- Trading plan

15 अप्रैल के लिए GBP/USD के लिए ट्रेडिंग सिफारिशें और विश्लेषण: पाउंड को स्थिर रहने का कोई कारण नहीं दिखाई देता है

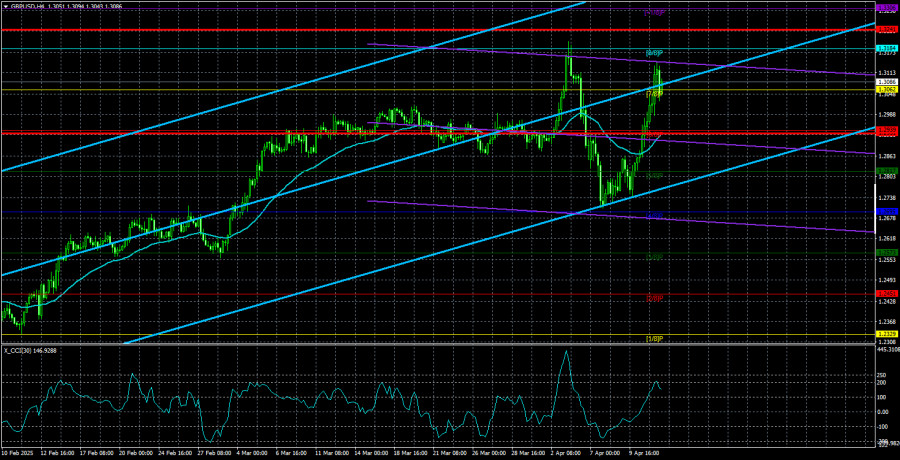

GBP/USD मुद्रा जोड़ी सोमवार को बिना किसी "लेकिन" के ऊंची व्यापार की। जबकि यूरो ने दिन के अंत तक कुछ लाभ दिखाए, वे महत्वपूर्ण नहीं थे — इसके विपरीत, ब्रिटिशलेखक: Paolo Greco

05:49 2025-04-15 UTC+2

0

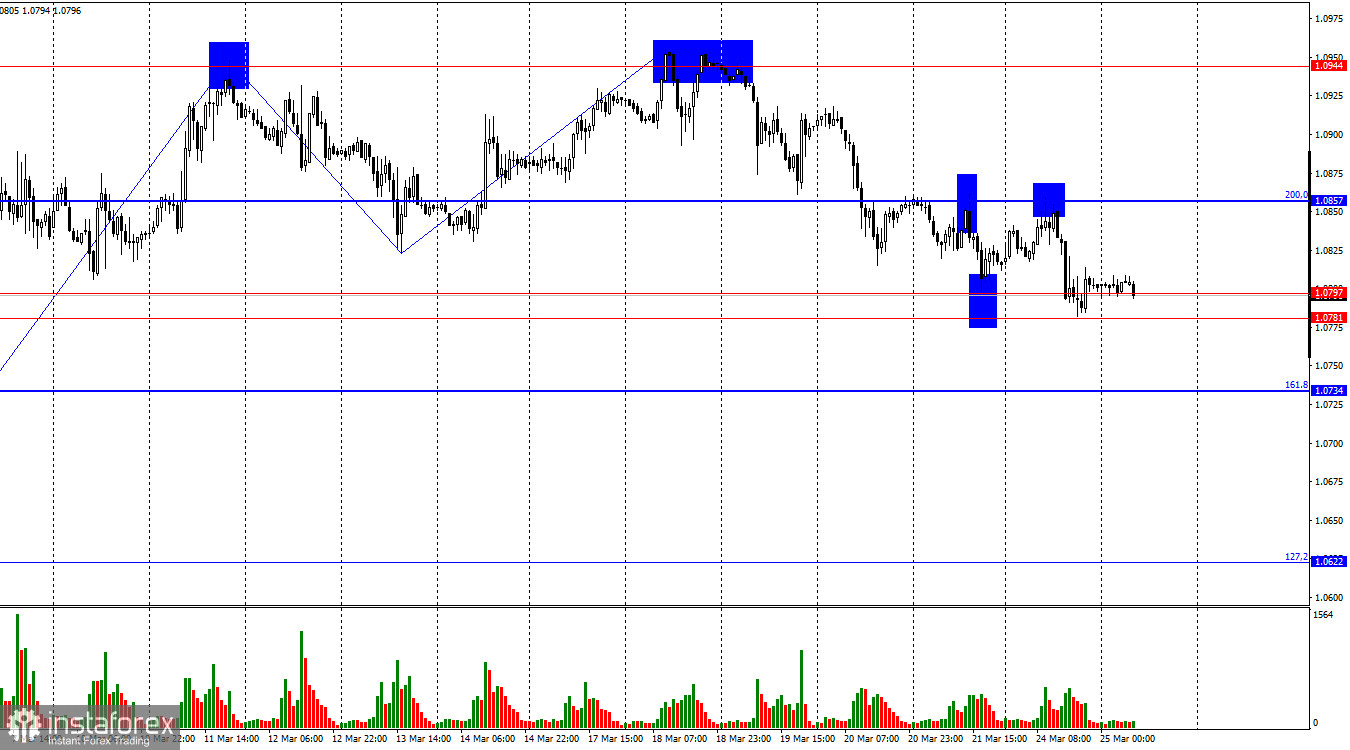

EUR/USD मुद्रा जोड़ी ने सोमवार को अपनी ऊँची चाल जारी रखी। इस बार वृद्धि धीमी होने के बावजूद, जोड़ी लगातार बढ़ रही है। कल 50 पिप्स की बढ़त थी;लेखक: Paolo Greco

