- गुरुवार को, अमेरिकी बेंचमार्क स्टॉक इंडेक्स लाल निशान में बंद हुए: डॉव जोन्स में 0.1% की गिरावट आई, NASDAQ में 0.3% की गिरावट आई और S&P 500 में 0.2% की

लेखक: Natalia Andreeva

19:06 2025-03-21 UTC+2

5

आज, राष्ट्रीय उपभोक्ता मूल्य सूचकांक (सीपीआई) में फरवरी माह की मंदी दर्शाने वाले आंकड़े जारी होने के बाद, जापानी येन में नकारात्मक रुख के साथ कारोबार जारी है, जिससे बाजारलेखक: Irina Yanina

19:05 2025-03-21 UTC+2

4

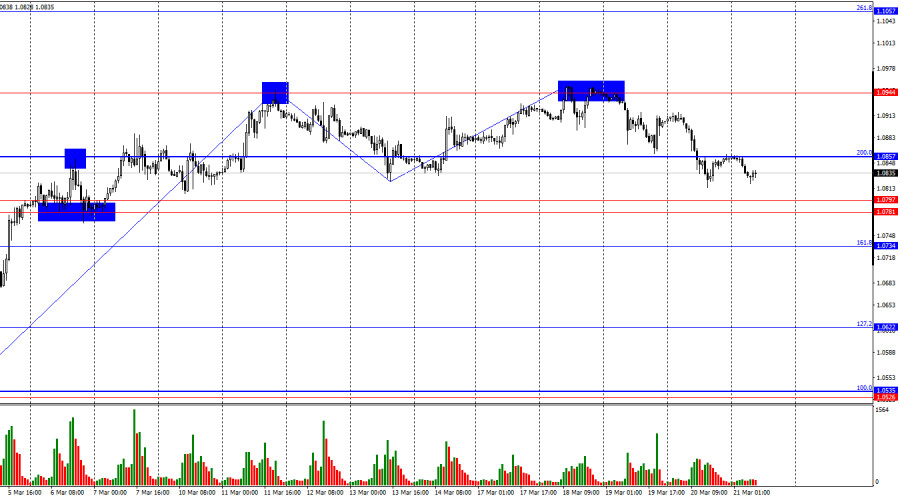

गुरुवार को, EUR/USD जोड़ी ने अपनी गिरावट जारी रखी और 1.0857 पर 200.0% फिबोनाची रिट्रेसमेंट स्तर से नीचे बंद हुई। इससे पता चलता है कि नीचे की ओर बढ़ना 1.0781–1.0797लेखक: Samir Klishi

19:04 2025-03-21 UTC+2

4

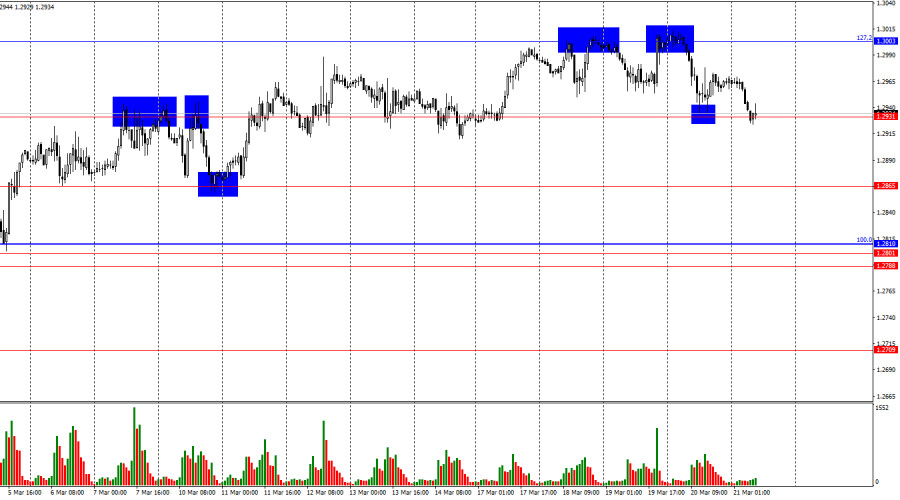

- प्रति घंटा चार्ट पर, GBP/USD जोड़ी गुरुवार को 1.2931 के स्तर पर गिर गई, फिर वापस उछली, थोड़ी बढ़त देखी और शुक्रवार की सुबह फिर से 1.2931 पर लौट आई।

