- क्या सबसे बुरा पीछे रह गया है? जैसे ही S&P 500 डोनाल्ड ट्रम्प के द्वारा tarif ख़तरे कम होने के बीच तीन हफ्तों के उच्चतम स्तर पर पहुंचा, बैंकों

लेखक: Marek Petkovich

10:10 2025-03-25 UTC+2

10

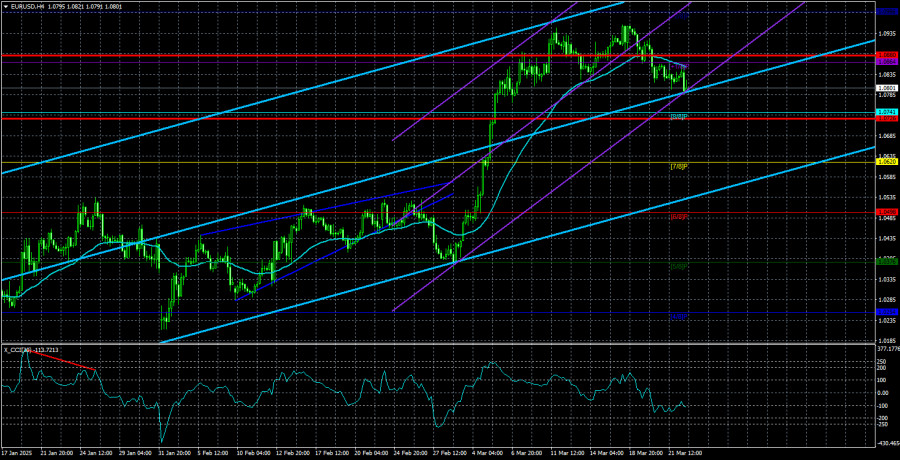

Fundamental analysisईयूआर/यूएसडी पेयर का अवलोकन – 25 मार्च: यूरो सुधार में धीरे-धीरे नीचे की ओर गिरता जा रहा है।

ईयूआर/यूएसडी करेंसी पेयर ने सोमवार को अपेक्षाकृत कम उतार-चढ़ाव दिखाया। हालांकि, नीचे दिए गए चार्ट को देखकर यह स्पष्ट होता है कि हाल ही में उतार-चढ़ाव अधिक नहीं रहा है—कुछलेखक: Paolo Greco

09:45 2025-03-25 UTC+2

3

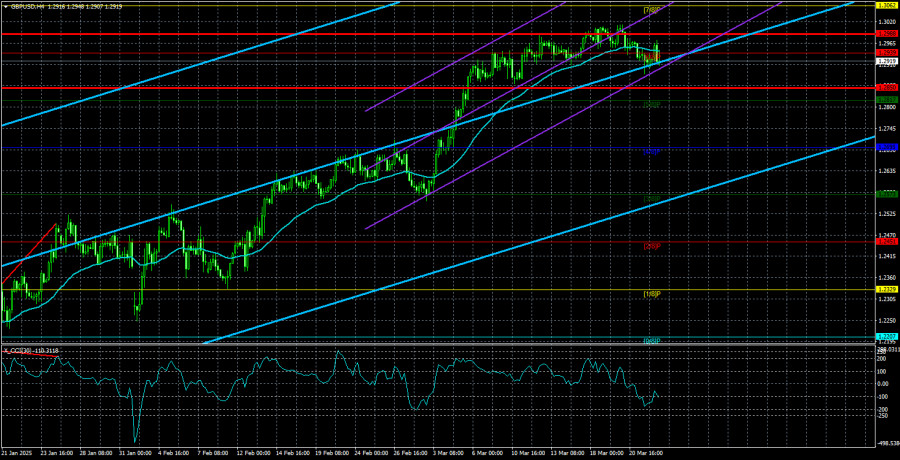

सोमवार को, जीबीपी/यूएसडी करेंसी पेयर ने फिर से ऊपर की ओर गति दिखाई। पाउंड स्टर्लिंग रातों-रात बढ़ने लगा, हालांकि इसके पीछे कोई स्पष्ट कारण या मौलिक ड्राइवर्स नहीं थे। फिरलेखक: Paolo Greco

