EUR/USD has experienced heightened volatility as the market anticipates the upcoming Federal Reserve and European Central Bank meetings, set to take place in early May.

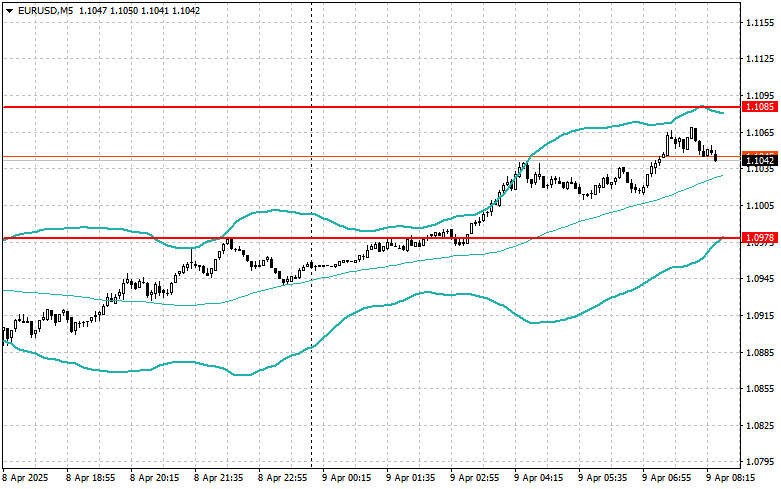

Early on Thursday, the currency pair consolidated, trading within a 25-30 point range. Investors adopted a cautious stance in anticipation of key US data releases.

The preliminary GDP estimate for the first quarter of 2023 was projected to show an increase of 2% YoY. However, the US Department of Commerce later reported that the world's largest economy expanded by just 1.1% YoY between January and March. This marked a notable slowdown compared to the 2.6% increase observed in the previous year's final quarter and fell short of the predicted 2% rise.

In response to the data, the US dollar went up against major currencies by over 0.4%, climbing above 101.50 points, while EUR/USD declined by almost 50 points from the previous close at 1.1040.

The dollar's increase, despite weak GDP figures, can be attributed to two factors. A 3.7% increase in personal consumption during the three-month period partially compensated for the decline in business inventories. If inventories had remained stable, annual GDP growth would have exceeded 3%. Businesses typically replenish inventories in the subsequent quarter after depleting them.

The Core PCE index, a key indicator monitored by the Fed to assess inflation risks, rose by 4.9% in Q1 from 4.4% in Q4.

A separate report indicated that initial jobless claims in the US decreased by 16,000 to 230,000 for the week ending April 22, surpassing expert predictions of 248,000.

Given the sustained inflationary pressures in the US and the ongoing tense labor market conditions, further rate hikes by the Federal Reserve are warranted.

FOMC officials say a period of below-trend growth and some easing of labor market conditions will be needed to return inflation to the Fed's long-standing 2% target. At the same time, they do not forecast a recession.

As of March, most officials anticipate a slowdown in inflation-adjusted GDP growth to 0.4% in 2023.

The probability of a 25 basis point rate hike by the Federal Reserve in May has risen to nearly 90%, up from about 70% prior to yesterday's data release

Traders also see a possibility of an additional 25 basis point increase in US central bank rates in June, with a probability exceeding 20%, according to CME Group data.

Typically, a Federal Reserve interest rate hike positively impacts the US dollar.

Meanwhile, the euro failed to take advantage of mixed eurozone data.

The European Commission reported that the composite index of business and consumer confidence in the eurozone reached 99.3 points in April, up slightly from 99.2 points the previous month. Analysts had projected an average rise to 99.9 points.

The services consumer confidence index increased to 10.5 points from 9.4 points in March, hitting its highest level since June of the previous year. However, the manufacturing sector indicator dropped to its lowest level since early 2021, hitting -2.6 points compared to -0.5 points the month before.

After initially climbing on Thursday, the greenback ultimately gave up most of its daily gains, closing the trading session up around 0.05% at 101.25.

As the US dollar retreated from local highs, EUR/USD managed to recoup more than half of its losses, recovering to 1.1025.

