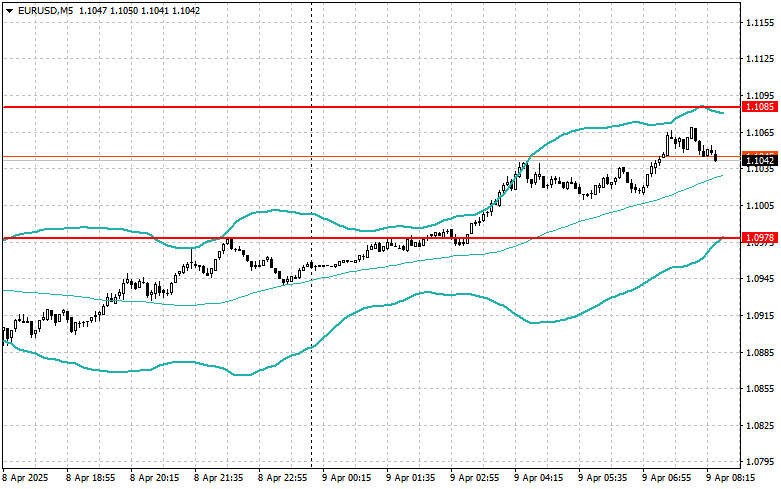

EUR/USD – 1H.

On August 28, the EUR/USD pair performed an increase to the corrective level of 23.6% (1.1906), an unsuccessful attempt to close above this level and a reversal in favor of the US currency (already this morning). I remind traders that the upper limit of the sideways trend corridor passes near the level of 1.1900, which is more clearly visible on the 4-hour chart. Thus, a rebound can be made from this line with a further drop of 100-200 points. On Friday, the information background for the euro/dollar pair was extremely poor. By and large, on this day, traders continued to work out the speech of Jerome Powell, which took place a day earlier. Let me remind you that the Fed Chairman said that his organization refuses to target inflation and link the inflation rate to the interest rate. Now, inflation will be allowed to rise above 2% without necessarily raising the Fed's key rate. According to Powell, this will allow to compensate for periods of low inflation without changes in the parameters of monetary policy. In total, at the end of two days, the US dollar still fell by more than 100 points, although it is definitely impossible to call Powell's speech "dovish". On the other hand, Powell also did not report anything "hawkish", so there were no grounds for optimism among traders either. As a result, most traders took Powell's words negatively.

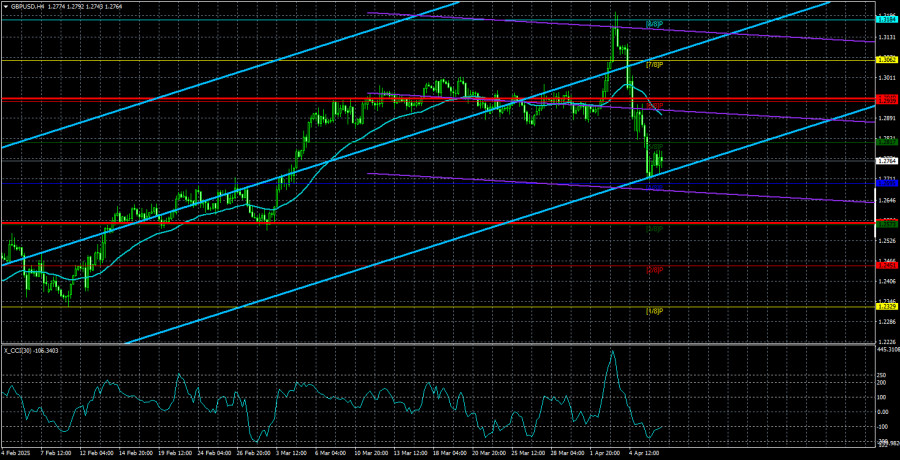

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a new growth to the upper border of the side corridor. A new rebound of quotes from this line will again work in favor of the US currency and the beginning of a fall in the direction of the corrective level of 127.2% (1.1729). Closing the pair's rate over the corridor will work in favor of continuing growth towards the next corrective level of 161.8% (1.2027). There are no emerging divergences today.

