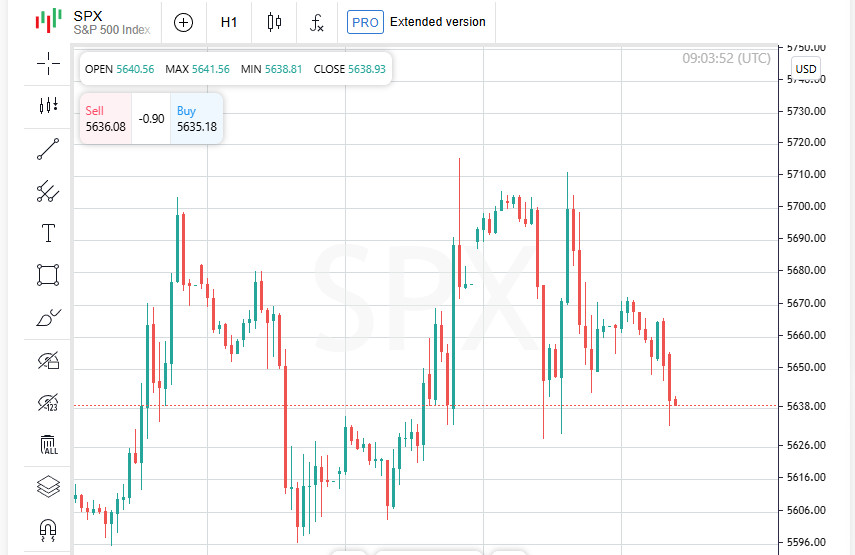

The euro and the pound continue to rise despite all the desperate attempts by sellers of risk assets to achieve at least some reasonable correction at the beginning of the week.

Yesterday's weak retail sales data from the U.S. led to a significant decline in the American dollar and strengthened several risk assets. Traders took this as a signal of a possible slowdown in U.S. economic growth, reducing the likelihood of the Federal Reserve maintaining high interest rates for an extended period.

As a result, currencies like the euro and the British pound gained support and appreciated against the dollar. Additionally, the value of other risk assets increased. However, it is important to note that a single data set is not a decisive factor for long-term trends. In the coming days, markets will closely monitor other economic indicators as well as statements from Federal Reserve officials, which will provide a clearer picture of the outlook for the U.S. economy and the central bank's future actions.

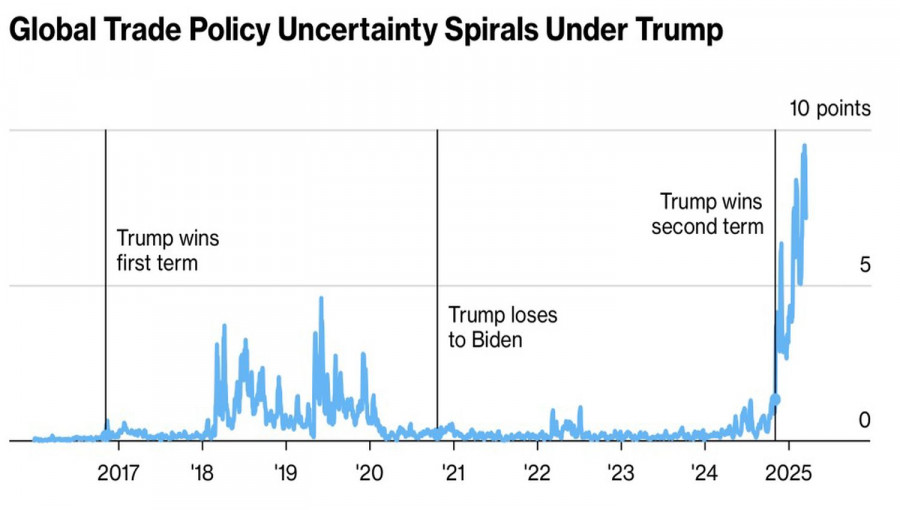

Today, several key economic reports from the eurozone will be released. The eurozone trade balance and business sentiment index, along with the ZEW Economic Sentiment Index and the Current Conditions Index, will shed light on the state of the European economy. Strong data will support a continued bullish trend for the euro, while weak data could lead to a correction in the EUR/USD pair.

When analyzing macroeconomic indicators, it is important to consider the relationship between business sentiment and actual economic performance. The ZEW Institute in Germany and the eurozone provides valuable insights into economic prospects. The trade balance reflects the eurozone's competitiveness and ability to generate export revenues, which could face serious challenges under Donald Trump's new policies.