09:37 2025-03-25 UTC+2

3

- ऑस्ट्रेलियाई डॉलर साइडवेज ट्रेंड रेंज की निचली सीमा को तोड़ने से बच गया और कल 11 पिप्स बढ़ा। हालांकि, दैनिक स्तर पर बैलेंस इंडिकेटर लाइन (लाल मूविंग एवरेज) ने कीमत

लेखक: Laurie Bailey

09:32 2025-03-25 UTC+2

5

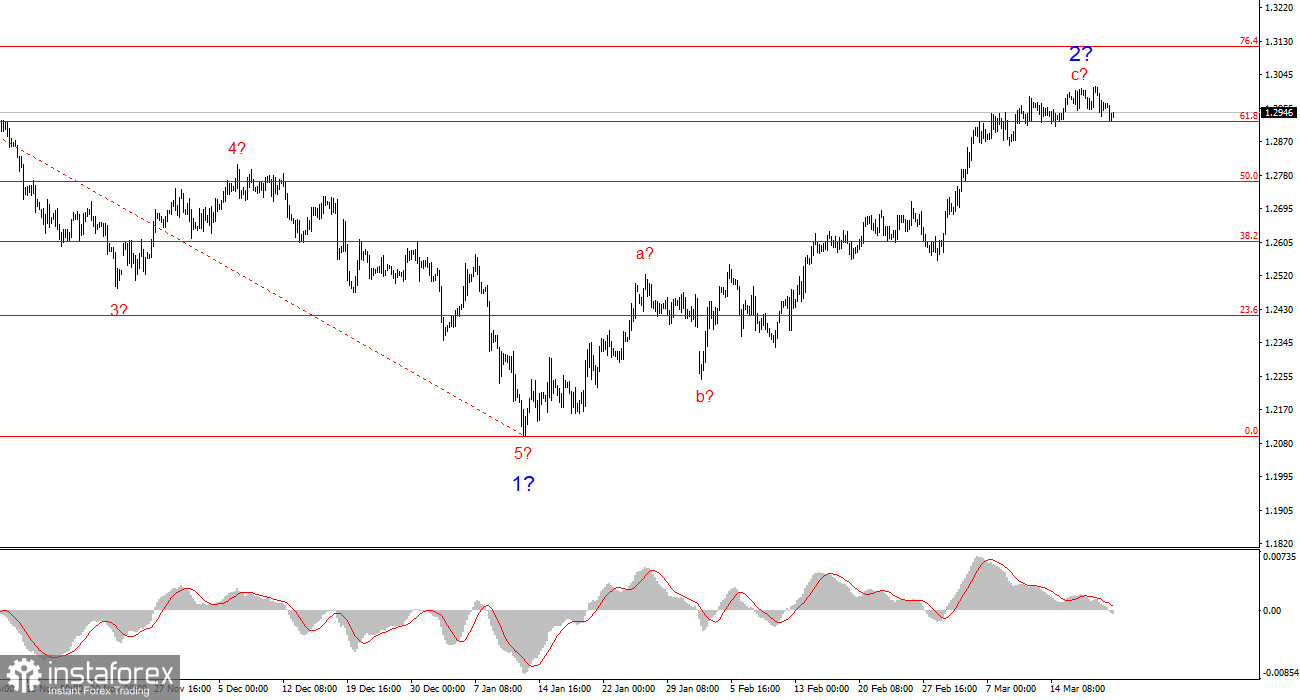

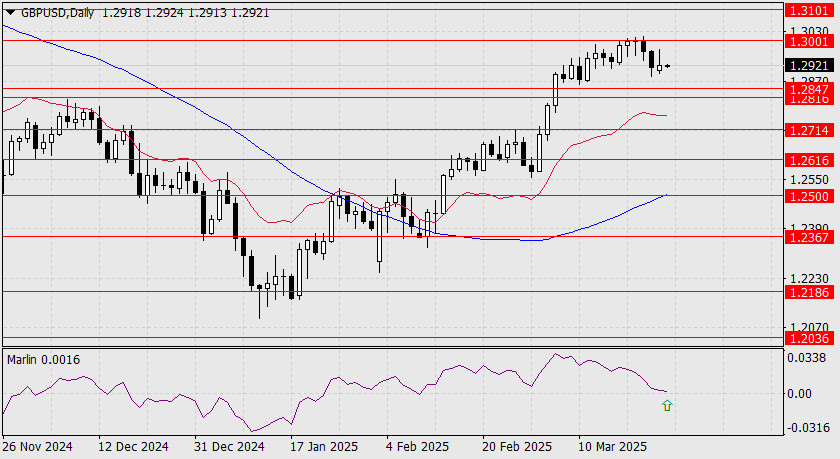

कल, ब्रिटिश पाउंड चार पिप्स बढ़ा, जिससे मार्लिन ऑस्सीलेटर नीचे गया और शून्य रेखा को छू लिया। अब हम उम्मीद कर सकते हैं कि ऊपर की ओर सिग्नल मजबूत होगालेखक: Laurie Bailey

09:28 2025-03-25 UTC+2

11

सोमवार को यूरो 14 पिप्स गिरा। ऊपर की ओर पलटाव करने की कोशिश की गई। आज एक और कोशिश संभव है और यह अधिक सफल हो सकती है, हालांकि 1.0762लेखक: Laurie Bailey

09:20 2025-03-25 UTC+2

7

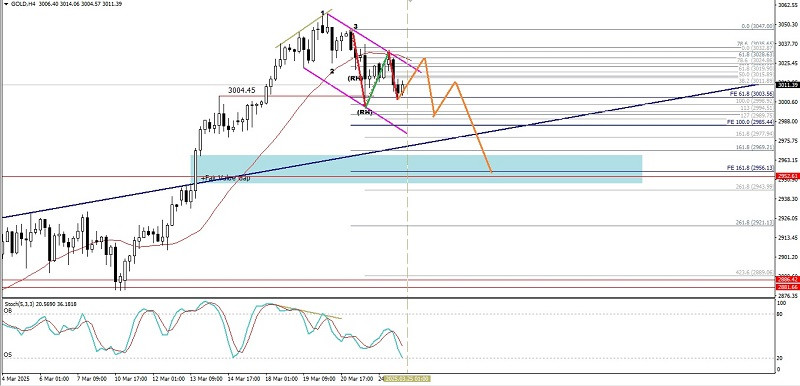

- Technical analysis

