baru ini ke rekor tertinggi sepanjang masa. Penurunan ini, meskipun moderat, didorong oleh beberapa faktor, termasuk

Penulis: Irina Yanina

12:00 2025-04-17 UTC+2

48

mengenai perubahan kebijakan moneter yang akan datang dari Bank Sentral Eropa (ECB) dan Federal Reserve (Fed) AS. Antisipasi pemotongan suku bunga sebesar 25 basis poin oleh ECB—pemotongan keenam berturut-turutPenulis: Irina Yanina

11:55 2025-04-17 UTC+2

32

Harga emas terus mendapatkan dukungan di tengah ketidakpastian yang menyelimuti masa depan perang tarif yang diprakarsai oleh Donald Trump. Harga emas telah naik hampir secara vertikal selama empat bulan. PendorongPenulis: Pati Gani

11:49 2025-04-17 UTC+2

19

- Euro tidak menunjukkan banyak reaksi, sementara pound sedikit melemah terhadap dolar AS setelah pidato yang disampaikan oleh Ketua Federal Reserve Jerome Powell kemarin. Menurut Powell, saat ini The Fed fokus

Penulis: Jakub Novak

11:34 2025-04-17 UTC+2

27

Pernyataan terbaru Jerome Powell memicu penjualan besar-besaran pada saham AS. Baik S&P 500 maupun Nasdaq mencatat kerugian yang signifikan setelah ketua Fed mengatakan bahwa suku bunga kemungkinan akan tetap tidakPenulis: Ekaterina Kiseleva

11:21 2025-04-17 UTC+2

15

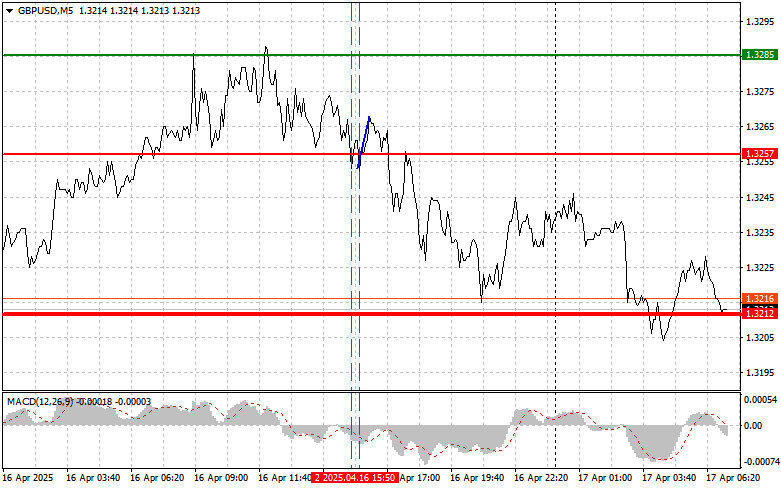

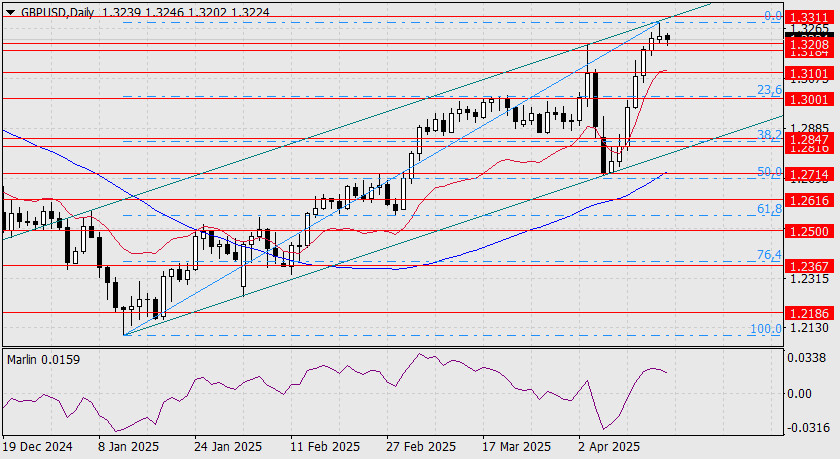

Analisis trading dan tips trading untuk pound Inggris Uji level harga 1.3257 terjadi ketika indikator MACD sudah bergerak jauh di bawah tanda nol, yang membatasi potensi penurunan pasangan ini. OlehPenulis: Jakub Novak

