For the Euro/Dollar pair, we expect the development of a downward structure from July 30 after the breakdown of 1.1812, the level of 1.1846 is a key support within the day. For the Pound/Dollar pair, we expect the continuation of the upward movement after the breakdown of 1.3967, the level of 1.3864 is the key support within the day. For the Dollar/Franc pair, the development of an upward structure is possible after the price passes the noise range 0.9082 - 0.9094. For the Dollar/Yen pair, we expect the development of an upward structure from August 4 after the breakdown of 109.92, the level of 109.22 is a key support. For the Euro/Yen pair, we are following the development of the downward structure from July 29, the level of 129.39 is the key resistance, and the level of 129.93 is the key support within the day. For the Pound/Yen pair, we expect the upward movement to resume after the breakdown of 153.03, the level of 152.16 is the key support within the day.

Forecast for August 6:

Analytical review of currency pairs on the H1 scale:

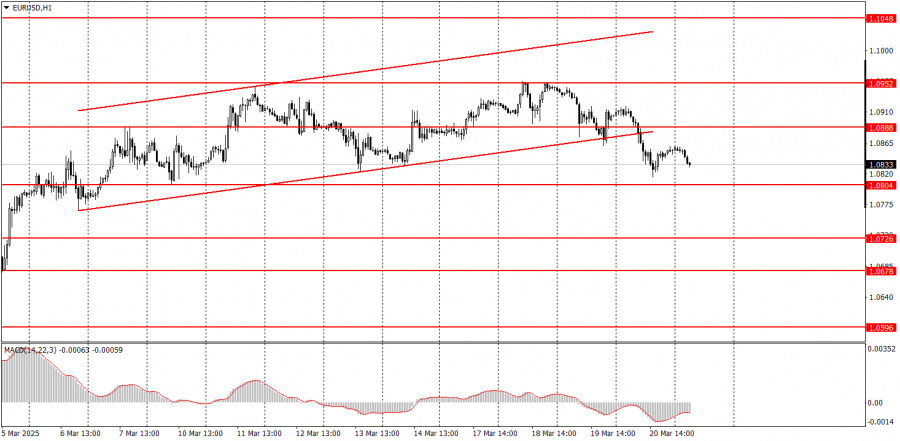

For the Euro/Dollar pair, the key levels are: 1.1866, 1.1846, 1.1836, 1.1820, 1.1812, 1.1795, 1.1778, and 1.1766. We are following the development of the July 30 downward structure. The continuation of the downward movement is expected after the price passes the noise range 1.1820 - 1.1812, with the target at 1.1795 and price consolidation near this level. The breakdown of 1.1795 will allow us to count on a movement to the level of 1.1778. We consider the level of 1.1766 as a potential value for the low. Upon reaching which we expect consolidation, as well as an upward rollback.

A short-term upward movement is possible in the 1.1836 - 1.1846 corridor, the breakout of the last value will lead to a deep correction with the target at 1.1866, the key support for the downward trend.

The main trend is the downward structure from July 30.

Key levels of structure development:

Upward resistance: 1.1836. Target: 1.1845

Upward resistance: 1.1847. Target: 1.1866

Downward resistance: 1.1812. Target: 1.1797

Downward resistance: 1.1793. Target: 1.1778

For the Pound/Dollar pair, the key levels are: 1.4066, 1.4037, 1.3967, 1.3934, 1.3893, 1.3864, 1.3813, and 1.3781. We are following the development of the July 20 upward structure. A short-term upward movement, as well as consolidation, is expected in the 1.3934 - 1.3967 corridor. The breakdown of the last value should be accompanied by a pronounced upward movement with the target at 1.4037. We consider the level of 1.4066 as a potential value for the high. Upon reaching which we expect consolidation, as well as a pullback downward.

A short-term downward movement is expected in the 1.3893 - 1.3864 corridor. A breakdown of the last value will lead to a deep correction with the target at 1.3813. The 1.3813 - 1.3781 range is the key support for the upward structure from July 20.

The main trend is the upward structure from July 20.

Key levels of structure development:

Upward resistance: 1.3935. Target: 1.3966

Upward resistance: 1.3969. Target: 1.4035

Downward resistance: 1.3892. Target: 1.3866

Downward resistance: 1.3862. Target: 1.3815

For the Dollar/Franc pair, the key levels are: 0.9122, 0.9094, 0.9082, 0.9053, 0.9039, 0.9025, 0.9011, and 0.8988. We are following the development of the downward structure from July 20. At the moment, the price is in correction and has formed a potential high from August 4. The range 0.9082 - 0.9094 is the key support for the downward structure, its passage by the price will encourage the development of an upward trend, with the potential target at 0.9122.

A short-term downward movement is possible in the corridor 0.9053 - 0.9039. A breakdown of the last value will dispose to the subsequent development of a downward trend from July 20, with the initial target at 0.9025 and price consolidation at the 0.9025 - 0.9011 corridor. The potential value for the low is 0.8988, from which we expect an upward rollback.

The main trend is the downward structure from July 20, the stage of correction.

