While the U.S. dollar struggles with growth, President Donald Trump's 25% tariffs on steel and aluminum imports came into effect today, triggering retaliatory measures from the European Union. It is clear that the global trade order is entering a new and risky phase.The latest U.S. tariffs, applied without exceptions to all countries, took effect following a turbulent day at the White House, during which Trump threatened to double tariffs on Canadian metals to 50% but backed down after Ontario agreed to scrap plans for a surcharge on electricity supplied to the U.S.

In response, the European Commission launched swift and proportional countermeasures on U.S. imports, reinstating tariffs from 2018 and 2020 while adding new industrial and agricultural products. The planned EU countermeasures will target U.S. exports worth €26 billion, matching the economic impact of the U.S. tariffs. "We deeply regret this measure," said European Commission President Ursula von der Leyen in a statement. "Tariffs are taxes. They are bad for business, and even worse for consumers."

Trump's expansion of his trade offensive comes at a dangerous moment. His rapid efforts to reshape the U.S. economy into a global manufacturing powerhouse have already rattled financial markets, unsettled consumers still grappling with post-pandemic inflation, and heightened recession fears amid growing uncertainty for corporate America.

The threat of new tariffs on imports from Mexico, alongside existing trade barriers against China, Europe, and other key partners, is creating a complex web of obstacles to global trade. Companies dependent on international supply chains are being forced to reassess their strategies, leading to higher costs that are ultimately passed on to consumers—fueling inflation.

Trump's unpredictable trade policy is also undermining investor confidence. Sudden shifts in trade rules are prompting businesses to delay investments and expansion, fearing further disruptions.

Reports suggest that Trump acted with support from certain U.S. industry leaders, who claim that protectionist measures could boost American manufacturers' profits and bring jobs back to the steel and aluminum industries.

The metal tariffs apply globally, affecting both economic rivals and close U.S. allies, including the European Union, Australia, South Korea, and Japan. China, notably absent from this latest round of tariffs, has not yet responded. Experts argue that these tariffs are part of Trump's broader strategy to build significant trade barriers around the U.S. economy, a move he sees as necessary to restore balance in a system that, in his view, exploits the country.

Last week, Trump imposed 25% tariffs on Canada and Mexico but later announced a one-month exemption for goods covered under the North American trade agreement. At the same time, he doubled tariffs on China to 20%.

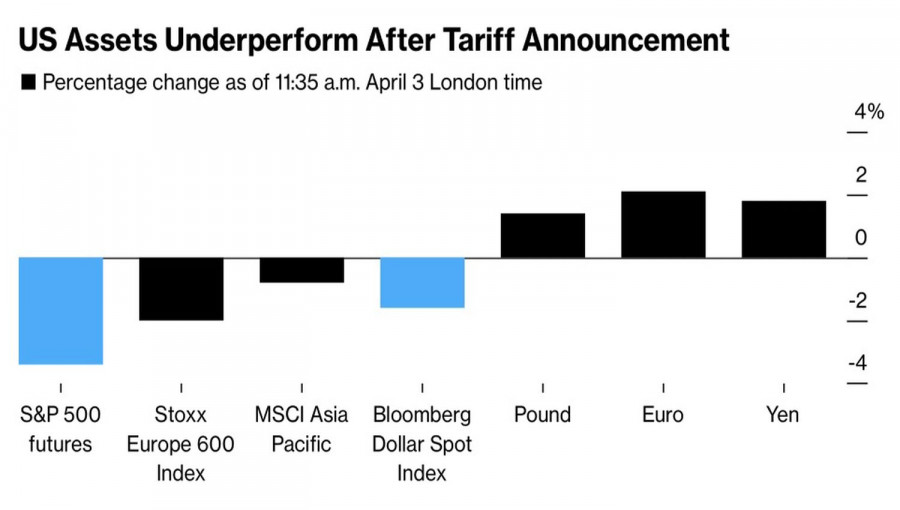

So far, the currency market has reacted mildly, as these tariffs were widely expected and discussed since February. No significant pressure on risk assets has been observed yet, but this could change after today's U.S. inflation data. If inflation remains resilient, the Federal Reserve is likely to maintain its hawkish stance, which would lead to renewed risk aversion. Conversely, if inflation comes in lower than expected, hopes for a more dovish Fed could spark a stock market rally and weaken the dollar. However, even in a positive scenario, global recession risks remain elevated.

Regarding the technical outlook for EUR/USD, buyers need to push above 1.0950 to target 1.0980. From there, a move toward 1.1010 is possible, but this would require strong support from institutional players. The ultimate target would be 1.1050. If the pair declines, significant buyer interest is expected around 1.0890. If no support emerges there, it would be better to wait for a retest of 1.0840 or open long positions from 1.0800.

For GBP/USD, buyers need to break the nearest resistance at 1.2960 to aim for 1.3010, a key level that will be difficult to surpass. The final upward target is 1.3040. In case of a decline, bears will attempt to regain control at 1.2915. A successful break below this range would deal a serious blow to bullish positions, pushing GBP/USD down to 1.2875, with potential for a drop to 1.2840.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.