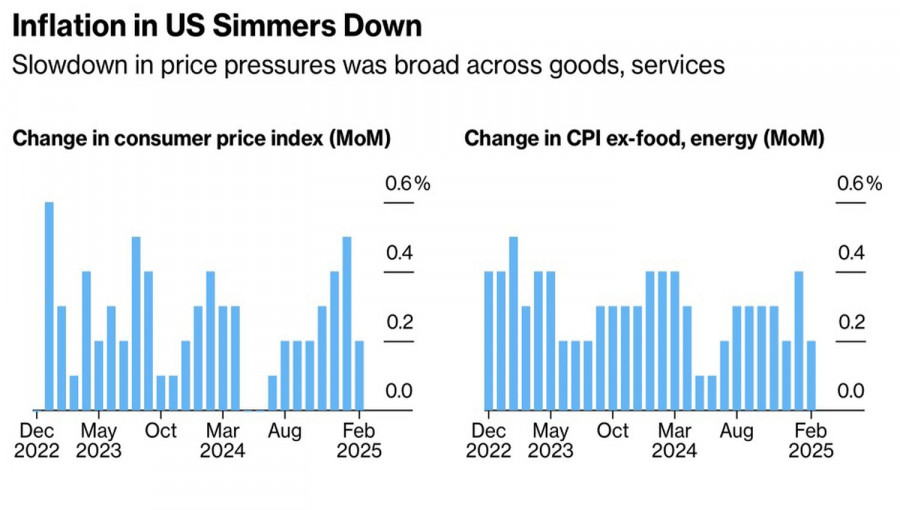

- यूरो और पाउंड ने इस खबर पर बहुत कम प्रतिक्रिया दिखाई कि फरवरी में अमेरिका में उपभोक्ता कीमतें चार महीनों में सबसे धीमी गति से बढ़ीं - अमेरिकी परिवारों के

लेखक: Jakub Novak

13:47 2025-03-13 UTC+2

25

इंटेल के शेयरों में उछाल इस खबर के बाद आया कि TSMC ने अमेरिकी चिप निर्माताओं के साथ संयुक्त उद्यम का विस्तार किया है। दूसरी ओर, ब्रोकरेज डाउनग्रेड के कारणलेखक:

13:44 2025-03-13 UTC+2

24

S&P500 13.03 को बाज़ार अपडेट बुधवार को बेंचमार्क यू.एस. स्टॉक इंडेक्स का स्नैपशॉट: डॉव -0.2%, NASDAQ +1.2%, S&P 500 +0.5%, S&P 500 5,599 पर, रेंज 5,400 – 6,000 मेगा-कैप स्पेसलेखक: Jozef Kovach

13:41 2025-03-13 UTC+2

35

- अमेरिकी शेयर खरीदना गिरते हुए चाकू को पकड़ने जैसा है। यह आपके जीवन के लिए अप्रिय और खतरनाक है - या बल्कि, आपके बटुए के लिए। फिर भी, अमेरिकी शेयर

लेखक: Marek Petkovich

13:39 2025-03-13 UTC+2

43

TSMC द्वारा अमेरिकी चिप निर्माताओं के साथ संयुक्त उद्यम का अनावरण करने के बाद इंटेल में उछाल ब्रोकर डाउनग्रेड के बाद पेप्सिको में गिरावट CPI ने दिखाया कि फरवरी मेंलेखक: Thomas Frank

13:33 2025-03-13 UTC+2

30

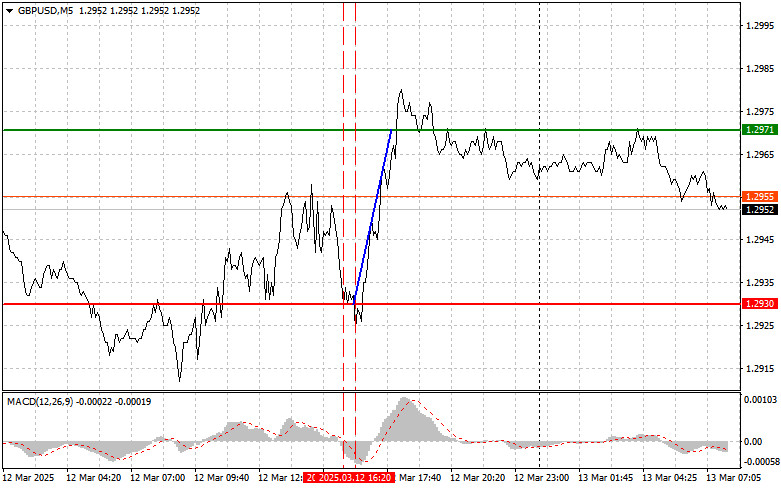

ForecastGBP/USD: 13 मार्च को शुरुआती ट्रेडर्स के लिए सरल ट्रेडिंग टिप्स। कल के फॉरेक्स ट्रेड्स की समीक्षा