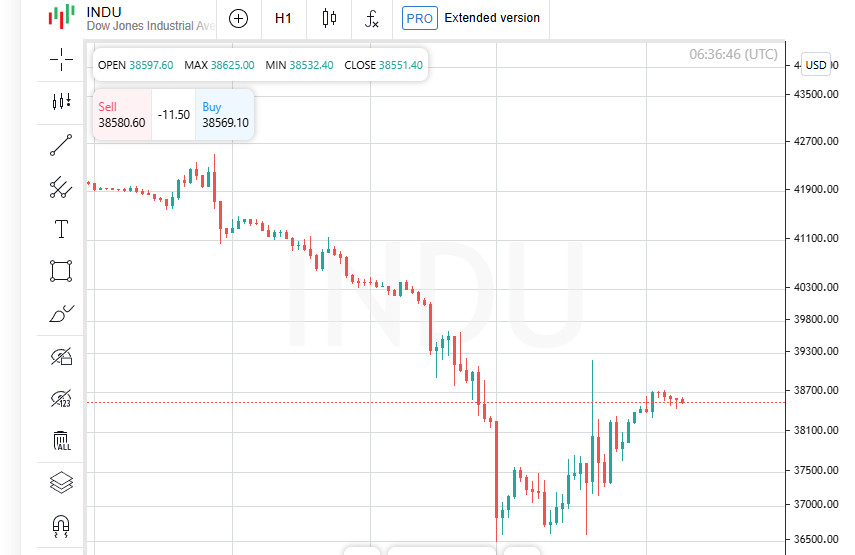

Key Wall Street indicators offered a helping hand to the euro, demonstrating strong growth on Thursday.

The S&P 500 added 1.96%, rising to 4135.35 points, marking its largest increase since January 6.

Negative US GDP data were offset by strong quarterly reports from American companies, including those in the technology sector.

According to Refinitiv data, the total profit of S&P 500 companies reporting for the past quarter exceeded expectations by 7.9%.

On Friday, US stock futures have mostly declined, while the greenback continues to strengthen against major competitors.

The US dollar index has climbed to its highest level since April 17 at around 101.80, adding about 0.5%.

EUR/USD has once again dipped below the 1.1000 mark, losing around 0.3%.

Investors' focus today is on the US Personal Consumption Expenditures (PCE) index for March, the Federal Reserve's preferred inflation indicator.

Forecasts suggest the indicator would grow by 0.3% month-over-month in March, as it did in February.

If the core PCE index unexpectedly declines, US stocks will rally and the dollar will come under pressure. In such a case, the FOMC may consider suspending its monetary policy tightening campaign.

A pause in June would allow the Fed to assess the impact of its actions over the past year and the consequences of recent banking shocks, which, as Chairman Jerome Powell previously stated, may have the same effect as a rate hike.

A 0.4% or higher increase of the core PCE index would justify further monetary policy tightening in the US. In this scenario, the likelihood of the Federal Reserve raising rates by 25 basis points in June would increase.

As a result, US stocks would struggle, and the US dollar would continue to rise.

Despite the current rebound, the greenback is still on track for monthly losses of just under 1% after falling about 2.5% in March.

However, those betting on further dollar weakness may be disappointed, especially if today's data ensures the Fed remains committed to fighting inflation and does not indulge market expectations for rate cuts in the second half of the year.

Societe Generale strategists mentioned that while many anticipate the Fed to hike rates next week, they expect the regulator to keep interest rates unchanged until the end of the year due to persistent inflation instability, thus dashing hopes for policy shifts in the latter half of 2023.

While the US dollar is poised to record a monthly loss, the euro could show a monthly gain of around 1.3%.

The ECB is likely to hike rates for the seventh consecutive time on May 4, but policymakers are divided on the size of the move.

Some lean towards a 25 basis point increase, while others favor a 50 basis point hike.

Key inflation and bank lending data releases in the coming days may influence the outcome.

With the return of some stability to the banking sector in April following March's turmoil, the hawks on the ECB's Governing Council may feel confident in pushing for a significant rate increase.

Preliminary eurozone inflation data for April, due to be released on Tuesday, May 2, will likely confirm that core price pressure remains uncomfortably high and exceed 5%.

However, if bank lending data, also scheduled for release on Tuesday, show a substantial tightening of lending conditions, the ECB Governing Council doves may gain courage and backtrack.

Any hints from the regulator that it is willing to soften its stance could trigger a swift shift in eurozone interest rate expectations and exert downward pressure on EUR.

The euro reached a new 13-month high of $1.1095 this week before retreating.

Recent statements from ECB officials support further rate hikes, but this view contradicts some loss of momentum in the region's economic indicators.

The eurozone GDP growth, according to first estimates, slowed to 1.3% YoY in Q1 from 1.8% recorded in Q4.

The marginal 0.1% increase compared to the previous quarter, according to ING strategists, is also no cause for celebration.

The nearest support for EUR/USD is at 1.0950. A decline below this mark would open the way towards 1.0900 and 1.0850.

On the other hand, the 1.1000 mark acts as an obstacle on the way to 1.1050 and 1.1100.

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.