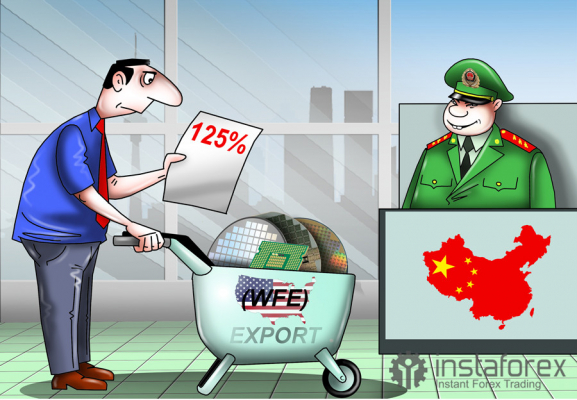

- अमेरिकी डॉलर ने कई वैश्विक मुद्राओं के मुकाबले मजबूती दिखाई, जैसे कि अमेरिकी शेयर बाजार में भी वृद्धि हुई, यह खबर आने के बाद कि चीनी सरकार कुछ प्रकार के

लेखक: Jakub Novak

12:21 2025-04-25 UTC+2

44

कल $94,000 के ऊपर बने रहने की असफल कोशिश यह दिखाती है कि अभी भी महत्वपूर्ण खरीदारी रुचि मौजूद है। एथेरियम भी काफी अच्छी तरह से संभल रहा है, हालांकिलेखक: Miroslaw Bawulski

12:17 2025-04-25 UTC+2

28

Fundamental analysisसोने की कीमतों में भारी गिरावट क्यों आ सकती है? (संभावना है कि सोने में गिरावट जारी रह सकती है, जबकि नैस्डैक 100 फ्यूचर्स कॉन्ट्रैक्ट पर सीएफ़डी में तेजी देखी जा सकती है)

वास्तविक बातचीत की शुरुआत निकट भविष्य में सोने की कीमतों में भारी गिरावट का कारण बन सकती है। पूर्व लेखों में, मैंने सुझाव दिया था कि पहले बढ़ रही सोनेलेखक: Pati Gani

12:14 2025-04-25 UTC+2

41

- पिछले नियमित सत्र के अंत में, अमेरिकी स्टॉक सूचकांक ऊँचाई पर बंद हुए। एसएंडपी 500 में 2.03% की वृद्धि हुई, जबकि नैस्डैक 100 ने 2.74% का लाभ दर्ज किया। डॉव

लेखक: Jakub Novak

12:10 2025-04-25 UTC+2

35

Crypto-currenciesपोलकाडॉट क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 25 अप्रैल 2025।

हालाँकि वर्तमान में पोलकाडॉट की प्राइस मूवमेंट WMA (30 शिफ्ट 2) के ऊपर चल रही है, जो यह संकेत देती है कि बाजार की प्रवृत्ति अब भी बुलिश है, लेकिनलेखक: Arief Makmur

12:08 2025-04-25 UTC+2

27

Crypto-currenciesसोलाना क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 25 अप्रैल 2025।

हालाँकि वर्तमान में सोलाना क्रिप्टोकरेंसी एक मज़बूत स्थिति में चल रही है, जिसकी पुष्टि इसके प्राइस मूवमेंट के WMA (30 शिफ्ट 2) से ऊपर रहने से होती है, लेकिन सोलानालेखक: Arief Makmur

12:01 2025-04-25 UTC+2

24

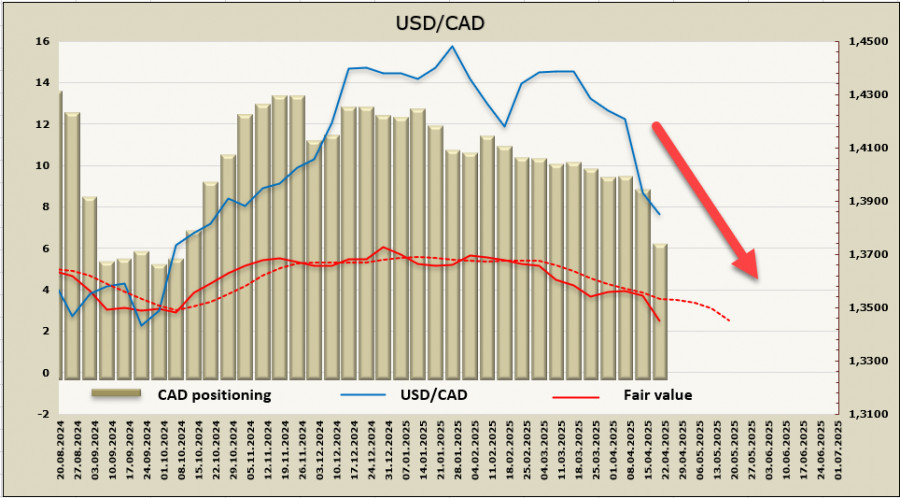

- पिछले हफ्ते, कनाडा के बैंक ने अपनी ब्याज दर को 2.75% पर अपरिवर्तित रखा, जैसा कि अपेक्षित था। साथ में जारी किया गया बयान तटस्थ था, जिसमें चल रही अनिश्चितता

