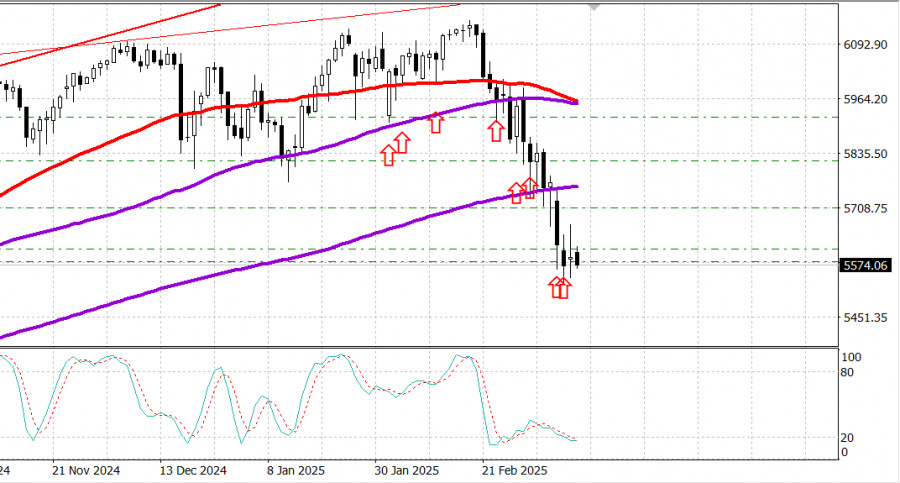

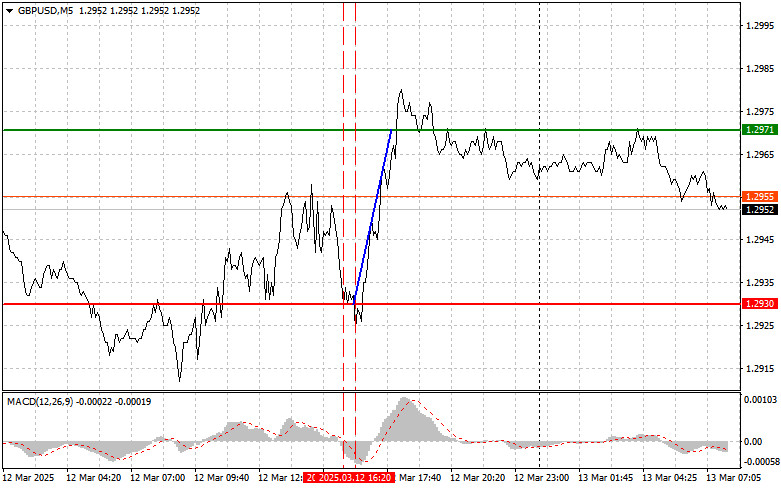

Analysis of Trades and Trading Tips for the British Pound

The first test of the 1.2941 price level occurred when the MACD indicator had already moved significantly downward from the zero mark, limiting the pair's downside potential. For this reason, I chose not to sell the pound. The second test of 1.2941, which took place shortly after, coincided with an oversold MACD signal, allowing Scenario #2 for buying to unfold. However, the pair did not experience significant growth.

