- MSCI एशिया पैसिफिक इंडेक्स में 0.3% की वृद्धि के बाद तेज गिरावट आई। अमेरिकी तांबे की कीमतें आयात शुल्क की आशंका के बीच रिकॉर्ड उच्चतम स्तर तक पहुंच गईं। अमेरिकी

लेखक: Jakub Novak

09:51 2025-03-26 UTC+2

3

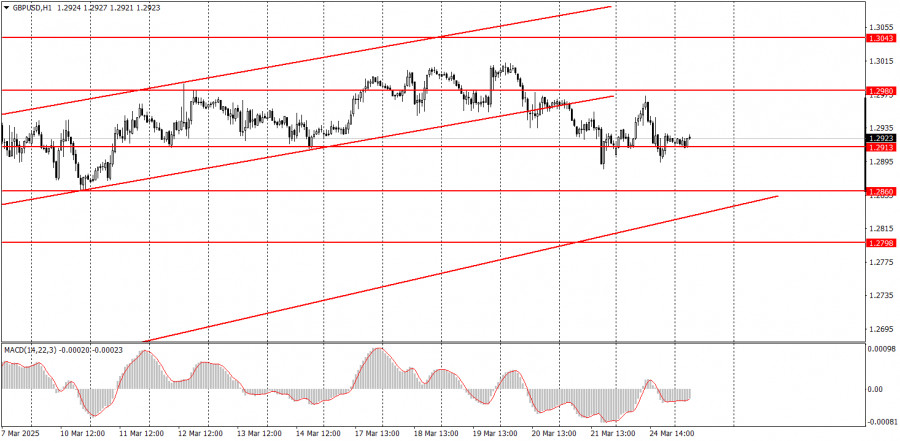

Fundamental analysisGBP/USD जोड़ी का अवलोकन – 26 मार्च: पाउंड भी कोशिश नहीं कर रहा है। जड़ विकास जारी है।

GBP/USD मुद्रा जोड़ी ने मंगलवार को अपनी ऊर्ध्वगति को फिर से शुरू किया। यह उस दिन हुआ जब यूके में कोई महत्वपूर्ण घटना नहीं थी, और अमेरिका से केवललेखक: Paolo Greco

