- गुरुवार के अमेरिकी सत्र के अंत में बिटकॉइन और एथेरियम की कीमतों में गिरावट आई, लेकिन आज एशियाई ट्रेडिंग घंटों के दौरान उन्होंने रिकवरी कर ली। यह अब आम बात

लेखक: Miroslaw Bawulski

11:56 2025-04-11 UTC+2

13

Crypto-currenciesपोलकाडॉट क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार, 11 अप्रैल, 2025

पोलकाडॉट क्रिप्टोकरेंसी की कीमत की गति और स्टोकैस्टिक ऑस्सीलेटर इंडिकेटर के बीच डाइवर्जेंस दिखाई देने के साथ, ऐसा प्रतीत होता है कि निकट भविष्य में पोलकाडॉट के मजबूत होने कीलेखक: Arief Makmur

11:53 2025-04-11 UTC+2

10

Crypto-currenciesयूनिस्वैप क्रिप्टोकरेंसी की इंट्राडे प्राइस मूवमेंट का तकनीकी विश्लेषण, शुक्रवार 11 अप्रैल 2025।

यूनिस्वैप क्रिप्टोकरेंसी के 4-घंटे के चार्ट से जो दिखाई दे रहा है, उसके अनुसार यूनिस्वैप की प्राइस मूवमेंट और स्टोकास्टिक ऑस्सीलेटर इंडिकेटर के बीच एक डाइवर्जेंस (विसंगति) नजर आ रहीलेखक: Arief Makmur

