Review of Trades and Trading Recommendations for the Japanese Yen

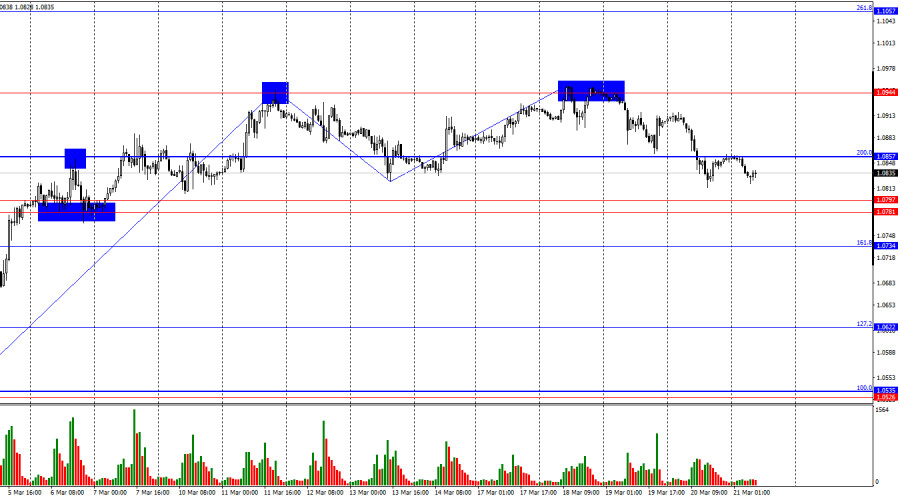

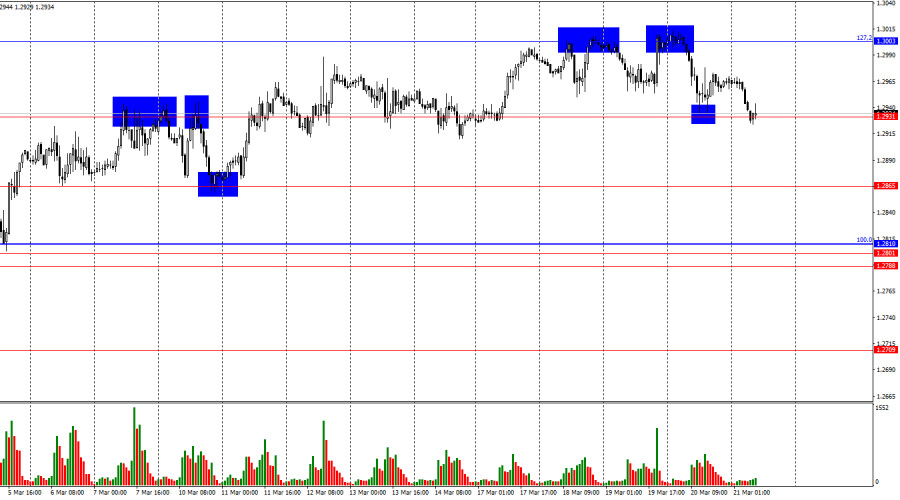

The test of the 149.59 level coincided with the MACD indicator just starting to move downward from the zero mark, confirming a valid entry point for selling the US dollar. As a result, the pair declined by 30 points.

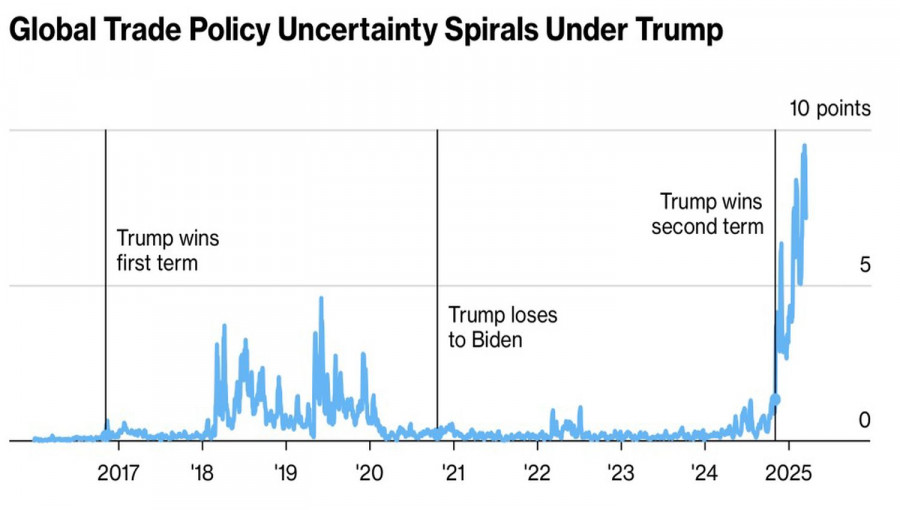

The yen weakened following the Bank of Japan's decision to keep interest rates unchanged. According to statements from the BOJ Governor, this decision was made in response to domestic economic signals. However, further rate hikes in Japan remain possible. "Wages and prices are rising as expected," Ueda said during his press conference. "But it is difficult to assess how close we are to achieving our goal, given the rising uncertainty surrounding US policy and external trade conditions."