सोने की कमोडिटी उपकरण के इंट्राडे मूल्य गति का तकनीकी विश्लेषण, मंगलवार, 25 मार्च 2025।

अगर हम सोने की कमोडिटी उपकरण के 4 घंटे के चार्ट को देखें, तो एक बियरिश 123 पैटर्न दिखाई देता है, इसके बाद कई बियरिश रॉस हुक (RH) आते हैंलेखक: Arief Makmur

09:17 2025-03-25 UTC+2

8

Technical analysisईयूआर/जेपीवाई क्रॉस करेंसी पेयर की इंट्राडे मूल्य गति का तकनीकी विश्लेषण, मंगलवार, 25 मार्च 2025।

जो 4 घंटे के चार्ट पर ईयूआर/जेपीवाई क्रॉस करेंसी पेयर में देखा जा रहा है, वह स्पष्ट रूप से यह दिखा रहा है कि ईयूआर/जेपीवाई एक सुदृढ़ स्थिति में बढ़लेखक: Arief Makmur

09:15 2025-03-25 UTC+2

9

यूरो के लिए व्यापार विश्लेषण और सुझाव 1.0842 स्तर का परीक्षण तब हुआ जब MACD संकेतक पहले ही शून्य चिह्न से काफी ऊपर चला गया था, जिसने जोड़े कीलेखक: Jakub Novak

19:44 2025-03-24 UTC+2

8