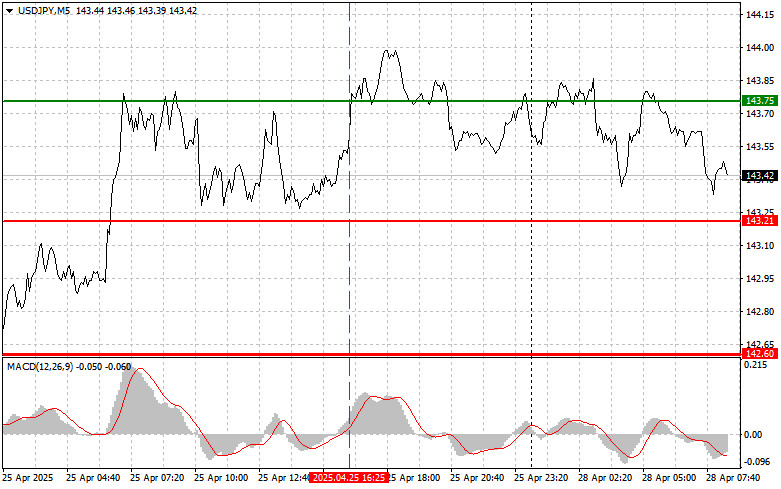

- S&P 500 dan Nasdaq mengakhiri sesi trading sebelumnya dengan lebih tinggi, menentang gejolak kinerja di bursa Asia dan Eropa. Para investor kini memusatkan perhatian pada data ekonomi mendatang dan laporan

Penulis: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

58

Berita Analitik100 hari pertama Trump telah berlalu: Pasar menanti tarif dan pendapatan dari raksasa

Ringkasan kebijakan Trump Pada hari Senin, saham Eropa naik setelah kenaikan mingguan kedua berturut-turut Para investor memperhatikan perubahan tarif, serta minggu yang sibuk dengan laporan pendapatan dan data ekonomi IndeksPenulis: Thomas Frank

11:22 2025-04-28 UTC+2

11

Analisis WavePrediksi Mingguan Berdasarkan Simplified Wave Analysis untuk GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, dan Indeks Dolar AS — 28 April

Pada minggu ini, pound Inggris kemungkinan besar akan mengikuti jalur pergerakan menyamping secara umum. Diperkirakan akan terbentuk penurunan harga singkat pada awal minggu. Menjelang akhir pekan, volatilitas kemungkinan akan meningkatPenulis: Isabel Clark

09:32 2025-04-28 UTC+2

37

- Analisis Wave

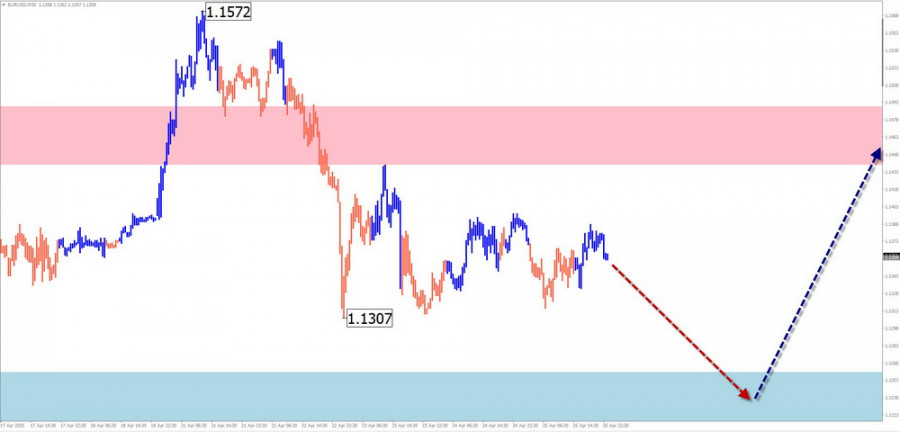

Prakiraan Mingguan Berdasarkan Analisis Gelombang Sederhana untuk EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, dan EMAS — 28 April

Pada awal minggu mendatang, mata uang Eropa diprediksi akan terus bergerak menyamping di sepanjang zona counter-trend yang telah dihitung. Pergerakan ke bawah lebih mungkin terjadi di awal minggu. Menjelang akhirPenulis: Isabel Clark

09:28 2025-04-28 UTC+2

11

Para pejabat di Bank Sentral Eropa sedang bersiap untuk terus menurunkan suku bunga, dengan memperkirakan bahwa kebijakan tarif AS akan menyebabkan kerugian besar dan berkepanjangan pada ekonomi, bahkan jika pemerintahanPenulis: Jakub Novak