1.2930 पर शुरुआती मूल्य परीक्षण तब हुआ जब MACD संकेतक शून्य चिह्न से काफी नीचे गिर गया था, जिसने जोड़े की डाउनसाइड क्षमता को सीमित कर दिया था। इस कारणलेखक: Jakub Novak

13:31 2025-03-13 UTC+2

28

- Forecast

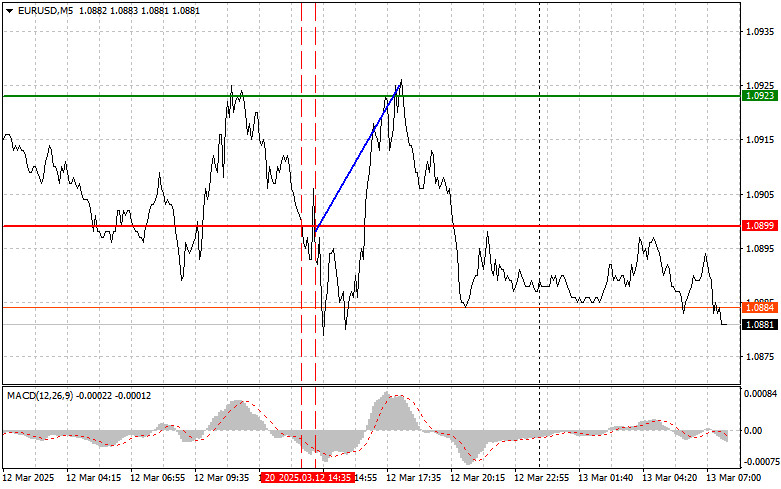

EUR/USD: 13 मार्च को शुरुआती ट्रेडर्स के लिए सरल ट्रेडिंग टिप्स। कल के फॉरेक्स ट्रेड्स की समीक्षा

1.0899 पर मूल्य परीक्षण तब हुआ जब MACD संकेतक पहले ही शून्य चिह्न से काफी नीचे चला गया था, जिसने, मेरी राय में, जोड़ी की डाउनसाइड क्षमता को सीमितलेखक: Jakub Novak

13:28 2025-03-13 UTC+2

33

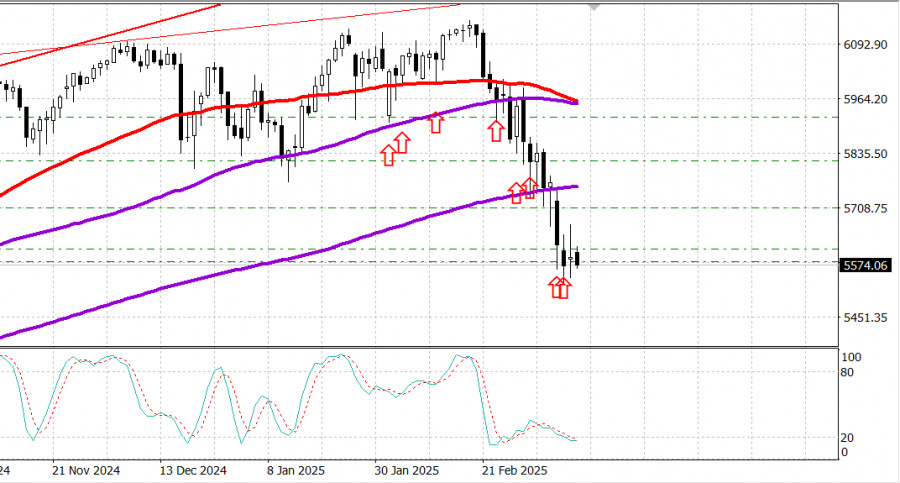

Technical analysisनैस्डैक 100 इंडेक्स की इंट्राडे मूल्य आंदोलन का तकनीकी विश्लेषण, गुरुवार, 13 मार्च, 2025।

नैस्डैक 100 इंडेक्स की कीमत अपने MA (50) के नीचे जाने और नैस्डैक 100 इंडेक्स और स्टोकास्टिक ऑस्सीलेटर इंडिकेटर के बीच डाइवर्जेंस दिखाई देने के साथ, यह पुष्टि होलेखक: Arief Makmur

11:53 2025-03-13 UTC+2

32

बिटकॉइन सप्ताह की शुरुआत में बड़े बिकवाली के बाद अपनी रिकवरी जारी रखे हुए है। हालांकि, कल साप्ताहिक उच्च स्तर को तोड़ने में विफलता शॉर्ट-टर्म बुलिश दृष्टिकोण पर संदेह उत्पन्नलेखक: Jakub Novak

11:36 2025-03-13 UTC+2

30