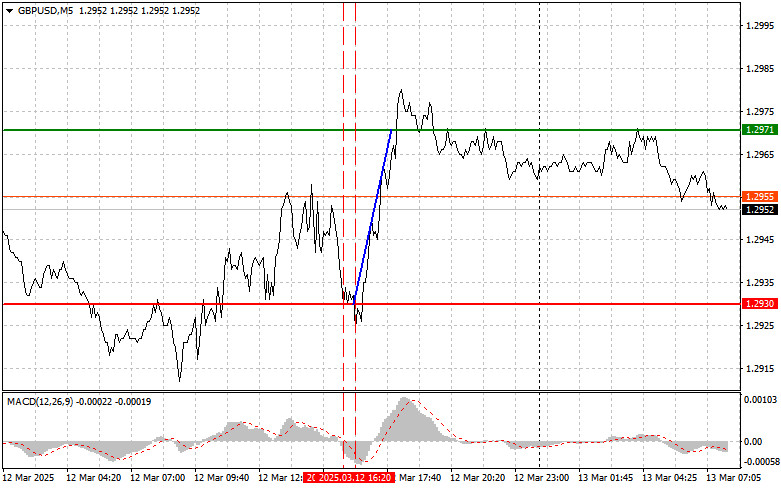

EUR/USD 5-Minute Analysis

The EUR/USD currency pair experienced very weak volatility on Thursday, with only a slight correction. Over the past few weeks, the euro has gained 600 pips, and this entire upward movement doesn't even fit on the chart. Consequently, the current pullback of 70-80 pips is relatively inconsequential. It is challenging to determine whether the market has finished reacting to Donald Trump's policies, but it continues to ignore macroeconomic data.

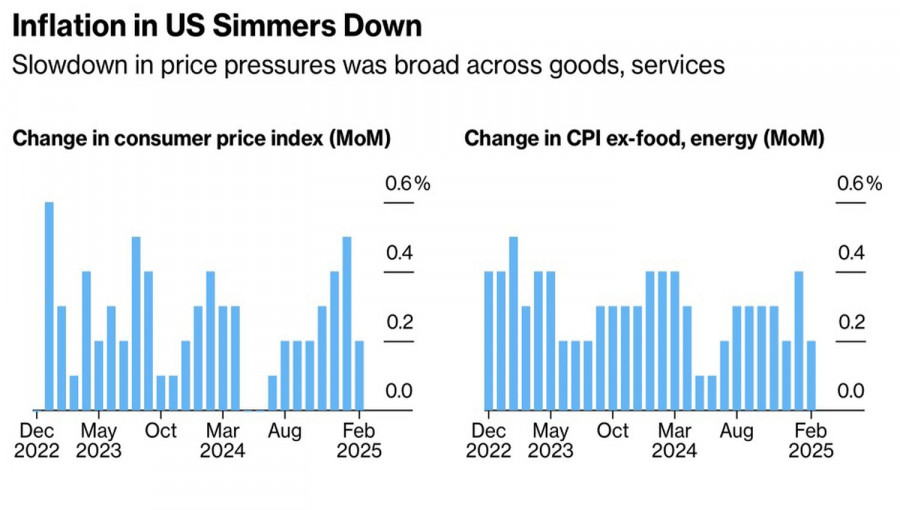

On Thursday, three reports were published, each of which was initially deemed secondary in importance. Therefore, there was no expectation of a strong market reaction. The day before, a notable inflation report was released in the U.S., yet this barely triggered any response. In fact, this report, which contained unexpected and impactful figures, could have contributed to the dollar's decline observed over the past week and a half. However, by Wednesday, the market no longer seemed inclined to sell the dollar.