Key levels of structure development:

Upward resistance: 0.9083. Target: 0.9093

Upward resistance: 0.9096. Target: 0.9122

Downward resistance: 0.9053. Target: 0.9040

Downward resistance: 0.9037. Target: 0.9025

For the Dollar/Yen pair, the key levels are: 110.45, 110.29, 109.92, 109.72, 109.42, 109.22, 108.74, 108.51, and 108.19. Here the price has developed a fairly pronounced potential for the August 4 high. A short-term upward movement is expected in the 109.72 - 109.92 corridor. A breakout of the last value will lead to a pronounced upward movement with the target at 110.29. We consider the level of 110.45 as a potential value for the high. Upon reaching which we expect consolidation, as well as a rollback downward.

A short-term downward movement is expected in the 109.42 - 109.22 corridor. The breakdown of the last value will be conducive to the subsequent development of the downward structure from July 23, with the target at 108.74 and price consolidation in the 108.74 - 108.51 corridor. The potential value for the low is 108.19.

The main trend is the downward structure from July 23, building up potential for the August 4 high.

Key levels of structure development:

Upward resistance: 109.72. Target: 109.92

Upward resistance: 109.94. Target: 110.29

Downward resistance: 109.42. Target: 109.22

Downward resistance: 109.18. Target: 108.74

For the Canadian dollar/US dollar pair, the key levels are: 1.2741, 1.2691, 1.2631, 1.2594, 1.2495, 1.2459, 1.2420, 1.2364, 1.2327, and 1.2240. We are following the medium-term downward structure from July 19. At the moment, the price is in correction and has formed a potential high from July 30. The development of the upward structure from July 30 is expected after the breakout of 1.2594, with the first target at 1.2631 and consolidation near this level. The breakout of 1.2631 should be accompanied by a pronounced upward movement with the target at 1.2691. We consider the level of 1.2741 as a potential value for the high. Upon reaching which, we expect a rollback downward.

A short-term downward movement is possible in the range of 1.2495 - 1.2459. A breakdown of the last value will be conducive to the subsequent development of the downward structure from July 19, with the initial target at 1.2420.

The main trend is the downward structure from July 19, the stage of deep correction.

Key levels of structure development:

Upward resistance: 1.2594. Target: 1.2630

Upward resistance: 1.2632. Target: 1.2690

Downward resistance: 1.2495. Target: 1.2462

Downward resistance: 1.2457. Target: 1.2365

For the Australian dollar/US dollar pair, the key levels are: 0.7482, 0.7467, 0.7442, 0.7425, 0.7388, 0.7370, 0.7345, and 0.7291. We are following the July 21 upward structure. A short-term upward movement is expected in the 0.7425 - 0.7442 corridor. A breakout of the last value will lead to a pronounced upward movement, with the target at 0.7467 and price consolidation in the 0.7467 - 0.7482 corridor.

A short-term downward movement is expected in the 0.7388 - 0.7370 corridor. A breakdown of the last value will lead to a deep correction with the target at 0.7345, the key support for the high.

The main trend is the downward structure from July 6, the stage of correction.

Key levels of structure development:

Upward resistance: 0.7426. Target: 0.7441

Upward resistance: 0.7443. Target: 0.7467

Downward resistance: 0.7388. Target: 0.7371

Downward resistance: 0.7369. Target: 0.7346

For the Euro/Yen pair, the key levels on the H1 scale are: 130.51, 130.28, 129.93, 129.67, 129.39, 129.15, 128.82, 128.52, and 128.21. We are following the development of the downward structure from July 29. At the moment, the price is in a correction. We expect the downward movement to resume after the breakdown of 129.39, with the initial target at 129.15. The breakdown of which, in turn, will continue the development of the main downward trend from July 29 with the next target at 128.82. The breakdown of which will allow us to count on a movement to the level of 128.52, with consolidation near this level. We consider 128.21 as a potential value for the low. Upon reaching this level, we expect an upward rollback.

A short-term upward movement is possible in the 129.67 - 129.93 corridor. A breakdown of the last value will encourage the formation of an upward structure with the first potential target at 130.28. We expect a short-term upward movement in the 130.28 - 120.51 corridor, as well as consolidation.

The main trend is the downward structure from July 29, the stage of correction.

Key levels of structure development:

Upward resistance: 129.68. Target: 129.91

Upward resistance: 129.95. Target: 130.28

Downward resistance: 129.63. Target: 129.41

Downward resistance: 129.37. Target: 129.16

For the Pound/Yen pair, the key levels are: 154.34, 153.89, 153.31, 153.03, 152.46, 152.16, 151.66, and 151.14. We are following the development of the local upward structure from August 3. A short-term upward movement is expected in the 153.03 - 153.31 corridor. A breakout of the last value will lead to a pronounced upward movement, with the target at 153.89. We consider the level of 154.34 as a potential value for the high. Upon reaching which, we expect consolidation, as well as a rollback downward.

A short-term downward movement is possible in the range of 152.46 - 152.16. A breakdown of the last value will lead to a deep correction with the target at 151.66, the key support for the high.

The main trend is the medium-term upward structure from July 20, the stage of deep correction.

Key levels of structure development:

Upward resistance: 153.03. Target: 153.30

Upward resistance: 153.36. Target: 153.89

Downward resistance: 152.45. Target: 152.17

Downward resistance: 152.12. Target: 151.70