11:49 2025-04-11 UTC+2

9

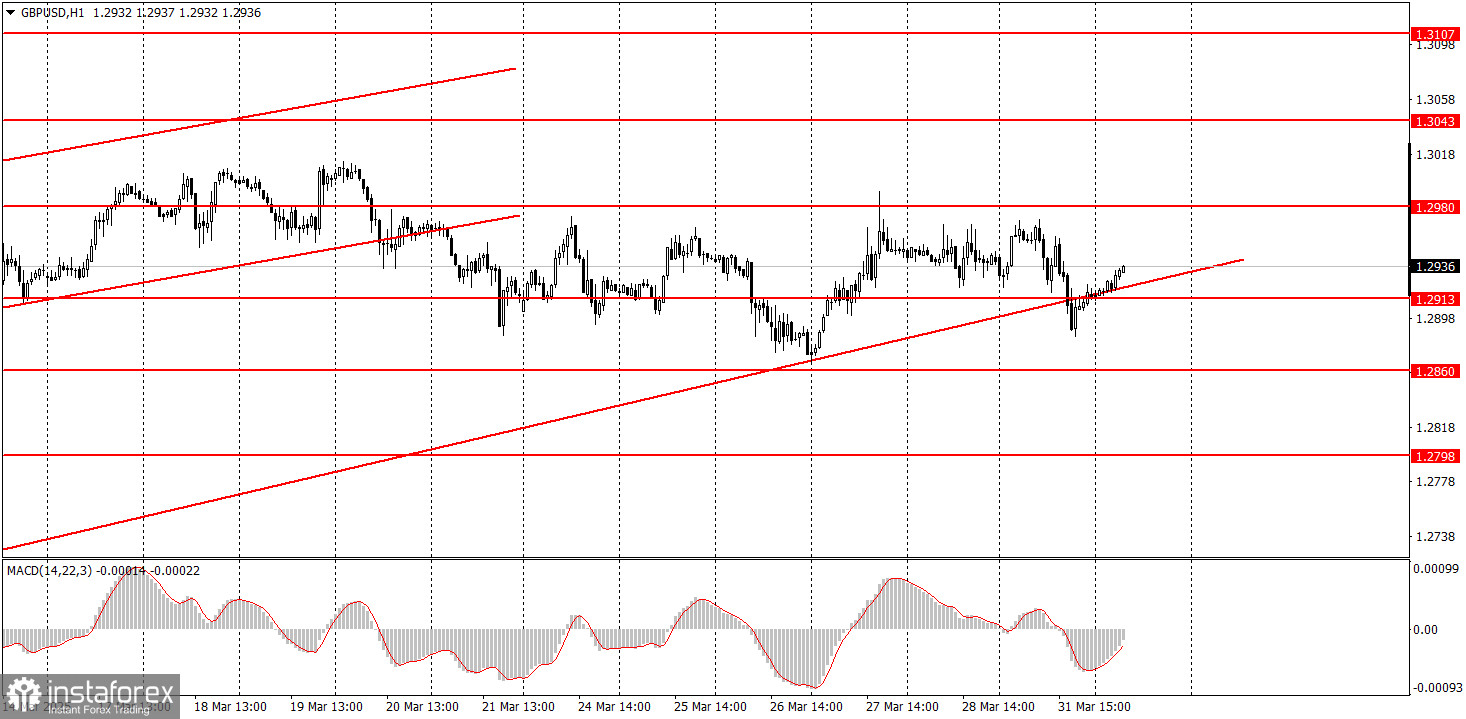

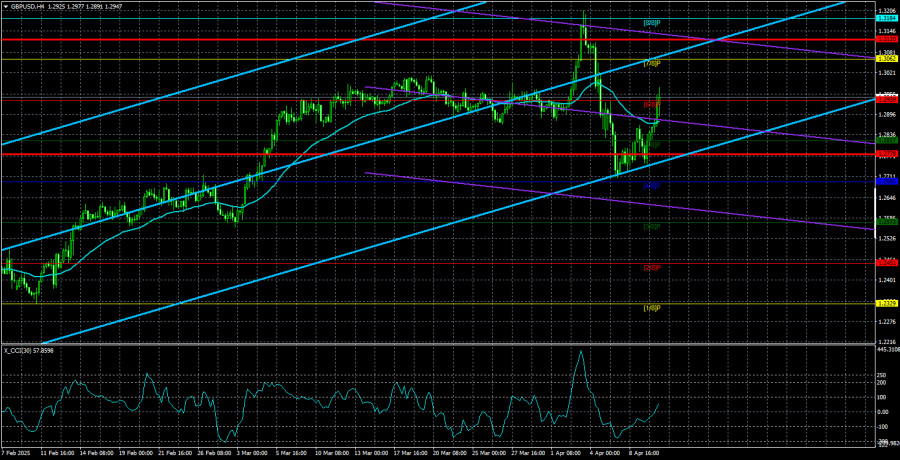

- GBP/USD मुद्रा जोड़ी भी गुरुवार को ऊपर ट्रेड हुई। याद दिलाने के लिए, मौद्रिक और पारंपरिक मौलिक कारक वर्तमान में मुद्रा आंदोलनों पर थोड़ा या बिल्कुल भी प्रभाव नहीं डाल

लेखक: Paolo Greco

06:22 2025-04-11 UTC+2

20

Trading planEUR/USD के लिए व्यापार सिफारिशें और विश्लेषण 11 अप्रैल: ट्रंप ने फिर से चीन पर टैरिफ बढ़ाए

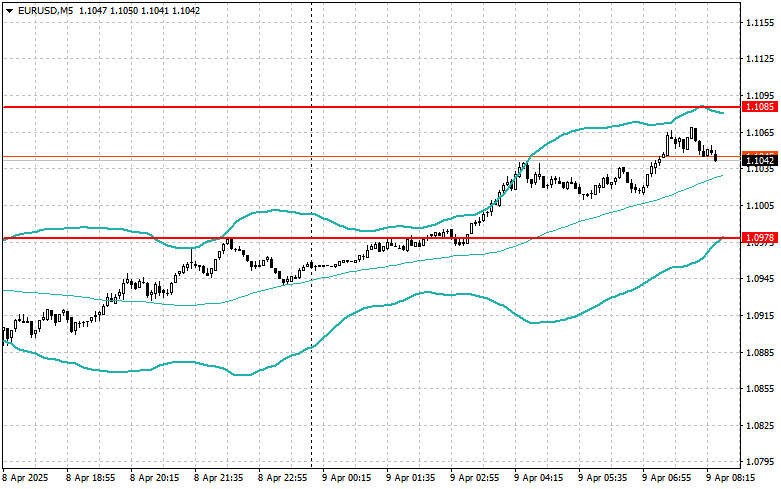

EUR/USD मुद्रा जोड़ी ने गुरुवार को अत्यधिक मजबूत वृद्धि दिखाई — एक कदम जो अब तक शायद किसी को भी आश्चर्यचकित नहीं कर पाया। जैसे ही हमने रिपोर्ट किया किलेखक: Paolo Greco

