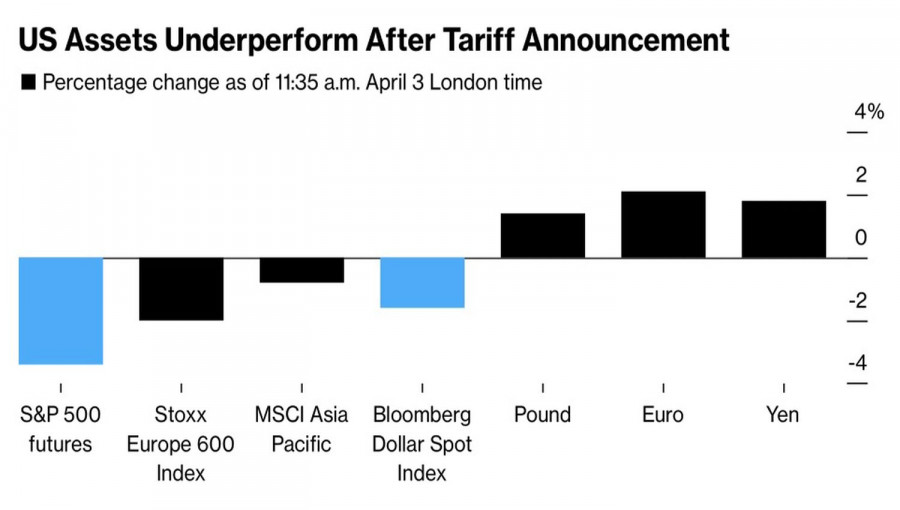

- कल की नियमित ट्रेडिंग सत्र के परिणामस्वरूप, अमेरिकी शेयर सूचकांक लाल निशान पर बंद हुए। S&P 500 में 4.84% की तेज गिरावट दर्ज की गई, जबकि Nasdaq 100 में 5.97%

लेखक: Jakub Novak

12:33 2025-04-04 UTC+2

29

किसी और के लिए समस्या न पैदा करें; आप खुद भी इसमें फंस सकते हैं। डोनाल्ड ट्रंप ने वैश्विक अर्थव्यवस्था में संयुक्त राज्य अमेरिका की प्रमुख स्थिति का फायदा उठानेलेखक: Marek Petkovich

07:55 2025-04-04 UTC+2

22

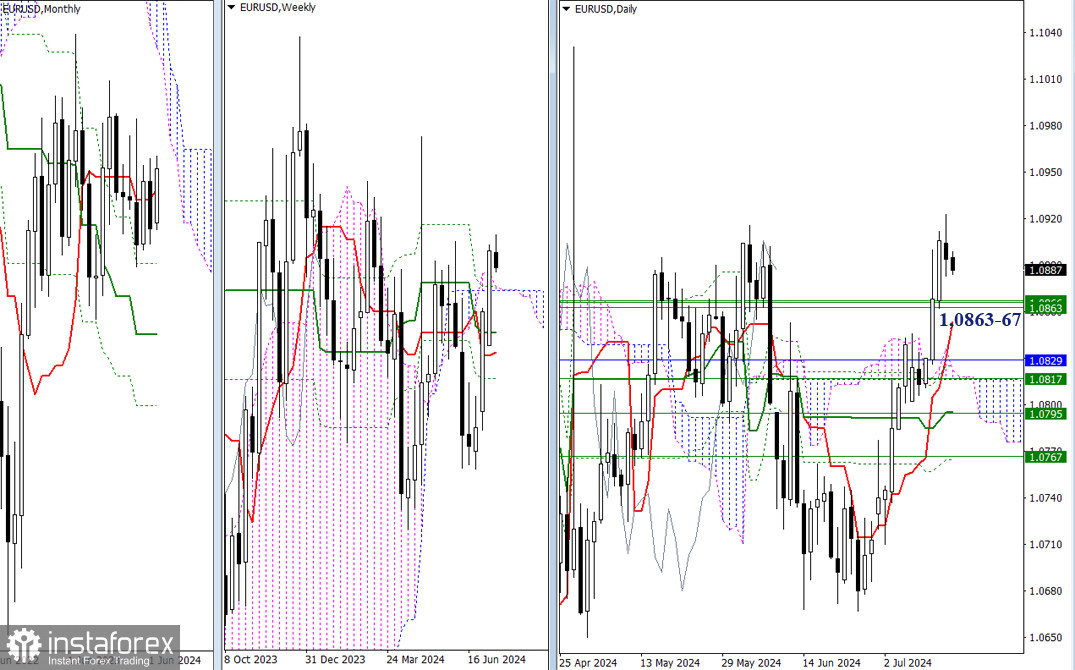

क्या मजबूत नॉनफार्म पेरोल्स डॉलर की मदद कर सकते हैं? यह सवाल जटिल है, क्योंकि बाजार इस समय डोनाल्ड ट्रंप के नए टैरिफ़्स से बहुत हिल चुका है। पारंपरिक मौलिकलेखक: Irina Manzenko

07:46 2025-04-04 UTC+2

19

- ऑस्ट्रेलियाई डॉलर ने ट्रंप के टैरिफ़्स पर काफी शांत प्रतिक्रिया दी, दिन को 0.6273–0.6351 की व्यापक संकुचन सीमा के भीतर समाप्त किया। हालांकि, शुक्रवार की शुरुआत निर्णायक गिरावट के साथ

लेखक: Laurie Bailey

07:41 2025-04-04 UTC+2

23

कल के अंत तक, ब्रिटिश पाउंड 92 पिप्स बढ़ चुका था, जिसमें 204 पिप्स की अधिकतम बढ़त थी। कीमत 1.3184–1.3208 के लक्ष्य सीमा तक पहुंची, उसके बाद 1.3101 के समर्थनलेखक: Laurie Bailey

07:34 2025-04-04 UTC+2

23

गुरुवार को, निवेशकों ने जोखिम से बचते हुए डॉलर ने अपने उच्चतम स्तर को छुआ: S&P 500 में 4.84% की गिरावट आई, डॉलर इंडेक्स में 1.64%, तेल में 6.90%, सोनेलेखक: Laurie Bailey

07:24 2025-04-04 UTC+2

24

- ट्रंप के फैसले और व्यापारिक टैरिफ की घोषणा से पहले ही बिटकॉइन और एथेरियम में बढ़त देखी गई थी, लेकिन इसके बाद जोखिम भरे एसेट्स पर दबाव काफी बढ़ गया।

लेखक: Miroslaw Bawulski

11:35 2025-04-03 UTC+2

35

कल की नियमित सत्र की समाप्ति पर, अमेरिकी स्टॉक इंडेक्स सकारात्मक दायरे में बंद हुए। S&P 500 में 0.67% की बढ़त हुई, Nasdaq 100 ने 0.87% की बढ़त दर्ज कीलेखक: Jakub Novak

11:25 2025-04-03 UTC+2

38

GBP/USD जोड़ी ट्रंप की अपेक्षित शुल्क घोषणा से पहले मजबूत बनी हुई है। मंगलवार को, पाउंड 1.2878 के साप्ताहिक निचले स्तर पर पहुँच गया, फिर अचानक पलटते हुए 1.29लेखक: Irina Manzenko

06:54 2025-04-03 UTC+2

26