- बिटकॉइन $94,000 के स्तर के ऊपर टिकने में नाकाम रहा और यह $92,500 के क्षेत्र तक करेक्शन में आ गया, जहाँ यह कुछ अधिक स्थिर दिखाई दे रहा है। एथेरियम

लेखक: Miroslaw Bawulski

11:47 2025-04-24 UTC+2

15

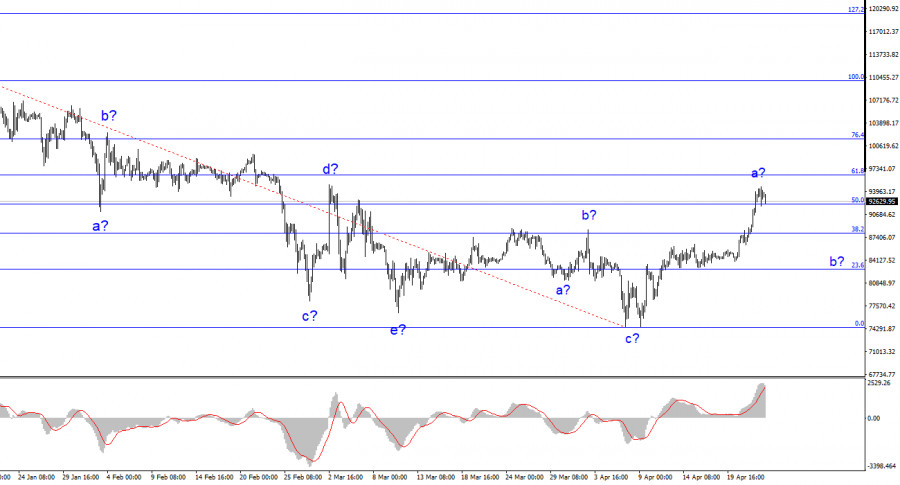

BTC/USD के 4-घंटे के चार्ट पर वेव पैटर्न अब कुछ हद तक अधिक जटिल हो गया है। हमने एक करेक्टिव डाउनवर्ड स्ट्रक्चर को देखा जो लगभग $75,000 के आसपास पूरालेखक: Chin Zhao

11:43 2025-04-24 UTC+2

6

Trading plan24 अप्रैल को GBP/USD जोड़े पर ट्रेड कैसे करें? शुरुआती लोगों के लिए सरल टिप्स और ट्रेड विश्लेषण

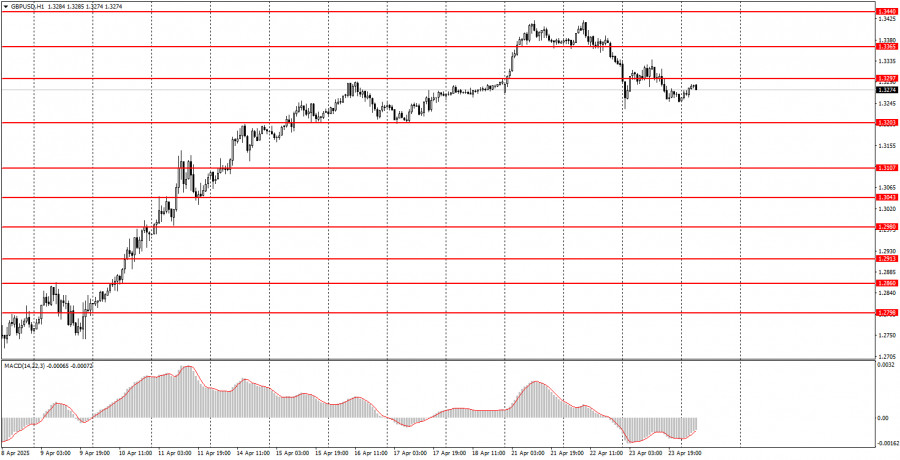

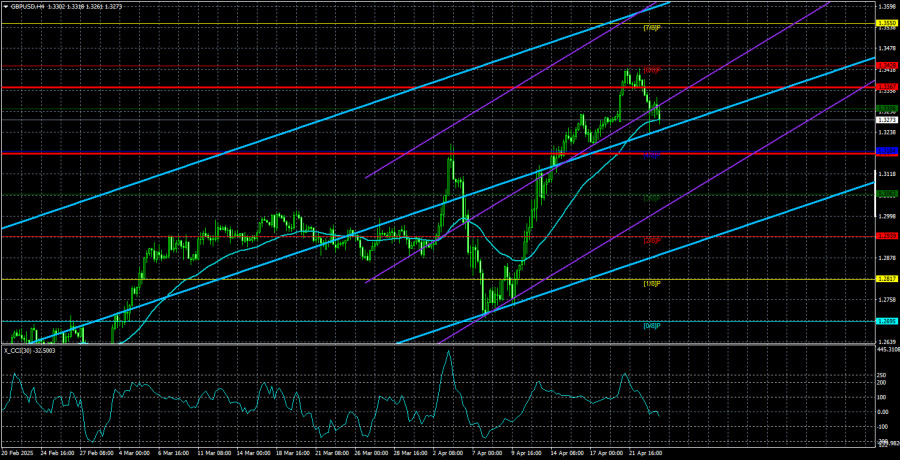

बुधवार के ट्रेड्स का विश्लेषण 1 घंटे का चार्ट (GBP/USD) बुधवार को, GBP/USD जोड़ी ने EUR/USD जोड़ी की चालों का बारीकी से अनुसरण किया, जो यह और अधिक पुष्टि करतालेखक: Paolo Greco