06:17 2025-04-11 UTC+2

16

Fundamental analysis11 अप्रैल के लिए GBP/USD के लिए व्यापारिक सिफारिशें और विश्लेषण: डॉलर को दोहरा झटका

GBP/USD करेंसी पेयर ने भी गुरुवार को मजबूत वृद्धि दिखाई, हालांकि यह EUR/USD पेयर जितना मजबूत नहीं था। पाउंड ने केवल लगभग 200 पिप्स की वृद्धि की — जो वर्तमानलेखक: Paolo Greco

06:11 2025-04-11 UTC+2

18

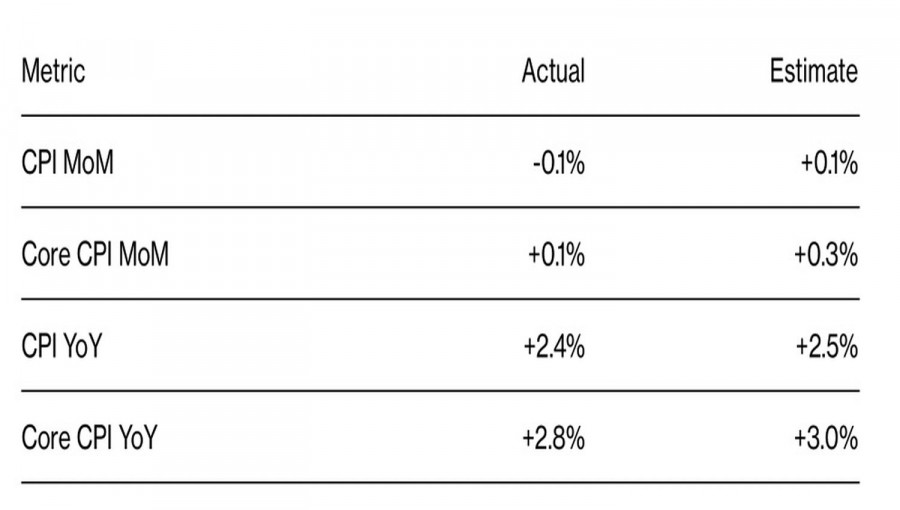

- यूरोपीय स्टॉक सूचकांकों में वृद्धि, अमेरिकी मुद्रास्फीति की धीमी गति, और यह तथ्य कि 90-दिन की स्थगन के बावजूद अमेरिकी शुल्क में कोई महत्वपूर्ण बदलाव नहीं हुआ, सभी ने EUR/USD

लेखक: Marek Petkovich

06:04 2025-04-11 UTC+2

26

Fundamental analysisEUR/USD. अतीत से एक संदेश: यू.एस. CPI रिपोर्ट डॉलर को समर्थन देने में विफल रही।

प्रकाशित यू.एस. CPI रिपोर्ट "लाल क्षेत्र" में आई, जो मुद्रास्फीति में मंदी को दर्शाती है। हालांकि, हाल की घटनाओं को देखते हुए, इस रिलीज़ की प्रासंगिकता पर गंभीर सवाल उठतेलेखक: Irina Manzenko

05:59 2025-04-11 UTC+2

21

यूरो और पाउंड नवीनीकरण बिक्री दबाव के तहत अपनी स्थिति बनाए रखे हुए हैं और आज की एशियाई सत्र के दौरान थोड़े लाभ भी दर्ज किए हैं। कल अमेरिकी NFIBलेखक: Miroslaw Bawulski

09:04 2025-04-09 UTC+2

27