If the data matches economists' expectations, relying on a Mean Reversion strategy is best. A Momentum strategy is preferable if the data significantly exceeds or falls short of expectations.

Momentum Strategy (on breakout):

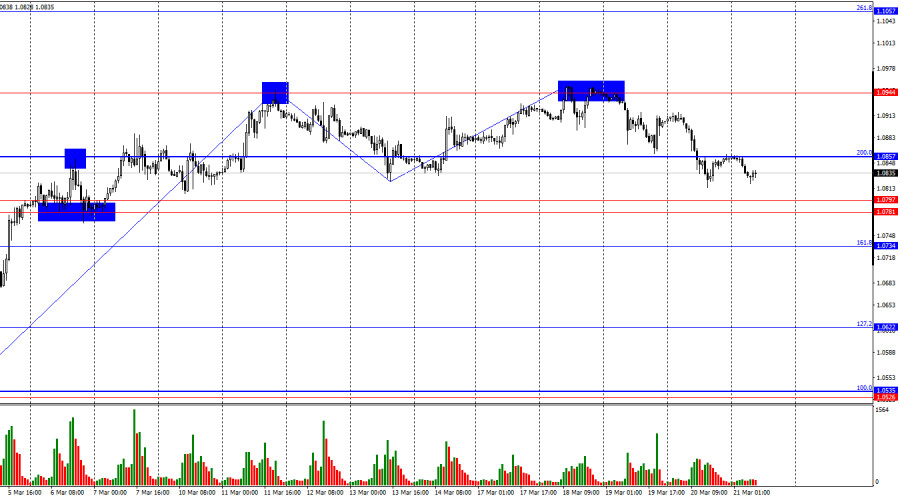

EUR/USD

Buying on a breakout above 1.0945 could push the euro toward 1.0997 and 1.1047.

Selling on a breakout below 1.0904 could lead to a decline toward 1.0866 and 1.0827.

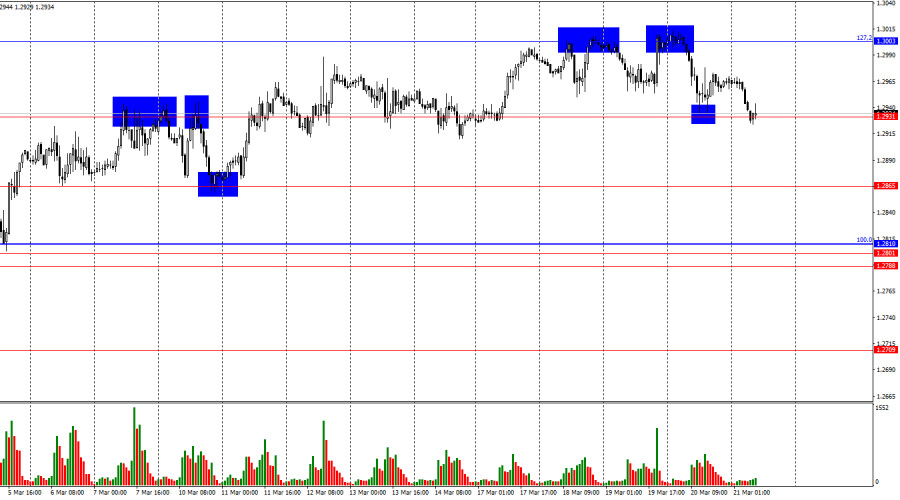

GBP/USD

Buying on a breakout above 1.2990 could drive the pound toward 1.3028 and 1.3068.

Selling on a breakout below 1.2960 could send the pound down toward 1.2940 and 1.2910.

USD/JPY

Buying on a breakout above 149.70 could lift the dollar toward 150.00 and 150.30.

Selling on a breakout below 149.50 could lead to a decline toward 149.20 and 148.90.

Mean Reversion Strategy (on pullbacks):

EUR/USD

I will look for sell opportunities after an unsuccessful breakout above 1.0925 followed by a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.0901 followed by a return above this level.

GBP/USD

I will look for sell opportunities after an unsuccessful breakout above 1.2993 followed by a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.2963 followed by a return above this level.

AUD/USD

I will look for sell opportunities after an unsuccessful breakout above 0.6399 followed by a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 0.6362 followed by a return above this level.

USD/CAD

I will look for sell opportunities after an unsuccessful breakout above 1.4313 followed by a return below this level.

I will look for buy opportunities after an unsuccessful breakout below 1.4282 followed by a return above this level.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.