05:43 2025-04-15 UTC+2

0

S&P500 शुक्रवार को प्रमुख अमेरिकी स्टॉक इंडेक्स का स्नैपशॉट: डॉव जोन्स: +1.6% NASDAQ: +2.1% S&P 500: +1.8%, अब 5,268 पर, जो 4,800 और 5,800 के बीच एक रेंज में व्यापारलेखक: Jozef Kovach

12:01 2025-04-14 UTC+2

12

- GBP/USD मुद्रा जोड़ी भी शुक्रवार को ऊपर ट्रेड हुई। हालांकि, यह ध्यान देने योग्य है कि ब्रिटिश मुद्रा—जो हाल के वर्षों में डॉलर के खिलाफ अपनी उल्लेखनीय सहनशीलता के लिए

लेखक: Paolo Greco

11:55 2025-04-14 UTC+2

11

पिछले व्यापारिक सप्ताह में, बाजार ने बुल्स को नियंत्रण पुनः प्राप्त करने का एक संभावित अवसर दिखाया। चाहे यह संभावनाएँ अब साकार होती हैं या नहीं, यह इस पर निर्भरलेखक: Evangelos Poulakis

11:51 2025-04-14 UTC+2

4

Stock Markets14 अप्रैल को अमेरिकी स्टॉक मार्केट का अपडेट: SP500 और NASDAQ ने इलेक्ट्रॉनिक्स पर शुल्क विराम के बीच अपनी स्थिति फिर से प्राप्त की।

अमेरिका के प्रमुख स्टॉक सूचकांकों ने शुक्रवार को सामान्य उत्तरी अमेरिकी सत्र को हरे रंग में समाप्त किया। S&P 500 में 1.81% की वृद्धि हुई, जबकि Nasdaq 100 में 2.06%लेखक: Jakub Novak

11:47 2025-04-14 UTC+2

17

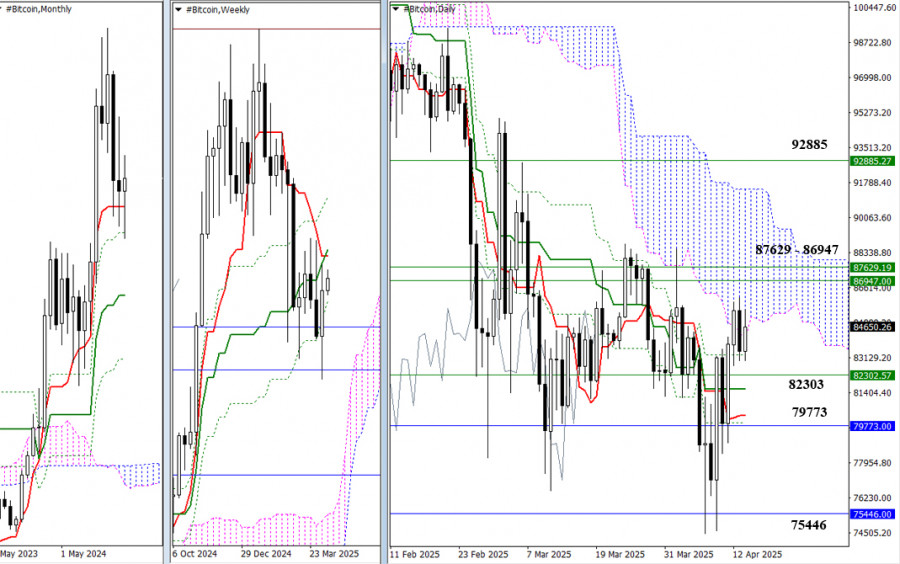

- पिछले सप्ताहांत में, बिटकॉइन और एथेरियम ने अच्छी स्थिरता दिखाई, जिससे आगे की सुधार की संभावना बनी रही। जबकि तकनीकी दृष्टिकोण से, ये संभावना काफी कम लग सकती हैं, फिर

लेखक: Miroslaw Bawulski

11:43 2025-04-14 UTC+2

8

गुरुवार के अमेरिकी सत्र के अंत में बिटकॉइन और एथेरियम की कीमतों में गिरावट आई, लेकिन आज एशियाई ट्रेडिंग घंटों के दौरान उन्होंने रिकवरी कर ली। यह अब आम बातलेखक: Miroslaw Bawulski

11:56 2025-04-11 UTC+2

26

Crypto-currenciesपोलकाडॉट क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 11 अप्रैल, 2025

पोलकाडॉट क्रिप्टोकरेंसी की कीमत की गति और स्टोकैस्टिक ऑस्सीलेटर इंडिकेटर के बीच डाइवर्जेंस दिखाई देने के साथ, ऐसा प्रतीत होता है कि निकट भविष्य में पोलकाडॉट के मजबूत होने कीलेखक: Arief Makmur

11:53 2025-04-11 UTC+2

30