11:17 2025-04-17 UTC+2

11

- Perkiraan

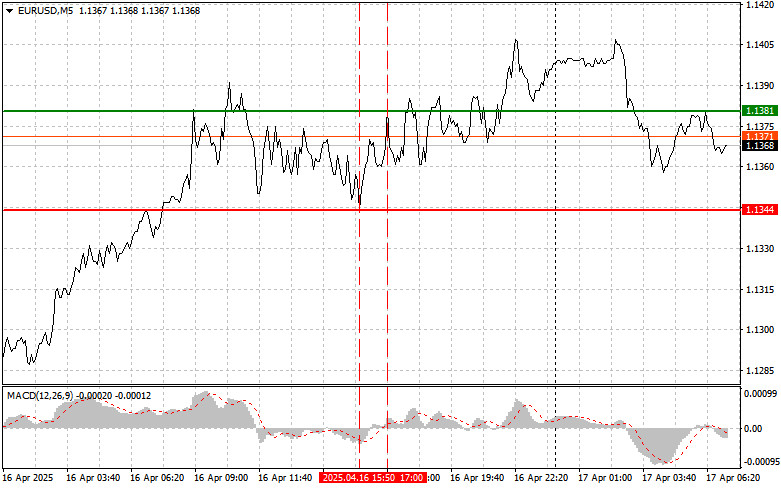

EUR/USD: Kiat-kiat Trading Sederhana untuk Trader Pemula pada 17 April – Ulasan Trading Forex

Analisis dan Kiat-kiat Trading Euro Uji level harga 1,1344 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, sayaPenulis: Jakub Novak

11:15 2025-04-17 UTC+2

10

Pada hari Rabu, euro sekali lagi bergerak ke dalam rentang target 1.1385–1.1420. Namun, perilaku harga terbaru menunjukkan bahwa level 1.1385 kini menjadi tidak relevan — kita melihat rentang konsolidasi antaraPenulis: Laurie Bailey

11:07 2025-04-17 UTC+2

12

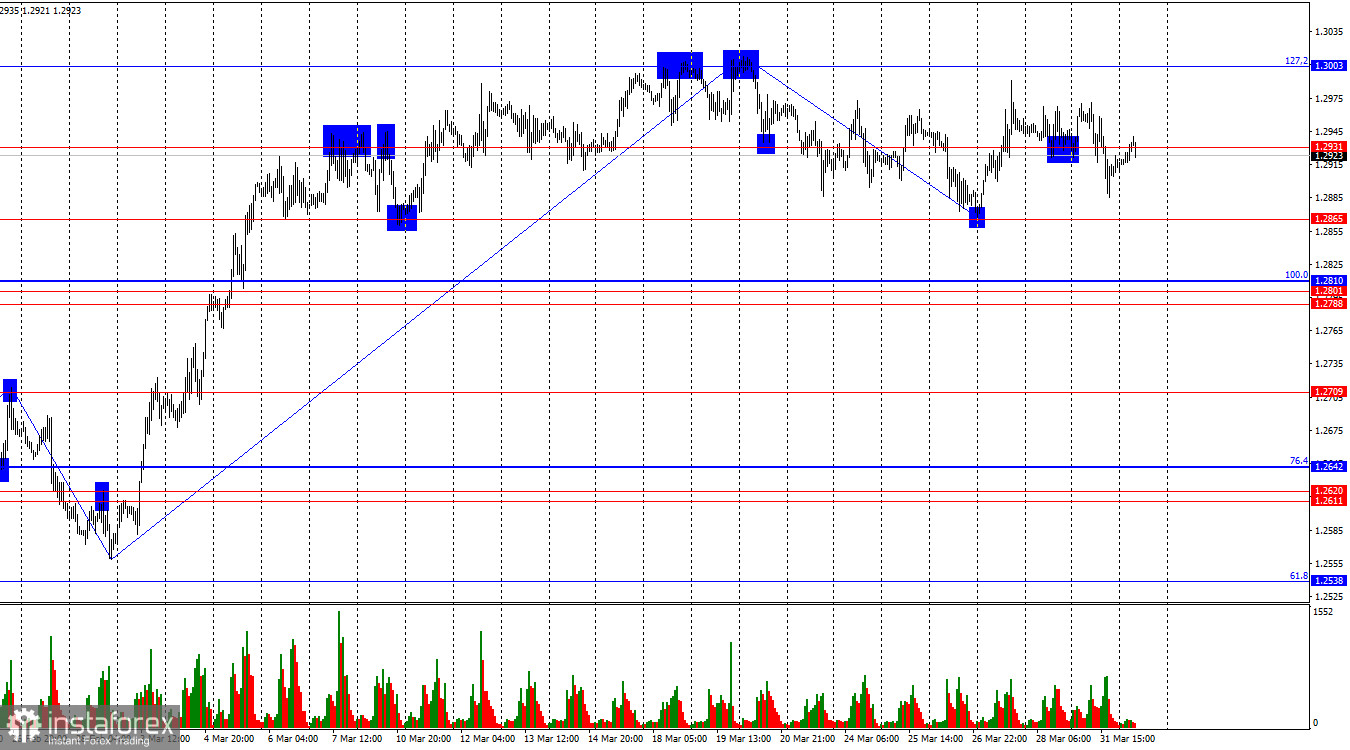

Kemarin, Inggris merilis data inflasi untuk bulan Maret. Core CPI turun dari 3,0% y/y menjadi 2,8% y/y, dan headline CPI turun dari 2,8% y/y menjadi 2,6% y/y, di bawah perkiraanPenulis: Laurie Bailey

11:02 2025-04-17 UTC+2

12