07:33 2025-03-26 UTC+2

3

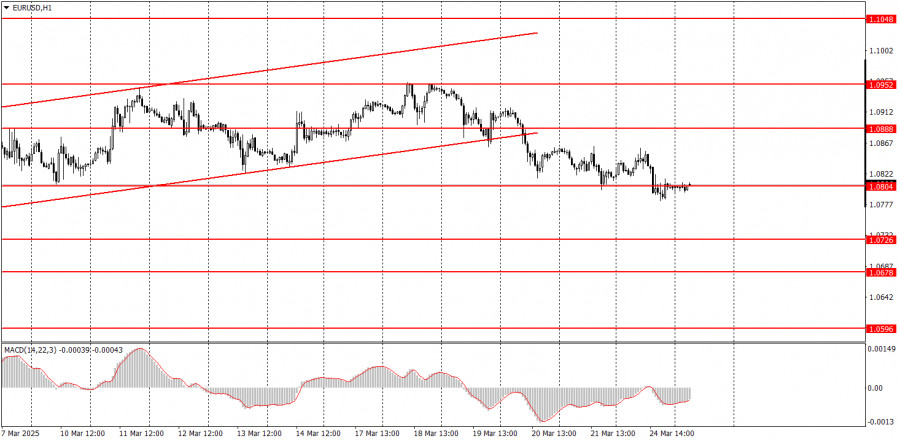

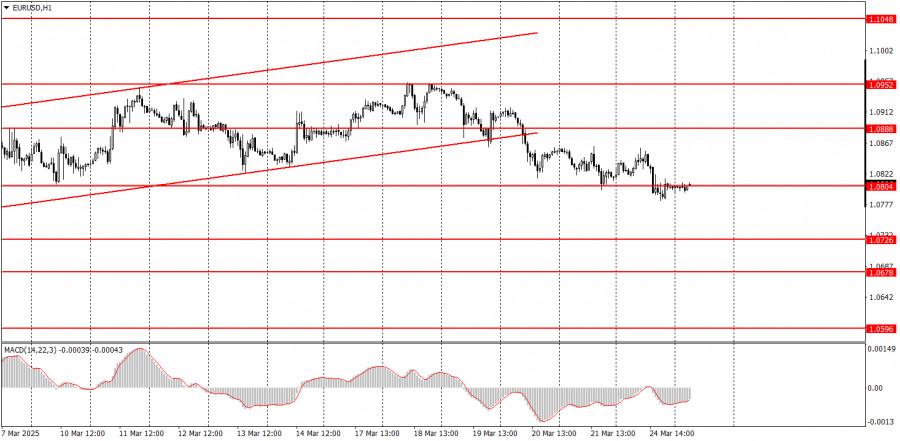

EUR/USD जोड़ी के आसपास मिश्रित स्थिति बन गई है। एक ओर, मंदी की भावना हावी है: पिछले सप्ताह, कीमत 1.0955 पर 5 महीने के उच्चतम स्तर तक पहुंची, जबकि मंगलवारलेखक: Irina Manzenko

07:19 2025-03-26 UTC+2

3

- Stock Markets

अमेरिकी शेयर बाजार में तेजी का नया दौर शुरू हो गया है। निवेशकों को संकेत मिल रहा है कि गिरावट का दौर खत्म हो गया है।

S&P500 25 मार्च को बाज़ार अपडेट सोमवार को अमेरिकी शेयर बाज़ार का स्नैपशॉट: डॉव +1.4%, NASDAQ +2.3%, S&P 500 +1.8%, S&P 500 5,500 से लेकर 5,767 के बीच कारोबारलेखक: Jozef Kovach

19:09 2025-03-25 UTC+2

15

मार्च में एसएंडपी कंपोजिट पीएमआई 53.5 रहा, जबकि फरवरी में यह 51.6 था ब्रोकरेज डाउनग्रेड के बाद लॉकहीड मार्टिन में गिरावट बिटकॉइन में तेजी के कारण क्रिप्टो शेयरों में उछाललेखक: Thomas Frank

19:08 2025-03-25 UTC+2

6

Fundamental analysis25 मार्च को किन बातों पर ध्यान दें? शुरुआती लोगों के लिए बुनियादी घटनाओं का विवरण

मंगलवार के लिए बहुत कम मैक्रोइकोनॉमिक इवेंट निर्धारित हैं, और उनमें से कोई भी महत्वपूर्ण नहीं है। सबसे अच्छा, जर्मन बिजनेस क्लाइमेट रिपोर्ट और यू.एस. नए घर की बिक्री केलेखक: Paolo Greco

19:07 2025-03-25 UTC+2

7

- Trading plan

25 मार्च को EUR/USD जोड़ी में कैसे ट्रेड करें? शुरुआती लोगों के लिए सरल सुझाव और ट्रेड विश्लेषण

सोमवार के ट्रेडों का विश्लेषण EUR/USD का 1H चार्ट EUR/USD मुद्रा जोड़ी ने सोमवार को अपनी कमज़ोर गिरावट जारी रखी। दिन के अंत तक डॉलर में कोई खास बढ़त नहींलेखक: Paolo Greco

18:51 2025-03-25 UTC+2

6

Trading plan25 मार्च को GBP/USD जोड़ी में कैसे ट्रेड करें? शुरुआती लोगों के लिए सरल सुझाव और ट्रेड विश्लेषण

सोमवार के ट्रेडों का विश्लेषण GBP/USD का 1H चार्ट GBP/USD जोड़ी ने सोमवार को ऊपर और नीचे दोनों तरफ कारोबार किया। ऊपर की ओर रुझान बरकरार है, जो एक महीनेलेखक: Paolo Greco

18:48 2025-03-25 UTC+2

10

Trading plan25 मार्च को EUR/USD के लिए ट्रेडिंग अनुशंसाएं और विश्लेषण: डॉलर में बाधाओं के मुकाबले मजबूती

सोमवार को, EUR/USD मुद्रा जोड़ी ने शुरू में ऊपर की ओर गति दिखाई, उसके बाद गिरावट आई, जिससे पूरा कारोबारी दिन कुछ हद तक विरोधाभासी हो गया। पूरे दिनलेखक: Paolo Greco

18:48 2025-03-25 UTC+2

8