07:12 2025-04-24 UTC+2

15

- Trading plan

कैसे करें EUR/USD जोड़ी में व्यापार 24 अप्रैल को? शुरुआत करने वालों के लिए सरल टिप्स और व्यापार विश्लेषण

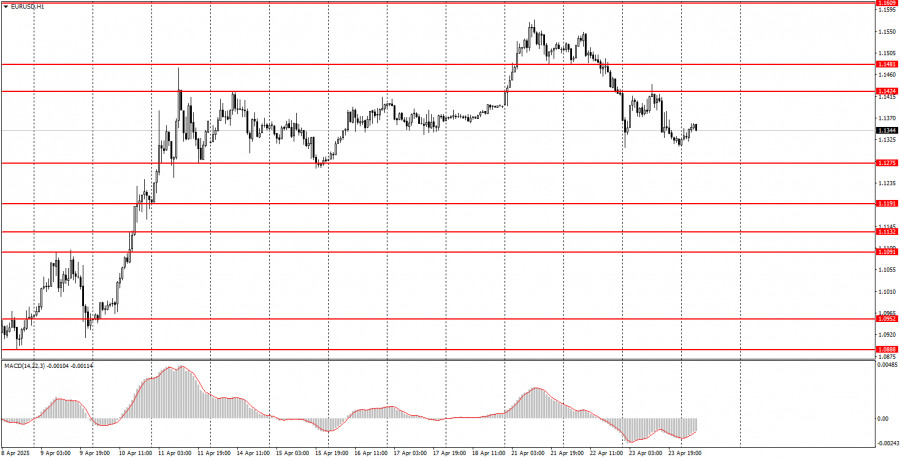

EUR/USD का 1 घंटे का चार्ट बुधवार को, EUR/USD मुद्रा जोड़ी मिश्रित तरीके से ट्रेड हुई। दिन के दौरान, कीमत ने कई बार दिशा बदली, और ये पलटाव मैक्रोइकोनॉमिक डेटालेखक: Paolo Greco

07:03 2025-04-24 UTC+2

15

बुधवार को, GBP/USD मुद्रा जोड़ी एक बड़ी गिरावट से बचने में सफल रही, हालांकि इससे एक दिन पहले ऐसा प्रतीत हो रहा था कि डाउनट्रेंड आखिरकार शुरू हो रहा था।लेखक: Paolo Greco

06:58 2025-04-24 UTC+2

16

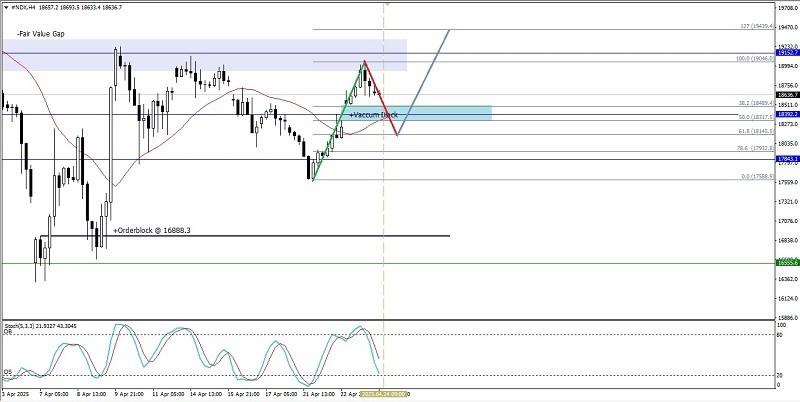

हालांकि 4-घंटे के चार्ट पर नैस्डैक 100 इंडेक्स साइडवेज़ (रुका हुआ) है, लेकिन इसका रेंज काफ़ी बड़ा है जिससे इंडेक्स में अभी भी एक काफ़ी आशाजनक अवसर मौजूद है। फिलहाललेखक: Arief Makmur

06:56 2025-04-24 UTC+2

7

- Technical analysis

चांदी कमोडिटी इंस्ट्रूमेंट की मूल्य गति का तकनीकी विश्लेषण – गुरुवार, 24 अप्रैल 2025।