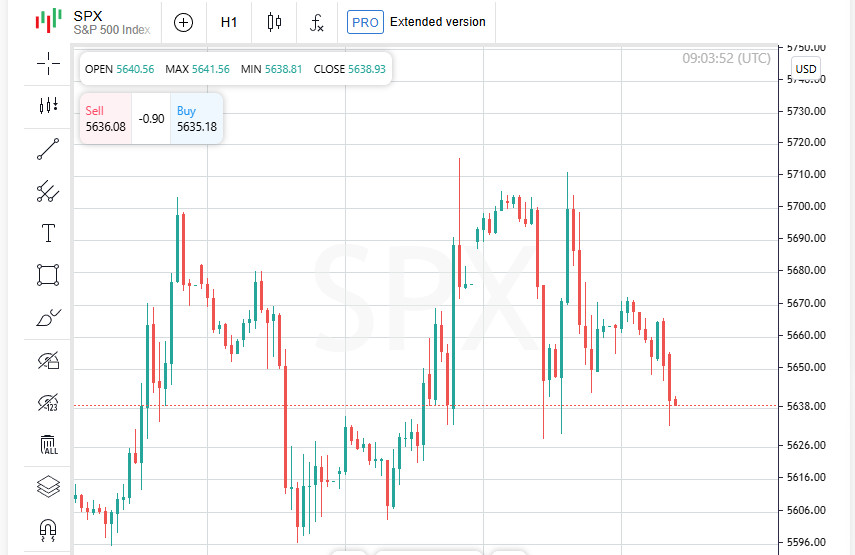

Today's FOMC decision on interest rates and the economic forecast will be a crucial moment. However, the real focus will be on what Fed Chair Jerome Powell has to say during his press conference. Special attention will be given to any signals regarding potential rate cuts. If Powell indicates that the Fed is prepared to ease monetary policy, this could trigger a yen rally against the US dollar, leading to a decline in USD/JPY.

For my intraday strategy, I will focus on Scenario #1 and Scenario #2.

Buy Signal

Scenario #1: Today, I plan to buy USD/JPY when the price reaches 150.15 (green line on the chart), targeting a rise to 151.10 (thicker green line). At 151.10, I will exit my long positions and open short positions in the opposite direction, expecting a 30-35 point downward correction. A continued uptrend is possible within a bullish correction phase. Important! Before buying, ensure that the MACD indicator is above zero and just beginning to rise.

Scenario #2: I also plan to buy USD/JPY if there are two consecutive tests of 149.63, when the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a market reversal to the upside. In this case, I expect a rise to the opposite levels of 150.15 and 151.10.

Sell Signal

Scenario #1: I plan to sell USD/JPY after it breaks below 149.63 (red line on the chart), which should trigger a rapid decline. The key target for sellers will be 148.70, where I will exit my short positions and immediately buy in the opposite direction, expecting a 20-25 point rebound. Selling pressure could return at any moment. Important! Before selling, ensure that the MACD indicator is below zero and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY if there are two consecutive tests of 150.15, when the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. In this case, I expect a decline to the opposite levels of 149.63 and 148.70.

Chart Explanation

- Thin green line – entry price for buying the instrument

- Thick green line – suggested Take Profit level or manual profit-taking zone, as further growth beyond this level is unlikely

- Thin red line – entry price for selling the instrument

- Thick red line – suggested Take Profit level or manual profit-taking zone, as further decline beyond this level is unlikely

- MACD Indicator – important to consider overbought and oversold zones before entering a trade

Important Notes

Beginner traders in the Forex market should exercise caution when making market entry decisions. Before major economic reports, it is best to stay out of the market to avoid sudden price swings. If you choose to trade during news releases, always set stop-loss orders to minimize risks. Trading without stop-loss protection can result in rapid capital losses, especially if money management is ignored and large position sizes are used.

Remember: Successful trading requires a clear and structured trading plan, similar to the one outlined above. Spontaneous trading decisions based on real-time price movements are a losing strategy for intraday traders.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.