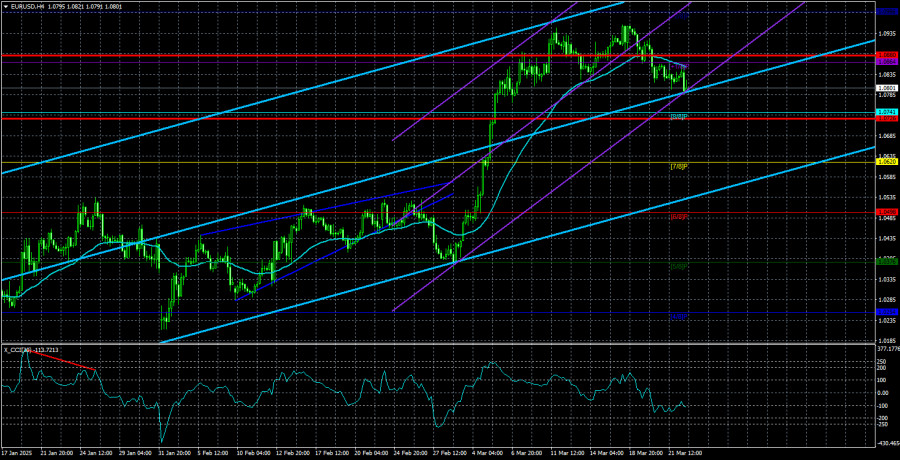

In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it. Let's take a look at the 5-minute chart and see what happened. The price did rise, but it never reached that area, so I had no trades. The technical picture remained unchanged for the second half of the day.

To open long positions on EUR/USD:

During the U.S. session, only FOMC member John Williams is scheduled to speak, with no other economic data on the calendar. Only a hawkish stance from the Fed official could help the dollar regain confidence and strengthen further against the euro. Otherwise, we may remain stuck in a sideways channel.

If the pair corrects downward, only a false breakout near the 1.0806 support will offer a signal to buy EUR/USD, expecting a new bullish trend with a target of retesting 1.0856. A breakout and retest of this range from above would confirm a valid long entry, targeting 1.0905, with the final target at 1.0952, where I will take profit.

If EUR/USD falls and shows no buyer activity around 1.0806—a more likely scenario—the pair may continue correcting. Sellers could then push the price down to 1.0770. Only after a false breakout forms at that level will I consider buying euro. I also plan to open long positions on a rebound from 1.0743, aiming for an intraday upward correction of 30–35 points.

To open short positions on EUR/USD:

Sellers have been quiet, but if there's a bearish reaction to the Fed official's comments, a false breakout around 1.0856 would allow entry into short positions, targeting a correction toward 1.0806. A break below and consolidation under this level would be another signal to sell, with a move toward 1.0770—a considerable correction in itself. The final target will be the 1.0743 area, where I plan to take profit.

If EUR/USD rises in the second half of the day and sellers fail to act at 1.0856, buyers may push the pair higher. In that case, I will delay short positions until a test of 1.0905. There, I will sell only if the price fails to consolidate above it. If no downward movement follows there either, I will look to sell on a rebound from 1.0952, targeting a 30–35 point downward correction.

COT (Commitment of Traders) Report – March 11:

The report showed an increase in long positions and a significant reduction in shorts. There's a growing interest in buying the euro, while sellers are exiting the market quickly. Germany's fiscal stimulus efforts and ECB's continued support are boosting demand for the euro. Add to that progress in resolving the conflict in Ukraine.

With the upcoming Fed meeting, if the regulator adopts a more dovish stance than expected, the dollar could weaken further. The COT report showed that non-commercial long positions rose by 3,424 to 188,647, while shorts dropped by 19,772 to 175,557. The gap between longs and shorts widened by 8,097 in favor of the bulls.

Indicator Signals:

Moving Averages: Trading is taking place below the 30- and 50-period moving averages, indicating a bearish trend.Note: The moving average periods and price levels are based on the author's H1 chart analysis and may differ from the classical daily moving averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower band around 1.0849 will act as support.

Indicator Descriptions:

- Moving average: Smooths volatility and noise to define the current trend. 50-period marked in yellow; 30-period marked in green.

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9.

- Bollinger Bands: Volatility bands based on a 20-period moving average.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total open long positions held by non-commercial traders.

- Short non-commercial positions: Total open short positions held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial long and short positions.

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.