हमारी टीम के पास 7,000,000 से अधिक ट्रेडर हैं!

प्रतिदिन हम ट्रेडिंग को बेहतर बनाने के लिए एक साथ काम करते हैं। हम उच्च परिणाम प्राप्त कर रहे हैं और आगे की ओर बढ़ रहे हैं।

दुनियाभर के लाखों लोगों द्वारा हमारे काम को पहचानना, हमारे काम की सबसे अच्छी सराहना है! आपने आपनी पसंद बनाई है और हम आपकी अपेक्षाओं को पूरा करने के लिए हर संभव प्रयास करेंगे!

हम एक साथ एक अच्छी टीम हैं!

इंस्टाफॉरेक्स को इस बात का गर्व है कि वह आपके लिए काम कर रहा है!

एक्टर, यूएफसी 6 टूर्नामेंट का विजेता और एक सच्चा हीरो!

वह आदमी, जिसने अपनी मेहनत से सब किया है। वह आदमी, जो हमारे रास्तों पर चलता है.

टैक्टारोव की सफलता का राज लक्ष्य की ओर लगातर अग्रसर रहना है।

अपनी प्रतिभा के सभी पक्षों को प्रकट करें!

खोज करें, कोशिश करें, विफल हो-लेकिन कभी न रूकें!

इंस्टाफॉरेक्स- हमारी सफलताओं की कहानी यहाँ से शुरू होती है!

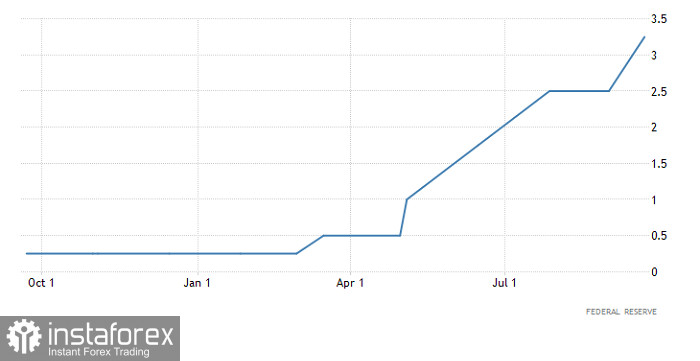

The growing tension and confrontation in Europe, as well as massive capital inflow to the US, has put pressure on EUR/USD. It intensified further after the Federal Reserve raised interest rates by 75 basis points and announced a similar one for the next meeting. The central bank reasoned that although inflation is slowing down, it is happening more slowly than expected. Thus, it is necessary to continue raising interest rates.

Interest rate (United States):

Unsurprisingly, dollar became heavily overbought, which means that for further growth, traders needs to release steam in the form of a rebound or a correction. It is possible that this is exactly what will happen today, after the Bank of England raises rates by 50 basis points. Such results will certainly lead to the growth of pound and, given the market's need for a rebound, it will pull euro along with it.

Interest rate (UK):

EUR/USD, in the course of an intense downward move, almost fell to the level of 0.9800. This signals the overheating of short positions in the market, which means that there may be a rebound towards the previously passed level of 0.9900.

GBP/USD has prolonged the current downward trend in the market by trading actively at 1985. This shows that the pair is oversold, and could see a technical rebound soon.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

ईमेल/एसएमएस संबंधी

अधिसूचनाएँ

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.