- Stock Markets

यहाँ है हिंदी में अनुवाद: **28 अप्रैल के लिए स्टॉक मार्केट अपडेट: S&P 500 और NASDAQ ने अपनी बढ़त को रोका**

पिछले नियमित सत्र में, अमेरिकी स्टॉक इंडेक्स उच्च स्तर पर बंद हुए। S&P 500 में 0.74% की वृद्धि हुई, Nasdaq 100 में 1.26% का उछाल आया, और Dow Jones Industrialलेखक: Jakub Novak

11:14 2025-04-28 UTC+2

6

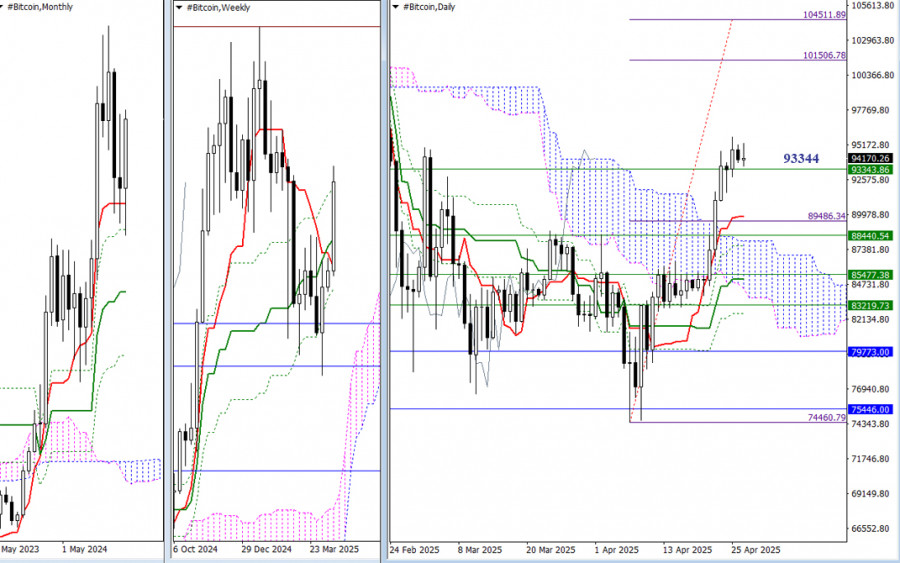

वर्तमान में, बुलिश खिलाड़ी स्थिति को बदलने और अप्रैल के लिए बुलिश उम्मीदवारी हासिल करने की कोशिश कर रहे हैं। पिछले हफ्ते, साप्ताहिक इचिमोकू क्रॉस (93344) के अंतिम स्तरलेखक: Evangelos Poulakis

10:26 2025-04-28 UTC+2

3

बिटकॉइन पर दबाव डाला जा रहा है, लेकिन यह फिर भी काफी आत्मविश्वास के साथ बना हुआ है। $92,000 के स्तर से उबरने के बाद, पहले क्रिप्टोक्यूरेंसी ने $94,000 केलेखक: Miroslaw Bawulski

10:22 2025-04-28 UTC+2

2

- अमेरिकी डॉलर ने कई वैश्विक मुद्राओं के मुकाबले मजबूती दिखाई, जैसे कि अमेरिकी शेयर बाजार में भी वृद्धि हुई, यह खबर आने के बाद कि चीनी सरकार कुछ प्रकार के

लेखक: Jakub Novak

12:21 2025-04-25 UTC+2

45

कल $94,000 के ऊपर बने रहने की असफल कोशिश यह दिखाती है कि अभी भी महत्वपूर्ण खरीदारी रुचि मौजूद है। एथेरियम भी काफी अच्छी तरह से संभल रहा है, हालांकिलेखक: Miroslaw Bawulski

12:17 2025-04-25 UTC+2

48

Fundamental analysisसोने की कीमतों में भारी गिरावट क्यों आ सकती है? (संभावना है कि सोने में गिरावट जारी रह सकती है, जबकि नैस्डैक 100 फ्यूचर्स कॉन्ट्रैक्ट पर सीएफ़डी में तेजी देखी जा सकती है)

वास्तविक बातचीत की शुरुआत निकट भविष्य में सोने की कीमतों में भारी गिरावट का कारण बन सकती है। पूर्व लेखों में, मैंने सुझाव दिया था कि पहले बढ़ रही सोनेलेखक: Pati Gani

12:14 2025-04-25 UTC+2

56

- पिछले नियमित सत्र के अंत में, अमेरिकी स्टॉक सूचकांक ऊँचाई पर बंद हुए। एसएंडपी 500 में 2.03% की वृद्धि हुई, जबकि नैस्डैक 100 ने 2.74% का लाभ दर्ज किया। डॉव

लेखक: Jakub Novak

12:10 2025-04-25 UTC+2

49

Crypto-currenciesपोलकाडॉट क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 25 अप्रैल 2025।

हालाँकि वर्तमान में पोलकाडॉट की प्राइस मूवमेंट WMA (30 शिफ्ट 2) के ऊपर चल रही है, जो यह संकेत देती है कि बाजार की प्रवृत्ति अब भी बुलिश है, लेकिनलेखक: Arief Makmur

12:08 2025-04-25 UTC+2

47

Crypto-currenciesसोलाना क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 25 अप्रैल 2025।

हालाँकि वर्तमान में सोलाना क्रिप्टोकरेंसी एक मज़बूत स्थिति में चल रही है, जिसकी पुष्टि इसके प्राइस मूवमेंट के WMA (30 शिफ्ट 2) से ऊपर रहने से होती है, लेकिन सोलानालेखक: Arief Makmur

12:01 2025-04-25 UTC+2

43