Tim kami memiliki lebih dari 7.000.000 trader!

Setiap harinya kami bekerja sama untuk meningkatkan trading. Kami memperoleh hasil tinggi dan terus bergerak maju.

Pengakuan dari jutaan trader diseluruh dunia merupakan apresiasi terbaik dari kerja kami! Anda membuat pilihan anda dan kami akan melakukan semua yang dibutuhkan untuk memenuhi ekspektasi anda!

We are a great team together!

InstaSpot. Bangga bekerja bersama anda!

Seorang Aktor, juara 6 turnamen UFC dan pahlawan sesungguhnya!

Pria yang berhasil. Pria yang berusaha keras.

Rahasia dibalik kesuksesan Taktarov adalah pergerakan konstan menuju target.

Tunjukkan seluruh sisi dari bakat anda!

Temukan, coba, gagal - namun jangan pernah berhenti!

InstaSpot. Cerita sukses anda dimulai disini!

Today, the GBP/USD pair is showing strong growth, reaching levels last seen in October 2024. This is driven by bearish momentum in the U.S. dollar, which has created favorable conditions for the British pound.

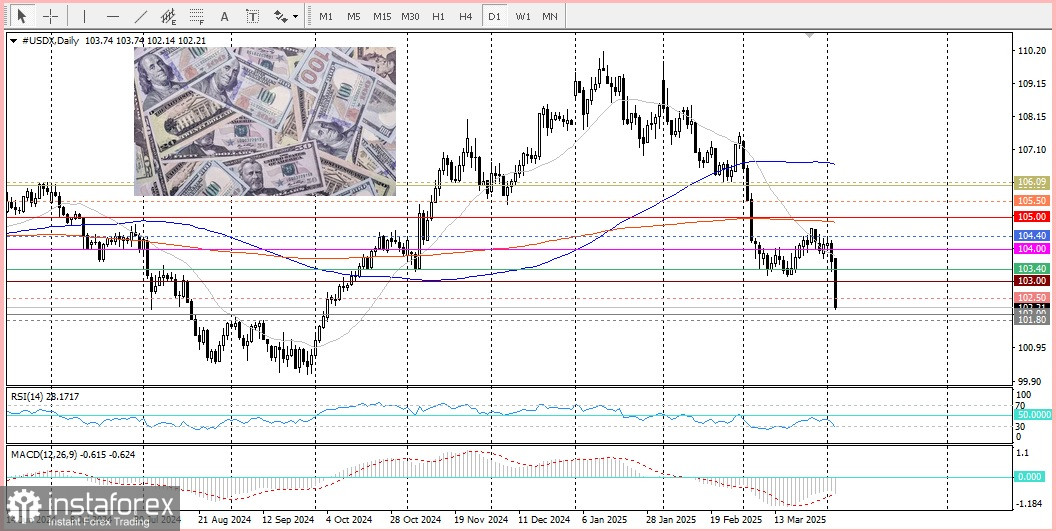

The decline in the U.S. Dollar Index to a new yearly low, in response to trade tariffs introduced by U.S. President Donald Trump, has heightened expectations for the Federal Reserve to begin a rate-cutting cycle sooner. As a result, U.S. Treasury yields have dropped sharply, undermining the dollar.

At the same time, the Bank of England is expected to cut rates more gradually than other central banks, including the Fed, which provides additional support to the pound. This further fuels demand for the British currency, helping the GBP/USD pair to rise.

From a technical perspective, the breakout above the psychological level of 1.3000 confirms the exit from a multi-week trading range, opening the way toward new targets. There is a high probability that GBP/USD could soon reach the 1.3180 area and the round level of 1.3200. However, it's important to note that oscillators on the daily chart are approaching overbought territory. Therefore, initiating new long positions at this moment may be premature—it's better to wait for consolidation or a short-term pullback.

On the other hand, the 1.3000 level now acts as a key support. A break below it would shift the bias in favor of the bears, pushing the pair back into its previous range. The nearest support is located around the 1.3100 round level, which the pair may revisit during consolidation, or to the 1.3056–1.3100 zone before potentially continuing its upward movement.

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Tinjauan analitis InstaSpot akan membuat Anda menyadari sepenuhnya tren pasar! Sebagai klien InstaSpot, Anda dilengkapi dengan sejumlah besar layanan gratis untuk trading yang efisien.

Klub InstaSpot

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.