लेखक: Kuvat Raharjo

06:53 2025-04-25 UTC+2

35

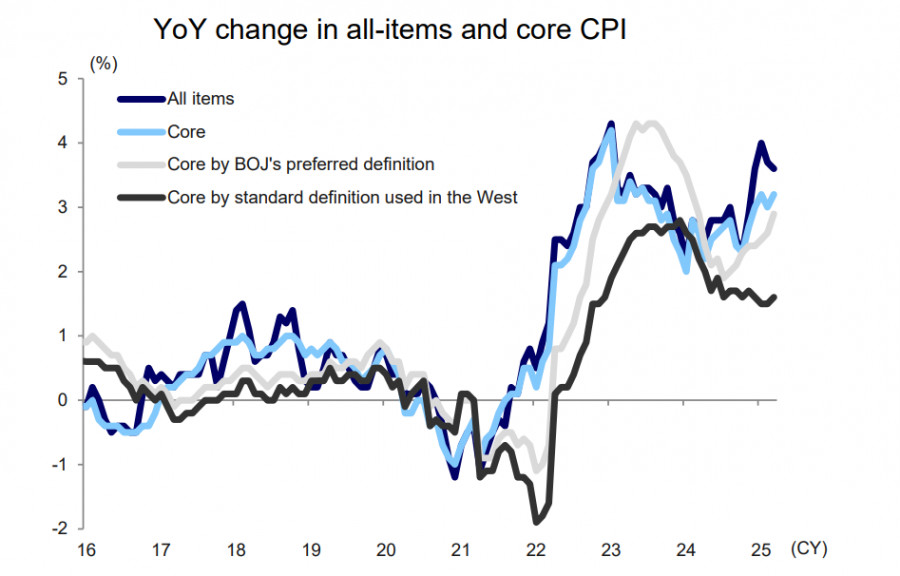

पिछले हफ्ते प्रकाशित राष्ट्रीय उपभोक्ता मूल्य सूचकांक ने मार्च में मुख्य मुद्रास्फीति में तेज़ी का संकेत दिया—जो 2.6% से बढ़कर 2.9% हो गई। मुद्रास्फीति का दबाव बढ़ रहा है, जोलेखक: Kuvat Raharjo

06:46 2025-04-25 UTC+2

40

Fundamental analysisअगर यू.एस.-चीन व्यापार युद्ध बढ़ता है, तो ऑस्ट्रेलियाई डॉलर को नुकसान हो सकता है।

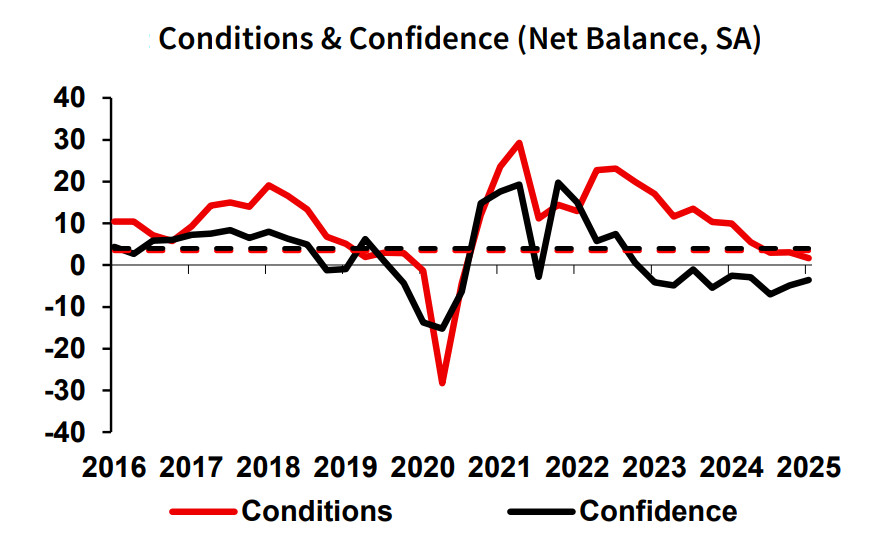

यू.एस. के राष्ट्रपति डोनाल्ड ट्रम्प ने एक बार फिर फेडरल रिजर्व के चेयरमैन जेरेम पावेल पर टिप्पणी की, दरों में कटौती की गति से असंतोष व्यक्त करते हुए। यह फेडलेखक: Kuvat Raharjo

06:46 2025-04-25 UTC+2

32