लेखक: Samir Klishi

19:03 2025-03-21 UTC+2

4

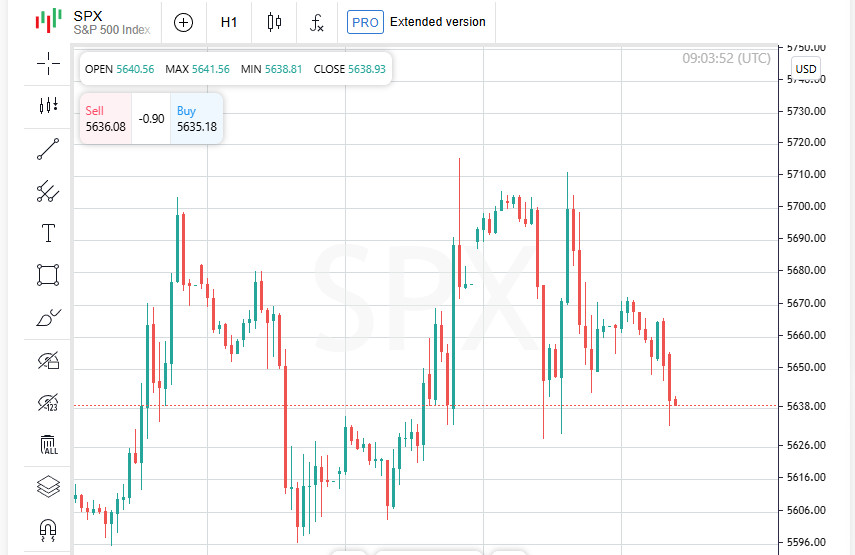

कल के नियमित कारोबारी सत्र के अंत में, अमेरिकी शेयर सूचकांक लाल निशान पर बंद हुए। एसएंडपी 500 में 0.22% की गिरावट आई, जबकि नैस्डैक 100 में 0.33% की गिरावटलेखक: Jakub Novak

19:02 2025-03-21 UTC+2

7

साप्ताहिक बेरोज़गारी दावों में 223,000 की वृद्धि हुई फेड अनुबंध रद्द करने की रिपोर्ट के बाद एक्सेंचर में गिरावट PBOC, BoE, रिक्सबैंक ने दरें बरकरार रखीं, स्विटज़रलैंड ने कटौती कीलेखक: Thomas Frank

19:01 2025-03-21 UTC+2

4

- S&P 500 21 मार्च का अवलोकन गुरुवार को अमेरिकी बाजार समेकन के चरण में प्रवेश कर गया, क्योंकि यह अपनी अगली दिशा निर्धारित करने के लिए संघर्ष कर रहा था।

लेखक: Jozef Kovach

19:00 2025-03-21 UTC+2

10

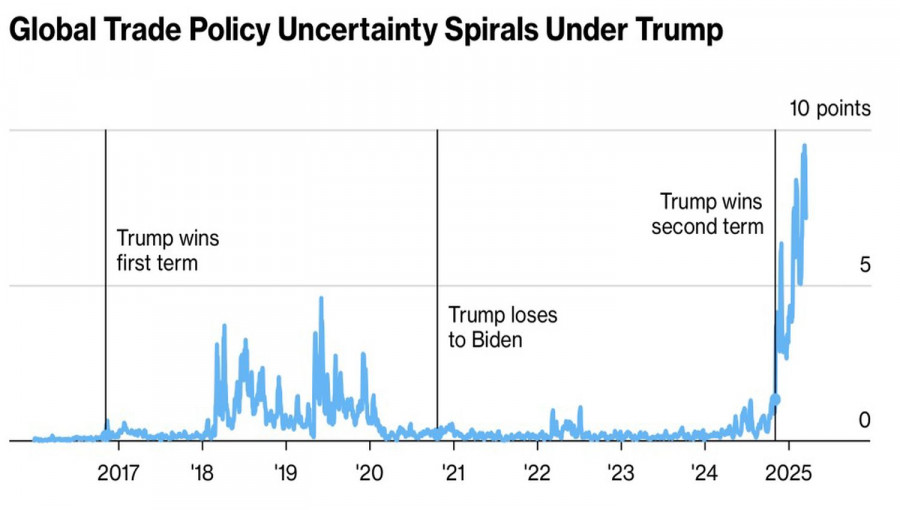

फेडरल रिजर्व ने बाजारों को शांत करने के लिए हर संभव प्रयास किया है, लेकिन 2025 में, स्पॉटलाइट केंद्रीय बैंक से हट गई है। एसएंडपी 500 ने मजबूत आवास डेटालेखक: Marek Petkovich

18:57 2025-03-21 UTC+2

7

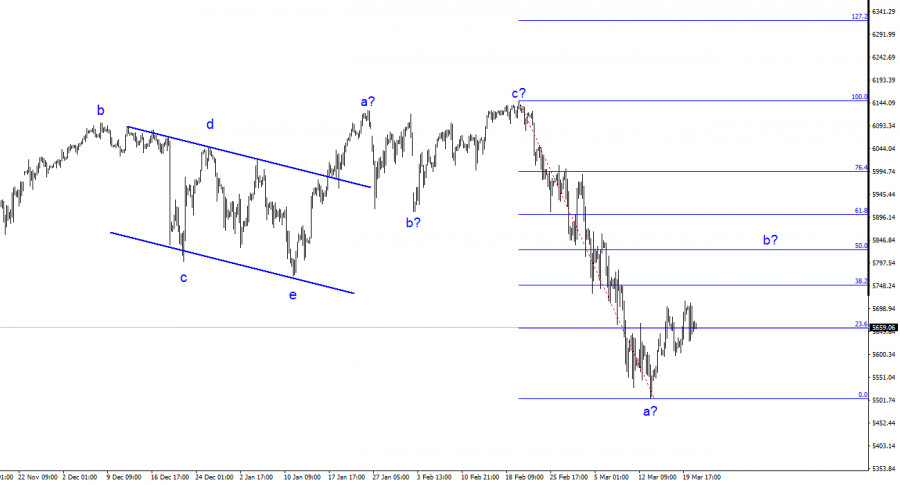

#SPX के लिए 24 घंटे के चार्ट पर तरंग संरचना काफी स्पष्ट है। पहला और सबसे महत्वपूर्ण बिंदु बड़े पैमाने पर पांच-तरंग संरचना है, जो इतनी चौड़ी है किलेखक: Chin Zhao

18:56 2025-03-21 UTC+2

5