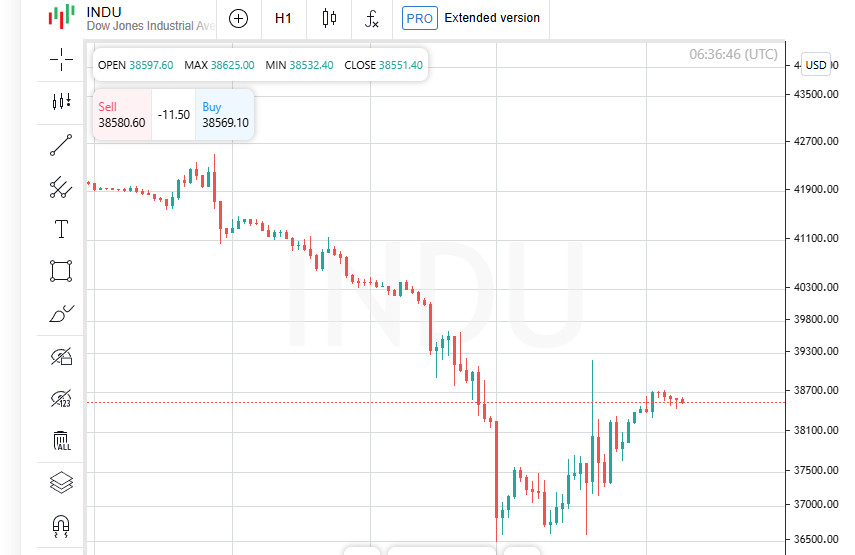

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another consolidation above the corrective level of 261.8% (1.1825). However, this level is not strong and I recommend paying more attention to the upward trend corridor, within which trading continues. The mood of traders remains "bullish".

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation over the "narrowing triangle", which now allows us to count on further growth of the euro currency, which may be strong, but in the long term.

Overview of fundamentals:

On August 28, the US released a report on changes in the levels of income and expenditure of the American population. Despite the fact that both indicators were higher than traders' expectations, the US dollar failed to grow on these data.

News calendar for the United States and the European Union:

Germany - consumer price index (12:00 GMT).

On August 31, the EU and US calendars are empty. Only in Germany will the inflation report be released, which is unlikely to have a serious impact on trading on Monday.

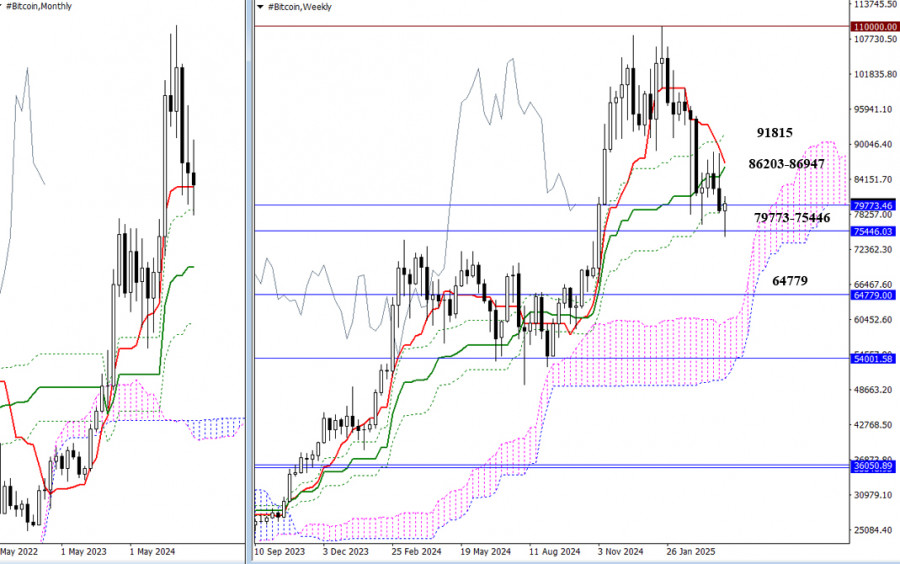

COT (Commitments of Traders) report:

The latest COT report was very revealing. According to the results of the reporting week, large traders of the "Non-commercial" group opened 1302 new long contracts and closed 11 thousand short contracts. Thus, their mood became even more "bullish". And the difference between the total volumes of long and short contracts focused on their hands has increased even more. Thus, the "bullish" mood of speculators has been growing continuously since June 20, which allows us to conclude that the upward trend for the euro/dollar pair continues. The "Commercial" group, which usually trades against the trend, opened 7 thousand short-contracts during the reporting week, and the total number of short-contracts for all groups of traders decreased by 7 thousand, and long-contracts - by a thousand.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with targets of 1.1838 - 1.1808, if a new rebound is made from the upper line of the side corridor on the 4-hour chart. I recommend buying the pair if the closing is performed over the side corridor with the goal of 1.2027.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.