09:24 2025-04-28 UTC+2

11

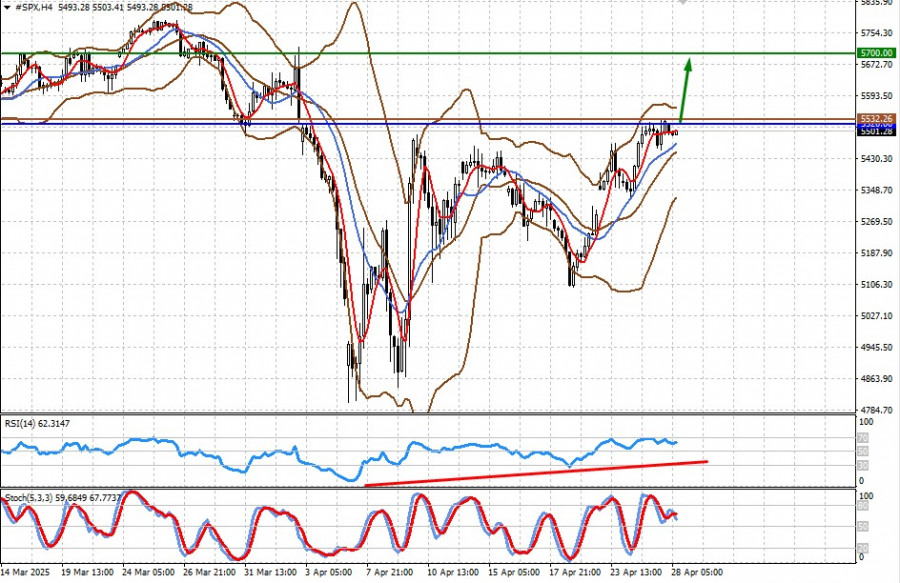

Analisis FundamentalMinggu Mendatang Mungkin Positif untuk Pasar tetapi Negatif untuk Dolar dan Emas (kami mengharapkan pertumbuhan lebih lanjut dalam kontrak CFD untuk S&P 500 futures dan Bitcoin)

Minggu depan akan dipenuhi dengan rilis data ekonomi penting, yang dapat memiliki dampak signifikan pada dinamika pasar — tetapi apakah mereka mampu melakukannya? Di tengah kekacauan geopolitik yang dihasilkan olehPenulis: Pati Gani

09:12 2025-04-28 UTC+2

9

- Dalam sesi reguler sebelumnya, indeks saham AS ditutup lebih tinggi. S&P 500 naik 0,74%, Nasdaq 100 naik 1,26%, dan Dow Jones Industrial Average naik tipis sebesar 0,05%. Indeks Asia memulai

Penulis: Jakub Novak

09:06 2025-04-28 UTC+2

8

Bitcoin sedang mengalami tekanan, tetapi masih bertahan dengan cukup percaya diri. Setelah bangkit dari level $92,000, mata uang kripto pertama ini kembali ke area $94,000, mempertahankan prospek pertumbuhan yang baikPenulis: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

7

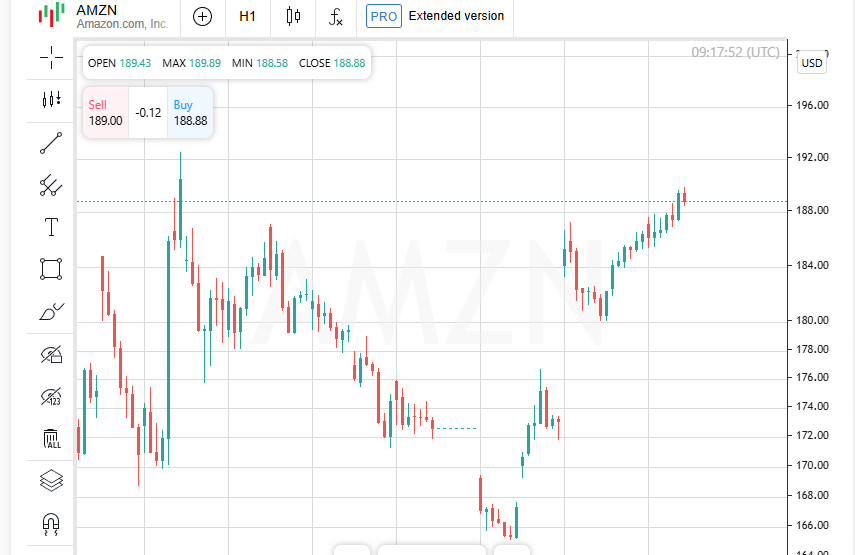

PerkiraanUSD/JPY: Tips Trading Sederhana untuk Trader Pemula pada 28 April. Tinjauan Perdagangan Forex Kemarin

Uji harga di 143.75 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolarPenulis: Jakub Novak

08:19 2025-04-28 UTC+2

7