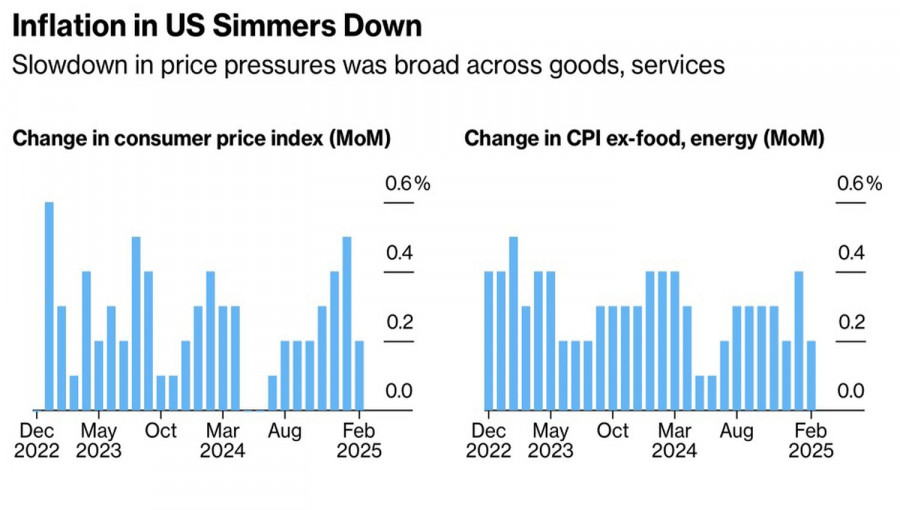

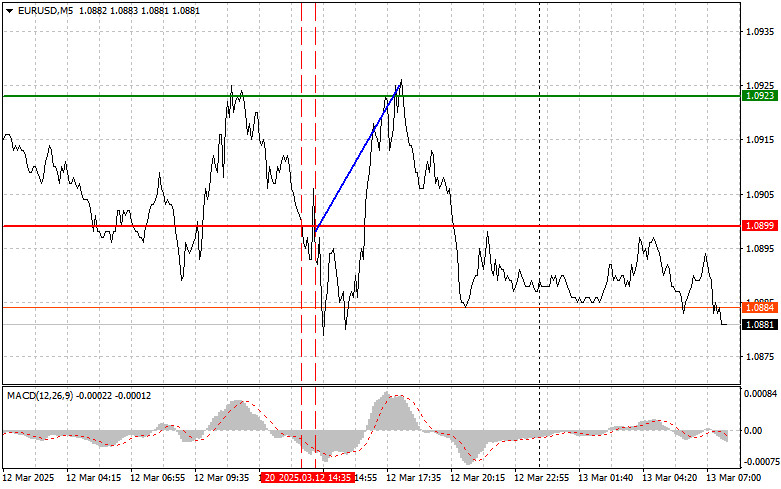

Yesterday's U.S. inflation data did not lead to a sharp strengthening of the dollar, as the numbers came in much lower than economists had forecasted. The decline in the producer price index enables the Federal Reserve to act more cautiously, reducing demand for the dollar and supporting risk assets. Nevertheless, despite these positive signals, uncertainty persists regarding the Fed's next steps.

Today, important economic data from the UK is expected, and investors will closely monitor the macroeconomic data to assess the state of the British economy. Positive data on GDP and industrial production could signal a recovery from recent economic challenges, strengthening confidence in the pound. Conversely, weak data could put pressure on the currency, potentially leading investors to sell off their pound holdings.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the entry point reaches the 1.2955 level (green line on the chart), targeting a rise to 1.2978 (thicker green line on the chart). Around 1.2978, I will exit my buy trades and open sell trades in the opposite direction, expecting a movement of 30-35 pips downward. The pound's growth can only be expected to continue if strong economic data supports the upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and starting to rise.

Scenario #2: I also plan to buy the pound if the price tests 1.2934 twice in a row while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a market reversal to the upside. Growth toward the 1.2955 and 1.2978 levels can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after breaking below 1.2934 (red line on the chart), which could trigger a rapid decline. The key target for sellers will be 1.2910, where I intend to exit my sell trades and immediately open buy trades in the opposite direction, expecting a movement of 20-25 pips upward. Selling the pound is preferable at the highest possible levels. Important! Before selling, ensure that the MACD indicator is below the zero mark and starting to decline.

Scenario #2: I also plan to sell the pound if the price tests 1.2955 twice in a row while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and trigger a market reversal downward. A decline toward the 1.2934 and 1.2910 levels can be expected.

What's on the Chart:

- The thin green line represents the entry price where the trading instrument can be bought.

- The thick green line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price growth above this level is unlikely.

- The thin red line represents the entry price where the trading instrument can be sold.

- The thick red line indicates the expected price level where a Take Profit order can be placed, or profits can be manually secured, as further price decline below this level is unlikely.

- The MACD indicator should be used to assess overbought and oversold zones when entering the market.

Important Notes:

- Beginner Forex traders should exercise extreme caution when making market entry decisions. It is advisable to stay out of the market before the release of important fundamental reports to avoid exposure to sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize potential losses. Trading without stop-loss orders can quickly wipe out your entire deposit, especially if you neglect money management principles and trade with high volumes.

- Remember, successful trading requires a well-defined trading plan, similar to the one outlined above. Making impulsive trading decisions based on the current market situation is a losing strategy for intraday traders.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.