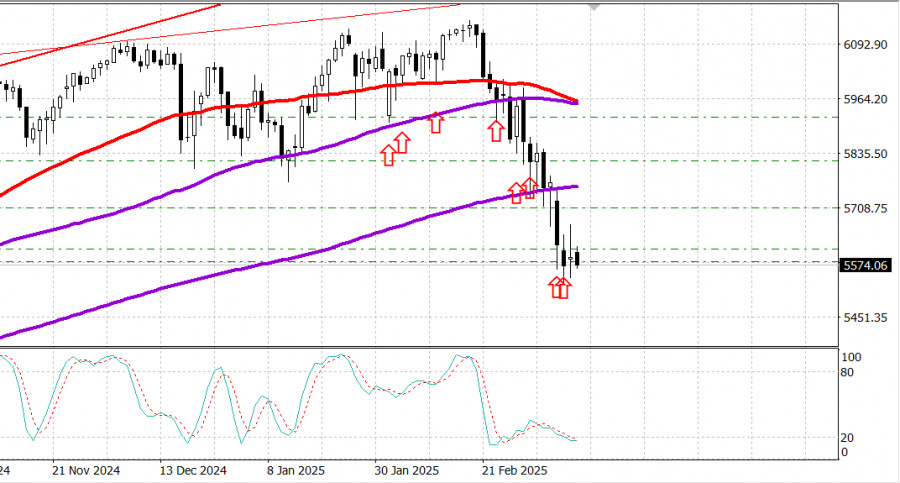

From a technical perspective, there is nothing new to report at the moment. On the hourly timeframe, traders do not even have a trend line to work with. This indicates that the price could correct downwards by another 300 pips, and the uptrend would still formally remain intact. There is still a lack of logical movement in the market, as it appears to be responding solely to Trump's decisions, and even then, in a selective manner.

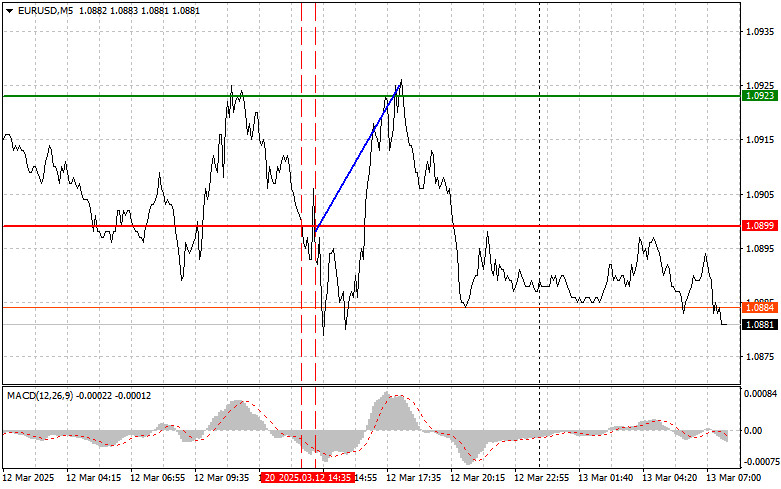

On the five-minute timeframe, several trading signals were generated yesterday, but there was no compelling reason to act on them. The levels of 1.0886 and 1.0857 were too close to each other. A breakout below 1.0843 could have been a potential trade opportunity; however, selling in a strong uptrend is generally not advisable. All the signals were questionable, so in such a situation, it would have been better to stay out of the market.

COT Report

The latest Commitment of Traders (COT) report is dated March 4. The illustration above clearly shows that the net position of non-commercial traders has remained bullish for an extended period; however, bears have recently gained the upper hand. Four months ago, the number of open short positions held by professional traders sharply increased, causing the net position to turn negative for the first time in a long time. This indicates that the euro is now being sold more frequently than it is being bought. Nevertheless, the advantage of the bears is quickly diminishing following Trump taking office as the U.S. president.

Currently, we do not observe any fundamental factors that would support a strengthening of the euro. However, one significant factor has emerged that is contributing to the decline of the U.S. dollar. It is possible that the pair will continue to correct for several more weeks or months, but the 16-year downtrend is unlikely to reverse quickly.

At this point, the red and blue lines have crossed again, indicating that the market trend is now neutral. During the last reporting week, the number of long positions in the "non-commercial" group increased by 2,500, while the number of short positions decreased by 12,800. As a result, the net position increased by another 15,300 contracts.

EUR/USD 1-Hour Analysis

The price continues to move upward on the hourly timeframe, though not as rapidly as before. A decline will likely resume in the medium term due to the differences in monetary policies between the ECB and the Fed. However, it is unclear how long the market will keep reacting to Trump-related factors. The current movement is market panic, and no one knows where it will take the pair next. Traders ignore everything except Trump's statements, and the dollar is sold off at every opportunity—just not when macroeconomic data suggests it should be.

For March 14, we highlight the following trading levels: 1.0340-1.0366, 1.0461, 1.0524, 1.0585, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0886, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B (1.0623) and Kijun-sen (1.0875) lines. The Ichimoku indicator lines may shift throughout the day, which should be considered when identifying trading signals. Don't forget to set a Stop Loss order at breakeven if the price moves 15 pips in the right direction. This will help protect against potential losses if a signal is false.

Inflation data will be published in Germany on Friday, and the University of Michigan Consumer Sentiment Index will be released in the U.S. Neither of these reports is particularly crucial for the market. A minor reaction may occur, but it is unlikely to influence price movement or create good trading opportunities significantly.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.