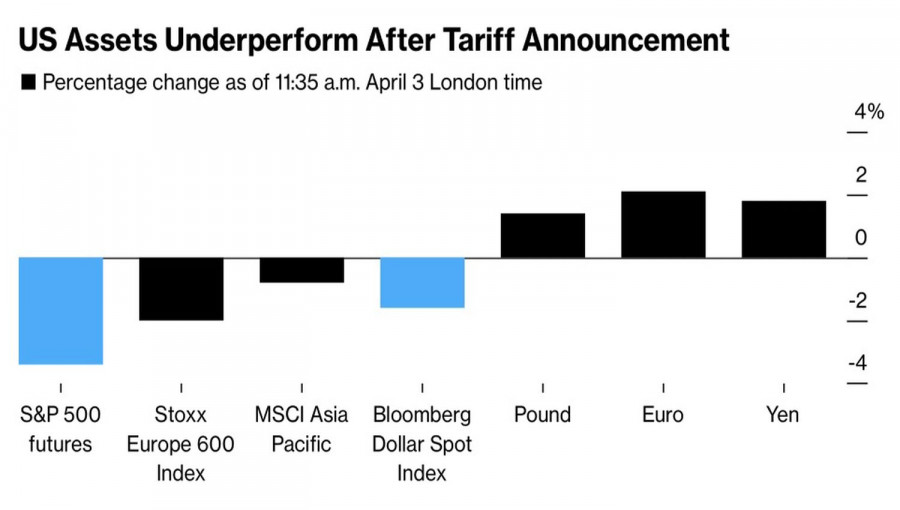

The situation on the global stock markets requires clarification. One could say that the markets are very likely to decline, but everything is not as simple. Indeed, some stock markets have now formed patterns suggesting a possible end to growth and there are enough reasons for this – Fed's statements about the upcoming rate hike at the end of 2023. But as always, the behavior of the markets is not in our liking, and if investors can afford to enjoy the growth of stocks, then traders who have taken a position to sell stock indices ahead of time risk getting losses and closing positions without waiting for the quotes' decline.

If we talk about US stock indices, the situation is as follows. The Dow 30 index formed a bearish pattern (Fig. 1), the SP500 index formed a bearish configuration (Fig. 2), while the Nasdaq100 index formed a bullish configuration (Fig. 3). Based on Charle Dow's rule: "Indices must confirm each other". At the moment, it can be seen that there is no agreement in the indices, but this does not mean that the situation cannot change anytime. So, let's take a closer look at what patterns were formed by stock indices, and try to estimate the probability of a decline in stock markets in the future from one to three months.

Figure 1: Dow 30 Daily Index

It is already known that technical analysis is more of an art than an exact science, and where someone sees a double top, another will see a false breakdown and a continuation of the trend. So, let's express my viewpoint on the situation, but one shouldn't take my judgment as the ultimate truth.

Looking at the chart of the Dow 30 index, it is very likely that an upward reversal has already occurred, since the index formed a new low in mid-June, which is lower than the previous value in May 2021. A special case of this rule is the presence of a false breakdown, which will be formed only after the Dow 30 index renews its historical low at 35000 and fixes it for at least one week.

The MACD indicators are in a bearish zone, and the RSI indicator signals a further increase. If we estimate the probability of growth and decline as a percentage, then we will come up with a ratio of 40% for the growth and 60% for the decline. Despite the fact that a further decline in the index is expected, the probability of such an outcome of events is by no means 100 percent, which means that the formation of a false breakdown with a subsequent upward price movement will not be ruled out, given the possibility of continued growth in my strategies.

Figure 2: S&P 500 Daily Index

Now, let's consider the key stock index S&P 500. Its dynamics from April to June forms an ascending wedge. Based on the observations, this formation breaks down in 75% of cases. In addition, it shows the divergences of the MACD and RSI indicators with the chart. The so-called divergences can signal an imminent decline in the index. At the same time, it should be put in mind that the value of divergences is significantly reduced when working against the trend. For example, the index updated the next high again from April 15 to May 15 when a slight decline led to the cancellation of the divergence signal.

Currently, the probability of a decline and an increase on the S&P 500 chart would be estimated as 45 to 55 in favor of further price growth. According to my experience, the markets are designed in such a way that before the decline occurs, they can update the highs by a small amount for a long time. So, for example, the S& P500 index rose by only 2.5% from April 15 to June 30, which is not a very large value compared to the previous growth impulse.

Figure 3: The Nasdaq Composite Daily Index

Analyzing the Nasdaq Composite Index, it should be noted that this value cannot serve as a signal of a trend reversal despite the overbought RSI indicator At the same time, the MACD indicator is in a positive zone, which suggests further growth of the index. In the context of the analysis of divergences, it is necessary to note the breakdown of the divergence between the chart and the MACD indicator in the period February - May 2021. Despite the initial testing of the signal, the situation changed dramatically in May, and by June, the index updated the historical high again. The breakdown of reversal patterns - "double top" and "divergence" is a clear example of the fact that trends in the markets develop in real-time, and not in the static assumptions of analysts, investors, and traders.

It is also worth noting that the breakdown of the strongest reversal patterns is a significant signal indicating the possibility of further growth of the Nasdaq index. In this regard, we can say that there is a possibility of continuing the growth trend at 75%, against a 25% probability of a possible reversal and subsequent decline.

Moreover, if we talk about the probability in the trends of stock indices and any other instruments, an important factor of the time perspective should be noted. The daily time considers trends for the future from one to three months, which implies the probability of an increase in this particular time period. In other words, if the probability of an increase is currently estimated at 75%, this means that the index value will become higher than it is now in the period from one to three months.

Looking at the presented analysis, it is impossible to certainly say whether the markets will decline or continue their growth. It should be noted that the indices do not confirm each other and their directions contradict. Consequently, the best solution in this situation would be to refrain from any actions on the stock market, which does not exclude the purchase of shares of the most attractive companies.

.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.