4-घंटे के चार्ट पर, चांदी कमोडिटी इंस्ट्रूमेंट की स्थिति मजबूत होती दिखाई दे रही है, जिसकी पुष्टि इस बात से होती है कि चांदी की कीमत WMA (30 शिफ्ट 2)लेखक: Arief Makmur

06:54 2025-04-24 UTC+2

12

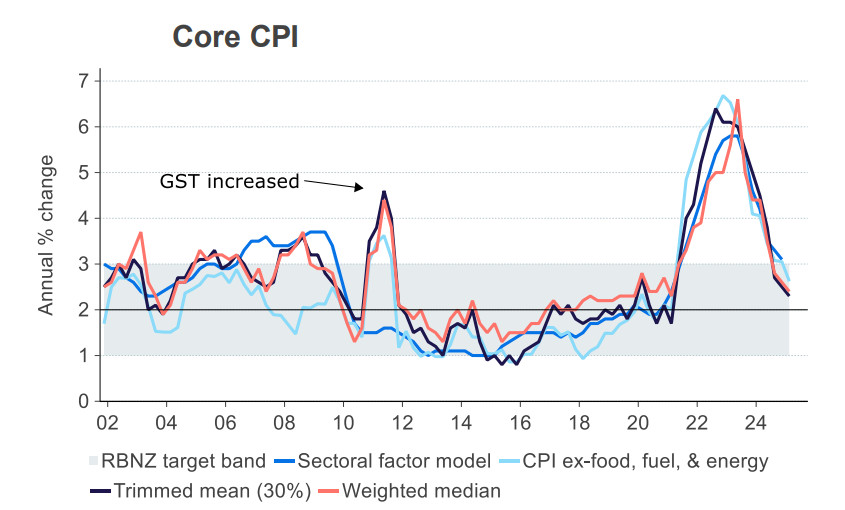

न्यूजीलैंड में पहले तिमाही में महंगाई उम्मीदों से थोड़ी अधिक रही, जो साल दर साल 2.2% से बढ़कर 2.5% हो गई। यह मुख्य रूप से वस्त्र क्षेत्र के कारण थालेखक: Kuvat Raharjo

06:14 2025-04-24 UTC+2

12

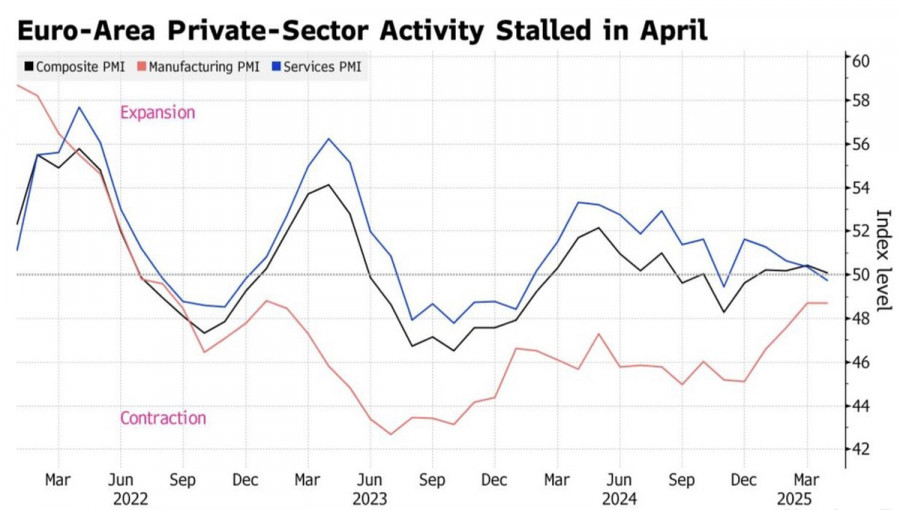

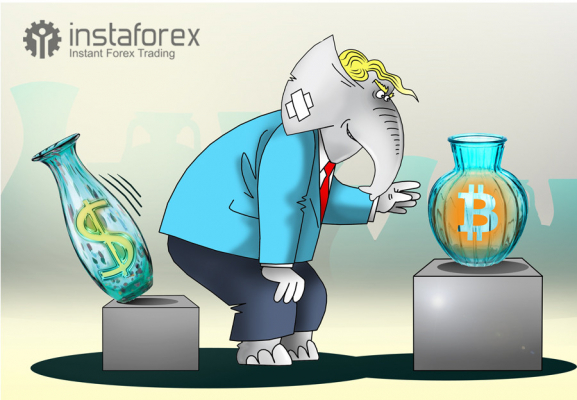

व्यापार युद्धों में कोई भी विजेता नहीं होगा। अमेरिकी डॉलर और अन्य अमेरिकी संपत्तियों में विश्वास की हानि के कारण अमेरिका को नुकसान होगा, जबकि यूरोप को आर्थिक मंदी सेलेखक: Marek Petkovich

06:07 2025-04-24 UTC+2

12